|

市场调查报告书

商品编码

1627215

北美包装自动化:市场占有率分析、行业趋势和成长预测(2025-2030)NA Packaging Automation - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

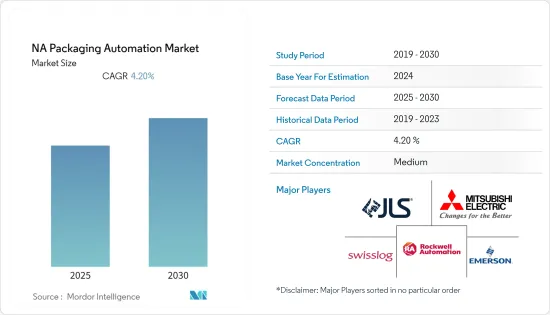

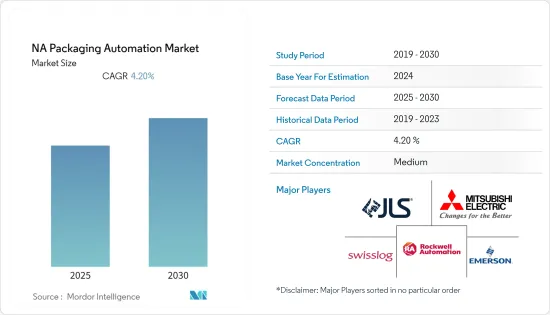

北美包装自动化市场预计在预测期内复合年增长率为 4.2%

主要亮点

- 随着生产变得更加全球化,包装产业的竞争变得更加激烈,企业都在努力实现利润最大化,降低成本至关重要。这增加了在包装中采用自动化的需求。

- 北美是包装自动化市场的领导者。该地区的成长得益于北美的电子商务文化和包装食品产业等因素。此外,该地区的公司现在正在拥抱工业 4.0,这正在推动製造商采用包装自动化解决方案,以便能够与相关人员互动并优化复杂的物流计划,再加上对链条整合的需求不断增加。

- 製造业是美国GDP的最大贡献者。根据美国製造商协会(NAM)统计,2020年其贡献了23,458.5亿美元,占美国製造业产出的10.94%。由于大多数美国製造公司在全球范围内运营,不断上升的人事费用和按时完成任务的压力正在推动工厂自动化。

- 包装食品需求的激增对该地区的製造商来说是增加市场占有率的巨大机会。大多数食品製造公司都在尝试创新包装以提高消费者的兴趣。由于北美地区国家的经济正在蓬勃发展,如果製造商不根据最新的包装趋势改变其产品,则可能会落后,预计在预测期内该地区的这种情况将会增加。增长。

北美包装自动化市场趋势

食品饮料产业成长显着

- 食物偏好的动态变化、餐厅、速食连锁店的激增以及 grub hub 和鱼子酱等食品配送应用程式正在增加消费者的可用性,并推动北美食品和饮料行业的强劲增长。

- 为了满足这些不断增长的期望,包装设备产业正在迅速转向技术来开发面向未来的包装的创新解决方案,并发展加工、生产和供应链模式。

- 例如,2020年,PGP International的加州工厂安装了一条新的自动化包装线,使灯泡袋中的麵粉包装更快、更安全、更节能。此自动包装设备配备了高速填充製程、线上超音波密封能力、自动堆迭和拉伸缠绕设备,确保包装产品在运输过程中的稳定性和安全性。

- 根据机器人工业协会和自动化推进协会的数据,2020 年食品和消费品製造商的机器人系统订单增加了 56%。根据自动化促进协会旗下机器人工业协会(RIA)发布的行业统计数据,2020 年北美企业订购了 31,044 台机器人,价值 15.72 亿美元。

- 包装行业越来越多地采用自动化,预计不仅会提高包装线的效率,还会开闢新的机会,并为预测期内包装设备更加数位化的未来铺平道路。

美国占较大市场占有率

- 美国是北美成长最快的包装市场之一。 Amcor Ltd 和 Mondi PLC 等领先包装公司的存在支持了该国对创新和研发活动的投资。

- 从历史上看,美国一直是工业技术的早期采用者。目前向工业 4.0 的转变进一步推动了自动化、人工智慧和物联网等技术在製造业的采用。

- 此外,美国拥有强大的包装器材出口基础,这有助于成长。博世包装服务等公司透过投资糖果零食、烘焙、生鲜食品、冷冻食品和药品等各种包装领域扩大了业务。

- 最近,美国政府宣布了几项倡议,以应对大萧条以来最严重的经济衰退,以提振製造业。其中包括价值 3000 亿美元的研发投资以及自动化等推动美国经济成长的尖端技术。

- 所有这些努力,加上美国工业部门对扩大技术采用的兴趣,预计将在预测期内推动包装自动化产业的成长。

北美包装自动化产业概况

北美包装自动化产业竞争适中,由多家大型企业组成。趋势变化和产品创新是影响北美包装自动化产业策略的主要因素。在该地区企业发展的主要公司包括 JLS Automation、三菱电机公司和罗克韦尔自动化。近期趋势如下。

- 2021 年 3 月 - ATS Automation Tooling Systems Inc. 宣布,ATS 间接全资控股的有限责任公司 ATS Automation Holdings Italy Srl 拥有食品和饮料设备市场全球供应商 CFT SpA 的已发行股和投票权。 %股权的结果

- 2021 年 7 月 - JLS Automation 宣布已开发出一种臂端工具 (EOAT),以协助实现 CTI Foods 热处理塔可饼包装线的自动化。 Tacobots 使用独特的二选一机械工具有效升级和自动化您的生产。最近的生产线整合计划荣获 ProFood World 2021 年製造创新奖。

其他好处:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 产业价值链分析

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买方议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间敌对关係的强度

- COVID-19 对市场的影响

第五章市场动态

- 市场促进与市场约束因素介绍

- 市场驱动因素

- 製造商降低营业成本的压力越来越大

- 减少机器停机时间和产品浪费

- 新兴市场的崛起导致劳动成本下降和竞争加剧

- 市场限制因素

- 初始投资高

第六章 市场细分

- 依业务类型

- B2B电子商务零售商

- B2C电子商务零售商

- 全通路零售商

- 批发商

- 製造商

- 个人文件运输公司

- 其他的

- 按行业分类

- 食物

- 药品

- 化妆品

- 家庭使用

- 饮料

- 化学品

- 糖果

- 仓库

- 其他的

- 依产品类型

- 填充

- 标籤

- 卧式枕/立式枕

- 箱式包装

- 套袋

- 码垛

- 封顶

- 包裹

- 按国家/地区

- 美国

- 加拿大

- 其他北美地区

第七章 竞争格局

- 公司简介

- JLS Automation

- Mitsubishi Electric Corporation

- Rockwell Automation

- DESTACO

- Swisslog Holdings AG

- Emerson Industrial Automation

- ULMA Packaging

- ATS Automation Tooling Systems

- ABB Ltd.

- Massman Automation Designs, LLC

- Schneider Electric

- DENSO-Holding GmbH & Co. KG

- Gerhard Schubert GmbH

第八章投资分析

第9章市场的未来

简介目录

Product Code: 51203

The NA Packaging Automation Market is expected to register a CAGR of 4.2% during the forecast period.

Key Highlights

- With the increasing globalization of production and the intensely competitive nature of the packaging industry, cost-cutting becomes imperative as companies are striving to maximize profits; but compromising on quality is not an option as the consumers are increasingly being aware and conscious of the products they use. This has created a great need for automation to be employed in packaging.

- North America is among the leaders in the packaging automation market. The growth in this region is attributed to factors like the culture of e-commerce and packaged food industry in North America. Furthermore, companies in this region are now adopting industry 4.0, and it is coupled with the rise in the need for supply chain integration which is driving the manufacturers towards packaging automation solutions due to their ability to interact with the stakeholders and the optimization of complicated logistics schedules.

- The manufacturing sector is amongst the highest contributor to the United States' GDP. In 2020, it contributed USD 2345.85 billion and drove 10.94% of the United States manufacturing output, according to the National Association of Manufacturers (NAM). As most of the U.S based manufacturing companies operate globally, the rising cost of labor, along with the pressure to meet deadlines, has resulted in the increased adoption of automation in factories.

- The Surging demand for packaged food is a substantial opportunity for the manufacturers in this region to carve out greater market share. The majority of food production companies are trying to engage consumers with revamped packaging better. The manufacturers are likely to lag if they do not modify their products according to the latest packaging trends, as the economy of the countries in the North American region is flourishing, which is expected to drive the growth of the packaging automation market in this region during the forecast period.

North America Packaging Automation Market Trends

Food and Beverage Industry to Show Significant Growth

- Dynamic variations in food preferences, increasing number of restaurants, fast-food chains, and food delivery apps such as grub hub, caviar, and others enhance the availability to consumers, resulting in strong growth in the food and beverage industry in the North American region.

- In order to accommodate these surging expectations, the packaging equipment industry is rapidly turning to technology to develop innovative solutions for future-ready packaging and to evolve processing, production, and supply chain model.

- For instance, in 2020, PGP International's California plant implemented a new automated packaging line to make flour packing in valve bags quicker, safer and more power-efficient. The automated packaging equipment features a high-speed filling process, in-line ultrasonic sealing capacity, and automated palletization and stretch-wrapping facilities, to ensure stability and safety of the packaged product, even during transit.

- According to the Robotic Industries Association and Association for Advancing Automation, orders of robotic systems by food and consumer goods manufacturers grew by 56% in 2020. Industry statistics-released by the Robotic Industries Association (RIA), part of the Association for Advancing Automation -show that North American companies ordered 31,044 robotic units, valued at USD 1.572 billion in 2020.

- The increased adoption of automation in the packaging industry will not only boost the efficiency of packaging lines, but also open up new opportunities, paving the way to a more digitized future for packaging equipment during the forecast period.

United States to Hold a Significant Market Share

- The United States is one of the fastest-growing packaging markets in North America. The presence of large packaging companies, such as Amcor Ltd, Mondi PLC, etc., drives investments for innovation and R&D activities in the country.

- Historically, the United States has been among the early adopters of technology in the industrial sector. The current shift towards industry 4.0 is further driving the adoption of technologies such as automation, AI, and IoT in the manufacturing sector.

- Furthermore, the United States boasts of a strong export base of packaging machinery, which has contributed to its growth. Companies like Bosch Packaging Services have expanded their businesses by investing in various packaging sectors, such as confectionery, bakery, fresh food, frozen food, and pharmaceutical.

- Recently, the govt of the United States has announced several initiatives to strengthen the manufacturing sector, which is in the midst of the worst economic downturn since the Great Depression, which includes an investment worth USD 300 billion in R&D and advanced technology such as automation which has been the catalyst for the economic growth in the U.S.

- All these initiatives combined with the willingness of the industrial sector in the United States towards increased adoption of technology are expected to drive the growth of the packaging automation industry during the forecast period.

North America Packaging Automation Industry Overview

The North American packaging Automation industry is moderately competitive and consists of several major players. The changing trends and product innovations are the primary factors shaping the strategies of the North American packaging automation industry. Some of the major players operating in the region include JLS Automation, Mitsubishi Electric Corporation, Rockwell Automation, etc. Some of the recent developments are

- March 2021 - ATS Automation Tooling Systems Inc. announced results for the voluntary public tender offer launched by ATS Automation Holdings Italy S.r.l., a limited liability company indirectly and wholly controlled by ATS, to acquire 100% of the outstanding shares and voting rights of CFT S.p.A, an established global supplier to the food and beverage equipment market.

- July 2021 - JLS Automation announced that it had developed an end-of-arm tool (EOAT) to help CTI foods automate its hot to handle taco packaging line. Tacobots efficiently upgrade and automate production with a unique two-pick mechanical tool. The recent line integration project wins a 2021 Manufacturing Innovation Award from ProFood World.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Force Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Introduction to Market Drivers and Restraints

- 5.2 Market Drivers

- 5.2.1 Increasing Pressure on Manufacturers to Cut Down Operating Costs

- 5.2.2 Reduces Machine Downtime and Product Waste

- 5.2.3 Emerging Markets are Emerging as Low Cost Labor and Increased Competition

- 5.3 Market Restraints

- 5.3.1 High initial investment

6 MARKET SEGMENTATION

- 6.1 By Businesses Type

- 6.1.1 B2B e-commerce retailers

- 6.1.2 B2C e-commerce retailers

- 6.1.3 Omni Channel Retailers

- 6.1.4 Wholesale Distributors

- 6.1.5 Manufacturers

- 6.1.6 Personal Document Shippers

- 6.1.7 Others

- 6.2 By End-User Vertical

- 6.2.1 Food

- 6.2.2 Pharmaceuticals

- 6.2.3 Cosmetics

- 6.2.4 Household

- 6.2.5 Beverages

- 6.2.6 Chemical

- 6.2.7 Confectionary

- 6.2.8 Warehouse

- 6.2.9 Others

- 6.3 By Product Type

- 6.3.1 Filling

- 6.3.2 Labelling

- 6.3.3 Horizontal/Vertical Pillow

- 6.3.4 Case Packaging

- 6.3.5 Bagging

- 6.3.6 Palletizing

- 6.3.7 Capping

- 6.3.8 Wrapping

- 6.4 By Country

- 6.4.1 United States

- 6.4.2 Canada

- 6.4.3 Rest of North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 JLS Automation

- 7.1.2 Mitsubishi Electric Corporation

- 7.1.3 Rockwell Automation

- 7.1.4 DESTACO

- 7.1.5 Swisslog Holdings AG

- 7.1.6 Emerson Industrial Automation

- 7.1.7 ULMA Packaging

- 7.1.8 ATS Automation Tooling Systems

- 7.1.9 ABB Ltd.

- 7.1.10 Massman Automation Designs, LLC

- 7.1.11 Schneider Electric

- 7.1.12 DENSO-Holding GmbH & Co. KG

- 7.1.13 Gerhard Schubert GmbH

8 INVESTMENT ANALYSIS

9 FUTURE OF THE MARKET

02-2729-4219

+886-2-2729-4219