|

市场调查报告书

商品编码

1627177

中东和非洲的包装自动化:市场占有率分析、行业趋势和成长预测(2025-2030)MEA Packaging Automation - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

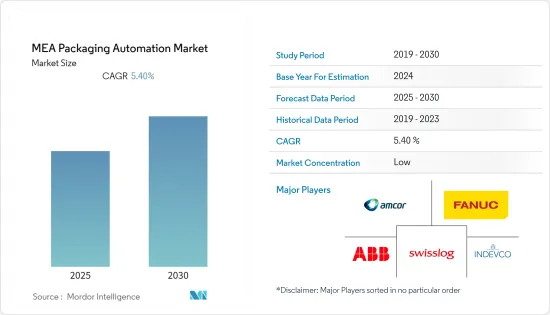

中东和非洲包装自动化市场预计在预测期内复合年增长率为 5.4%

主要亮点

- 许多运动控制系统旨在包装工业产品,以便消费者安全、有效率地使用。现有的包装自动化产业包括食品和饮料加工商、零件製造商和家庭园丁。新用户包括医疗、实验室和製药业,这些行业对准确性和清洁度有特殊要求。

- 中东和非洲的企业正在寻求自动化解决方案,以降低人事费用并跟上全球供应趋势。国际食品趋势正在更快地进入中东市场,因为透过社群媒体,我们可以看到其他地区提供的商品。例如,该公司的 RE 已从提供简单的托盘和 X 射线密封机转向提供配备製程设备、输送机、包装机和自动送料机的承包生产线以组装纸箱。

- 此外,阿联酋地方政府致力于应对永续性挑战,旨在回收阿联酋75%的废弃物,杜拜世界贸易中心(DWTC)举办了第六届中东地区最大的食品饮料加工和包装展览会东亚和非洲展示了他们对创造包装解决方案以满足不断增长的工业和消费者需求的承诺。

- 对包装食品不断增长的需求使该地区的生产商获得了巨大的市场占有率。大多数食品公司都努力透过更好的包装更新来吸引消费者。预计该地区包装自动化的成长在预测期内将会成长,迫使製造商不断升级其产品以适应最新趋势。

- COVID-19的全球疫情对中东和非洲的包装自动化产生了重大影响;自疫情爆发以来,对某些包装的需求增加。然而,一些行业正受到旅行限制的负面影响。例如,在阿拉伯联合大公国(UAE),饮料包装市场对酒精饮料的需求大幅下降。

中东和非洲包装自动化市场趋势

食品和饮料包装的需求正在上升

在中东和非洲,食品因文化和宗教原因而受到重视,技术在初级和二级包装解决方案的生产中尤其重要。

- 据食品和饮料加工及包装公司Gulfood Manufacturing称,食品贸易量增加了21%,儘管受到COVID-19大流行的影响,食品和饮料出口仍实现了3%的成长。

- 包装器材产业正在迅速转向技术,为面向未来的包装以及先进的加工、製造和供应链模式开发创新解决方案。例如,Jacob White 向波湾合作理事会(GCC) 地区供应装盒机,并与客户密切合作,以实现并满足他们的要求。

- 随着全部区域新餐厅、配送应用程式和食品链的不断涌现,食品业每年都在增长,製造商和经销商需要强大而可靠的包装机械,例如托盘和袋子。冷冻食品的包装也在考虑之中,每家公司都克服自己的挑战来满足客户的需求。

- 此外,公司也致力于跨地区扩展业务并改进产品。例如,2021年5月,Futamaki在南非建立了一家纺织包装工厂。这个新设施将使我们能够更好地服务于不断增长的纺织品包装行业和未来对永续包装的需求。这也显着增强了我们在这领域的地位。

- 包装产业越来越多地采用自动化,预计不仅会提高包装线的效率,还会为包装机数位化的未来铺平道路,并在预测期内开闢新的机会。

沙乌地阿拉伯市场占有率最高

沙乌地阿拉伯在食品、饮料和药品等各行业的包装产业中拥有最高的市场占有率。该地区的主要企业正在投资于新产品创新的研发。

- 2021 年 7 月,区域线上食品配送和 Q 商务平台 Talabat 启动了永续,以减少整个全部区域的塑胶废弃物和碳排放,首先在阿拉伯联合大公国和卡达启动了一项包装计画。该计划将可供餐厅合作伙伴和供应商采用。

- 根据 Delivery Hero 进行的一项调查,消费者想要一个更永续的交付生态系统。 92% 的阿联酋客户正在考虑从提供有机包装的餐厅订购,2/3 的阿联酋客户正在增加从提供有机包装的餐厅订购。

- 沙乌地阿拉伯标准、计量和品质组织 (SASO) 推出了针对塑胶包装的新规则和规定。例如,生物分解性塑胶技术法规的适用仅限于仅在法规第一阶段列出的所有产品。这包括曾经使用过的塑料,例如编织大麦袋。因此,第二阶段和第三阶段调控的实施已暂停。

- 政府工业包装印刷公司在沙乌地阿拉伯进行了投资,在利雅德订购了两台新印刷机。根据呼吁药品智慧包装进行的一项调查,约 95% 的受访者表示他们参与在家中储存药品。其中,80.9%的人回应为急救或附加治疗,43.2%的人回应为慢性病治疗。此外,超过 35% 的人表示他们保留它是因为他们不知道如何丢掉它。

- Ball 也在该地区创新新的饮料产品,致力于完善和改进消费者友善技术,在产品中添加可回收材料,并开发新的金属合金等产品,使产品更轻。

中东和非洲包装自动化产业概况

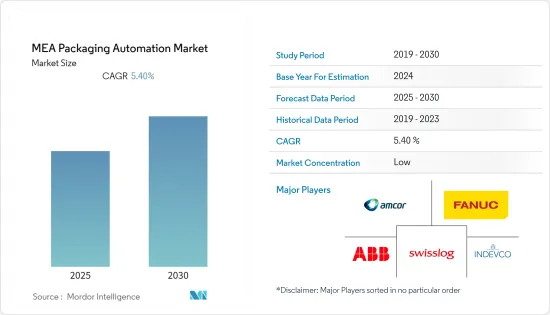

中东和非洲的包装自动化市场竞争激烈且分散,主要企业包括: Indevco Group、Amcor Worldwide、ABB Ltd、Swisslog Holding Ag、Fanuc Corporation 等公司致力于透过采用新技术和设备来创新新产品,以满足该地区不断增长的包装需求。

- 2020 年 10 月 - FANUC公司和 NTT Communications 公司宣布成立新公司 DUCNET,该公司将提供云端服务以支援工具机产业乃至更广泛的製造业的数位转型。

- 2021 年 10 月 - Indevco 和 Napco National 联合推出 100%永续包装解决方案。永续品牌包括生物分解性包装、轻量化包装、回收内容包装、可再生包装等。 INDEVCO 和 Napco National 将透过机器优化和减少能源消耗来减少碳足迹,并最大限度地减少其营运对环境的影响。

其他好处:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 产业价值链分析

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买方议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间敌对关係的强度

- COVID-19 对市场的影响

第五章市场动态

- 市场促进与市场约束因素介绍

- 市场驱动因素

- 製造商降低营业成本的压力越来越大

- 减少机器停机时间和产品浪费

- 新兴市场的崛起导致劳动成本下降和竞争加剧

- 市场限制因素

- 初始投资高

第六章 市场细分

- 依业务类型

- B2B电子商务零售商

- B2C电子商务零售商

- 全通路零售商

- 批发商

- 製造商

- 个人文件运输公司

- 其他的

- 按行业分类

- 食物

- 药品

- 化妆品

- 家庭使用

- 饮料

- 化学品

- 糖果

- 仓库

- 其他的

- 依产品类型

- 填充

- 标籤

- 卧式枕/立式枕

- 箱式包装

- 套袋

- 码垛

- 封盖

- 包裹

第七章 竞争格局

- 公司简介

- Mitsubishi Electric Corporation

- Rockwell Automation

- Swisslog Holdings AG

- Emerson Industrial Automation

- ULMA Packaging

- ATS Automation Tooling Systems

- ABB Ltd.

- Schneider Electric

- DENSO-Holding GmbH & Co. KG

- Fanuc Corporation

- Gerhard Schubert GmbH

第八章投资分析

第9章 市场的未来

The MEA Packaging Automation Market is expected to register a CAGR of 5.4% during the forecast period.

Key Highlights

- Many motion control systems are designed to package industrial products for safe and efficient use by consumers. Existing packaging automation industries include food and beverage processors, component manufacturers, and home and garden, suppliers. New users include the medical, laboratory, and pharmaceutical industries with special demands on accuracy and cleanliness.

- Businesses in the Middle East and Africa are looking for automated solutions to reduce labor costs and keep up with global supply trends. International food trends are entering the Middle East market much faster as people can see what is being offered elsewhere on social media. The company's RE shifted, for example, from providing simple trays or X-ray sealers to providing turnkey production lines with automatic feeders for assembling process equipment, conveyors, packaging machines, and cartons.

- Additionally, local governments, the UAE, are committed to addressing sustainability challenges, aiming to recycle 75% of UAE waste, and the 6th edition of the largest food and beverage processing and packaging trade fair in the Middle East and Asia and Africa at the Dubai World Trade Center (DWTC), providing a platform for manufacturers to demonstrate their commitment to creating packaging solutions to meet growing industrial and consumer demand.

- The growing demand for packaged food provides a significant market share for producers in the region. Most food companies are working to engage consumers with updated packaging better. Manufacturers are required to keep upgrading the products to the latest trends as the growth for packaging automation in this region is expected to grow during the forecast period.

- The global outbreak of COVID-19 significantly impacted the Middle East and Africa Packaging Automation; since the outbreak of the pandemic, the demand for certain packaging has increased. However, some sectors have experienced the negative impact of the imposed travel restrictions. For instance, in the UAE, the demand for alcoholic beverages in the beverage packaging market has declined sharply.

MEA Packaging Automation Market Trends

Demand for Food and Beverage Packaging on Rise

The Middle East and Africa are regions where food is emphasized with cultural and religious reasons for which technology is particularly important in primary and secondary packaging solutions production.

- According to Gulfood Manufacturing, a food and beverage processing, and packaging company, the volume of food trade has increased by 21%; despite the COVID-19 pandemic, the country achieved a 3% growth in food and beverage exports.

- The packaging machinery industry is rapidly shifting to technology to develop innovative solutions for future-ready packaging and advanced processing, manufacturing, and supply chain models. For instance, Jacob White supplies cartoning machines to Gulf Cooperation Council (GCC) area, working closely with clients to deliver and meet their requirements.

- With the increase in the food sector every year with new restaurants, delivery apps, and food chains across the region, the manufacturers and distributors require robust and reliable machinery for packaging trays, bags, and more. The packaging for frozen food is also considered, and unique challenges are met by the companies to meet the customer requirements.

- Companies are also concentrating on expanding their business across the regions and improving their products. For instance, in May 2021, Huhtamaki established a plant for its fiber packaging in South Africa. This new facility will allow it to better serve the growing textile packaging sector and future demand for sustainable packaging. This also greatly strengthens our position in this area.

- The increasing adoption of automation in the packaging industry will not only improve the efficiency of packaging lines but will also pave the way for the digital future of packaging machines over the forecast period, opening up new opportunities.

Saudi Arabia to hold highest market share

Saudi Arabia holds the highest market share in the packaging industry in various industries such as food, beverage, pharmaceutical, and more. The major player in this region is investing in the research and the development of new product innovations.

- The regional online food delivery and q-commerce platform Talabat in July 2021 launched a sustainable packaging program to reduce plastic waste and carbon emissions across the region, starting with pilot operations in the UAE and Qatar. This program will be available for restaurant partners and vendors to be adopted.

- According to research conducted by Delivery Hero, consumers wanted a more sustainable delivery ecosystem. 92% of UAE customers considered ordering from restaurants that offer organic packaging, and 2/3 of UAE customers order more from restaurants that offer organic packaging.

- New rules and regulations have been introduced in the plastic packaging by Saudi Standards, Metrology and Quality Organization (SASO), such as limiting the application of the technical regulations for biodegradable plastics to all products listed only in the first stage of the Regulation. This includes plastics that are once used, such as woven barley bags. The implementation of the second and third phases of the regulation has therefore been suspended.

- The government industrial packaging printing press makes investments in Saudi Arabia, an order of two new presses was placed in Riyadh. According to a survey conducted as a call for smart packaging for pharmaceutical products, about 95% said they were involved in storing medicines at home. Among them, 80.9% reported first aid and additional treatment, and 43.2% answered that they were treating chronic diseases. A little over 35% said that they store drugs because they don't know how to throw them away.

- Ball Corporation also adopts to refining and improving the technology that is suitable for the consumers and develops products such as new metal alloy that adds recyclable material to the products reducing its weight and is innovating new beverage products in the region.

MEA Packaging Automation Industry Overview

The Middle East and Africa Packaging Automation Market is highly competitive and fragmented due to the presence of key players such as Indevco Group, Amcor Worldwide, ABB Ltd, Swisslog Holding Ag, Fanuc Corporation, and more. These companies are focusing on innovating new products by adopting new technologies and equipment to meet the rising demand for packaging in the region.

- October 2020 - Fanuc Corporation and NTT Communications Corporation announced the establishment of DUCNET CO., Ltd, a new compnay that will offer a cloud service to support digital transformation first in the machine tool industry and subsequently in the broader manufacturing industry.

- October 2021 - Indevco and Napco National collaborated to showcase 100% sustainable packaging solutions. The sustainable brands include biodegradable packaging, lightweight and recycled content packaging, renewable packaging, and more. INDEVCO and Napco National minimize the environmental impact of operations by reducing carbon footprint through machinery optimization and less energy consumption.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Force Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Introduction to Market Drivers and Restraints

- 5.2 Market Drivers

- 5.2.1 Increasing Pressure on Manufacturers to Cut Down Operating Costs

- 5.2.2 Reduces Machine Downtime and Product Waste

- 5.2.3 Emerging Markets are Emerging as Low Cost Labor and Increased Competition

- 5.3 Market Restraints

- 5.3.1 High Initial Investment

6 MARKET SEGMENTATION

- 6.1 By Businesses Type

- 6.1.1 B2B e-commerce retailers

- 6.1.2 B2C e-commerce retailers

- 6.1.3 Omni Channel Retailers

- 6.1.4 Wholesale Distributors

- 6.1.5 Manufacturers

- 6.1.6 Personal Document Shippers

- 6.1.7 Others

- 6.2 By End-User Vertical

- 6.2.1 Food

- 6.2.2 Pharmaceuticals

- 6.2.3 Cosmetics

- 6.2.4 Household

- 6.2.5 Beverages

- 6.2.6 Chemical

- 6.2.7 Confectionary

- 6.2.8 Warehouse

- 6.2.9 Others

- 6.3 By Product Type

- 6.3.1 Filling

- 6.3.2 Labelling

- 6.3.3 Horizontal/Vertical Pillow

- 6.3.4 Case Packaging

- 6.3.5 Bagging

- 6.3.6 Palletizing

- 6.3.7 Capping

- 6.3.8 Wrapping

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Mitsubishi Electric Corporation

- 7.1.2 Rockwell Automation

- 7.1.3 Swisslog Holdings AG

- 7.1.4 Emerson Industrial Automation

- 7.1.5 ULMA Packaging

- 7.1.6 ATS Automation Tooling Systems

- 7.1.7 ABB Ltd.

- 7.1.8 Schneider Electric

- 7.1.9 DENSO-Holding GmbH & Co. KG

- 7.1.10 Fanuc Corporation

- 7.1.11 Gerhard Schubert GmbH