|

市场调查报告书

商品编码

1850010

美国压力感测器:市场份额分析、行业趋势、统计数据和成长预测(2025-2030 年)US Pressure Sensors - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

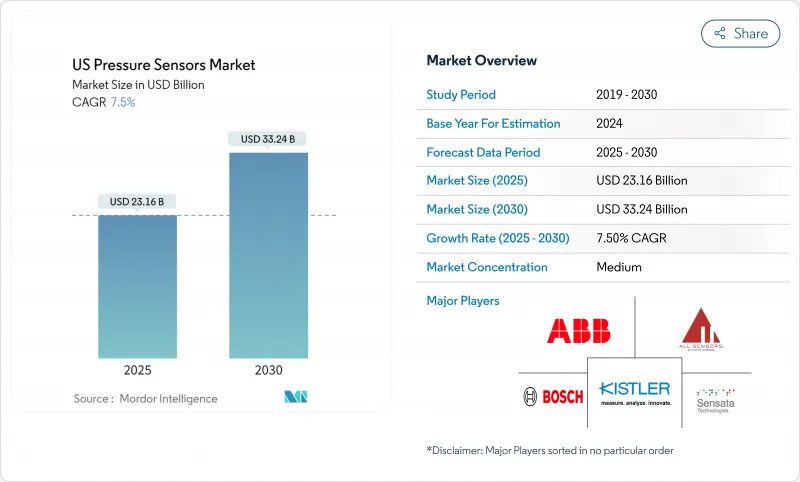

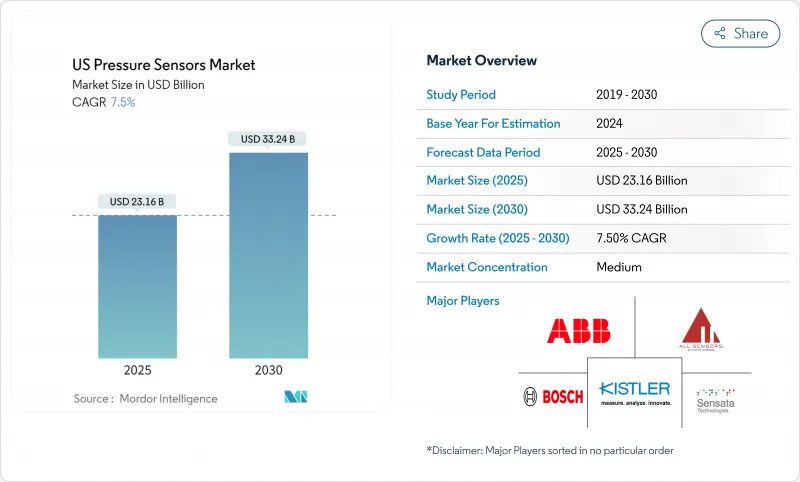

美国压力感测器市场预计到 2025 年将达到 231.6 亿美元,到 2030 年将达到 332.4 亿美元,年复合成长率为 7.50%。

半导体製造商正推动这一扩张的很大一部分,因为半导体晶圆厂将真空和气体控制的公差提高到满量程的±0.05%甚至更低。儘管汽车、医疗和液化天然气基础设施领域安全法规的日益严格给供应链带来了压力,但需求仍然保持强劲。 MEMS和NEMS平台的融合正在重塑成本曲线,奈米级装置正在树立新的精确度标准,同时也更容易整合到人工智慧模组中。电池供电的物联网系统正在推动电容式设计的应用,这种设计兼具低功耗和温度稳定性。从区域来看,南方地区凭藉其能源成本优势吸引了新的晶圆厂,而氦气短缺则迫使封装技术进行创新,以提高长期密封性。

美国压力感测器市场趋势与洞察

胎压监测系统 (TPMS) 更换週期驱动售后市场需求

随着第一代胎压监测系统(TPMS)的使用寿命接近尾声,感测器供应商正迎来回头客。 2007年《轮胎磨损法案》(TREAD Act)实施后生产的车辆正进入第二或第三次更换週期,而美国东北部和中西部地区冬季道路融雪剂的使用加速了电池损耗。 Bartec Auto ID 推出的2025款Rite-SensorBlue®专为特斯拉车型设计,并新增了蓝牙诊断功能,这标誌着TPMS正朝着延长保养週期的电动车优化方向发展。这些设备内建的预测性警报功能正推动售后市场从被动更换转向定期维护,从而支撑起更高的价格分布。

医疗保险对家用血压监测仪的报销

联邦医疗保险和医疗补助计划的覆盖范围已扩大,目前已覆盖84%的家用血压监测仪,惠及约140万高血压患者。密西根州的计画为每个设备支付最高75美元,树立了全国价格标竿。这种报销政策正在推动市场对可靠的低压感测器的快速需求,这些感测器可以装入小巧的臂带中,并将数据传输到远端医疗平台。

智慧型手机市场饱和度

由于气压感测器现在几乎被所有中高阶行动电话所采用,限制了消费性电子产品的销售成长,製造商正专注于差异化功能,例如穿戴式装置的超低功耗和无人机的高精度高度计,以吸引集中在西海岸供应链成熟领域的细分市场。

细分市场分析

到2024年,MEMS将占据美国压力感测器市场31.05%的份额,为主流汽车和工业设计提供动力。产量比率的硅生产线降低了单位成本,而石墨烯薄膜将灵敏度提升至66µV/V/kPa,提高了高度计和医疗穿戴式装置的精确度。应变计装置在石油上游等严苛环境中仍备受青睐,碳化硅设计可在600°C下可靠运作。光学感测器在强电磁场环境中具有优势。

随着代工厂采用共用模具,生产规模将缩小微机电系统(MEMS)与微型机电系统(MEMS)之间的成本差距,并促进其在医疗抛弃式批量生产中的应用。因此,美国压力感测器市场将逐步融合微型和奈米技术,形成包含人工智慧和资料加密等技术的混合型模组。

到2024年,压阻式架构将占据46.00%的营收份额,因为该架构允许製造商復用成熟的CMOS后端製程。近期碳化硅技术的改进已将零功耗温度係数降低至每摄氏度0.08%,满足了严苛的油田和航太应用的需求。 ASIC中嵌入的多项式迴归演算法将残差降低至0.008%FS,从而满足关键任务的精确度要求。

电容式感测技术预计将以 10.20% 的复合年增长率成长,其卓越的能源效率对于电池供电的物联网节点至关重要。 ES Systems 于 2024 年推出的产品总误差仅为 ±0.25% FS,并提供 I2C、SPI 和类比输出介面。谐振式真空计仍是一种特殊真空计,用于测量半导体腔室压力,分辨率可达 0.1 Pa。随着供应商将多种技术整合到单一封装中,美国压力感测器市场将出现竞争重迭,这将使 OEM 厂商能够根据特定应用的需求客製化效能。

美国压力感测器市场报告按感测器类型(MEMS、应变计、其他)、技术(压阻式、电容式、其他)、输出介面、压力范围、应用(汽车、医疗、工业、家电、其他)和美国地区(东北部、中西部、其他)进行细分。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 胎压监测系统 (TPMS) 更换週期驱动售后市场需求

- 医疗保险对家用血压监测仪的报销

- OSHA液化天然气连续测井需求

- 半导体工厂对超高精度的需求

- 市场限制

- 智慧型手机市场饱和度

- 氦气短缺推高了MEMS封装成本

- 价值/供应链分析

- 监管环境

- 技术展望

- 波特五力分析

- 供应商的议价能力

- 买方的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

第五章 市场规模与成长预测

- 依感测器类型

- MEMS

- 应变计

- NEMS

- 光学

- 透过技术

- 压阻式

- 电容式

- 共振类型

- 其他的

- 透过输出介面

- 模拟

- 数位式(IC/SPI)

- 按压力范围

- 低于 10 kPa(低)

- 10 kPa 1 MPa(中压)

- 超过 1 兆帕(高)

- 透过使用

- 车

- 医疗保健

- 家用电器

- 产业

- 航太与国防

- 饮食

- HVAC

- 其他的

第六章 竞争情势

- 市场集中度

- 策略趋势

- 市占率分析

- 公司简介

- Honeywell International Inc.

- Sensata Technologies Inc.

- Bosch Sensortec GmbH

- Emerson Electric Co.(Rosemount)

- ABB Ltd.

- Infineon Technologies AG

- STMicroelectronics NV

- Tektronix-Kistler Group

- NXP Semiconductors NV

- Panasonic Industry Co.

- TE Connectivity Ltd.

- Omron Corporation

- Pressure Systems Inc.

- All Sensors Corp.

- Endress+Hauser AG

- Rockwell Automation Inc.

- Yokogawa Electric Corp.

- Siemens AG

- Kulite Semiconductor Products Inc.

- TDK-Invensense Inc.

第七章 市场机会与未来展望

The US pressure sensors market is valued at USD 23.16 billion in 2025 and is projected to climb to USD 33.24 billion by 2030, advancing at a 7.50% CAGR.

Semiconductor manufacturers are driving a large share of this expansion as fabs tighten vacuum and gas control tolerances below +-0.05% full scale. Heightened safety rules in automotive, medical, and LNG infrastructure keep demand resilient even when supply chains face stress. The convergence of MEMS and NEMS platforms is reshaping cost curves, with nanoscale devices setting new accuracy benchmarks while easing integration into AI-ready modules. Battery-powered IoT systems are pushing adoption of capacitive designs that combine low power with temperature stability. Regionally, the South benefits from energy-cost advantages that attract new plants, while helium scarcity is forcing packaging innovation that improves long-term hermeticity.

US Pressure Sensors Market Trends and Insights

TPMS Replacement Cycle Accelerates Aftermarket Demand

First-generation mandatory Tire Pressure Monitoring Systems are now reaching end-of-life, creating repeat business for sensor suppliers. Vehicles built after the 2007 TREAD Act are entering second and third replacement cycles, and winter road-salt exposure in the Northeast and Midwest quickens battery depletion. Bartec Auto ID's 2025 Rite-SensorBlue(R), tailored for Tesla models, illustrates the shift toward EV-optimized TPMS that adds Bluetooth diagnostics and extends service intervals. Predictive alerts embedded in these units move the aftermarket from reactive swaps to scheduled maintenance, supporting premium price points.

Medicare Reimbursement for Home BP Monitors

Expanded Medicare and Medicaid coverage now reaches 84% of state plans for self-measured blood pressure devices, opening access for about 1.4 million beneficiaries with hypertension. Michigan's program pays up to USD 75 per device, setting a national pricing anchor. This reimbursement landscape fuels rapid demand for reliable low-pressure sensors that fit in compact arm-cuffs while streaming data into telehealth platforms.

Smart-Phone Barometer Saturation

Nearly every mid-to-high-tier handset now ships with a barometric sensor, capping volume growth in consumer electronics. Manufacturers pivot toward differentiated performance such as ultra-low-power variants for wearables or high-precision altimeters for drones, carving niche gains in an otherwise mature space concentrated in West Coast supply chains.

Other drivers and restraints analyzed in the detailed report include:

- OSHA LNG Continuous-Logging Mandate

- Semiconductor-Fab Ultra-High-Accuracy Demand

- Helium Shortage Inflates MEMS Packaging Cost

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

MEMS held 31.05% of the US pressure sensors market share in 2024 and underpin mainstream automotive and industrial designs. Yield-optimized silicon lines keep unit costs low, while graphene membranes now lift sensitivity to 66 µV/V/kPa, enhancing resolution for altimeters and medical wearables. Strain-gauge devices remain favored in harsh settings such as upstream oil where silicon carbide variants work reliably at 600 °C. Optical sensors gain ground in environments with strong electromagnetic fields.

As foundries deploy shared tooling, production scale will narrow cost gaps with MEMS, opening broader adoption in high-volume medical disposables. The US pressure sensors market will therefore see a gradual blend of micro and nano formats in mixed-technology modules that embed AI and data encryption.

Piezoresistive architectures led with 46.00% revenue share in 2024 because manufacturers can reuse mature CMOS back-end steps. Recent silicon-carbide revisions cut the temperature coefficient of zero output to 0.08% per °C, fitting harsh oilfield or aerospace needs. Polynomial-regression algorithms embedded in ASICs trim residual errors to 0.008% FS, aligning accuracy with mission-critical expectations.

Capacitive sensing, projected to rise at a 10.20% CAGR, provides superior energy efficiency vital for battery-powered IoT nodes. ES Systems' 2024 release achieves +-0.25% FS total error while offering I2C, SPI, and analog outputs. Resonant techniques stay in specialty vacuum gauges where 0.1 Pa resolution guides semiconductor chamber pressure. The US pressure sensors market will see competitive overlap as vendors integrate multiple technologies into single packages that let OEMs dial performance to application-specific thresholds.

The United States Pressure Sensors Market Report is Segmented by Sensor Type (MEMS, Strain-Gauge and More), Technology (Piezoresistive, Capacitive and More), Output Interface, Pressure Range, Application (Automotive, Medical, Industrial, Consumer Electronics and More), US Region (Northeast, Midwest and More)

List of Companies Covered in this Report:

- Honeywell International Inc.

- Sensata Technologies Inc.

- Bosch Sensortec GmbH

- Emerson Electric Co. (Rosemount)

- ABB Ltd.

- Infineon Technologies AG

- STMicroelectronics NV

- Tektronix-Kistler Group

- NXP Semiconductors NV

- Panasonic Industry Co.

- TE Connectivity Ltd.

- Omron Corporation

- Pressure Systems Inc.

- All Sensors Corp.

- Endress+Hauser AG

- Rockwell Automation Inc.

- Yokogawa Electric Corp.

- Siemens AG

- Kulite Semiconductor Products Inc.

- TDK-Invensense Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 TPMS replacement cycle accelerates aftermarket demand

- 4.2.2 Medicare reimbursement for home BP monitors

- 4.2.3 OSHA LNG continuous?logging mandate

- 4.2.4 Semiconductor-fab ultra-high-accuracy demand

- 4.3 Market Restraints

- 4.3.1 Smart-phone barometer saturation

- 4.3.2 Helium shortage inflates MEMS packaging cost

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Sensor Type

- 5.1.1 MEMS

- 5.1.2 Strain-Gauge

- 5.1.3 NEMS

- 5.1.4 Optical

- 5.2 By Technology

- 5.2.1 Piezoresistive

- 5.2.2 Capacitive

- 5.2.3 Resonant

- 5.2.4 Others

- 5.3 By Output Interface

- 5.3.1 Analog

- 5.3.2 Digital (IC/SPI)

- 5.4 By Pressure Range

- 5.4.1 <10 kPa (Low)

- 5.4.2 10 kPa 1 MPa (Medium)

- 5.4.3 >1 MPa (High)

- 5.5 By Application

- 5.5.1 Automotive

- 5.5.2 Medical

- 5.5.3 Consumer Electronics

- 5.5.4 Industrial

- 5.5.5 Aerospace & Defence

- 5.5.6 Food & Beverage

- 5.5.7 HVAC

- 5.5.8 Others

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.4.1 Honeywell International Inc.

- 6.4.2 Sensata Technologies Inc.

- 6.4.3 Bosch Sensortec GmbH

- 6.4.4 Emerson Electric Co. (Rosemount)

- 6.4.5 ABB Ltd.

- 6.4.6 Infineon Technologies AG

- 6.4.7 STMicroelectronics NV

- 6.4.8 Tektronix-Kistler Group

- 6.4.9 NXP Semiconductors NV

- 6.4.10 Panasonic Industry Co.

- 6.4.11 TE Connectivity Ltd.

- 6.4.12 Omron Corporation

- 6.4.13 Pressure Systems Inc.

- 6.4.14 All Sensors Corp.

- 6.4.15 Endress+Hauser AG

- 6.4.16 Rockwell Automation Inc.

- 6.4.17 Yokogawa Electric Corp.

- 6.4.18 Siemens AG

- 6.4.19 Kulite Semiconductor Products Inc.

- 6.4.20 TDK-Invensense Inc.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space & Unmet-need Assessment