|

市场调查报告书

商品编码

1627128

北美穿戴式感测器:市场占有率分析、产业趋势和成长预测(2025-2030)NA Wearable Sensors - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

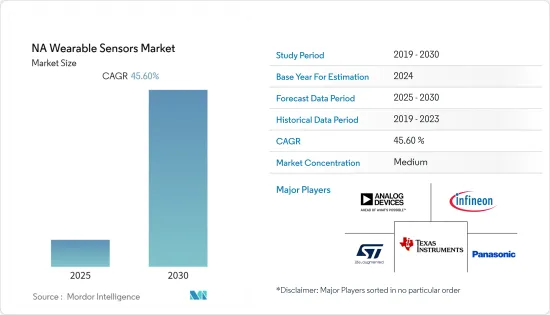

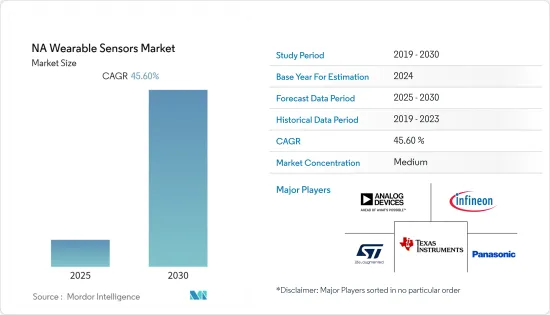

北美穿戴式感测器市场预计在预测期内复合年增长率为 45.6%

主要亮点

- 人们对健康和健身意识的增强推动了市场的发展,其中可穿戴感测器发挥关键作用。此外,研发投资降低了用于製造穿戴式感测器的组件的价格,使穿戴式装置更加便宜。

- 健身、医疗保健和安全领域的可穿戴技术等各个应用领域的需求不断增长,正在推动北美穿戴式感测器市场的快速成长。

- 在 COVID-19 爆发期间,穿戴式装置中的感测器的需求激增,这些感测器可以为第一线医护人员提供即时资料并快速筛检体温较高的人。

- 然而,由于持续的晶片短缺,预计晶片供应量将会减少。随着可供购买的产品减少和需求增加,可穿戴感测器和基于穿戴式感测器的装置的价格预计将会上涨。

北美穿戴式感测器市场趋势

对穿戴式健身设备的需求增加推动市场

- 该地区可穿戴感测器的主要市场之一是运动健身市场。市面上不断出现健身追踪产品,包括 Nike Fuelband、Jawbone UP、Microsoft Band 和 Fitbit。

- 这些设备可以戴在身上,追踪步数、行走距离、燃烧卡路里等各种参数,并且可以与行动电话同步,追踪你的日常进展。这些设备在该地区很受欢迎,因为超重和肥胖是一个严重的问题。

- 根据 CDC 的数据,美国65.5% 的成年人和大约 17% 的儿童患有肥胖症。不规则和不健康的饮食习惯以及缺乏运动会加剧这个问题。

- 穿戴式装置正在帮助改善大众的健康。穿戴式装置在运动健身中的应用正在成为北美地区的庞大市场。许多设备製造商都发现健身追踪解决方案的销售量增加。

改变消费者对穿戴式科技的观点

- 在过去的十年中,消费者对穿戴式装置的观点发生了变化,由于其功能和不断发展的技术整合正在改变消费者与环境的互动方式,因此它们越来越受欢迎。

- 在健身追踪器和智慧型手錶等穿戴式装置中,最有影响力的因素是年龄、收入和性别。根据 AARP 2020 报告,50 岁以上、50-59 岁、60-69 岁和 70 岁以上的美国成年人中分别有 83%、87%、81% 和 79% 使用穿戴式科技。

- 此外,根据 Attest 的《2019 年消费者研究和世代趋势报告》,2019 年,32.1% 的英国受访者拥有智慧型手錶/健康追踪器计算设备,其中32.7% 的Z 世代和32.7% 的千禧世代拥有智慧手錶/健康追踪器计算设备X世代占37.6%,X世代占31.4%,婴儿潮世代占22.2%。

- 此外,随着科技采用的增加,消费者对这些穿戴装置的观点也越来越好,以满足他们的期望。儘管对增加功能的需求,消费者对使用穿戴式装置越来越感兴趣。这为製造商创造了实现穿戴式产品多样化并克服消费者强调的问题的机会。

- 此外,随着物联网的发展,我们认为消费者将越来越多地使用穿戴式装置与周围的其他装置和实体物件交换资讯。

北美穿戴式感测器产业概况

北美穿戴式感测器市场适度分散,由少数国际公司和本土企业主导。

- 穿戴式智慧手环製造商的主要供应商包括苹果、华为科技公司、Polar Electro Oy、Garmin Ltd.、Fitbit Inc.、小米公司和三星电子。他们不断透过融入最新技术来更新产品,以保持其在市场中的地位和份额。

- 2020 年 3 月:市场上的一些供应商已与医疗机构合作,检测各种与健康相关的疾病和问题,并为其自有品牌智慧型手錶提供竞争优势。例如,Fitbit 与史克里普斯研究所和史丹佛大学医学院合作研究,旨在利用 Fitbit资料来帮助检测、追踪和遏制 COVID-19 等感染疾病。

其他好处:

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 市场概况

- 产业吸引力-波特五力分析

- 新进入者的威胁

- 买家/消费者的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争公司之间的敌对关係

- 市场驱动因素

- 科技的快速发展和感测器的小型化

- 工业领域应用不断增加

- 市场限制因素

- 大规模引入工业领域初期成本较高

- 产业价值链分析

- COVID-19 对市场的影响

- 技术简介

- 主要技术概述(MEMS、CMOS等)

第五章市场区隔

- 按类型

- 健康感测器

- 环境感测器

- MEMS感测器

- 动作感测器

- 其他的

- 按设备

- 手腕佩戴

- 紧身衣和鞋类

- 其他的

- 按用途

- 健康与保健

- 安全监控

- 家庭康復

- 其他的

- 按国家/地区

- 美国

- 加拿大

第六章 竞争状况

- 公司简介

- STMicroelectronics

- Infineon Technologies AG

- Texas Instruments Incorporated

- Analog Devices Inc.

- InvenSense Inc.

- Freescale Semiconductor Inc

- Panasonic Corporation

- NXP Semiconductors NV

- TE Connectivity Ltd.

- Bosch Sensortec GmbH(Robert Bosch GmbH)

第七章 投资分析

第八章 市场机会及未来趋势

简介目录

Product Code: 49683

The NA Wearable Sensors Market is expected to register a CAGR of 45.6% during the forecast period.

Key Highlights

- The market is driven by the rising awareness of health and fitness, where wearable sensors play a vital role. Moreover, due to investments in research and development, the reducing price of the components used to manufacture the wearable sensors is making the wearable devices affordable.

- Increasing demand across various application sectors such as wearable technology for fitness, healthcare, and security is driving the North American wearable sensors market to grow at a rapid rate.

- During the COVID-19 outbreak, the demand for wearable devices' sensors that offer real-time data to frontline healthcare workers and let them quickly screen individuals with a high temperature skyrocketed.

- However, the ongoing chip shortage is expected to result in a decline in chip availability. As fewer products become available to buy, and with increasing demands, prices of wearable sensors and wearable sensor-based devices are expected to increase.

North America Wearable Sensors Market Trends

Increase in demand of wearable fitness devices is driving the market

- One of the major markets for wearable sensors in this region is the sports and fitness market. Products like Nike Fuelband, Jawbone UP, Microsoft Band, and Fitbit have come into the market that is there for fitness tracking.

- These devices are worn on the body to track various parameters such as steps taken, distance traveled, calories burned, etc., and can be synced with the phone to track the progress daily. These devices are getting popular in this region because of the serious problem of people being overweight and obese.

- In the USA, according to CDC, 65.5% of adults and around 17% of children are obese. This problem is growing because of the irregular, unhealthy diet and the lack of exercise.

- Wearable devices are helping the masses to get more fit. The application of wearable devices in sports and fitness is becoming a huge market in the North American region. Many device manufacturers have witnessed growing sales with respect to fitness tracking solutions.

Changing consumer perspective towards wearable technology

- Consumer perspectives towards wearable devices are changing in the last decade owing to features and evolving technology integration that is changing the way consumers interact with the environment, and their popularity is growing.

- Age, income, and gender are the most influencing factor among these wearable devices, such as fitness trackers and smartwatches. According to AARP 2020 report, the age of usage of wearable technology among United States adults aged 50 years and older, between 50-59 years, between 60-69 years, and between 70 years and plus accounted for 83%, 87%, 81%, and 79% respectively.

- Further, according to Attest consumer survey and generational trend report 2019, the share of respondents who own a smartwatch/health-tracker computing device in the United Kingdom in 2019 accounted for 32.1%, where Generation Z, Millenials, Generation X, and Baby boomers accounted for 32.7%, 37.6%, 31.4%, and 22.2% respectively.

- Further, the consumer perspective towards these wearable devices is increasing towards meeting their expectation with the technology adoption rising. Despite the need for improved functionality, an increasing number of consumers are interested in using wearables. This creates opportunities for manufacturers to diversify their wearables offerings and overcome the issues highlighted by consumers.

- Moreover, with the growth of IoT, consumers feel that they will be using wearables to exchange information with other devices and physical things around them.

North America Wearable Sensors Industry Overview

The wearable sensors market in North America is dominated by few international players amongst local players and is moderately fragmented.

- Major vendors of wearable smart bands manufacturers consist of Apple Inc., Huawei Technologies Co. Ltd, Polar Electro Oy, Garmin Ltd, Fitbit Inc., Xiaomi Corporation, and Samsung Electronics Co. Ltd. They keep on updating their products by embedding the latest technologies to retain their market position and share.

- March 2020: Some of the vendors in the market are partnering with healthcare institutes to research various sensors which can be embedded within the device to detect various health-related diseases or problems and provide a competitive advantage to their brand of smartwatches. For instance, Fitbit has collaborated with the Scripps Research Institute and Stanford Medicine on research that is aimed at using Fitbit data to help detect, track, and contain infectious diseases like COVID-19.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Force Analysis

- 4.2.1 Threat of New Entrants

- 4.2.2 Bargaining Power of Buyers/Consumers

- 4.2.3 Bargaining Power of Suppliers

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Market Drivers

- 4.3.1 Rapid technological developments and miniaturization of sensors

- 4.3.2 Increasing applications in the industrial sector

- 4.4 Market Restraints

- 4.4.1 High initial costs for large scale implementation in industries

- 4.5 Industry Value Chain Analysis

- 4.6 Impact of COVID-19 on the Market

- 4.7 Technology Snapshot

- 4.7.1 Key technology overview (MEMS, CMOS, etc)

5 MARKET SEGMENTATION

- 5.1 By Type

- 5.1.1 Health Sensors

- 5.1.2 Environmental Sensors

- 5.1.3 MEMS Sensors

- 5.1.4 Motion Sensors

- 5.1.5 Others

- 5.2 By Device

- 5.2.1 Wristwear

- 5.2.2 Bodywear & Footwear

- 5.2.3 Others

- 5.3 By Application

- 5.3.1 Health & Wellness

- 5.3.2 Safety Monitoring

- 5.3.3 Home Rehabilitation

- 5.3.4 Others

- 5.4 By Country

- 5.4.1 United States

- 5.4.2 Canada

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 STMicroelectronics

- 6.1.2 Infineon Technologies AG

- 6.1.3 Texas Instruments Incorporated

- 6.1.4 Analog Devices Inc.

- 6.1.5 InvenSense Inc.

- 6.1.6 Freescale Semiconductor Inc

- 6.1.7 Panasonic Corporation

- 6.1.8 NXP Semiconductors N.V.

- 6.1.9 TE Connectivity Ltd.

- 6.1.10 Bosch Sensortec GmbH (Robert Bosch GmbH)

7 INVESTMENT ANALYSIS

8 MARKET OPPORTUNITIES AND FUTURE TRENDS

02-2729-4219

+886-2-2729-4219