|

市场调查报告书

商品编码

1640501

中东和非洲穿戴式感测器市场占有率分析、产业趋势、统计数据和成长预测(2025-2030 年)Middle East And Africa Wearable Sensors - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

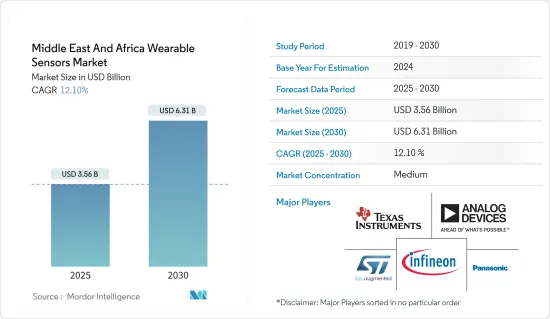

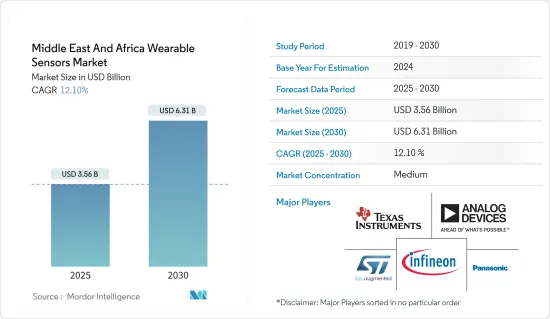

中东和非洲的可穿戴感测器市场规模预计在 2025 年为 35.6 亿美元,预计到 2030 年将达到 63.1 亿美元,预测期内(2025-2030 年)的复合年增长率为 12.1%。

由于现代技术和小型化电路的发展,可穿戴感测器在健康监测系统等数位系统中越来越受欢迎。穿戴式技术通常包含感测器和无线连接,允许用户监控、追踪和分析资料。腕带、眼镜、耳机和智慧型手机等各种配件都与这些穿戴式感测器系统结合。

关键亮点

- 家用电子电器产品支出的增加、生活方式的改善和都市化进程的加快,正在推动人们健康和安全意识的增强。随着可支配收入的增加,智慧腕带、智慧型手錶、健身追踪器、 VR头戴装置、活动追踪器、运动手錶、医疗应用、企业和工业应用等设备越来越受欢迎。 2023 年 6 月,Uniccon Group 在 2023 年 GITEX Africa 展会上推出了备受期待的VR头戴装置。

- 据沙乌地货币管理局称,预计沙乌地阿拉伯私人消费将在 2022 年第一季增长至3,433.74 亿沙特里亚尔(915.54 亿美元),高于2020 年第四季的3335.55 亿沙特里亚尔(889.36亿美元)。此外,根据经合组织的预测,以色列2022年经济成长率为4.9%,2023年将为4%。

- 预测期内推动穿戴式感测器市场发展的关键因素之一是老年人口的增加。未来几十年沙乌地阿拉伯老龄人口将迅速成长。

- 根据联合国预测,沙乌地阿拉伯老年人口比例将从2017年的5.6%成长至2050年的22.9%。此外,根据联合国人口基金的数据,埃及60 岁及以上人口预计将在2020 年至2050 年间增加一倍以上,从840 万人(占总人口的8%)增加到2,200 万(占总人口的14% )。

- 现今市场充满了智慧互联产品,而且数量还在快速成长。实现正确的感测器资料和资讯交流的首要条件是标准化。有几家公司正在製定感测器通讯标准。

- OGC 感测器网路支援 (SWE) 计画满足了高度复杂和基础应用对改进感测器连接的需求。借助 SWE 标准,使用 OGC 和其他标准的数千个地理空间应用程式可以轻鬆合併这些资料。感测器通讯缺乏通用标准也带来了互通性问题。

- 随着消费者对智慧型穿戴装置的追求日益增长,装置的价格也随之上涨,零件成本也不断上升,限制了市场普及。智慧型手錶和健身追踪器采用低成本组件,吸引了大量消费者的注意。然而,随着技术的进步,其他设备如鞋类、眼镜产品和内衣产品价格高昂,采用率低。目前大多数穿戴式科技价格较高,对市场采用产生了负面影响。

- 俄罗斯和乌克兰之间持续的衝突可能会对电子产业产生重大影响。竞争已经加剧了影响该行业一段时间的半导体供应链问题和晶片短缺问题。这些影响可能表现为镍、钯、铜、钛、铝和铁矿石等主要原料的价格波动,导致材料短缺。这被认为对穿戴式感测器的生产造成了阻碍。

中东和非洲穿戴式感测器市场趋势

医疗领域预计将显着成长

- 穿戴式感测器广泛应用于医疗领域。穿戴式感测器附着在患者的身上,用于密切监测患者的生理状况。穿戴式医疗感测器监测患者的生命征象(例如体温、心率、血压、血氧饱和度)。随着穿戴式生命征象感测器和位置标籤的兴起,各种感测器在医疗应用中的出现正获得发展势头,这些感测器可以即时持续追踪医护人员和患者的状况和位置。

- 2023年10月,华为在阿联酋推出了全新智慧型手錶、freebuds、智慧眼镜和MatePad系列,开创了时尚、注重健康和运动的可穿戴设备的新时代。华为Watch GT 4是热门智慧型手錶系列的新成员,高阶的华为手錶Ultimate Design,高传真TWS耳机华为Freebuds Pro 3,智慧眼镜华为Eyewear 2,以及光干扰等多款新品即将发表的还有华为MatePad 11吋Paper Matte版、MatePad 11.5吋Paper Matte版等多款新品,噪音降低97%,实现如纸般阅读、书写体验。

- 根据 AppDynamics 2022 年的一项研究(调查了全球超过 12,000 名消费者),阿联酋的大多数人计划在未来 12 个月内购买可穿戴健康技术或应用程式。调查发现,88% 的海湾受访者打算在 2023 年使用 Fitbit 和智慧型手錶等医疗穿戴装置。此外,约 90% 的阿联酋受访者希望透过手錶或其他穿戴式装置获取心率、血压、心律、体力活动和呼吸频率。阿联酋的受访者表示,他们相信穿戴式科技可以改变个人健康和公共健康。

- 这个市场正在见证企业之间的合作与协作,利用彼此的能力来开发创新的整合解决方案。 2023 年 11 月,提供个人化、临床级健康洞察的全球知名手錶品牌 LifeQ 与 AAIC Investment 合作。此消息由 LifeQ 执行长兼联合创始人劳伦斯 (Laurie) 奥利维尔 (Laurence (Laurie) Olivier) 宣布。 AAIC Investment 专注于非洲医疗保健领域快速发展的公司,并致力于改善非洲的医疗保健。

- 为了满足对穿戴式医疗感测器的激增需求,2022年3月,持续健康监测和临床智慧公司BioIntelliSense与穆巴达拉投资公司旗下的综合医疗网络Mubadala Health建立了策略伙伴关係。合作伙伴关係。此次合作将把 BioIntelliSense 的创新远距照护技术融入穆巴达拉医疗的持续照护模式,以推动更高效的临床工作流程,解锁资料主导的临床见解并提供个人化护理。体验。

- 该地区人们对心臟病、糖尿病、癌症和呼吸系统疾病等健康问题的兴趣日益浓厚,这可能会导致穿戴式感测器的采用率增加。例如,根据沙乌地阿拉伯卫生署的数据,到2026年,预计沙乌地阿拉伯成年人口的24.3%将患有糖尿病。预计这些因素将推动市场的成长。

沙乌地阿拉伯占主要市场占有率

- 穿戴式感测器在沙乌地阿拉伯正在经历强劲成长。穿戴式科技正越来越多地融入全国各地的日常生活和各个行业,其应用包括健身追踪、医疗监测和工业应用。根据世界卫生组织预测,2022年沙乌地阿拉伯的卫生支出总额将达607亿美元。报告称,预计2027年沙乌地阿拉伯医疗保健支出将达771亿美元。

- 对塑造体形、增强身体免疫力和控制压力的关注推动了健身类穿戴装置的流行度激增。智慧型手錶作为使用者身体的延伸和智慧型手机的配件,发挥着至关重要的作用。这些设备可以全天佩戴并充当用户的智慧助手,帮助他们主动管理健康,同时探索身临其境型的应用体验。

- 2022年3月,华为与沙乌地阿拉伯全民运动联合会(SFA)联手推广专为跑者设计的先进穿戴式装置。沙乌地阿拉伯足球协会举办这场马拉松赛事是为了促进公民健康,提高公民的体育活动水平,并符合沙乌地阿拉伯 2030 愿景目标。

- 结果,超过 10,000 名跑者参加了首届马拉鬆比赛。华为向所有马拉松参赛者赠送了价值 200 沙特里亚尔的代金券,可透过华为官方网站购买。其中包括令人兴奋的HUAWEI WATCH GT系列,其中包括该公司首款专业跑步手錶HUAWEI WATCH GT Runner,它提供广泛的健康和幸福感监测功能以及数十款智慧手錶,可帮助用户提高健身水平。运动模式。这些努力提高了人们对用于监测健康和健身的现代穿戴式感测器的认识,从而促进了市场的成长。

- 该国智慧型手机用户数量的不断增加,使得穿戴式装置的整合成为可能,预计将提供有利可图的市场成长机会。根据欧盟统计局的数据,2023 年 1 月沙乌地阿拉伯的网路用户数量为 3,630 万,高于去年的 3,580 万。

- 癌症患者接受化疗和/或放射线治疗来治疗其癌症状况。此外,由于关注健康的人数迅速增加,对穿戴式医疗感测器的需求也在增加。根据世界银行的数据,到 2050 年,该国人口可能达到 4,510 万,复合年增长率为 1.02%。预计人口成长将增加该国对医疗保健服务的需求。

中东和非洲穿戴式感测器产业概况

中东和非洲的穿戴式感测器市场是半固体的,其中有几家主要参与者,例如意法半导体、英飞凌科技股份公司、德州仪器公司和 ADI 公司。公司不断投资于策略联盟和产品开发以获得市场占有率。

- 2023年11月:小米智慧型手錶Redmi K70系列在阿联酋获得TDRA认证。智慧型手錶註册为短距离智慧型手錶设备。小米子品牌 Redmi 即将推出 Redmi K70 系列,包括 Redmi K70e、Redmi K70 和 Redmi K70 Pro。 Redmi K70e 配备 6.67 吋 OLED 显示屏,刷新率为 120Hz,解析度为 2712 x 1220 像素。

- 2023 年 10 月:Google推出 Pixel Watch 2 ,智慧型手錶,包括心率追踪和睡眠追踪。该设备采用光电脉衝光子光谱 (PPG) 感测器,透过在使用者的手腕上照射绿色 LED 灯来测量血液循环。我们也改进了我们的人工智慧演算法,为您提供更准确的心率资料。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第 2 章执行摘要

第三章调查方法

第四章 市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

- 价值链分析

- 评估宏观经济趋势对市场的影响

第五章 市场动态

- 市场驱动因素

- 拥抱最新技术与创新

- 更重视健康与健身

- 市场限制

- 与电子产品相关的高成本

第六章 市场细分

- 按类型

- 温度

- 压力

- 成像/光学

- 运动

- 其他感测器

- 按应用

- 健康与福祉

- 安全监控

- 运动与健身

- 其他的

- 按国家

- 阿拉伯聯合大公国

- 沙乌地阿拉伯

第七章 竞争格局

- 公司简介

- STMicroelectronics

- Infineon Technologies AG

- Texas Instruments Incorporated

- Analog Devices

- Panasonic Corporation

- InvenSense Inc.

- NXP Semicondutors

- TE Connectivity Ltd

- Bosch Sensortec GmbH(Robert Bosch GmbH)

- Broadcom Limited

第八章投资分析

第九章:市场的未来

The Middle East And Africa Wearable Sensors Market size is estimated at USD 3.56 billion in 2025, and is expected to reach USD 6.31 billion by 2030, at a CAGR of 12.1% during the forecast period (2025-2030).

Wearable sensors are gaining popularity in digital systems like health monitoring systems due to ongoing developments in modern technologies and miniature circuits. Wearable technology generally includes sensors and wireless connections, allowing users to monitor, track, and analyze data. Various accessories, including wristbands, eyeglasses, headphones, and smartphones, are combined with these wearable sensor systems.

Key Highlights

- Increased spending on consumer electronics, improved lifestyles, and a surge in urbanization have led to a rise in health and safety awareness. With rising disposable incomes, devices like smart wristbands, smartwatches, fitness trackers, VR headsets, activity trackers, sports watches, healthcare applications, and enterprise and industrial applications are gaining tremendous traction. In June 2023, the Uniccon Group launched a highly anticipated VR headset at the GITEX Africa 2023.

- According to the Saudi Arabian Monetary Agency, consumer spending in Saudi Arabia increased to SAR 343,374 million (USD 91.554 billion) in the first quarter of 2022 from SAR 333,555 million (USD 88.936 billion) in the fourth quarter of the previous year. Furthermore, according to the OECD, Israel's economy grew by 4.9% in 2022 and 4% in 2023.

- One significant factor anticipated to drive the wearable sensors market during the forecast period is the growing elderly population. Over the coming decades, Saudi Arabia's aging population will rapidly grow.

- According to UN projections, the senior population in Saudi Arabia will rise from 5.6% in 2017 to 22.9% by 2050. Furthermore, according to the UN Population Fund, Egypt is undergoing a demographic transition as the number of people over 60 is predicted to more than double from 8.4 million (8% of the overall population) to 22 million between 2020-2050 (14%).

- The market is currently flooded with smart, Internet-connected products, and the number is expanding quickly. The primary condition for enabling adequate sensor data and information exchange is standardization. A few businesses have developed standards for sensor communication.

- The OGC's Sensor Web Enablement (SWE) measures satisfy the need for improved sensor connectivity in highly complicated and basic applications. Thousands of geospatial applications that use the OGC or other standards may easily incorporate this data due to the SWE standards. Interoperability problems are also brought on by the absence of universal standards for sensor communication.

- With the growing propensity of consumers toward smart wearables, the prices of instruments are also soaring, along with the increasing cost of components, thereby limiting adoption in the market. Smartwatches and fitness trackers have low-cost components that drive significant attention from consumers. However, with the increase of technology, other devices such as footwear, eyewear, and body wear products are highly priced and have lower adoption rates. Most wearable technologies are currently highly priced, negatively impacting adoption in the market.

- The ongoing conflict between Russia and Ukraine will significantly impact the electronics industry. The competition has already exacerbated the semiconductor supply chain issues and the chip shortage that have affected the industry for some time. The disruption may come in the form of volatile pricing for critical raw materials such as nickel, palladium, copper, titanium, aluminum, and iron ore, resulting in material shortages. This would obstruct the manufacturing of wearable sensors.

Middle East And Africa Wearable Sensors Market Trends

The Healthcare Sector is Expected to Register Significant Growth

- Wearable sensors are widely used in the healthcare sector. They are arranged on a patient's body and can be utilized to closely monitor patients' physiological condition. Wearable medical sensors monitor the patient's vital body signs (for example, temperature, heart rate, blood pressure, and oxygen saturation). The emergence of various sensors in healthcare applications is gaining momentum through the increasing array of wearable vital sign sensors and place tags, which can continuously track healthcare personnel and patient status/ location in real time.

- In October 2023, Huawei entered a new era of stylish, health-focused, and sport-ready wearables by introducing a new line-up of smartwatches, freebuds, smart glasses, and MatePad in the UAE. The range of new devices, including the Huawei Watch GT 4, the new addition to the popular smartwatch series, the high-end Huawei Watch Ultimate Design, Huawei Freebuds Pro 3 high-fidelity TWS earbuds, Huawei Eyewear 2 smart glasses, and the Huawei MatePad 11-inch PaperMatte Edition and MatePad 11.5-inch PaperMatte Edition that offer a paper-like reading and writing with 97% light interference reduction.

- According to a survey published by AppDynamics in 2022 (a study of more than 12,000 consumers worldwide), most people in the UAE bought more wearable health technology or applications in the following 12 months. The survey found that 88% of respondents in the Gulf country intended to use medical wearables, like Fitbit or smartwatches, in 2023. Further, around 90% of respondents in the UAE wanted access to heart rate, blood pressure, heart rhythms, physical activity, and respiratory rate from a watch or other wearable gadget. The UAE respondents said they believed wearable technology could transform both personal and public health.

- The market is witnessing collaborations as companies partner to develop innovative integrated solutions by leveraging each other's capabilities. In November 2023, LifeQ, a company using globally recognized watch brands to generate personalized, clinical-grade health insights, partnered with AAIC Investment. LifeQ co-founder Laurence (Laurie) Olivier, CEO, made the announcement. AAIC Investment focuses on fast-growing companies in Africa's healthcare sector and is deeply committed to improving healthcare in Africa.

- To cater to the upsurge in demand for healthcare wearable sensors, in March 2022, BioIntelliSense, Inc., a continuous health monitoring and clinical intelligence company, announced its strategic collaboration with Mubadala Health, an integrated healthcare network of Mubadala Investment Company. The partnership incorporates BioIntelliSense's innovative remote care technologies with Mubadala Health's continuous care model to drive clinical workflow efficiencies, unlock data-driven clinical insights, and deliver a personalized care experience.

- Increasing health concerns like heart ailments, diabetes, cancer, and respiratory diseases in the region are likely to drive the population toward adopting wearable sensors. For instance, according to the Ministry of Health, Saudi Arabia, 24.3% of the adult population in Saudi Arabia is expected to have diabetes by 2026. Such factors are expected to boost the market's growth.

Saudi Arabia Holds a Significant Market Share

- Wearable Sensors are experiencing significant growth in Saudi Arabia. Wearable technology has become increasingly integrated into daily life and various industries nationwide, utilized for fitness tracking, healthcare monitoring, and industrial applications. According to the WHO, in 2022, Saudi Arabia's expenditure on healthcare totaled USD 60.7 billion. According to the report, the healthcare expenditure of Saudi Arabia in 2027 is expected to reach USD 77.1 billion.

- A dedicated focus on getting in shape, building the body's immunity, and managing stress drives the surge in the popularity of wearables in the fitness category. Smartwatches play a vital role by becoming extensions of the user's body and a smartphone accessory. These devices can be worn all day and work as the user's smart assistant to aid them in actively managing their health while exploring immersive application experiences.

- In March 2022, Huawei and SFA (Saudi Sports for All Federation) joined forces to promote advanced wearable devices designed specifically for runners. The SFA organized a marathon event to promote well-being and increase physical activity levels across the population in line with the Saudi Vision 2030 objectives.

- As a result, more than 10,000 runners participated in the inaugural marathon. Huawei gifted all marathon participants with a 200 SAR voucher to buy anything from the official Huawei website, such as the stunning HUAWEI WATCH GT Series, including the company's first professional running watch, the HUAWEI WATCH GT Runner, which has a wide range of health and well-being monitoring features as well as dozens of sport modes to help users level up their fitness. Such initiatives spread awareness about the latest wearable sensors to monitor health and fitness, thereby driving the growth of the market.

- The country's increasing number of smartphone users is expected to offer lucrative market growth opportunities as they enable wearable device integration. According to Eurostat, the number of internet users in Saudi Arabia in January 2023 was 36.3 million users, up from 35.8 million users in the previous year.

- Cancer patients are undergoing chemotherapy and radiotherapy as therapeutic treatments for their cancer conditions. Demand for wearable medical sensors is also increasing due to the rapidly growing population concerned about health conditions. According to the World Bank, the country's population may reach 45.1 million by 2050, with a 1.02% average annual growth. This increase in population is anticipated to boost the demand for healthcare services in the country.

Middle East And Africa Wearable Sensors Industry Overview

The Middle East and African wearable sensor market is semi-consolidated, with the presence of a few significant companies like STMicroelectronics, Infineon Technologies AG, Texas Instruments Incorporated, and Analog Devices. The companies continuously invest in strategic collaborations and product developments to gain market share.

- November 2023: The upcoming Redmi K70 series, a Xiaomi Smartwatch, surfaced on the UAE's TDRA certification. Bearing the model code M2320W1, the smartwatch was registered as a short-range smartwatch device. Xiaomi's subbrand Redmi plans to launch the Redmi K70 Series, which consists of the Redmi K70e, Redmi K70, and Redmi K70 Pro. The Redmi K70e will come with a 6.67-inch OLED display with a 120Hz refresh rate and a resolution of 2712 x 1220 pixels.

- October 2023: Google launched its Pixel Watch 2 smartwatch, featuring advanced health-related characteristics such as heart rate tracking and sleep tracking. The device uses a photoplethysmography (PPG) sensor that measures blood circulation by shining a green LED light onto the user's wrist. The watch also includes improved AI-powered algorithms to provide more accurate heart rate data.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Value Chain Analysis

- 4.4 Assessment of the Impact of Macroeconomic Trends on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Adoption of Latest Technology and Innovations

- 5.1.2 Increased Focus on Health and Fitness

- 5.2 Market Restraints

- 5.2.1 High Costs Associated with Gadgets

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 Temperature

- 6.1.2 Pressure

- 6.1.3 Image/Optical

- 6.1.4 Motion

- 6.1.5 Other Types of Sensors

- 6.2 By Application

- 6.2.1 Health and Wellness

- 6.2.2 Safety Monitoring

- 6.2.3 Sports and Fitness

- 6.2.4 Other Applications

- 6.3 By Country

- 6.3.1 United Arab Emirates

- 6.3.2 Saudi Arabia

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 STMicroelectronics

- 7.1.2 Infineon Technologies AG

- 7.1.3 Texas Instruments Incorporated

- 7.1.4 Analog Devices

- 7.1.5 Panasonic Corporation

- 7.1.6 InvenSense Inc.

- 7.1.7 NXP Semicondutors

- 7.1.8 TE Connectivity Ltd

- 7.1.9 Bosch Sensortec GmbH (Robert Bosch GmbH)

- 7.1.10 Broadcom Limited