|

市场调查报告书

商品编码

1851523

欧洲包装自动化:市场份额分析、行业趋势、统计数据和成长预测(2025-2030 年)Europe Packaging Automation - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

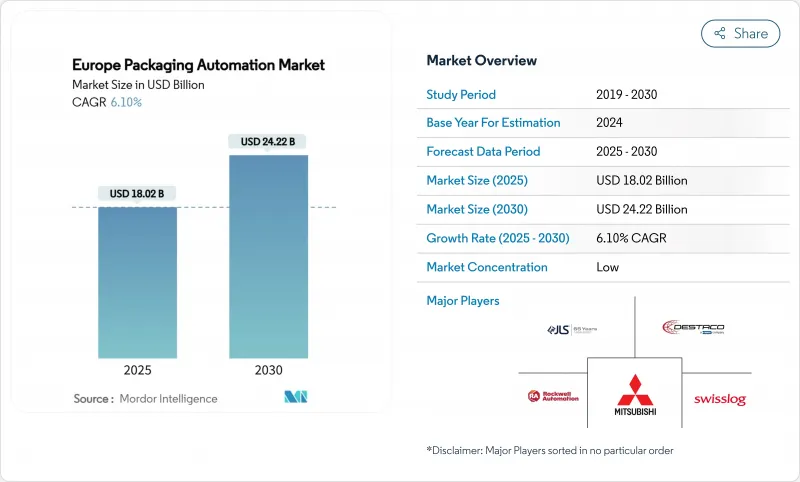

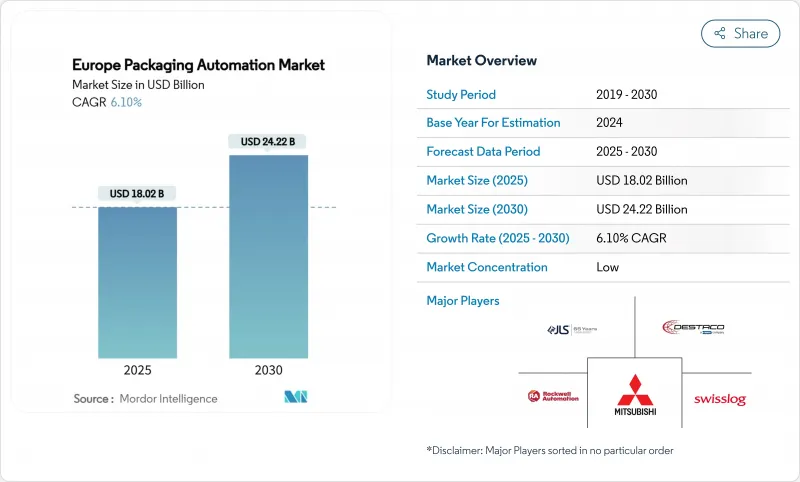

据估计,欧洲包装自动化市场规模将在 2025 年达到 180.2 亿美元,到 2030 年达到 242.2 亿美元,在预测期(2025-2030 年)内复合年增长率为 6.10%。

日益严格的法规,尤其是欧盟的《包装和包装废弃物法规》(PPWR),与不断上涨的人事费用和技术的快速发展交织在一起,再形成欧洲製造业的资本支出重点。企业正转向自动化,以确保符合可回收性要求、弥补劳动力缺口并保护利润免受能源价格波动的影响。从人工智慧驱动的侦测到协作机器人辅助的码垛,生产线数位化正在创造新的竞争标准。同时,终端用户正在扩大供应商范围,以降低原材料价格波动和网路风险的影响,从而提高了对整合化、安全且可升级的自动化解决方案的期望。买家对整体拥有成本的日益关注,使得能够将硬体、分析和生命週期服务整合到单一价值提案中的供应商更具优势,加速了设备製造商和软体专家之间的整合。

欧洲包装自动化市场趋势与洞察

降低营运成本的压力

欧洲各地的包装厂面临持续的工资上涨和远高于2022年水准的能源成本,因此自动化无疑是缓解营运压力的最有效途径。 ABB在Striebel & John公司实施多机器人包装岛后,生产率提高了25%,并将瓦楞纸板的SKU数量从15个减少到9个。儘管聚合物价格持续高企,但克朗斯(Krones)也凭藉类似的成果,实现了2024年10.1%的EBITDA获利率,这表明先行者正在拉大与后进企业之间的成本差距。

技术工人数量减少

欧盟製造业就业人数预计在2024年将下降2.1%,其中包装线技术员是最难招募的职位。博世力士乐的电池驱动移动协作机器人工作站允许一名操作员监督以往需要三人完成的任务,从而解放劳动力从事更高价值的工作。 ABB的OmniVance即插即用单元预先配置并自动校准,进一步降低了技术门槛,使中小企业无需内部程式设计人员即可部署机器人。

高初始投资

承包的机器人生产线造价可能在500万至1000万欧元之间,即使有补贴和税收优惠,许多中型加工企业也难以承担如此巨额的费用。供应商正在推出订阅模式来应对这项挑战,将支出从资本预算转移到营运支出,但漫长的投资回收期仍然是家族企业面临的一大障碍。

细分市场分析

製造商将自动化支出与全厂效率提升计画挂钩,在2024年占据了欧洲包装自动化市场41.5%的份额。他们的规模优势支援多条生产线的部署,从而可以将软体和维护成本分摊到更大的产量上。同时,全通路零售商将自动化装袋系统与人工系统结合,以加快履约週期。 B2C电商营运商在2024年区域线上销售额达到8,870亿欧元的推动下,将在2030年之前实现13.0%的复合年增长率,成为该细分市场中成长最快的企业。他们将投资于智慧分类、自动化装袋和尺寸测量模组,这些模组每小时可处理数千个小包裹。个人文件托运人和合约包装商虽然仍属于小众市场,但他们正在稳步投资于可追踪印表机和防篡改封口机。

越来越多的原始设备製造商正在重新思考「自製还是外购」的决策,他们将二级或三级包装外包给代工包装商,同时保留核心填充和封口工序的所有权。这种转变扩大了模组化解决方案的潜在客户群,这些解决方案可以根据订单量的波动进行重新部署,使供应商能够透过产品改造和生产线扩展获得持续收入。

食品饮料产业总合占欧洲包装自动化市场44.0%的份额,其中以连续式灌装机、旋转式旋盖机和环绕式装箱机为主,这些设备均针对大批量SKU进行了最佳化。可口可乐公司位于根斯哈根和吕讷堡的工厂计画于2025年进行升级改造,新增一条每小时可生产6万个玻璃瓶的生产线,凸显了其对高速系统的持续投入。同时,受对序列化和个人化药物需求的推动,製药业预计到2030年将以12.3%的复合年增长率成长。自动化组装、侦测和符合低温运输的码垛是重点投资领域,Systec和ABB正在试行一套多摄影机视觉系统,用于在产品放行前进行验证。

为了在提升产品品质的同时兼顾不断增长的SKU数量,化妆品和个人护理品牌正在采用柔性纸盒包装机和按需印刷的套施用器。家用化学品和清洁剂製造商则专注于无洩漏剂量和节省空间的二级包装,以满足日益严格的运输排放法规。糖果甜点和烘焙食品製造商正在部署Delta机器人和超音波封袋机,以快速保存易碎产品;而第三方物流供应商则在扩展自动化邮件处理机和标籤贴标施用器,以服务全通路客户。

欧洲包装自动化市场报告按业务类型(製造商、批发商、全通路零售商等)、最终用户行业(食品、食品和饮料、製药、化妆品、个人护理等)、包装阶段(初级包装、二级包装、生产线末端包装、三级包装和物流)、产品类型(灌装机、贴标和编码、成形充填密封等)以及地区进行细分。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 降低营运成本的压力

- 技术纯熟劳工数量减少

- 欧盟包装废弃物和可追溯性法规

- 大规模客製化和缩短SKU

- 人工智慧驱动的预测性维护

- 即插即用模组化协作机器人

- 市场限制

- 高额前期投资

- 网路安全漏洞

- 缺乏互通性标准

- 原料供应波动

- 监管环境

- 技术展望

- 波特五力分析

- 供应商的议价能力

- 买方的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争的激烈程度

第五章 市场规模与成长预测

- 依业务类型

- 製造商

- 经销商

- 全通路零售商

- B2B电子商务零售商

- B2C电子商务零售商

- 个人文件托运人

- 其他的

- 按最终用户行业划分

- 食物

- 饮料

- 製药

- 化妆品和个人护理

- 家用清洁剂

- 化学

- 糖果甜点和烘焙

- 仓储和第三方物流

- 其他的

- 包装阶段

- 初级(填充和密封)

- 二次包装(装箱/装箱)

- 生产线末端(托盘堆迭/拉伸包装)

- 三级物流与物流

- 依产品类型

- 灌装机

- 标籤和编码

- 成形充填密封(H/VFFS)

- 装袋和装袋

- 码垛和卸垛

- 其他的

- 按地区

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 其他欧洲地区

第六章 竞争情势

- 市场集中度

- 策略趋势

- 市占率分析

- 公司简介

- ABB

- Siemens AG

- Rockwell Automation

- Mitsubishi Electric

- Schneider Electric

- JLS Automation

- ULMA Packaging

- Swisslog Holding AG

- Gerhard Schubert GmbH

- Destaco

- Emerson(Branson)

- ATS Automation

- Massman Automation

- Krones AG

- Fanuc Corporation

- KUKA AG

- Coesia SpA

- Syntegon Technology

- Sidel Group

- Yaskawa Electric

- Brenton Engineering

- Tetra Pak

第七章 市场机会与未来展望

The Europe Packaging Automation Market size is estimated at USD 18.02 billion in 2025, and is expected to reach USD 24.22 billion by 2030, at a CAGR of 6.10% during the forecast period (2025-2030).

Heightened regulatory demands, especially the EU Packaging and Packaging Waste Regulation (PPWR), converge with rising labor costs and rapid technological progress to re-shape capital-spending priorities across European manufacturing. Companies are automating to ensure recyclability compliance, close labor gaps and shield margins from energy-price swings. Line-side digitization, from AI-enabled inspection to cobot palletizing, is creating new competitive baselines. Simultaneously, end-users are widening supplier pools to mitigate raw-material volatility and cyber-risk exposure, thereby raising expectations for integrated, secure and upgradeable automation solutions. Intensifying buyer scrutiny around total cost of ownership favors vendors able to bundle hardware, analytics and life-cycle services into a single value proposition, accelerating consolidation among equipment makers and software specialists.

Europe Packaging Automation Market Trends and Insights

Pressure to Reduce Operating Costs

Packaging plants across Europe face sustained wage inflation and energy bills that remain well above 2022 levels, making automation the clearest path to offsetting operating pressure. ABB documented a 25% productivity gain at Striebel & John after deploying a multi-robot packaging island that also trimmed cardboard SKU counts from 15 to 9. Similar gains underpin Krones' 10.1% 2024 EBITDA margin, despite persistently high polymer prices, signalling that early adopters are widening their cost gap over late movers.

Shrinking Skilled-Labour Pool

Manufacturing employment in the EU fell 2.1% in 2024, with packaging-line technicians among the hardest roles to fill. Bosch Rexroth's battery-powered mobile cobot station lets one operator oversee tasks that previously needed a three-person team, freeing scarce labour for higher-value work. ABB's OmniVance plug-and-play cells further lower the expertise barrier by shipping pre-configured and self-calibrating, enabling SMEs to deploy robots without in-house programmers.

High Up-Front Capex

Turn-key robotic lines can demand EUR 5-10 million, a figure that still deters many mid-sized converters even after grants and tax incentives. Vendors are responding with subscription models that shift spend from capital budgets to OPEX, though long payback windows remain a hurdle for family-owned firms.

Other drivers and restraints analyzed in the detailed report include:

- EU Packaging-Waste and Traceability Mandates

- Mass-Customisation and Shorter SKUs

- Cyber-Security Vulnerabilities

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Manufacturers captured 41.5% of Europe packaging automation market share in 2024 by tying automation spend to overall plant-wide efficiency programs. Their scale supports multi-line roll-outs that amortize software and maintenance across higher volumes. Wholesale distributors adopt automation chiefly for palletising and cross-docking, whereas omni-channel retailers blend goods-to-person systems with automated bagging to accelerate fulfillment cycles. B2C e-commerce operators, buoyed by EUR 887 billion in regional online sales during 2024, will log a 13.0% CAGR to 2030, the fastest within the segment hierarchy. Investments gravitate toward smart sortation, auto-bagging and dimensioning modules capable of processing thousands of individualized parcels per hour. Personal-document shippers and contract packers remain niche but show steady uptake in track-and-trace capable printers and tamper-evident sealers.

A growing share of original manufacturers is revisiting make-versus-buy decisions, outsourcing secondary or tertiary packaging to co-packers yet retaining ownership of core filling and closing operations. That shift widens the addressable base for modular solutions that can be redeployed as order books fluctuate, ensuring vendors maintain recurring revenue from retrofits and line extensions.

Food and beverage control a combined 44.0% stake in the Europe packaging automation market, anchored by continuous-motion fillers, rotary cappers and wrap-around case packers optimized for high-volume SKUs. Coca-Cola's 2025 upgrades in Genshagen and Luneburg feature 60,000-container-per-hour glass lines, underscoring ongoing appetite for high-speed systems. Meanwhile the pharmaceutical sector, spurred by serialization and demand for personalized medicines, is expanding at 12.3% CAGR through 2030. Automated aggregation, inspection and cold-chain compliant palletizing are top investment areas, with Systech and ABB piloting multi-camera vision suites that certify every bundle before release.

Cosmetics and personal care brands adopt flexible cartoners and print-on-demand sleeve applicators to balance premium aesthetics with rising SKU counts. Household-chem and detergent makers focus on leak-proof dosing and space-saving secondary packs to navigate tightening transport-emission rules. Confectionery and bakery outfits deploy gentle-handling delta robots and ultrasonic bag sealers to preserve fragile products at speed, while 3PL providers scale up automated mailers and label applicators for omnichannel clients.

Europe Packaging Automation Market Report is Segmented by Business Type (Manufacturers, Wholesale Distributors, Omni-Channel Retailers and More), End-User Vertical (Food, Beverages, Pharmaceuticals, Cosmetics and Personal Care and More), Packaging Stage (Primary, Secondary, End-Of-Line, Tertiary & Intralogistics), Product Type (Filling Machines, Labelling and Coding, Form-Fill-Seal and More), and Geography.

List of Companies Covered in this Report:

- ABB

- Siemens AG

- Rockwell Automation

- Mitsubishi Electric

- Schneider Electric

- JLS Automation

- ULMA Packaging

- Swisslog Holding AG

- Gerhard Schubert GmbH

- Destaco

- Emerson (Branson)

- ATS Automation

- Massman Automation

- Krones AG

- Fanuc Corporation

- KUKA AG

- Coesia S.p.A.

- Syntegon Technology

- Sidel Group

- Yaskawa Electric

- Brenton Engineering

- Tetra Pak

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Pressure to Reduce Operating Costs

- 4.2.2 Shrinking Skilled-Labour Pool

- 4.2.3 EU Packaging-Waste and Traceability Mandates

- 4.2.4 Mass-Customisation and Shorter SKUs

- 4.2.5 AI-Enabled Predictive Maintenance

- 4.2.6 Plug-and-Play Modular Cobots

- 4.3 Market Restraints

- 4.3.1 High Up-Front Capex

- 4.3.2 Cyber-Security Vulnerabilities

- 4.3.3 Lack of Interoperability Standards

- 4.3.4 Raw-Material Supply Volatility

- 4.4 Regulatory Landscape

- 4.5 Technological Outlook

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Bargaining Power of Suppliers

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Threat of New Entrants

- 4.6.4 Threat of Substitutes

- 4.6.5 Intensity of Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Business Type

- 5.1.1 Manufacturers

- 5.1.2 Wholesale Distributors

- 5.1.3 Omni-channel Retailers

- 5.1.4 B2B e-Commerce Retailers

- 5.1.5 B2C e-Commerce Retailers

- 5.1.6 Personal-Document Shippers

- 5.1.7 Others

- 5.2 By End-User Vertical

- 5.2.1 Food

- 5.2.2 Beverages

- 5.2.3 Pharmaceuticals

- 5.2.4 Cosmetics and Personal Care

- 5.2.5 Household and Detergents

- 5.2.6 Chemical

- 5.2.7 Confectionery and Bakery

- 5.2.8 Warehousing and 3PL

- 5.2.9 Others

- 5.3 By Packaging Stage

- 5.3.1 Primary (Filling/Sealing)

- 5.3.2 Secondary (Cartoning/Case-Packing)

- 5.3.3 End-of-Line (Palletising/Stretch-Wrap)

- 5.3.4 Tertiary and Intralogistics

- 5.4 By Product Type

- 5.4.1 Filling Machines

- 5.4.2 Labelling and Coding

- 5.4.3 Form-Fill-Seal (H/VFFS)

- 5.4.4 Bagging and Pouching

- 5.4.5 Palletising and Depalletising

- 5.4.6 Others

- 5.5 By Geography

- 5.5.1 Germany

- 5.5.2 United Kingdom

- 5.5.3 France

- 5.5.4 Italy

- 5.5.5 Spain

- 5.5.6 Rest of Europe

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 ABB

- 6.4.2 Siemens AG

- 6.4.3 Rockwell Automation

- 6.4.4 Mitsubishi Electric

- 6.4.5 Schneider Electric

- 6.4.6 JLS Automation

- 6.4.7 ULMA Packaging

- 6.4.8 Swisslog Holding AG

- 6.4.9 Gerhard Schubert GmbH

- 6.4.10 Destaco

- 6.4.11 Emerson (Branson)

- 6.4.12 ATS Automation

- 6.4.13 Massman Automation

- 6.4.14 Krones AG

- 6.4.15 Fanuc Corporation

- 6.4.16 KUKA AG

- 6.4.17 Coesia S.p.A.

- 6.4.18 Syntegon Technology

- 6.4.19 Sidel Group

- 6.4.20 Yaskawa Electric

- 6.4.21 Brenton Engineering

- 6.4.22 Tetra Pak

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment