|

市场调查报告书

商品编码

1627198

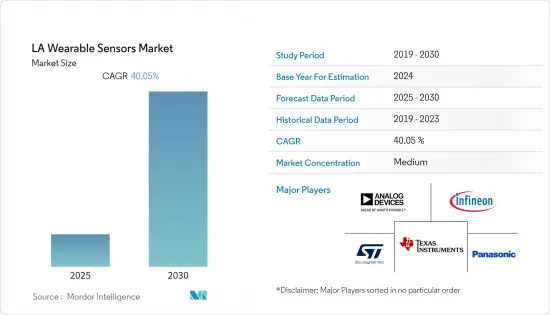

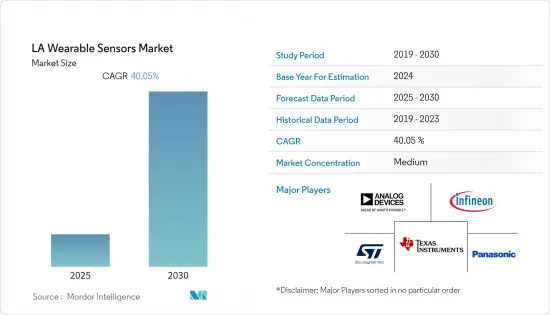

拉丁美洲穿戴式感测器:市场占有率分析、产业趋势、产业趋势、成长预测(2025-2030)LA Wearable Sensors - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

拉丁美洲穿戴式感测器市场预计在预测期内复合年增长率为 40.05%

主要亮点

- 人们对健康和健身意识的增强推动了市场的发展,其中可穿戴感测器发挥关键作用。由于用于製造可穿戴感测器的组件价格下降,可穿戴设备变得越来越便宜。

- 健身、医疗保健和安全领域的可穿戴技术等各个应用领域的需求不断增长,正在推动拉丁美洲可穿戴感测器市场的显着成长。

- 在 COVID-19 大流行期间,对穿戴式装置感测器的需求激增,这些感测器可以为第一线医护人员提供即时资料并快速筛检体温升高的人。

- 然而,由于持续的晶片短缺,预计晶片供应量将会减少。由于可供购买的产品减少且需求增加,拉丁美洲可穿戴感测器和基于穿戴式感测器的装置的价格预计将上涨。

拉丁美洲穿戴式感测器市场趋势

穿戴式装置需求的增加推动市场发展

- 智慧型手机和平板电脑市场的扩张使得穿戴式装置与智慧型手机的整合成为可能。腕錶领域占据大部分市场占有率,预计在预测期内将主导市场。

- 三星、SONY和耐吉等公司推出的智慧型手錶正在推动这一市场的发展。预计到 2022 年,拉丁美洲将占全球市场的 4% 左右,这主要得益于该地区感测器技术的进步。

- 例如,据Cisco称,到 2021 年,拉丁美洲穿戴装置的销售量预计将达到 3,900 万台。因此,该地区智慧型穿戴装置的日益普及预计将进一步增加对更广泛的具有温度感测功能的可穿戴设备的需求。

- 此外,拉丁美洲数位环境的变化和行动装置的激增也促进了穿戴式装置的成长。例如,根据 GSMA 的数据,到 2025 年,拉丁美洲的行动装置数量预计将达到 4.24 亿台。

该地区的高科技进步预计将推动拉丁美洲可穿戴感测器市场

- 随着各国政府对通讯的关注以及中国尤其对新兴技术的投资,拉丁美洲正经历技术繁荣。巴西和阿根廷将引领该地区经济,消费者支出预计也将进一步增加。

- 汽车和医疗保健生产支持该地区的无线感测器需求。该地区缺乏航太和军事设备以及其他工业控制系统的本地生产。

- 墨西哥的工业部门与该国汽车製造厂数量的增加有关。像英特尔这样专注于自动驾驶汽车领域的公司正在投资全球第六大汽车出口国墨西哥。该公司计划在2024年为自动驾驶乘用车市场做出重大贡献。 TPMS 在大多数地区都是强制性的,因此无线感测器的需求量很大。

- GDP的成长和中阶的崛起也推动了拉丁美洲地区的汽车销售。各类汽车生产厂预计将为无线感测器市场提供巨大机会。

拉丁美洲穿戴式感测器产业概况

北美穿戴式感测器市场适度分散,由少数国际公司和本土公司主导。

- 墨西哥、巴西和阿根廷等国家为这些新兴经济体提供智慧穿戴装置的公司提供了潜在的机会。例如,三星在这些地区已经拥有最大的智慧型手錶业务。 Fitbit 在阿根廷推出了屡获殊荣且最畅销的 Fitbit Versa、Fitbit Ionic 和 Fitbit Ionic 阿迪达斯版智慧型手錶。这些重要的发展预计将促进这些地区穿戴式装置的成长。

其他好处:

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 市场概况

- 产业吸引力-波特五力分析

- 新进入者的威胁

- 买方议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争公司之间的敌对关係

- 市场驱动因素

- 市场限制因素

- 价值链分析

- COVID-19 市场影响评估

- 技术简介

- 主要技术概述(MEMS、CMOS等)

第五章市场区隔

- 按类型

- 健康感测器

- 环境感测器

- MEMS感测器

- 动作感测器

- 其他的

- 按设备

- 手腕佩戴

- 紧身衣/鞋类

- 其他的

- 按用途

- 健康与保健

- 安全监控

- 家庭康復

- 其他的

- 按国家/地区

- 巴西

- 墨西哥

- 阿根廷

- 其他的

第六章 竞争状况

- 公司简介

- STMicroelectronics

- Infineon Technologies AG

- Texas Instruments Incorporated

- Analog Devices Inc.

- InvenSense Inc.

- Freescale Semiconductor Inc

- Panasonic Corporation

- NXP Semiconductors NV

- TE Connectivity Ltd.

- Bosch Sensortec GmbH(Robert Bosch GmbH)

第七章 投资分析

第八章市场机会与未来趋势

简介目录

Product Code: 50737

The LA Wearable Sensors Market is expected to register a CAGR of 40.05% during the forecast period.

Key Highlights

- The market is driven due to the rising awareness of health and fitness, where wearable sensors play a vital role. The falling price of the components used to manufacture the wearable sensors is making the wearable devices affordable.

- Increasing demand across various application sectors such as wearable technology for fitness, healthcare, and security is driving the Latin American wearable sensors market to grow lucratively.

- During the COVID-19 outbreak, the demand for wearable devices' sensors that offer real-time data to frontline healthcare workers and let them quickly screen individuals with a high temperature skyrocketed.

- However, the ongoing chip shortage is expected to result in a decline in chip availability. As fewer products become available to buy, and with increasing demands, prices of wearable sensors and wearable sensor-based devices are expected to increase in Latin America.

Latin America Wearable Sensors Market Trends

Increase in demand of wearable devices is driving the market

- The rising market of smartphones and tablets is enabling the integration of wearable devices with smartphones. The wristwear segment holds the majority of the market share and is anticipated to dominate the market during the forecast period.

- The introduction of smartwatches from companies like Samsung, Sony, and Nike, among others, has given a boost to this market. Latin America is expected to account for about 4% of the global market in 2022, mainly due to advancements in sensor technologies in the region.

- For instance, according to Cisco Systems, the unit sales of wearable devices in Latin America are expected to reach 39 million by 2021. Thus, the growing penetration of smart wearables in the region is further expected to create a demand for a more diverse set of wearables with temperature sensing capabilities.

- Also, the changing digital landscape in the Latin America region and mobile penetration contributes to the growth of wearables. For instance, according to GSMA, the number of mobile devices in Latin America is expected to reach 424 million by 2025.

High technological advancements in the region are expected to drive the wearable sensor market in Latin America

- Latin America is undergoing a technology boom, owing to the government's emphasis on telecommunications and the Chinese investment in the region, especially in emerging technologies. With the economy of the region expected to be driven by Brazil and Argentina, consumer spending is also expected to increase further.

- Automotive and healthcare production substantiates the region's demand for wireless sensors. The region lacks the local production of aerospace and military equipment and other industrial control systems.

- The Mexican industrial sector can be associated with the growing number of automotive manufacturing plants in the country. Companies like Intel that are focusing on the autonomous vehicle space are investing in Mexico, which is the sixth global car exporter. The company is planning to contribute significantly to autonomous passenger vehicles in the market by the year 2024. As TPMS is mandated across most of the regions, the demand for wireless sensors is significant.

- The rising GDP and the emerging middle class are also driving automotive sales in the Latin American region. Various automobile production plants are expected to provide significant opportunities for the wireless sensors market.

Latin America Wearable Sensors Industry Overview

The wearable sensors market in North America is dominated by few international players amongst local players and is moderately fragmented.

- Countries such as Mexico, Brazil, and Argentina, among others, provide a potential opportunity for companies offering smart wearables devices across these emerging economies. For instance, Samsung has already established one of the most substantial smartwatch presence throughout these regions. Fitbit had launched its award-winning and top-selling Fitbit Versa, Fitbit Ionic, and Fitbit Ionic Adidas Edition smartwatches in Argentina. These significant developments are expected to boost the growth of wearables in these regions.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Force Analysis

- 4.2.1 Threat of New Entrants

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Bargaining Power of Suppliers

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Market Drivers

- 4.4 Market Restraints

- 4.5 Value Chain Analysis

- 4.6 Assessment of the Impact of COVID-19 on the Market

- 4.7 Technology Snapshot

- 4.7.1 Key technology overview (MEMS, CMOS, etc)

5 MARKET SEGMENTATION

- 5.1 By Type

- 5.1.1 Health Sensors

- 5.1.2 Environmental Sensors

- 5.1.3 MEMS Sensors

- 5.1.4 Motion Sensors

- 5.1.5 Others

- 5.2 By Device

- 5.2.1 Wristwear

- 5.2.2 Bodywear and Footwear

- 5.2.3 Others

- 5.3 By Application

- 5.3.1 Health and Wellness

- 5.3.2 Safety Monitoring

- 5.3.3 Home Rehabilitation

- 5.3.4 Others

- 5.4 By Country

- 5.4.1 Brazil

- 5.4.2 Mexico

- 5.4.3 Argentina

- 5.4.4 Others

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 STMicroelectronics

- 6.1.2 Infineon Technologies AG

- 6.1.3 Texas Instruments Incorporated

- 6.1.4 Analog Devices Inc.

- 6.1.5 InvenSense Inc.

- 6.1.6 Freescale Semiconductor Inc

- 6.1.7 Panasonic Corporation

- 6.1.8 NXP Semiconductors N.V.

- 6.1.9 TE Connectivity Ltd.

- 6.1.10 Bosch Sensortec GmbH (Robert Bosch GmbH)

7 INVESTMENT ANALYSIS

8 MARKET OPPORTUNITIES AND FUTURE TRENDS

02-2729-4219

+886-2-2729-4219