|

市场调查报告书

商品编码

1627143

北美智慧工厂:市场占有率分析、产业趋势与成长预测(2025-2030)North America Smart Factory - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

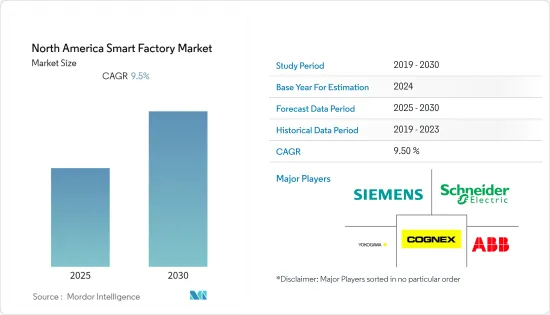

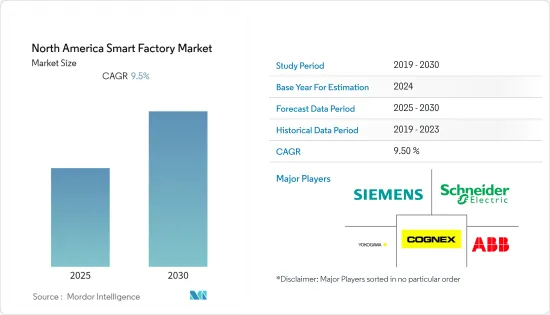

北美智慧工厂市场预计在预测期内复合年增长率为 9.5%

主要亮点

- 玛丽维尔大学预测,到 2025 年,全球每年将产生超过 180 兆千兆位元组的资料。其中大部分将由工业物联网支援的产业产生。根据工业IoT(IIoT) 巨头微软的一项研究,85% 的公司至少拥有一个 IIoT使用案例计划。这一数字可能还会增加,94% 的受访者表示他们将在 2021 年之前实施 IIoT 策略。

- 物联网技术正在克服製造业的劳动力短缺问题,尤其是在美国等已开发国家。为此,在美国,联邦政府和私人企业正在投资工业4.0物联网技术,以扩大美国已经输给中国和其他人事费用较低国家的工业基础。因此,物联网技术可能主要推动智慧工厂解决方案在全球的采用。

- 此外,最近的关税上涨可能会迫使美国製造商以更低的成本生产商品,这可以透过自动化来实现。在关税上调之前投资自动化的汽车公司处于领先地位,并已成为其他公司削减成本的蓝图。生产工业机器人和自动化产品的公司将受益,因为它们是自动化所需机器人和设备的最大生产商。

- 协作机器人等自动化技术需要人工干预和互动。此外,工业控制系统(ICS)存在潜在的安全风险。因此,需要实施ICS安全解决方案来防止系统受到安全威胁,增加了ICS的维修成本。网路安全解决方案的进步正在减少人们对 ICS 相关安全问题的担忧。

北美智慧工厂市场趋势

半导体产业显着成长

- 该地区的电子行业正在稳步增长,并在设计和无晶圆厂领域运营的许多公司中占有很大份额。根据美国人口普查局的数据,到2023年,半导体和其他电子元件产业的收益预计将达到1,051.6亿美元。

- 此外,该地区对智慧型手机和消费性电子产品的需求强劲,这推动了研究市场的需求。爱立信表示,在 5G 需求的推动下,到 2025 年,智慧型手机用户预计将达到 3.6 亿。

- 此外,该地区对智慧型穿戴装置不断增长的需求正在引领半导体需求。据思科系统公司称,到2022年,北美连网穿戴装置数量将达到4.39亿美元。这些发展正在增加该地区的市场需求。

- 根据半导体产业协会(SIA)统计,半导体产业在美国直接僱用了近25万名工人。美国也是一些世界领先的汽车製造商的所在地,这些製造商正在投资电动车以及需要高性能积体电路的自动驾驶汽车的潜力。这是推动半导体硅片市场需求的主要因素之一。例如,2020年12月,全球锂离子应用硅碳复合材料供应商Group14 Technologies获得由SK Materials主导的1,700万美元B轮资金筹措。

- 儘管新冠疫情对美国许多人和许多行业造成了严重影响,但半导体产业却是一大局部。这导致对各种晶片的需求增加,给已经全速运转的供应链带来了更大的压力。这导致市场相关人员投资于产品开发。

通讯是市场领先的细分市场之一

- 有线通讯在将讯息从特定来源传送到目的地时往往具有相对较小的失真。例如,当从有线类比数位转换器接收数位编码资料并以 8kbit/s 的固定速率传送到单一数位控制器时,几乎没有资料遗失或失真。此外,还有有线网路通讯协定,例如 PROFIBUS-DP 和 ControlNet,旨在透过使用令牌控制对网路的存取来实现相对恆定的延迟设定檔。

- 例如,FieldComm Group、PI(Profibus & Profinet International)和ODAVA正在共同努力推动工业乙太网路的发展。它旨在利用 IEEE 802.3.cg 目前正在进行的工作,将 EtherNet/IP、HART-IP 和 PROFINET 的使用扩展到製程工业中的危险场所。

- 无线网路的发展为工业自动化提供了多种可能性。无线工业自动化的想法长期以来一直是许多组织无法实现的目标,但 5G 正在开始使这一目标成为现实。私人公司已经开始在其工厂内部署 5G 网络,并看到效能、延迟更低、确定性和可靠性方面的改进。

- 例如,康宁和Verizon已在康宁位于美国希科里的光缆製造工厂部署了5G超宽频服务。康宁将使用 Verizon 的 5G 技术,在全球最大的光纤电缆製造工厂之一测试 5G 在工厂自动化、品质保证和其他增强方面的应用。

- 包含无线通讯的单一设备的成本通常比有线网路更高。然而,增加的初始成本可以透过多种方式抵消。从长远来看,无线设备通常是最具成本效益的选择,可以节省您生产区域内的布线成本。

北美智慧厂产业概况

北美智慧工厂市场适度整合,有多家大型企业。公司不断投资于策略联盟和产品开发,以增加市场占有率。我们将介绍一些最近的市场发展趋势。

- 2021年4月-三菱电机公司开发了7款新的X系列产品,包括2款HVIGBT和5款HVDIODE,使X系列功率半导体模组总合达到24种。这些模组是为高电压马达、直流输电设备、大容量工业设备等大容量、小容量高压大电流设备的逆变器而开发的。将于7月起依序发售。

- 2020 年 9 月 - 西门子和格兰富签署数位策略合作伙伴关係关係,重点关注两家公司在三个主要领域提供的互补产品和解决方案:用水和污水应用、工业自动化和楼宇技术。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买方议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间的敌对关係

- 产业价值链分析

- COVID-19 对市场的影响

第五章市场动态

- 市场驱动因素

- 在整个价值链中扩大物联网 (IoT) 技术的采用

- 对能源效率的需求不断增长

- 市场限制因素

- 庞大资金投入转型

- 容易受到网路攻击

第六章 市场细分

- 副产品

- 机器视觉系统

- 相机

- 处理器

- 软体

- 外壳

- 影像撷取卡

- 整合服务

- 照明

- 工业机器人

- 关节式机器人

- 笛卡儿机器人

- 圆柱形机器人

- SCARA机器人

- 并联机器人

- 协作工作机器人

- 控制设备

- 继电器和开关

- 伺服马达及驱动器

- 感应器

- 通讯技术

- 有线

- 无线的

- 其他的

- 机器视觉系统

- 依技术

- 产品生命週期管理 (PLM)

- 人机介面 (HMI)

- 企业资源规划(ERP)

- 製造执行系统(MES)

- 集散控制系统(DCS)

- 监控控制和资料采集(SCADA)

- 可程式逻辑控制器(PLC)

- 其他的

- 按最终用户产业

- 车

- 半导体

- 石油和天然气

- 化学/石化

- 製药

- 航太/国防

- 饮食

- 矿业

- 其他的

- 按国家/地区

- 美国

- 加拿大

第七章 竞争格局

- 公司简介

- ABB Ltd.

- Cognex Corporation

- Siemens AG

- Schneider Electric SE

- Yokogawa Electric Corporation

- Kuka AG

- Rockwell Automation Inc.

- Honeywell International Inc.

- Robert Bosch GmbH

- Mitsubishi Electric Corporation

- Fanuc Corporation

- Emerson Electric Company

- FLIR Systems Inc.

第八章投资分析

第九章 市场未来展望

简介目录

Product Code: 50131

The North America Smart Factory Market is expected to register a CAGR of 9.5% during the forecast period.

Key Highlights

- The Maryville University estimates that by 2025, over 180 trillion gigabytes of data will be created worldwide every year. A large portion of this will be generated by IIoT-enabled industries. A survey by the Industrial IoT (IIoT) giant, Microsoft, found that 85% of companies have at least one IIoT use case project. This number will increase, as 94% of the respondents said they will implement IIoT strategies by 2021.

- IoT technologies are overcoming the labor shortage in the manufacturing sector, especially in the developed countries, like the United States. Due to this, the Federal Government and the private sector in the United States are investing in Industry 4.0 IoT technologies, to increase the American industrial base, which was taken over by China and other low labor cost countries. Therefore, IoT technologies may mainly drive the adoption of smart factory solutions, across the world.

- Also, the recent increase in tariffs is likely to force manufacturers of the United States to produce goods at a lower cost, which is to be achieved through automation. Auto companies that invested in automation pre-tariffs are ahead of the game, and they are the cost-saving blueprint for other companies. Companies that produce industrial robots and automation products are set to benefit, as they are the largest producers of the robots and equipment needed for automation.

- Automation technologies, such as collaborative robots, require human intervention/ interaction. Furthermore, industrial control systems (ICS) are laced with security risks. Hence, ICS security solutions must be installed to prevent security threats to the systems, which increases the cost of maintaining ICS. Nevertheless, advancements in cybersecurity solutions are reducing the fear of security issues associated with ICS.

North America Smart Factory Market Trends

Semiconductor Industry is Observing a Significant Growth

- The electronics industry in the region is growing at a steady pace and holds a prominent share in a number of enterprises operating in the design and fabless space. According to the US Census Bureau, the revenue of the semiconductors and other electronic components sector is expected to reach USD 105.16 billion by 2023.

- Moreover, the region commands significant demand for smartphones and consumer electronics, which is driving demand for the studied market. According to Ericsson, smartphone subscription is expected to reach 360 million by 2025, augmented by the demand from 5G.

- Additionally, the increasing demand for smart wearables in the region is spearheading the demand for semiconductors in the region. By 2022, the number of connected wearable devices in North America is expected to reach USD 439 million, according to Cisco Systems. Such developments are augmenting demand for the market in the region.

- According to the Semiconductor Industry Association (SIA), the semiconductor industry directly employs nearly a quarter of a million workers in the United States. The United States is also home to some of the world's major automotive players, who are investing in electric vehicles and in the self-driving potential of cars, which demand high-performance ICs. This is one of the major factors to drive demand for the semiconductors silicon wafers market. For instance, in December 2020, Group14 Technologies, a global provider of silicon-carbon composite materials for lithium-ion applications, secured USD 17 million in Series B funding led by SK Materials.

- The pandemic has been brutally bad for many people and industries in the United States, but the semiconductor industry has been one of the only bright spots. That translates to additional demand for chips of all sorts, which increased the pressure on a supply chain that was already running as fast as it could. Thus, driving market players to invest in product development.

Communication is One of the Segment Driving the Market

- Wired communication tends to have a relatively low degree of distortion when delivering information from a particular source to a destination. For instance, receiving digitally encoded data from a wired analog to digital converter, sent to a single digital controller at a fixed rate of 8 kbit/second, occurs with little data loss and distortion, i.e., only the least significant bits tend to have errors. In addition, there are wired networking protocols that aim to achieve a relatively constant delay profile by using a token to control access to the network, such as PROFIBUS-DP and ControlNet.

- For instance, FieldComm Group, PI (Profibus & Profinet International), and ODAVA are working together to promote developments for Industrial Ethernet. It is aimed to expand the use of EtherNet/IP, HART-IP, and PROFINET into hazardous locations in the process industry, leveraging the work currently underway in the IEEE 802.3.cg.

- Wireless networks are advancing in ways that are driving many possibilities for industrial automation. The idea of wireless industrial automation has long been an unachievable goal for many organizations, but 5G is starting to make this goal a reality. Companies are already beginning to deploy private 5G networks within plants and are seeing an increase in performance, low latency, determinism, and reliability.

- For instance, Corning and Verizon have installed a 5G Ultra-Wideband service in Corning's fiber optic cable manufacturing facility in Hickory, United States. Corning will use Verizon's 5G technology to test the application of 5G to enhance functions, such as factory automation and quality assurance, in one of the most extensive fiber optic cable manufacturing facilities in the world.

- Individual devices incorporating wireless communication are generally costlier than wired networks. However, this increased upfront cost offset in multiple ways. Wireless devices often prove to be the most cost-effective option over the long run, owing to factors such as saving the cost of running cabling through a production area.

North America Smart Factory Industry Overview

The North American Smart Factory Market is moderately consolidated, with the presence of a few major companies. The companies are continuously investing in making strategic partnerships and product developments to gain more market share. Some of the recent developments in the market are:

- April 2021- Mitsubishi Electric Corporation developed seven new X-Series products, including two HVIGBTs and five HVDIODEs, bringing the total number of X-Series power semiconductor modules to 24. These modules are designed for increasingly big-capacity, small-sized inverters used in traction motors, DC-power transmitters, substantial industrial machines, and other high-voltage, large-current equipment. Beginning in July, the models will be released in order.

- September 2020 - Siemens and Grundfos signed a digital partnership framework for strategic cooperation between the two companies to focus on complementary products and solutions provided by both parties in three main areas: water and wastewater applications, industrial automation and building technology.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Impact of Covid-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growing Adoption of Internet of Things (IoT) Technologies Across the Value Chain

- 5.1.2 Rising Demand for Energy Efficiency

- 5.2 Market Restraints

- 5.2.1 Huge Capital Investments for Transformations

- 5.2.2 Vulnerable to Cyber Attacks

6 MARKET SEGMENTATION

- 6.1 By Product

- 6.1.1 Machine Vision Systems

- 6.1.1.1 Cameras

- 6.1.1.2 Processors

- 6.1.1.3 Software

- 6.1.1.4 Enclosures

- 6.1.1.5 Frame Grabbers

- 6.1.1.6 Integration Services

- 6.1.1.7 Lighting

- 6.1.2 Industrial Robotics

- 6.1.2.1 Articulated Robots

- 6.1.2.2 Cartesian Robots

- 6.1.2.3 Cylindrical Robots

- 6.1.2.4 SCARA Robots

- 6.1.2.5 Parallel Robots

- 6.1.2.6 Collaborative Industry Robots

- 6.1.3 Control Devices

- 6.1.3.1 Relays and Switches

- 6.1.3.2 Servo Motors and Drives

- 6.1.4 Sensors

- 6.1.5 Communication Technologies

- 6.1.5.1 Wired

- 6.1.5.2 Wireless

- 6.1.6 Other Products

- 6.1.1 Machine Vision Systems

- 6.2 By Technology

- 6.2.1 Product Lifecycle Management (PLM)

- 6.2.2 Human Machine Interface (HMI)

- 6.2.3 Enterprise Resource and Planning (ERP)

- 6.2.4 Manufacturing Execution System (MES)

- 6.2.5 Distributed Control System (DCS)

- 6.2.6 Supervisory Controller and Data Acquisition (SCADA

- 6.2.7 Programmable Logic Controller (PLC)

- 6.2.8 Other Technologies

- 6.3 By End-user Industry

- 6.3.1 Automotive

- 6.3.2 Semiconductors

- 6.3.3 Oil and Gas

- 6.3.4 Chemical and Petrochemical

- 6.3.5 Pharmaceutical

- 6.3.6 Aerospace and Defense

- 6.3.7 Food and Beverage

- 6.3.8 Mining

- 6.3.9 Other End-user Industries

- 6.4 By Country

- 6.4.1 United States

- 6.4.2 Canada

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 ABB Ltd.

- 7.1.2 Cognex Corporation

- 7.1.3 Siemens AG

- 7.1.4 Schneider Electric SE

- 7.1.5 Yokogawa Electric Corporation

- 7.1.6 Kuka AG

- 7.1.7 Rockwell Automation Inc.

- 7.1.8 Honeywell International Inc.

- 7.1.9 Robert Bosch GmbH

- 7.1.10 Mitsubishi Electric Corporation

- 7.1.11 Fanuc Corporation

- 7.1.12 Emerson Electric Company

- 7.1.13 FLIR Systems Inc.

8 INVESTMENT ANALYSIS

9 FUTURE OUTLOOK OF THE MARKET

02-2729-4219

+886-2-2729-4219