|

市场调查报告书

商品编码

1686173

水自动化和仪器:市场占有率分析、行业趋势和统计、成长预测(2025-2030 年)Water Automation and Instrumentation - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

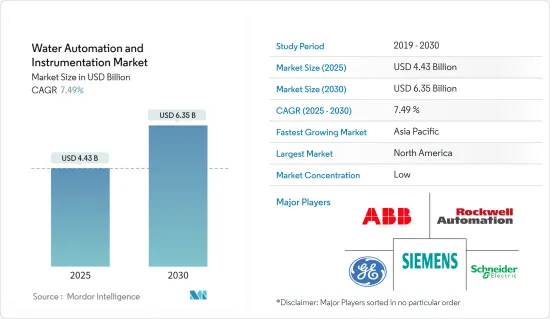

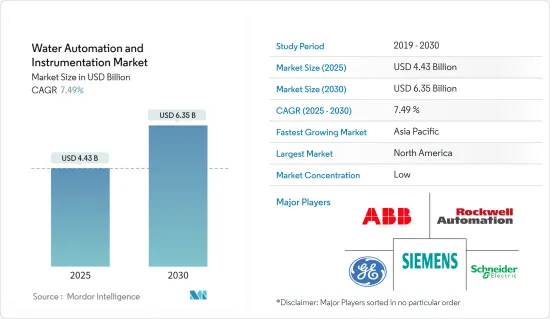

预计 2025 年水自动化和仪器市场规模将达到 44.3 亿美元,到 2030 年将达到 63.5 亿美元,预测期内(2025-2030 年)的复合年增长率为 7.49%。

2020 年初,COVID-19 疫情严重阻碍了水自动化设备的生产。这是因为多个国家为遏制 COVID-19 病毒传播而实施的封锁措施,严重扰乱了用水和污水景观仪器所用零件的全球供应链。

主要亮点

- 随着饮用水资源的减少和政府实施监管,控制营运成本已成为水产业相关人员面临的最大挑战之一。人事费用和能源成本占营业单位营运成本的最大部分。

- 消费者对预防水传播疾病的健康关注度日益提高,导致瓶装水消费量增加。此外,这一趋势导致对基础设施开发的投资增加,以支持水自动化市场。

- 随着当地供水站数量的增加和水质的多样性,分散式控制系统的使用越来越多。 PLC 等自动化解决方案有助于控制马达接触器、搅拌马达、泵站中的分散阀门以及测量水压变送器。

- 仪器解决方案,包括液体分析仪和液位传送器,有助于维持化学和製药业的精确度。由于某些感测器的价格较高,此类设备的成本可能很高。然而,用户营运成本的降低预计会降低整体拥有成本。

- 创新包括改进海水淡化技术以利用以前无法获得的供应,并透过新的水回收技术提高工业效率。特别是,将基于物联网 (IoT) 的控制和监控系统与用于水资源管理的 SCADA 软体相结合的新型水技术自动化解决方案可以帮助开始解决特定问题。

水自动化和仪器市场趋势

食品饮料产业需求呈现明显成长率

- 食品和饮料生产需要大量的水,水是食品和饮料加工行业的关键原料之一,因此水质对产品品质和运作可靠性至关重要。在食品和饮料行业实施供水和废水自动化可以透过消除错误和浪费、提高效率和生产力以及扩大利润率来为公司节省大量收益。

- 此外,食品和饮料行业的不同公司实施不同的自动化和仪器方法。例如,秘鲁的一家食品加工厂面临的天然地下水过于混浊且受到砷污染,无法用于食品加工。 AMI 的客製化解决方案结合了超过滤滤膜和凝聚剂预处理、深度过滤和过滤氯化,以生产符合客户食品加工高品质标准的水。该系统是 AMI PLC 自动化系统,具有中央控制柜和触控萤幕 HMI 操作员介面。

- 此外,液体分析仪、压力测量系统和流量测量系统等仪器技术正在食品和饮料行业中实施,以便在从生产线排放产品时使用上述仪器技术来减少过程中产生的污水量。

- 此外,可以使用模组化、节省空间的分析面板有效监测原水、製程水和污水。这简化了食品和饮料行业的日常流程整合和操作。

美国占有较大的市场占有率

- 工厂经理通常没有时间研究规格和供应商来寻找满足其特定应用需求的解决方案。为了满足这些需求,供应商提供完整的水应用产品系列以及设备顾问的专业知识。

- 最初,该地区的供应商为该行业领域提供了一系列位准计和压力计,但最近,水分析设备已扩大工具范围,涵盖了水生产和净化中的所有技术。

- 美国人已经习惯打开水龙头,看到干净的水流出来,废弃物顺着管道消失。然而,并没有多少人了解提供这些服务所需的复杂且昂贵的系统。例如,美国有26英里长的自来水管道,每英里州际公路就有120万英里的自来水管道。这只是一个饮用水系统。污水管的数量也大致相同。

- 因此,为了建立如此庞大的排水系统并维护有序的水道,许多公司正在进行策略性收购以获得技术专长。例如,2021 年 5 月,TASI 集团公司收购了乔治亚诺克罗斯的 Mission Communication,以补充 TASI Flow 现有的资产管理和无线连接策略,使其在用水和污水市场中占据更强的地位。

水自动化和仪器行业概况

主要参与者包括 ABB 集团、西门子股份公司、施耐德电气 SE、通用电气公司、罗克韦尔自动化公司、工业公司、艾默生电气、横河电机株式会社、Endress+Hauser Pvt。 Ltd、Eurotek India、Phoenix Contact、NALCO、MJK Automation、Blue Water Automation 等。市场分散,主要参与者之间的竞争非常激烈。因此,预计市场集中度较低。

- 2020 年 11 月 - 新加坡国家水务局 (PUB) 授予 ABB 一套完整的全厂监控和控制系统,用于其大士水回收厂,价值 3000 万美元。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场动态

- 市场概况

- 市场驱动因素

- 政府制定节约水资源和能源的规定

- 智能水技术的应用日益广泛

- 市场限制

- 缺乏操作仪器设备的熟练人员

- 产业价值链分析

- 产业吸引力-波特五力分析

- 新进入者的威胁

- 购买者/消费者的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争对手之间的竞争强度

- COVID-19 市场影响评估

第五章 市场区隔

- 水自动化解决方案

- DCS

- SCADA

- PLC

- IAM

- HMI

- 其他水自动化解决方案

- 仪器解决方案

- 压力变送器

- 液位传送器

- 温度变送器

- 液体分析仪

- 气体分析仪

- 洩漏检测系统

- 流量感测器/变送器

- 其他水测量解决方案

- 最终用户产业

- 化学

- 製造业

- 食品饮料业

- 公共产业

- 纸和纸浆

- 其他最终用户产业

- 地区

- 北美洲

- 美国

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 其他欧洲国家

- 亚太地区

- 澳洲

- 中国

- 日本

- 印度

- 其他亚太地区

- 拉丁美洲

- 中东和非洲

- 沙乌地阿拉伯

- 阿拉伯聯合大公国

- 其他中东和非洲地区

- 北美洲

第六章 竞争格局

- 公司简介

- ABB Group

- Siemens AG

- Schneider Electric SE

- GE Corporation

- Rockwell Automation Inc.

- Mitsubishi Motors Corporation

- Emerson Electric

- Yokogawa Electric Corporation

- Endress+Hauser Pvt. Ltd

- Eurotek India

- Phoenix Contact

- NALCO

- MJK Automation

- KROHNE LTD

第七章投资分析

第 8 章:市场的未来

The Water Automation and Instrumentation Market size is estimated at USD 4.43 billion in 2025, and is expected to reach USD 6.35 billion by 2030, at a CAGR of 7.49% during the forecast period (2025-2030).

The COVID-19 pandemic considerably hampered the production of water automation instrumentation at the beginning of 2020. This is because the lockdown imposed in several countries to curb the spread of the COVID-19 virus caused considerable disruptions in the global supply chain of the parts and components used in the water and wastewater landscape instruments.

Key Highlights

- Managing operational costs emerged as one of the biggest challenges posed by stakeholders of the water industry, as the governments are imposing regulations, along with depletion of potable water resources. Expenses relating to labor and energy constitute the largest share in OPEX for water utilities.

- The increasing health concerns for preventing water-borne diseases among consumers augmented the consumption of bottled drinking water. Furthermore, this trend led to an increase in infrastructure development investments that support the water automation market.

- There has been an increase in the use of decentralized control systems, with the rise in the number of outstations and varied qualities of water in a region. Automation solutions, such as PLC, help in controlling pump station motor contactors, stirrer motors, and distributed valves, as well as to measure the pressure transmitter of the water.

- Water instrumentation solutions, such as liquid analyzers and level transmitters, are helping chemical and pharmaceutical industries maintain precision. The high prices of specific sensors might increase the cost of such instruments. However, reduced operational costs due to the users are expected to decline the total cost of ownership.

- Technological innovations include taking advantage of previously unusable supplies through improved water desalination and increased industrial efficiency through new water reclaiming technologies. A new breed of water tech automation solutions, especially the Internet of Things (IoT)-based control and monitoring systems combined with SCADA software for water management, are solutions that can be explored to help begin to solve certain issues.

Water Automation And Instrumentation Market Trends

Demand from Food and Beverage Industry to Witness a Significant Growth Rate

- The production of food and beverages requires a large amount of water, and water quality is crucial to product quality and operational reliability as water is one of the important raw materials in the food and beverage processing industry. The implementation of water and wastewater automation in the food and beverage industry can save significant revenues for the company along with eliminating errors and waste, enhancing efficiency and productivity, and expanding profit margins.

- Further, various companies in the Food and beverage industry are deploying various automation and instrumentation methods. For instance, a food processing plant in Peru was faced with natural groundwater contaminated with high turbidity and arsenic, making it unsuitable for use in food processing. AMI's custom-engineered solution incorporates ultrafiltration membranes with pretreatment by coagulant and depth filtration, as well as chlorination of the filtrate to produce water meeting the customer's high-quality standards for use in food product processing. The system is AMI PLC automated using a central control enclosure and touchscreen HMI operator interface.

- Moreover, instrumentation technology such as liquid analyzer, pressure measurement system, flow measurement system is being deployed in the food and beverage industry to reduce the volume of wastewater during the process by using the above-mentioned instrumentation technology when discharging products from the lines.

- Further, Raw water, process water or wastewater can be efficiently monitored with modular, space-saving analysis panels. This simplifies daily process integration and operation in the food and beverage industries.

United States to Account for Significant Market Share

- Plant managers generally do not have the time to study specifications and suppliers to find the solution to specific application requirements. To counter this requirement, vendors offer a complete product portfolio for water industry applications and instrument consultants' expertise.

- Originally vendors in the region offered a portfolio of level and pressure instruments for this industry segment, but recently, water analytical instruments have widened the range of tools to encompass all the technologies of water production and purification.

- Americans have become accustomed to receiving clean water when they turn on their taps and having waste disappear down their pipes. Yet, not many understand the complicated and expensive systems required to deliver those services. For instance, the United States has 26 miles of water mains, 1.2 million miles of water supply mains for every mile of interstate highway. That is just the drinking water system. There is nearly an equal number of sewer pipes.

- Thus, to maintain such a vast establishment and organized channel of the wastewater system, many companies are making strategic acquisitions to gain technical expertise. For instance, in May 2021, The TASI Group of Companies acquired Mission Communication, Norcross GA, to complement TASI Flow's existing Asset Management and Wireless Connectivity Strategy, bringing a strong presence in the Water and Wastewater market.

Water Automation And Instrumentation Industry Overview

The major players, include ABB Group, Siemens AG, Schneider Electric SE, GE Corporation, Rockwell Automation Inc., Mitsubishi Motors Corporation, Emerson Electric, Yokogawa Electric Corporation, Endress+ Hauser Pvt. Ltd, EurotekIndia, Phoenix Contact, NALCO, MJK Automation, and Blue Water Automation. As the market is fragmented, there is a major competition between the major players. Therefore, the market concentration is expected to be low.

- November 2020 - PUB, Singapore's National Water Agency, issued ABB a contract for a complete site-wide plant monitoring and control system for the Tuas Water Reclamation Plant valued at USD 30 million.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Government Regulation to Save Water Resources and Energy

- 4.2.2 Increase in Adoption of Smart Water Technologies

- 4.3 Market Restraints

- 4.3.1 Lack of Skilled Personnel to Operate Instrumentation

- 4.4 Industry Value Chain Analysis

- 4.5 Industry Attractiveness - Porter's Five Force Analysis

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Buyers/Consumers

- 4.5.3 Bargaining Power of Suppliers

- 4.5.4 Threat of Substitute Products

- 4.5.5 Intensity of Competitive Rivalry

- 4.6 Assessment of the COVID-19 Impact on the Market

5 MARKET SEGMENTATION

- 5.1 Water Automation Solution

- 5.1.1 DCS

- 5.1.2 SCADA

- 5.1.3 PLC

- 5.1.4 IAM

- 5.1.5 HMI

- 5.1.6 Other Water Automation Solutions

- 5.2 Water Instrumentation Solution

- 5.2.1 Pressure Transmitter

- 5.2.2 Level Transmitter

- 5.2.3 Temperature Transmitter

- 5.2.4 Liquid Analyzers

- 5.2.5 Gas Analyzers

- 5.2.6 Leakage Detection Systems

- 5.2.7 Flow Sensors/Transmitters

- 5.2.8 Other Water Instrumentation Solutions

- 5.3 End-user Industry

- 5.3.1 Chemical

- 5.3.2 Manufacturing

- 5.3.3 Food and Beverages

- 5.3.4 Utilities

- 5.3.5 Paper and Pulp

- 5.3.6 Other End-user Industries

- 5.4 Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.2.4 Italy

- 5.4.2.5 Rest of Europe

- 5.4.3 Asia Pacific

- 5.4.3.1 Australia

- 5.4.3.2 China

- 5.4.3.3 Japan

- 5.4.3.4 India

- 5.4.3.5 Rest of Asia Pacific

- 5.4.4 Latin America

- 5.4.5 Middle East and Africa

- 5.4.5.1 Saudi Arabia

- 5.4.5.2 United Arab Emirates

- 5.4.5.3 Rest of Middle East and Africa

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 ABB Group

- 6.1.2 Siemens AG

- 6.1.3 Schneider Electric SE

- 6.1.4 GE Corporation

- 6.1.5 Rockwell Automation Inc.

- 6.1.6 Mitsubishi Motors Corporation

- 6.1.7 Emerson Electric

- 6.1.8 Yokogawa Electric Corporation

- 6.1.9 Endress + Hauser Pvt. Ltd

- 6.1.10 Eurotek India

- 6.1.11 Phoenix Contact

- 6.1.12 NALCO

- 6.1.13 MJK Automation

- 6.1.14 KROHNE LTD