|

市场调查报告书

商品编码

1851411

包装自动化:市场份额分析、行业趋势、统计数据和成长预测(2025-2030 年)Packaging Automation - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

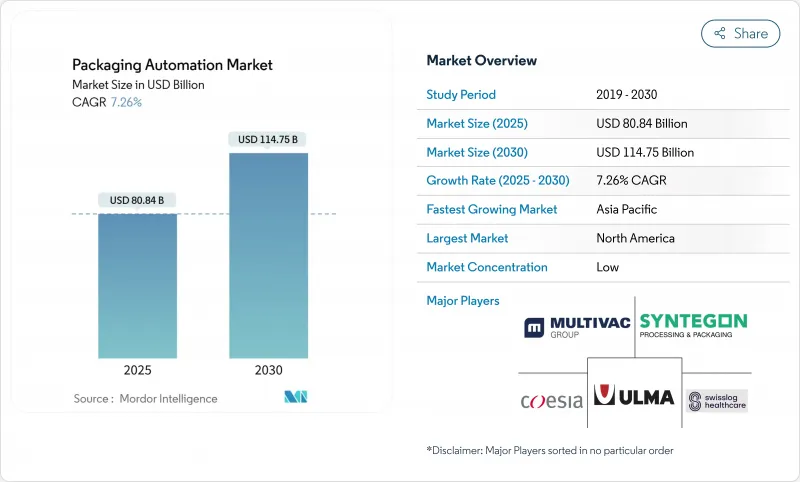

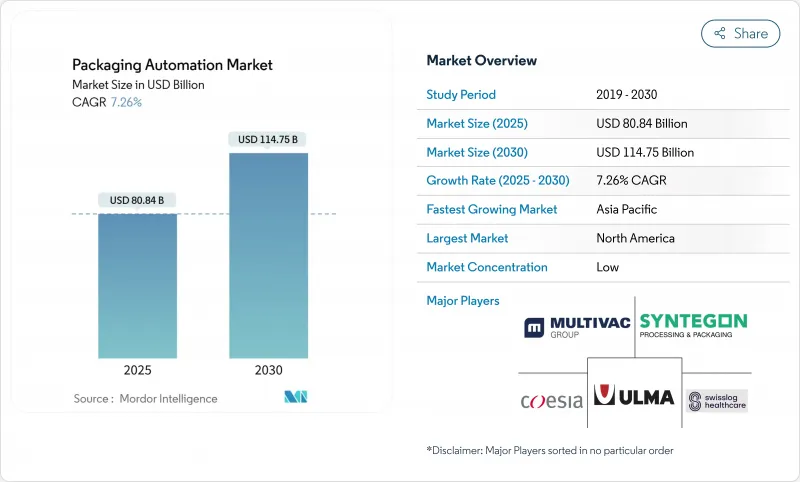

预计到 2025 年,包装自动化市场规模将达到 808.4 亿美元,到 2030 年将达到 1,147.5 亿美元,复合年增长率为 7.26%。

对智慧製造系统的持续投资正在缩小劳动力缺口,提高生产线精度,并满足监管要求。电子商务和严格的药品序列化推动了产量成长,促使生产线在吞吐量和可追溯性之间取得平衡,从而推动了该行业的蓬勃发展。北美保持领先地位,但亚太地区正以最快的速度扩张,这主要得益于中国数十亿美元的机器人技术投资。儘管销售仍以硬体为主,但以服务为中心的绩效付费模式正在加速发展,因为用户更倾向于获得运作保证而非所有权。瓦楞纸箱、折迭纸盒和物料输送供应商之间的整合正在扩大客户群体,并为自动化供应商创造新的规模。

全球包装自动化市场趋势与洞察

食品饮料、製药和电子商务产业自动化应用日益普及

2024年,包装器材出货量将会成长,这主要得益于製药生产线对弹性、小批量生产模式的需求,以及高产量食品生产的需求。製药公司将在2025年投入1,600亿美元用于工厂升级,以实现个人化药品包装。电商履约中心将采用可生产数千种不同规格包装盒的最佳化包装系统,在提高劳动生产力的同时,将纸板用量减少一半。随着一个产业成熟解决方案的推广应用以及包装自动化市场渗透率的提高,跨产业技术转移将加速。这些因素共同推动了对自适应机器人和整合视觉系统的需求,这些系统能够在不同SKU类别之间快速切换,且停机时间极短。

电子商务需要高速二次包装

一套尺寸合适的包装箱系统与移动机器人结合,在短短几个月内就将物流站点的生产力提高了97%,凸显了二次包装已成为提升效率的关键槓桿。可变尺寸自动化目前占包装自动化市场41.42%的份额,反映出快速处理混合订单的需求。亚太地区的线上零售额正在蓬勃发展,预计到2024年,该地区的资本支出将达到180亿美元。加之欧美地区的全通路模式,对生产线速度、软体编配和符合人体工学的码垛方式的持续需求,正在推动整个包装自动化市场的不断升级。

高昂的资本成本和网路安全风险

全规模包装单元需要大量的前期投资,这对许多中小企业来说难以承受。同时,日益增强的互联互通也使操作技术面临网路威胁,而製造业占工业事故总数的四分之一以上。企业必须同时投资自动化硬体和多层安全防护,这会加剧预算紧张并减缓技术普及。 「机器人即服务」(Robots-as-a-Service,简称ROaaS)模式透过将支出转移到营运支出(OPEX)并在订阅模式下提供託管网路安全服务来解决这两个难题。这种方法可以减轻对资产负债表的影响,但要在整个包装自动化市场推广,仍需加强市场教育。

细分市场分析

至2024年,纸箱包装将占包装自动化市场份额的32.12%,凸显其在产品分销过程中保护产品的重要角色。纸箱包装领域的成长稳定,这得益于永续性发展概念推动了更薄的纸板和更精准的黏合剂应用。儘管码垛业务的收入份额较小,但其复合年增长率仍高达12.31%。发那科(FANUC)的新型CRX-25iA协作机器人可处理30公斤的负载,并配备易于使用的示教器,同时还能缩小单元占地面积。协作机器人能够缩短试运行,改善工人的工作效率,使其成为自动化应用普及的领先指标。

在上游领域,随着灵活的无菌包装形式能够满足个人化治疗的需求,製药业的灌装机投资正在增加。贴标生产线正在增加序列化模组,以满足药品和饮料的监管追溯要求。轻质薄膜技术的进步推动了包装和封盖製程的发展,而捆扎技术正在试验中,旨在减少80%的塑胶用量。製袋生产线在耐磨材料领域也取得了进展,采用耐用的Hardox钢材以延长使用寿命。这些产品之间的相互作用预示着市场正朝着端到端单元的方向发展,将多种任务整合到可灵活适应的包装自动化解决方案中。

到2024年,食品製造商将占据包装自动化市场28.53%的份额,这主要得益于其庞大的SKU数量和严格的卫生标准。受注射疗法兴起的推动,医药包装预计将从目前的小基准增长至11.98%的复合年增长率。 Syntegon的Pharmatag 2025生产线可在严格的无菌条件下填充液体,并能快速改变包装规格以适应小批量生产。亚太地区的饮料生产线正在采用高速罐装和套标技术,以满足不断增长的中阶需求。

个人护理品牌正专注于采用自动化多行拣货的高端自订套装。化学製造商则使用费斯托(Festo)经防爆认证的致动器进行密封灌装,以减少产品暴露于腐蚀性介质的风险。随着药品序列化技术应用于消费品领域以打击仿冒品产品,技术跨界融合的趋势正在加速,从而拓宽了包装自动化市场的应用范围。

区域分析

2024年,北美将凭藉其先进的製造基础设施和FDA序列化要求,占据包装自动化市场34.14%的份额。製药公司将在2025年投入1,600亿美元用于设施升级,持续推动对无尘室相容型机器人的需求。 ABB在密西根州投资2,000万美元进行扩建,凸显了该公司对区域客户的承诺。电子商务履约中心的激增也将推动对适应性强的二级包装的需求。

亚太地区是成长最快的地区,预计到2030年复合年增长率将达到10.64%。中国计划在2024年投资66亿美元用于工业机器人,这反映了其机器人密度翻倍的政策。 2025年上海国际包装展(ProPak 2025)将吸引超过2,500家参展展示智慧包装解决方案,凸显该地区从人工生产线向数位化工厂的转型。像易斯顿自动化这样的本土供应商凭藉价格极具竞争力的机械臂正在不断扩大市场份额,推动本地包装自动化市场的发展。

在欧洲,永续性法规和工业4.0补贴正在推动包装自动化技术的应用。瑞典一家工厂透过自动化捆扎减少了80%的塑胶包装,实现了循环经济目标。一家德国先进机械製造商增设了人工智慧模组,以保持出口竞争力。同时,中东和非洲正在试验自动化乳製品生产线,以增强食品安全;而巴西一家南美工厂正在安装堆垛机,以满足该地区日益增长的饮料需求。这些多元化的措施正在拓展全球包装自动化市场。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 食品饮料、製药和电子商务产业的自动化程度正在不断提高。

- 电子商务推动了对二次包装的高速需求。

- 劳动力短缺加速了机器人技术的应用

- 利用人工智慧预测性维护(在监控下)减少停机时间

- 中小企业的模组化协作机器人单元(鲜为人知)

- 以永续发展主导的材料减量自动化(悄悄进行)

- 市场限制

- 高昂的资本成本和网路安全风险

- 熟练操作人员短缺

- 供应商对专有控制软体的锁定(鲜为人知)

- 缺乏针对低调应用的认证开放原始码机器视觉库

- 供应链分析

- 监管环境

- 技术展望

- 波特五力分析

- 供应商的议价能力

- 买方的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

第五章 市场规模与成长预测

- 依产品类型

- 填充

- 标籤

- 包装箱

- 装袋

- 托盘堆迭

- 帽子

- 包装

- 其他产品类型

- 最终用户

- 食物

- 饮料

- 製药

- 个人护理和盥洗用品

- 工业/化工

- 其他最终用户

- 按自动化级别

- 全自动生产线

- 半自动生产线

- 协作/混合系统

- 透过解决方案

- 硬体(机器人、输送机、感测器)

- 软体(SCADA、MES、分析)

- 服务(安装、维护、改装)

- 包装阶段

- 初级包装自动化

- 二级包装自动化

- 三级/生产线末端自动化

- 按地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 其他欧洲地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳洲和纽西兰

- 亚太其他地区

- 中东和非洲

- 中东

- 阿拉伯聯合大公国

- 沙乌地阿拉伯

- 土耳其

- 其他中东地区

- 非洲

- 南非

- 奈及利亚

- 埃及

- 其他非洲地区

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 北美洲

第六章 竞争情势

- 市场集中度

- 策略趋势

- 市占率分析

- 公司简介

- Multivac Group

- Coesia SpA

- ULMA Packaging

- Syntegon Technology

- Swisslog Healthcare

- Rockwell Automation Inc.

- Sealed Air Corporation

- Mitsubishi Electric Corporation

- Automated Packaging Systems LLC

- ABB Ltd.

- Fanuc Corp.

- KUKA AG

- Schneider Electric SE

- Siemens AG

- Tetra Pak International SA

- ProMach Inc.

- Barry-Wehmiller Companies Inc.

- Sidel Group

- Ishida Co. Ltd.

- Yaskawa Motoman Robotics

第七章 市场机会与未来展望

The packaging automation market size is valued at USD 80.84 billion in 2025 and is forecast to reach USD 114.75 billion by 2030, registering a 7.26% CAGR.

Continued investment in intelligent manufacturing systems is narrowing labor gaps, lifting line precision, and meeting rising regulatory expectations. The sector benefits from e-commerce volume growth that overlaps with stringent pharmaceutical serialization, forcing lines to balance throughput with traceability. North America retains leadership, yet Asia-Pacific delivers the fastest expansion, supported by China's multi-billion-dollar robotics outlays. Hardware still dominates revenue, but service-centric, outcome-based models accelerate as users seek guaranteed uptime rather than ownership. Consolidation across corrugated, folding carton, and material handling suppliers is enlarging customer footprints and creating fresh scale for automation providers.

Global Packaging Automation Market Trends and Insights

Rising Adoption of Automation Across F&B, Pharma and E-commerce Sectors

Packaging machinery shipments climbed in 2024, propelled by pharmaceutical lines that demand flexible, small-batch formats beside high-volume food operations. Pharmaceutical manufacturers are committing USD 160 billion to site upgrades in 2025 to enable personalized medicine packaging. E-commerce fulfillment centers adopt right-sizing systems generating thousands of box variations, halving corrugate use while boosting labor productivity. Cross-industry technology transfer quickens as solutions proven in one sector migrate to another, accelerating packaging automation market penetration. The combined momentum amplifies demand for adaptive robotics and integrated vision that can shift between SKU classes with limited downtime.

E-commerce-Induced Demand for High-Speed Secondary Packaging

Right-sized box systems coupled with mobile robots lifted a distribution site's productivity by 97% within months, underscoring how secondary packaging has become the pivotal efficiency lever. Variable-dimension automation now comprises 41.42% of the packaging automation market, reflecting the need to process mixed orders at speed. Asia-Pacific's surging online retail sales are projected to escalate regional equipment outlays to USD 18 billion in 2024. Coupled with omnichannel models in Europe and North America, the shift places sustained pressure on line speeds, software orchestration, and ergonomic palletizing, stimulating continuous upgrades across the packaging automation market.

High Capital Cost and Cybersecurity Risks

Full-scale packaging cells require significant upfront cash that many SMEs find prohibitive. Simultaneously, rising connectivity exposes operational technology to cyber threats, with manufacturing representing over one quarter of industrial incidents. Firms must invest in both automation hardware and layered security, stretching budgets and slowing adoption. Robots-as-a-Service models address this dual hurdle by shifting spending to OPEX and providing managed cybersecurity within the subscription. The approach lessens balance-sheet impact, yet market education is still needed before it scales across the packaging automation market.

Other drivers and restraints analyzed in the detailed report include:

- Labor Shortages Accelerating Robotics Deployment

- AI-Driven Predictive Maintenance Lowering Downtime

- Skilled-Operator Scarcity

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Case packaging accounted for 32.12% of packaging automation market share in 2024, underscoring its essential role in safeguarding goods during distribution. Growth within the case segment remains steady as sustainability pushes thinner corrugate and precision glue application. Palletizing, though smaller in revenue, is expanding at 12.31% CAGR. FANUC's new CRX-25iA cobot, able to handle 30 kg loads, compresses cell footprints while offering easy teach pendants. Collaborative robots shorten commissioning and improve worker ergonomics, making the segment a leading indicator of wider automation uptake.

Upstream, filling machines win pharmaceutical investment as flexible aseptic formats accommodate personalized therapies. Labeling lines add serialization modules that satisfy regulatory traceability in medicine and beverages. Wrapping and capping rise on the back of lightweight film advances, with banding technology reducing plastic by 80% in pilot deployments. Bagging lines gain footing in abrasive material sectors where ruggedized Hardox steel prolongs service life. The interplay among these products signals a move toward end-to-end cells that fuse multiple tasks into an adaptive packaging automation market solution.

Food manufacturers held 28.53% of the packaging automation market in 2024, benefiting from high-volume SKUs and rigid hygiene standards. Despite its smaller baseline, pharmaceutical packaging is poised for 11.98% CAGR as injectable therapies rise. Syntegon's Pharmatag 2025 line fills liquids under strict sterility while switching formats quickly to handle short runs. Beverage lines in Asia-Pacific install high-speed canning and sleeving to satisfy rising middle-class demand.

Personal-care brands focus on luxurious, custom packs enabled by automated multi-line order picking. Chemical producers adopt enclosed filling and sealing to limit exposure to aggressive media, leveraging Festo's EX-certified actuators. Technology crossover accelerates as pharma serialization migrates into consumer goods to combat counterfeits, broadening application scope for the packaging automation market.

The Packaging Automation Market Report is Segmented by Product Type (Filling, Labeling, Case Packaging, and More), End-User (Food, Beverage, Pharmaceuticals, and More), Automation Level (Fully-Automated Lines, Semi-Automated Lines, Collaborative/Hybrid Systems), Solution (Hardware, and More), Packaging Stage (Primary, Secondary, Tertiary/End-of-Line), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America contributed 34.14% to the packaging automation market in 2024, leveraging sophisticated manufacturing infrastructure and FDA serialization mandates. Drug makers will spend USD 160 billion on facility upgrades during 2025, sustaining demand for clean-room ready robots. ABB's USD 20 million expansion in Michigan underscores vendor commitment to regional customers. E-commerce fulfillment hubs proliferate, amplifying calls for adaptive secondary packaging.

Asia-Pacific is the fastest region at 10.64% CAGR through 2030. China spent USD 6.6 billion on industrial robots in 2024, reflecting policy ambitions to double robot density. Shanghai's ProPak 2025 will gather more than 2,500 exhibitors in smart packaging solutions, highlighting the region's shift from manual lines to digital factories. Domestic suppliers such as Estun Automation are winning share with competitively priced robotic arms, expanding the packaging automation market locally.

Europe drives adoption through sustainability regulation and Industry 4.0 grants. A Swedish facility cut plastic wrap by 80% via automated banding, satisfying circular-economy goals. Germany's advanced machine builders add AI modules to retain export competitiveness. Elsewhere, Middle East and Africa pilot automated dairy lines to bolster food security, while South American plants in Brazil install palletizers to serve growing regional beverage demand. These diverse initiatives collectively extend the global packaging automation market footprint.

- Multivac Group

- Coesia S.p.A.

- ULMA Packaging

- Syntegon Technology

- Swisslog Healthcare

- Rockwell Automation Inc.

- Sealed Air Corporation

- Mitsubishi Electric Corporation

- Automated Packaging Systems LLC

- ABB Ltd.

- Fanuc Corp.

- KUKA AG

- Schneider Electric SE

- Siemens AG

- Tetra Pak International SA

- ProMach Inc.

- Barry-Wehmiller Companies Inc.

- Sidel Group

- Ishida Co. Ltd.

- Yaskawa Motoman Robotics

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising adoption of automation across FandB, pharma and e-commerce sectors

- 4.2.2 E-commerce-induced demand for high-speed secondary packaging

- 4.2.3 Labor shortages accelerating robotics deployment

- 4.2.4 AI-driven predictive maintenance lowering downtime (under-radar)

- 4.2.5 Modular cobot cells for SMEs (under-radar)

- 4.2.6 Sustainability-led material-reduction automation (under-radar)

- 4.3 Market Restraints

- 4.3.1 High capital cost and cybersecurity risks

- 4.3.2 Skilled-operator scarcity

- 4.3.3 Vendor lock-in to proprietary control software (under-radar)

- 4.3.4 Lack of certified open-source machine-vision libraries for hygienic zones (under-radar)

- 4.4 Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS {VALUE)

- 5.1 By Product Type

- 5.1.1 Filling

- 5.1.2 Labeling

- 5.1.3 Case Packaging

- 5.1.4 Bagging

- 5.1.5 Palletizing

- 5.1.6 Capping

- 5.1.7 Wrapping

- 5.1.8 Other Product Types

- 5.2 By End-user

- 5.2.1 Food

- 5.2.2 Beverage

- 5.2.3 Pharmaceuticals

- 5.2.4 Personal Care and Toiletries

- 5.2.5 Industrial and Chemicals

- 5.2.6 Other End-users

- 5.3 By Automation Level

- 5.3.1 Fully-Automated Lines

- 5.3.2 Semi-Automated Lines

- 5.3.3 Collaborative/Hybrid Systems

- 5.4 By Solution

- 5.4.1 Hardware (Robots, Conveyors, Sensors)

- 5.4.2 Software (SCADA, MES, Analytics)

- 5.4.3 Services (Installation, Maintenance, Retrofits)

- 5.5 By Packaging Stage

- 5.5.1 Primary Packaging Automation

- 5.5.2 Secondary Packaging Automation

- 5.5.3 Tertiary / End-of-Line Automation

- 5.6 By Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Mexico

- 5.6.2 Europe

- 5.6.2.1 Germany

- 5.6.2.2 United Kingdom

- 5.6.2.3 France

- 5.6.2.4 Italy

- 5.6.2.5 Spain

- 5.6.2.6 Russia

- 5.6.2.7 Rest of Europe

- 5.6.3 Asia-Pacific

- 5.6.3.1 China

- 5.6.3.2 India

- 5.6.3.3 Japan

- 5.6.3.4 South Korea

- 5.6.3.5 Australia and New Zealand

- 5.6.3.6 Rest of Asia-Pacific

- 5.6.4 Middle East and Africa

- 5.6.4.1 Middle East

- 5.6.4.1.1 United Arab Emirates

- 5.6.4.1.2 Saudi Arabia

- 5.6.4.1.3 Turkey

- 5.6.4.1.4 Rest of Middle East

- 5.6.4.2 Africa

- 5.6.4.2.1 South Africa

- 5.6.4.2.2 Nigeria

- 5.6.4.2.3 Egypt

- 5.6.4.2.4 Rest of Africa

- 5.6.5 South America

- 5.6.5.1 Brazil

- 5.6.5.2 Argentina

- 5.6.5.3 Rest of South America

- 5.6.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles {(includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)}

- 6.4.1 Multivac Group

- 6.4.2 Coesia S.p.A.

- 6.4.3 ULMA Packaging

- 6.4.4 Syntegon Technology

- 6.4.5 Swisslog Healthcare

- 6.4.6 Rockwell Automation Inc.

- 6.4.7 Sealed Air Corporation

- 6.4.8 Mitsubishi Electric Corporation

- 6.4.9 Automated Packaging Systems LLC

- 6.4.10 ABB Ltd.

- 6.4.11 Fanuc Corp.

- 6.4.12 KUKA AG

- 6.4.13 Schneider Electric SE

- 6.4.14 Siemens AG

- 6.4.15 Tetra Pak International SA

- 6.4.16 ProMach Inc.

- 6.4.17 Barry-Wehmiller Companies Inc.

- 6.4.18 Sidel Group

- 6.4.19 Ishida Co. Ltd.

- 6.4.20 Yaskawa Motoman Robotics

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment