|

市场调查报告书

商品编码

1636585

亚太水务自动化与仪器:市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)APAC Water Automation And Instrumentation - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

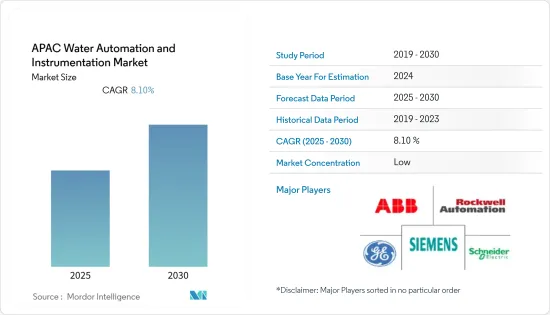

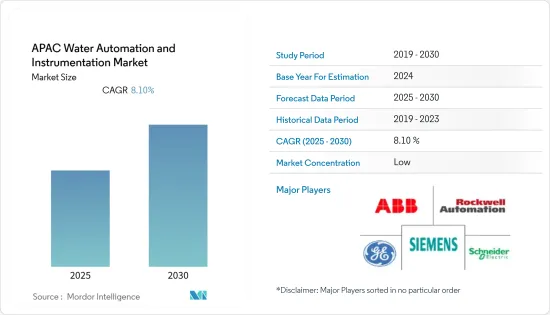

预计预测期内亚太水务自动化和仪器市场复合年增长率将达到 8.10%。

主要亮点

- 随着饮用水资源的减少和政府监管的加强,控制营运成本已成为水产业相关人员面临的最大挑战之一。人事费用和能源相关成本占营业单位营运支出的最大份额。

- 消费者预防水传播疾病的健康意识不断增强,导致瓶装水消费量增加。此外,这一趋势导致对基础设施开发的投资增加,以支持水自动化市场。

- 随着地方供水站数量的增加和水质的多样化,分散控制系统的数量也日益增加。 PLC 等自动化解决方案有助于控制马达接触器、搅拌马达、泵站中的分散阀门以及测量水压变送器。

- 创新包括透过改进海水淡化来利用以前无法利用的资源,以及透过新的水回收技术来提高工业效率。具体来说,可以考虑将基于物联网 (IoT) 的控制和监控系统与用于水资源管理的 SCADA 软体相结合的新型水技术自动化解决方案来解决特定问题。

- 在澳大利亚,对 SCADA 系统的需求源于降低营运风险和提高成本效率。 SCADA 系统技术为公共事业提供了开放标准,允许无限制地连接到任何资料库(包括 SQL)、可程式逻辑控制器 (PLC)、设备和企业系统。

亚太水务自动化和仪器市场趋势

食品饮料产业需求呈现明显成长率

- 食品和饮料生产需要大量的水,而水是食品和饮料加工行业必不可少的原材料之一,因此水质对产品品质和运作可靠性至关重要。在食品和饮料行业实施水和废水自动化可以节省大量收益,消除错误和浪费,提高效率和生产力,并扩大利润率。

- 此外,食品和饮料行业的各公司正在实施各种自动化和仪器方法。

- 此外,液体分析仪、压力测量污水和流量测量系统等仪器技术已被引入食品和饮料行业,在从生产线排放时使用仪器可以对製程进行精确测量。

- 此外,可以使用模组化、节省空间的分析面板有效监测原水、製程水和污水。这简化了食品和饮料行业的日常流程整合和操作。

中国占很大市场占有率

- 水资源短缺是中国北方面临的严重问题之一。因此,中国政府决定实施南水北调计划,将南方水资源丰富的地区调往北方。南水北调计划是世界规模最大的调水计划之一,具有远距、跨流域调水的显着特性。

- 此外,中国人口向城市迁移也增加了污水处理厂的数量以满足需求。 21 世纪初,中国约有 500 座污水处理厂;如今,数字已超过 4,000 座。

- 此外,多个案例研究表明,基于模型的先进控制系统可以帮助污水处理厂遵守更严格的排放许可,从而提高製程稳定性并节省能源。因此,近年来,中国开始在其污水处理厂安装和运作自动化製程控制系统并取得效益。

- 汕头潮南区将新建三座污水处理厂和300个污水截流井,以符合新的环境法规要求。 2020年,罗托克在中国南方广东省汕头的一家污水处理厂安装了700多台CK模组化电动致动器,实现污水处理。 CK 系列致动器是水处理产业阀门的理想选择,其模组化设计使其能够进行配置以满足各种应用的需求。

亚太地区水务自动化及仪器产业概况

主要参与者包括 ABB 集团、西门子股份公司、Schneider Electric股份有限公司、通用电气公司、罗克韦尔自动化公司、工业和横河电机株式会社。市场分散,主要参与者之间的竞争非常激烈。因此,预计市场集中度较低。

- 2020 年 11 月,新加坡水务局 (PUB) 授予 ABB 一份订单,为大士水回收厂提供一套完整的工厂监控和控制系统(价值 3,000 万美元)。

- 2020 年 10 月 – Enexio Water Technologies 荣获印度现有污水处理厂维修的第一级和侧流处理设计合约。该研究将开发一个示范工厂,研究如何根据当地情况调整污水处理,以便水可以重复利用并适合地下水补给。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概况

- 产业价值链分析

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争强度

- COVID-19 市场影响评估

第五章 市场动态

- 市场驱动因素

- 政府制定节约水资源和能源的规定

- 智能水技术的应用日益广泛

- 市场挑战

- 缺乏操作仪器设备的熟练人员

第六章 市场细分

- 水自动化解决方案

- DCS

- SCADA

- PLC

- HMI

- 其他水自动化解决方案

- 仪器解决方案

- 压力变送器

- 液位传送器

- 温度变送器

- 液体分析仪

- 气体分析仪

- 洩漏检测系统

- 流量感测器/变送器

- 其他仪器解决方案

- 按最终用户行业(定性分析)

- 化学

- 製造业

- 饮食

- 按国家

- 澳洲

- 中国

- 日本

- 印度

- 其他亚太地区

第七章 竞争格局

- 公司简介

- ABB Group

- Siemens AG

- Schneider Electric SE

- GE Corporation

- Rockwell Automation Inc.

- Mitsubishi Motors Corporation

- Emerson Electric

- Yokogawa Electric Corporation

- Endress+Hauser Pvt. Ltd

- Eurotek India

- Phoenix Contact

- NALCO

- MJK Automation

- KROHNE LTD

第八章投资分析

第九章:市场的未来

简介目录

Product Code: 49836

The APAC Water Automation And Instrumentation Market is expected to register a CAGR of 8.10% during the forecast period.

Key Highlights

- Managing operational costs emerged as one of the biggest challenges of the water industry stakeholders, as the governments are imposing regulations, along with depletion of potable water resources. Expenses relating to labor and energy constitute the largest share in OPEX for water utilities.

- The increasing health concerns for preventing water-borne diseases among consumers augmented the consumption of bottled drinking water. Furthermore, this trend led to increased infrastructure development investments supporting the water automation market.

- There has been an increase in decentralized control systems, with the rise in the number of outstations and varied qualities of water in a region. Automation solutions, such as PLC, help control pump station motor contactors, stirrer motors, and distributed valves and measure the pressure transmitter of the water.

- Technological innovations include taking advantage of previously unusable supplies through improved water desalination and increased industrial efficiency through new water reclaiming technologies. A new breed of water tech automation solutions, especially the Internet of Things (IoT)-based control and monitoring systems combined with SCADA software for water management, can be explored to help solve specific issues.

- In Australia, a need for a SCADA system arises from reducing operational risks and offering cost efficiencies. SCADA system technologies provide utilities with open standards that allow unlimited connections to any database (including SQL), programmable logic controllers (PLC), device, and enterprise system.

APAC Water Automation & Instrumentation Market Trends

Demand from Food and Beverage Industry to Witness a Significant Growth Rate

- The production of food and beverages requires a large amount of water, and water quality is crucial to product quality and operational reliability as water is one of the essential raw materials in the food and beverage processing industry. Implementing water and wastewater automation in the food and beverage industry can save significant revenues, eliminate errors and waste, enhance efficiency and productivity, and expand profit margins.

- Further, various companies in the Food and beverage industry are deploying various automation and instrumentation methods.

- Moreover, instrumentation technology such as liquid analyzer, pressure measurement system, flow measurement system is being deployed in the food and beverage industry to reduce the volume of wastewater during the process by using the instrumentation as mentioned earlier technology when discharging products from the lines.

- Further, Raw water, process water, or wastewater can be efficiently monitored with modular, space-saving analysis panels. This simplifies daily process integration and operation in the food and beverage industries.

China to Account for Significant Market Share

- Water scarcity is one of the serious issues faced in north China. Accordingly, the Chinese government decided to implement the South-to-North Water Diversion project to transfer water from the water-rich south China to China's northern region. The South-to-North Water Diversion project is one of the largest water diversion projects in the world, involving significant long-distance and inter-basin water transfer features.

- Moreover, China's internal migration of population to cities is causing wastewater treatment plant numbers to multiply to meet the demand. At the beginning of the millennium, China had around 500 municipal wastewater treatment plants, while now, numbers are above 4,000.

- Moreover, multiple case studies have demonstrated that an advanced model-based control system may assist wastewater treatment plants in meeting more stringent effluent permits and lead to improvements in process stability and energy savings. Hence, China has begun to reap the benefits of installing and operating automatic process control systems in wastewater treatment plants in recent years.

- Three new sewage treatment plants and 300 sewage intercepting wells will be built in Chaonan district, Shantou city, to comply with the new environmental regulations. In 2020, Rotork installed over 700 CK modular electric actuators at the Shantou wastewater treatment in Guangdong, southern China facilities, enabling sewage treatment. The CK range of actuators is ideal for valves in the water industry, and the modular nature of the actuators allows them to be configured to meet the needs of many different applications.

APAC Water Automation & Instrumentation Industry Overview

The major players include ABB Group, Siemens AG, Schneider Electric SE, GE Corporation, Rockwell Automation Inc., Mitsubishi Motors Corporation, Yokogawa Electric Corporation, etc. As the market is fragmented, there is major competition between the major players. Therefore, the market concentration is expected to be low.

- November 2020 - PUB, Singapore's National Water Agency, issued ABB a contract for a complete site-wide plant monitoring and control system for the Tuas Water Reclamation Plant valued at USD 30 million.

- October 2020 - ENEXIO Water Technologies has agreed to design primary treatment and sidestream treatment for retrofitting an existing Indian wastewater treatment plant. The study will develop a show-case plant to study how wastewater treatment can be adapted to local conditions so that the water can be reused and is suitable for groundwater recharge.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHT

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitutes

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Assessment of the COVID-19 Impact on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Government Regulation to Save Water Resources and Energy

- 5.1.2 Increase in Adoption of Smart Water Technologies

- 5.2 Market Challenges

- 5.2.1 Lack of Skilled Personnel to Operate Instrumentation

6 MARKET SEGMENTATION

- 6.1 By Water Automation Solution

- 6.1.1 DCS

- 6.1.2 SCADA

- 6.1.3 PLC

- 6.1.4 HMI

- 6.1.5 Other Water Automation Solutions

- 6.2 By Water Instrumentation Solution

- 6.2.1 Pressure Transmitter

- 6.2.2 Level Transmitter

- 6.2.3 Temperature Transmitter

- 6.2.4 Liquid Analyzers

- 6.2.5 Gas Analyzers

- 6.2.6 Leakage Detection Systems

- 6.2.7 Flow Sensors/Transmitters

- 6.2.8 Other Water Instrumentation Solutions

- 6.3 By End-User Industry (Qualitative Analysis)

- 6.3.1 Chemical

- 6.3.2 Manufacturing

- 6.3.3 Food and Beverages

- 6.4 By Country

- 6.4.1 Australia

- 6.4.2 China

- 6.4.3 Japan

- 6.4.4 India

- 6.4.5 Rest of Asia Pacific

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 ABB Group

- 7.1.2 Siemens AG

- 7.1.3 Schneider Electric SE

- 7.1.4 GE Corporation

- 7.1.5 Rockwell Automation Inc.

- 7.1.6 Mitsubishi Motors Corporation

- 7.1.7 Emerson Electric

- 7.1.8 Yokogawa Electric Corporation

- 7.1.9 Endress + Hauser Pvt. Ltd

- 7.1.10 Eurotek India

- 7.1.11 Phoenix Contact

- 7.1.12 NALCO

- 7.1.13 MJK Automation

- 7.1.14 KROHNE LTD

8 INVESTMENT ANALYSIS

9 FUTURE OF THE MARKET

02-2729-4219

+886-2-2729-4219