|

市场调查报告书

商品编码

1628718

亚太地区包装自动化:市场占有率分析、产业趋势与成长预测(2025-2030)APAC Packaging Automation - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

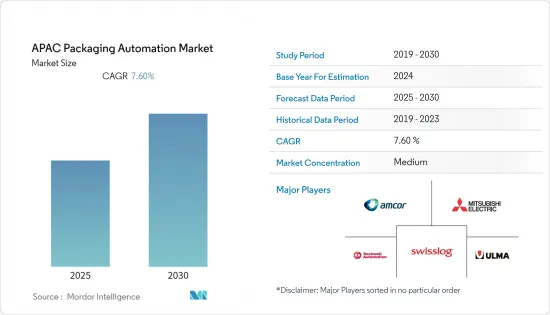

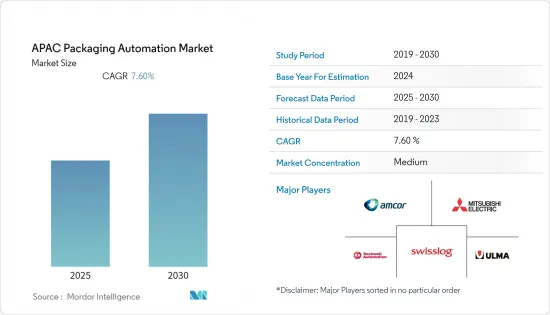

亚太包装自动化市场预计在预测期内复合年增长率为 7.6%

主要亮点

- 近年来,随着消费品需求的快速成长,高效、可靠的包装解决方案已成为迫在眉睫的问题。包装领域最重要的支柱之一是引进高速、高性能的包装机以及根据产品要求开发不同尺寸、形状和材料的包装的包装机。

- 此外,在当前的零售环境下,该地区正在经历超级市场、便利商店和购物中心等商店的快速扩张,为包装行业的创新开闢了新的机会。

- 此外,竞争激烈的电子商务行业的出现正在推动对创新包装解决方案的需求,以满足客户对复杂包装设备不断增长的需求。为了满足新兴市场的需求,包装器材产业正在迅速转向技术,以开发创新且未来性的包装解决方案。自动化包装设备是简化整个包装流程的有效方法。

- 根据研究,印度包装业约占全球包装业的4%。有组织零售和电子商务的爆炸性成长为未来零售成长提供了巨大潜力,包装产业将在此过程中受益匪浅。

- COVID-19 大流行在三个关键领域破坏了粮食安全:收入损失、导致需求重组的管道转变以及供应中断。这些问题影响该地区的低收入和高所得居民。

亚太地区包装自动化市场趋势

食品饮料产业快速成长

由于消费者的需求和日益增长的健康问题,该地区食品和饮料行业的需求不断增长。如今的消费者更喜欢包装精美的健康食品和饮料。该地区繁忙的生活方式推动了对易于使用和运输的包装食品和饮料产品的需求。

两大发展是增加该地区包装产业中小型企业的利润。其中之一是软机器人。传统上,包装行业被认为在采用机器人方面进展缓慢。也许这是因为大多数大型机器人缺乏更精緻的食品包装任务所需的精确度和灵活性。

软机器人技术是机器人技术的一个子集,它用高度适形的材料製造机器人,提高它们的灵活性、适应性和与人类安全合作的能力。这使得它们非常适合需要比传统工业机器人更柔软触感的包装任务。

将工业物联网 (IIoT) 引入包装设备越来越受欢迎。这项技术不仅提高了包装线的效率,也为改进机器、机器基础设施和操作人员开闢了新的机会,为未来十年包装设备的数位化铺平了道路。

例如,印度包装公司 Bandma 提供最先进、最现代化的机械和设备。该组织为各行业提供卓越的包装解决方案。为了满足当今的需求,Bandma 正在改变做法,向业界提供自动包装机,帮助公司拓展业务。

该地区不断创新新产品以促进成长,为了保持竞争力,食品製造商必须满足不断变化的客户需求。随着工业创新週期越来越短,消费者偏好的变化速度比以前快得多,因此包装企业必须不断更新产品。

印度对包装自动化的需求不断成长

印度正在采取果断措施减少碳排放,并致力于创造永续的包装解决方案。改善监管要求已成为当务之急,有助于减少食物废弃物、遵守卫生标准并尽量减少对环境的影响。

- FSSAI 的创建旨在将所有现有食品安全法律和标准统一为一个以科学为基础的监管机构,涵盖食品加工从製造到消费的所有阶段。 FSSAI 的目标是减少并逐步淘汰对环境和消费者健康有害的不可回收多层包装。

- 米歇尔曼印度公司表示,印度包装的三大趋势——全球市场趋势和地区趋势,如年轻人比例高和中阶不断壮大——将迅速促进包装产业的成长。最后,政府法规的变化正在扩大包装自动化的范围。

- 包装产业的主要焦点是向技术创新的决定性转变,以在国内生产安全、永续和环保的包装解决方案。公司正在利用机械和包装设备创新新产品,由于需求增加,产量也在增加。

- 由于消费者对包装商品的偏好,疫情期间包装食品和快速消费品的食品需求显着增加,这反映在对软包装印刷和加工机械的需求上。

- 在印度,在疫情期间,总部位于孟买的包装公司 SP Ultraflex 已向包装加工商和海外供应了超过 15 台机器。在印度,数位技术的采用迅速而广泛,技术的采用帮助企业快速完成各种交易。

亚太地区包装自动化产业概况

亚太地区包装自动化市场竞争激烈,主要企业包括三菱电机公司、罗克韦尔自动化、Swisslog Holding AG、ULMA Packaging 和 Amcor PLC。随着包装自动化需求的增加,这些主要企业正在努力创新新产品,采用新机械批量供应产品。

- 2021 年 10 月 - 王子控股收购了印度瓦楞纸包装公司 Empire Packages Ltd.。 Empire 是王子集团在东南亚、印度和大洋洲的第 35 家瓦楞纸公司。此次收购将帮助我们利用其他领域的关係并改善我们在该国的业务。

- 2020 年 11 月 - 罗克韦尔自动化收购了 Fix,一家电脑化维护管理系统公司。 Fiix 平台和专业知识的加入将为客户提供整合自动化、製造和维护资料的 360 度视图,以追踪和提高资产效能并优化维护业务。

其他好处:

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 产业价值链分析

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买方议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间敌对关係的强度

- COVID-19 市场影响评估

第五章市场动态

- 市场促进与市场约束因素介绍

- 市场驱动因素

- 製造商降低营业成本的压力越来越大

- 减少机器停机时间和产品浪费

- 新兴市场的崛起导致劳动成本下降和竞争加剧

- 市场限制因素

- 初始投资高

第六章 市场细分

- 依业务类型

- B2B电子商务零售商

- B2C电子商务零售商

- 全通路零售商

- 批发商

- 製造商

- 个人文件运输公司

- 其他的

- 按行业分类

- 食物

- 药品

- 化妆品

- 家庭使用

- 饮料

- 化学品

- 糖果零食

- 仓库

- 其他的

- 依产品类型

- 填充

- 标籤

- 卧式枕/立式枕

- 箱式包装

- 套袋

- 码垛

- 封盖

- 包裹

第七章 竞争格局

- 公司简介

- Amcor PLC

- Multivac Group

- Berry Global Inc.

- Ulma Packaging

- Westrock Company

- Robert Bosch GmBH

- Swisslog Holding AG

- Rockwell Automation

- Sealed Air Corporation

- Sonoco Products Company

- Tetra Pak International SA

- Misubishi Electric Corporation

第八章投资分析

第9章 市场的未来

The APAC Packaging Automation Market is expected to register a CAGR of 7.6% during the forecast period.

Key Highlights

- With the recent surge in demand for consumer products, efficient and reliable packaging solutions are an urgent task. One of the most important pillars in the packaging field is the introduction of high-speed and high-performance packaging machines or packaging machines designed to develop a variety of packaging in different sizes, shapes, and materials according to product requirements.

- Moreover, in this region, outlets such as supermarkets, convenience stores, and supercenters are rapidly expanding in the current retail environment, opening up new opportunities for innovation in the packaging industry.

- Additionally, the advent of the highly competitive e-commerce sector is driving the demand for innovative packaging solutions to meet customers growing demand for sophisticated packaging equipment. To meet the needs of a growing market, the packaging machinery industry is rapidly shifting to technology to develop innovative and future-proof packaging solutions. Automated packaging equipment is an effective way to simplify the entire packaging process.

- According to research conducted, the Indian packaging industry accounts for approximately 4% of the global packaging industry. The explosive growth of organized retail and e-commerce offers tremendous potential for future retail growth, but the packaging sector will benefit greatly in the process.

- The COVID-19 pandemic has weakened food security in three key areas such as income loss, channel shifts leading to demand to restructure, and supply disruptions. These issues have affected both low- and high-income in the region.

APAC Packaging Automation Market Trends

Food and Beverage industry to grow rapidly

The rising demand for the food and beverage industry in this region is high due to consumer requirements and growing health concerns. Consumers today prefer healthy food and beverages in a well-packed manner. The hectic lifestyle in the region has raised the demand for easy-to-use and carry packaged food and beverage products.

Two major developments in this region are increasing the benefits for small businesses in the packaging industry. One of them is a soft robot. Packaging as an industry has traditionally been seen as lagging behind in robotics adoption. Perhaps it was because most of the larger robots lacked the precision and dexterity needed for more delicate food packaging tasks.

Soft robotics is a subset of robotics that creates robots from highly compatible materials that increase their flexibility, adaptability, and ability to work safely with people. This makes them ideal for packaging operations that require a softer touch than traditional industrial robots.

The introduction of the Industrial Internet of Things (IIoT) into packaging equipment is gaining popularity. This technology will not only improve the efficiency of packaging lines but will also pave the way for the digital future of packaging equipment over the next decade by opening up new opportunities for improved machinery, machinery, machine infrastructure, and operators.

For instance, a packaging company in India - Bandma, offers some of the most sophisticated modern machinery and equipment; the organization provides superior packaging solutions for a variety of industries. In response to today's needs, Bandma changed its approach by providing the industry with automated packaging machines, helping the company expand its business.

The region has always been innovating new products for growth, and to remain competitive, food manufacturers must meet the ever-changing needs of their customers. With shorter industrial innovation cycles, consumer preferences are changing much faster than ever before, for which packaging companies must keep updating the products.

Increased demand for packaging automation in India

India is taking decisive steps to reduce its carbon footprint and working to create sustainable packaging solutions. The need to improve regulatory requirements becomes a higher priority, helping to reduce food waste, comply with hygiene standards and minimize environmental impact.

- The FSSAI was created to unify all existing food safety laws and standards into a single, science-based regulatory body that covers all stages of food processing, from manufacturing to consumption. FSSAI's goal is to reduce and phase out non-recyclable multi-layer packaging that is harmful to the environment and consumer health.

- According to Michelman India, the three trends packaging of India involves - global market trends, regional trends such as high percentage of young people and growing middle class, will rapidly increase the growth of packaging sector. Lastly, the changes in the government rules and regulations have improved the scope for package automation.

- The major focus of the packaging industry has been the decisive shift towards innovation to produce safe, sustainable, and environmentally-friendly packaging solutions in the country. The companies are innovating new products with machinery or packaging equipment, and for the increased demand, the production volume is also increased.

- The demand for food during the pandemic was considerably high for packaged food and FMCG products due to consumer preference for packaged goods, and this reflected in demand for flexible packaging printing and converting machinery.

- In India, a Mumbai-based packaging company SP Ultraflex supplied over 15 machines to packaging converters and overseas during the pandemic. The adoption of digital technologies was fast and widespread in India, and companies closed various deals faster due to the adoption of technology.

APAC Packaging Automation Industry Overview

The Asia Pacific packaging automation is competitive with the presence of key players in the market, such as Mitsubishi Electric Corporation, Rockwell Automation, Swisslog Holding AG, ULMA Packaging, Amcor PLC. These major companies are striving to innovate new products with the increased demand for packaging automation by adopting new machinery for delivering products in larger volumes.

- October 2021 - Oji Holdings acquired Empire Packages Ltd., a corrugated container company in India. Empire will be Oji group's 35th corrugated container plan in Southeast Asia, India, and Oceania. This acquisition helps to improve business in the country, leveraging the relationship in other areas too.

- November 2020 - Rockwell Automation acquired Fiix Inc., a computerized maintenance management system compnay. With the addition of Fiix's platform and expertise, customers benefit from a 360-degree view of integrated automation, manufacturing, and maintenance data that helps them track and improve the performance of their assets and optimize maintenance operations.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Force Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Assessment of the Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Introduction to Market Drivers and Restraints

- 5.2 Market Drivers

- 5.2.1 Increasing Pressure on Manufacturers to Cut Down Operating Costs

- 5.2.2 Reduces Machine Downtime and Product Waste

- 5.2.3 Emerging Markets are Emerging as Low Cost Labor and Increased Competition

- 5.3 Market Restraints

- 5.3.1 High initial investment

6 MARKET SEGMENTATION

- 6.1 By Businesses Type

- 6.1.1 B2B e-commerce retailers

- 6.1.2 B2C e-commerce retailers

- 6.1.3 Omni Channel Retailers

- 6.1.4 Wholesale Distributors

- 6.1.5 Manufacturers

- 6.1.6 Personal Document Shippers

- 6.1.7 Others

- 6.2 By End-User Vertical

- 6.2.1 Food

- 6.2.2 Pharmaceuticals

- 6.2.3 Cosmetics

- 6.2.4 Household

- 6.2.5 Beverages

- 6.2.6 Chemical

- 6.2.7 Confectionery

- 6.2.8 Warehouse

- 6.2.9 Others

- 6.3 By Product Type

- 6.3.1 Filling

- 6.3.2 Labelling

- 6.3.3 Horizontal/Vertical Pillow

- 6.3.4 Case Packaging

- 6.3.5 Bagging

- 6.3.6 Palletizing

- 6.3.7 Capping

- 6.3.8 Wrapping

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Amcor PLC

- 7.1.2 Multivac Group

- 7.1.3 Berry Global Inc.

- 7.1.4 Ulma Packaging

- 7.1.5 Westrock Company

- 7.1.6 Robert Bosch GmBH

- 7.1.7 Swisslog Holding AG

- 7.1.8 Rockwell Automation

- 7.1.9 Sealed Air Corporation

- 7.1.10 Sonoco Products Company

- 7.1.11 Tetra Pak International S.A

- 7.1.12 Misubishi Electric Corporation