|

市场调查报告书

商品编码

1685836

压力感测器产业:市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)Pressure Sensors Industry - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

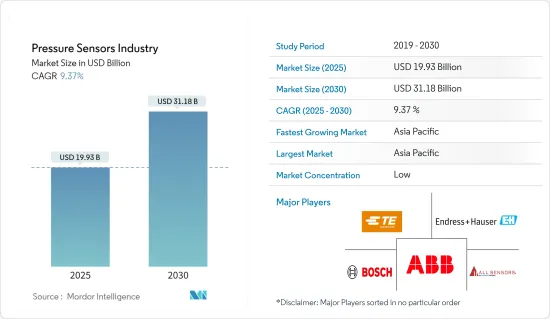

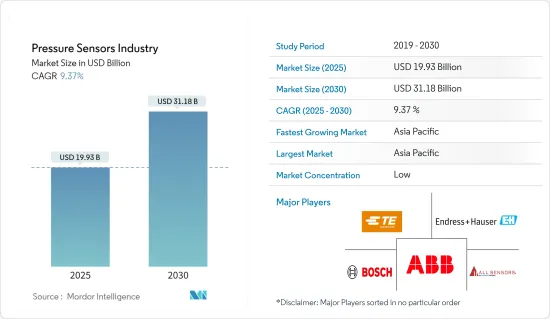

压力感测器产业预计将从 2025 年的 199.3 亿美元成长到 2030 年的 311.8 亿美元,预测期内(2025-2030 年)的复合年增长率为 9.37%。

主要亮点

- 压力感测器是一种装有压力敏感元件的设备,它能测量气体或液体相对于不銹钢、硅等材质的膜片的压力,并将测量值转换成电讯号输出。

- 持续收集和汇总静态和动态压力变化资料对于大多数製造设备和工业设施以及许多消费产品的正常运作至关重要。过大的压力可能会导致功率劣化、负移等问题,并且通常会损害应用程式的正常运作。近年来,压力感测器日益数位化、小型化、成本效益高、低耗电量,对收益成长产生了正面影响。这些变化正在提高感测器的效率和性能,引发新一轮技术创新浪潮。

- 压力感测器的应用范围十分广泛,因此需要多种多样的感测器类型和特性。有许多不同类型可供选择,包括适用于恶劣或腐蚀性环境的类型和适用于高可靠性应用的类型。例如,近几十年来,汽车一直是推动这些设备需求的主要产业之一。为该行业製造感测器的公司通常需要保持 IATF 16949、ISO 21750:2006、ISO 1550-2:2012 和 ISO 26262 等认证。汽车产业的压力感测器还必须满足 ISO 1142-4 的抗电气干扰要求。

- 市场的成长归因于对车辆安全功能的需求不断增加、政府法规日益严格以及汽车产业的成长。随着严格的安全法规的实施,压力感测器的作用预计将得到加强,因为设计人员将它们用于汽车的三个主要应用领域:引擎优化、排放控制和增强安全性。

- 感测器市场多样化且不断成长,设计工程师将更多的感测器塞入从汽车到智慧型手机的各种产品中,并实现智慧牙刷和猫砂盆等新应用。随着感测器变得越来越普及,成本问题继续困扰着工程师。预计与感测产品相关的高成本将阻碍市场成长。

- 在后疫情时代,2022年的开始对于全球消费性电子市场至关重要,但同时由于多种因素而极具挑战性。例如,乌克兰战争的后果和失控的通货膨胀导致消费者信心全线暴跌。此外,2022 年春季,该公司最大的销售市场中国实施了封锁,进一步对销售产生了负面影响。值得注意的是,第四季度的国际足总世界杯预计将提供机会,但经验表明,像这样的大型赛事会推动需求增加,尤其是对电视的需求。然而,考虑到消费者信心的恶化,这种影响不足以阻止2022年家电市场销售的下滑。

压力感测器产业趋势

汽车预计将占很大份额

- 汽车领域的压力感知器受到轮胎压力、煞车油压力、燃料箱中的蒸气压力、燃油喷射和CDRi、歧管绝对压力等关键因素的驱动,创造了应用机会。

- 长期以来,压力感知器广泛应用于包括汽车领域在内的各个行业,用于测量引擎油、变速箱和变速箱油以及煞车、冷却和燃油系统中的液压油等关键流体的压力。汽车产业正在进行技术进步以提高安全性、舒适性和娱乐性,并提供广泛的压力感测器选择。这些感测器的紧凑尺寸极大地影响了它们在汽车设计中的广泛应用。

- 此外,电动车还使用压力感测器来防止手指在室内被夹住。此外,大多数电动车的冷却系统都力求电池组长时间保持其最佳动作温度。随着汽车製造商寻求为电动车配备更大的电池组,他们对冷却系统的需求也越来越大。

- 这使得压力测量成为电动车液体冷却系统中的关键要素。压力感测器在提供调整和优化冷却系统的反馈以及检测可能表明洩漏的压力损失方面发挥着至关重要的作用。随着液体冷却系统变得越来越复杂,电动车冷却系统对精确、有弹性的压力感测器的需求预计会越来越大。

- 微机电系统 (MEMS) 感测器用于压力感测和空气质量流量感测器。技术进步正在推动更小、无电池的轮胎压力感测器模组的发展。基于 MEMS 的能源采集系统现已整合到轮胎中,以缩小模组尺寸。

- 随着电动车销量和产量的不断增长,对各种应用的压力感测器的需求也随之增加,包括电池冷却剂和蒸气检测。根据国际能源总署的数据,在净零排放情境下,到 2030 年电动车销售将占汽车总销量的 65% 左右。电动车销量的成长可能会创造对压力感测器的需求。

亚太地区占市场主导地位

- 中国是全球医疗保健产业一个极具前景的市场,其特征是规模庞大、多样性和成长潜力,加上政府的推动和人口结构的变化。此外,老龄人口的成长和对更好医疗设备的需求不断增长,促使各国政府优先发展医疗保健产业,这是市场发展的主要驱动力。

- 压力感测器用于医疗设备中,以监测腔内的压力并调整治疗期间施加的压力水平。中国是全球着名的医疗设备製造中心。

- 根据国家药品监督管理局统计,预计到2022年12月,中国医疗设备公司数量将达到32,632家,较2008年的13,000家稳定成长,其中90%以上为中小企业。这些重要的功能可能会增强该地区压力感测器的应用机会。

- 日本的汽车产业规模位居世界第三,汽车产量居世界第三位,在22个都道府县设有78家汽车工厂。丰田、京滨、日产等大公司对日本经济做出了巨大贡献,汽车製造业占运输机械产业的89%。

- 此外,汽车零件供应商的成长已成为日本经济的关键组成部分。这些关键的汽车功能在各种应用中产生了对压力感知器的需求,包括测量引擎油、变速箱和变速箱油等主要流体的压力,以及煞车、冷却和燃油系统中的液压油。此外,该地区电动车销量的成长预计也将刺激市场需求。

- 压力感测器用于 HVAC 系统中,以监测空气过滤器的状况。当过滤器被颗粒物堵塞时,您可以侦测到过滤器两端的压力差增加。由于 HVAC 设备的需求不断增加,预计印度对压力感测器的需求也将增加。随着该地区城市人口不断增长,住宅和商业基础设施预计将快速建设,因此这种需求预计还会加速。

- 家用电子电器製造业的崛起、汽车产业的投资以及其他产业的发展预计将推动亚太地区对压力感测器的需求。

压力感测器产业概况

压力感测器市场特征是分散、竞争激烈,国内外参与者并存。产业技术进步为供应商提供了永续的竞争优势。该市场上一些值得关注的公司包括 ABB Ltd.、TE Connectivity、Endress+Hauser AG、Bosch Sensortec GmbH 和 All Sensors Corporation。

2023 年 6 月,Thermo Control 与Schneider Electric合作,在罗马尼亚锡比乌 IFM Prover 建造的新工厂中实施 Ecostruxure 楼宇管理系统 (BMS) 解决方案。该系统负责监视、控制和管理工厂内的所有电气和机械设备。此外,工厂还将太阳能发电面板和热泵整合到 BMS 解决方案中,以提高能源效率并减少水电费。此外,用于监控和控制製程的温度、湿度和压力感测器均在 IFM 工厂内生产。

2023 年 1 月,博世感测器技术公司 (Bosch Sensortec) 在 CES 2023 上推出了一系列新型感测器,包括支援 AI 的感测器和下一代磁力仪。新发布的 BMP585 气压感测器可在具有挑战性的环境中提供高度跟踪,包括为游泳设计的可穿戴设备。这些感测器具有超低功耗,可确保延长电池寿命,同时提供高精度和最小噪音水平。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争强度

- 产业价值链分析

- 宏观趋势如何影响市场

第五章 市场动态

- 市场驱动因素

- 汽车和医疗保健等终端用户行业的成长

- MEMS 和 NEMS 系统在工业领域的应用日益广泛

- 市场限制

- 感测产品成本高

第六章 市场细分

- 依感测器类型

- 有线

- 无线的

- 依产品类型

- 绝对压力

- 压力差

- 表压

- 依技术分类

- 压阻式

- 电磁

- 电容式

- 共振固体

- 光学的

- 其他压力感测器

- 按应用

- 车

- 医疗

- 家电

- 产业

- 航太和国防

- 饮食

- HVAC

- 按地区

- 北美洲

- 美国

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 其他欧洲国家

- 亚太地区

- 中国

- 日本

- 印度

- 其他亚太地区

- 拉丁美洲

- 中东和非洲

- 北美洲

第七章 竞争格局

- 公司简介

- ABB Ltd

- All Sensors Corporation

- Bosch Sensortec GmbH

- Endress+Hauser AG

- TE Connectivity

- Honeywell International Inc.

- Schneider Electric

- Kistler Group

- Rockwell Automation Inc.

- Emerson Electric Co.

- Sensata Technologies Inc.

- SIEMENS AG

- Yokogawa Corporation

- Infineon Technologies Ag

- STMicroelectronics

- 压力感测器厂商-市场占有率

第八章投资分析

第九章 市场机会与未来趋势

The Pressure Sensors Industry is expected to grow from USD 19.93 billion in 2025 to USD 31.18 billion by 2030, at a CAGR of 9.37% during the forecast period (2025-2030).

Key Highlights

- A pressure sensor is a device equipped with a pressure-sensitive element that measures the pressure of a gas or a liquid against a diaphragm made of stainless steel, silicon, etc., and converts the measured value into an electrical signal as an output.

- Gathering and collecting continuous data on static and dynamic pressure changes is vital for most manufacturing units and industrial institutions and for the proper operation of many consumer products. Overpressure could cause issues such as deterioration and negative shifts of outputs and generally harm the normal performance of applications. In recent years, pressure sensors have turned digital, miniaturized, lower-cost, and lower-powered, thus positively impacting its revenue surge. These changes have increased sensor efficiency and performance, generating a new wave of innovation.

- There are many different types of applications for pressure sensors, which create a need for a wide variety of sensor types and characteristics. Variants are available for harsh or corrosive environments and are aimed at high-integrity applications. For instance, in the last couple of decades, automotive has been one of the main sectors to drive demand for these devices. Companies that manufacture sensors for this industry must often maintain certification under IATF 16949, ISO 21750:2006, ISO 1550-2:2012, ISO 26262, and others. Pressure sensors in the automotive industry must also meet the requirements of ISO 1142-4 for resistance to electrical interference.

- The market's growth is attributed to the increasing demand for vehicle safety features, rising government regulations, and the growing automotive industry. With strict safety regulations coming into existence, the role of pressure sensors is expected to strengthen as designers use automotive pressure sensors primarily in three application areas: engine optimization, emission control, and safety enhancement.

- The market for sensors is getting diverse and growing, with design engineers packing more sensors into everything from automobiles to smartphones and applying them in new applications like smart toothbrushes and cat litter boxes. As sensors proliferate, concerns over cost continue to preoccupy engineers. The high costs associated with sensing products are expected to hinder the growth of the market.

- In the post-COVID-19 scenario, the start of 2022 was crucial as well as highly difficult for the global consumer electronics market due to numerous factors. For instance, the impact of the war in Ukraine and runaway inflation led consumer sentiment to plummet across the board. Additionally, in spring 2022, there were lockdowns in the largest sales market, China, which further negatively impacted sales. Notably, the football World Cup in the fourth quarter was expected to offer an opportunity to compensate for the weak first half of the year, but experience has shown that major events such as increased demand, particularly for TVs. However, given the poor consumer sentiment, this effect was not big enough to keep sales in the consumer electronics market from decreasing during 2022 overall.

Pressure Sensors Industry Trends

Automotive is Expected to Hold Significant Share

- The pressure sensors in the automotive sector are driven by major factors such as tire pressure, brake fluid pressure, vapor pressure in the fuel tank, fuel injection and CDRi, and manifold absolute pressure, among others, which create application opportunities.

- For a long time, pressure sensors have been extensively utilized in various industries, including the automobile sector, to gauge the pressure of crucial fluids such as engine oil, gearbox and transmission oil, and hydraulic oil in braking, cooling, and fuel systems. The automotive industry offers diverse pressure sensor alternatives as it undergoes technological advancements to enhance safety, comfort, and entertainment. The compact size of these sensors has significantly influenced their widespread adoption in automotive design.

- Moreover, pressure sensors are utilized in electric vehicles to prevent finger entrapment indoors. Additionally, most electric vehicle cooling systems strive to maintain battery packs at their optimal operating temperature for extended periods. As automakers endeavor to incorporate battery packs with greater capacity in electric vehicles, the requirements for these cooling systems to manage such demands are also escalating.

- Therefore, pressure measurement has emerged as a crucial factor in the liquid cooling system of an electric vehicle. Pressure sensors play a pivotal role in providing feedback for regulating and optimizing the cooling system and detecting pressure loss that may indicate leakage. With the increasing complexity of liquid cooling systems, the need for precise and resilient pressure sensors for electric vehicle cooling systems is anticipated to be higher than ever.

- Microelectromechanical systems (MEMS) sensors are utilized for pressure sensing and as an air mass flow sensor. Technological advancements have led to the development of more compact and battery-free tire pressure sensor modules. MEMS-based energy harvesting systems are currently integrated into tires to reduce module size.

- The increasing sales and production of electric vehicles necessitate pressure sensors for various applications, including battery cooling fluid and vapor detection. As per the IEA, electric vehicle sales will constitute approximately 65% of total car sales by 2030 in the Net Zero Scenario. Such rising EV sales will create demand for pressure sensors.

Asia Pacific to Dominate the Market

- China presents a highly promising market for the global medical industry, characterized by vast size, diversity, and growth potential, driven by a confluence of government backing and evolving demographics. Furthermore, with an increasingly elderly populace and heightened demand for superior medical equipment, the government has prioritized developing the healthcare sector, serving as a key impetus for the market.

- Pressure sensors are utilized in medical devices to oversee the pressure within the chamber and regulate the pressure level administered during treatment. China is a prominent global hub for medical device manufacturing.

- As per the National Medical Products Administration, the number of medical device companies in China reached 32,632 by December 2022, exhibiting a steady growth from 13,000 in 2008. Most of these companies, over 90%, are small and medium-sized enterprises. Such significant capabilities will enhance the application opportunities for the pressure sensors in the region.

- The automotive industry in Japan is the third-largest producer of automobiles globally, boasting 78 factories across 22 prefectures. Major companies such as Toyota, Kei, and Nissan contribute significantly to the country's economy, with automotive manufacturing accounting for 89% of the transportation machinery industry.

- Additionally, the growth of auto parts suppliers has become a substantial component of Japan's economy. Such significant automotive capabilities will create the demand for pressure sensors for various applications, such as to gauge the pressure of crucial fluids such as engine oil, gearbox and transmission oil, and hydraulic oil in the braking, cooling, and fuel systems. The region's progress in augmenting electric vehicle (EV) sales is also anticipated to stimulate market demand.

- Pressure sensors are utilized in HVAC systems to monitor the state of air filters. The rise in differential pressure across the filter can be detected as it becomes clogged with particulates. The demand for pressure sensors in India is estimated to rise due to the increasing demand for HVAC equipment. This demand is expected to accelerate due to the rapid construction of residential and commercial infrastructure, which is anticipated to expand as a result of the growing urban population in the region.

- The rising consumer electronics manufacturing, investments in the automotive industry, and developments in other sectors are expected to create the damned for pressure sensors in Asia-Pacific.

Pressure Sensors Industry Overview

The pressure sensor market is characterized by fragmentation and intense competition, with a presence of both domestic and international players. Technological advancements in the industry provide vendors with a sustainable competitive edge. Notable companies in this market include ABB Ltd., TE Connectivity, Endress+Hauser AG, Bosch Sensortec GmbH, and All Sensors Corporation.

In June 2023, Thermo Control, in partnership with Schneider Electric, implemented the Ecostruxure Building Management System (BMS) solution in a new factory constructed by IFM Prover in Sibiu, Romania. This system serves to monitor, control, and manage all electrical and mechanical installations within the factory. Additionally, the factory has integrated photovoltaic panels and heat pumps into the BMS solution, enhancing energy efficiency and reducing utility costs. Furthermore, the temperature, humidity, and pressure sensors utilized in the monitoring and control processes are manufactured within the IFM factory.

In January 2023, Bosch Sensortec unveiled a range of new sensors at CES 2023, including an AI-enabled sensor and a next-generation magnetometer. The newly introduced BMP585 barometric pressure sensors offer altitude tracking capabilities even in challenging environments, such as for wearables designed for swimming. These sensors boast ultra-low power consumption, ensuring extended battery life while delivering high accuracy and minimal noise levels.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Impact of Macro Trends on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growth of End-user Verticals, Such as Automotive and Healthcare

- 5.1.2 Increasing Adoption of MEMS and NEMS Systems in the Industry

- 5.2 Market Restraints

- 5.2.1 High Costs Associated with Sensing Products

6 MARKET SEGMENTATION

- 6.1 By Type of Sensor

- 6.1.1 Wired

- 6.1.2 Wireless

- 6.2 By Product Type

- 6.2.1 Absolute

- 6.2.2 Differential

- 6.2.3 Gauge

- 6.3 By Technology

- 6.3.1 Piezoresistive

- 6.3.2 Electromagnetic

- 6.3.3 Capacitive

- 6.3.4 Resonant Solid-State

- 6.3.5 Optical

- 6.3.6 Other Pressure Sensors

- 6.4 By Applications

- 6.4.1 Automotive

- 6.4.2 Medical

- 6.4.3 Consumer Electronics

- 6.4.4 Industrial

- 6.4.5 Aerospace and Defense

- 6.4.6 Food and Beverage

- 6.4.7 HVAC

- 6.5 By Geography

- 6.5.1 North America

- 6.5.1.1 United States

- 6.5.1.2 Canada

- 6.5.2 Europe

- 6.5.2.1 United Kingdom

- 6.5.2.2 Germany

- 6.5.2.3 France

- 6.5.2.4 Rest of Europe

- 6.5.3 Asia-Pacific

- 6.5.3.1 China

- 6.5.3.2 Japan

- 6.5.3.3 India

- 6.5.3.4 Rest of Asia Pacific

- 6.5.4 Latin America

- 6.5.5 Middle East and Africa

- 6.5.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 ABB Ltd

- 7.1.2 All Sensors Corporation

- 7.1.3 Bosch Sensortec GmbH

- 7.1.4 Endress+Hauser AG

- 7.1.5 TE Connectivity

- 7.1.6 Honeywell International Inc.

- 7.1.7 Schneider Electric

- 7.1.8 Kistler Group

- 7.1.9 Rockwell Automation Inc.

- 7.1.10 Emerson Electric Co.

- 7.1.11 Sensata Technologies Inc.

- 7.1.12 SIEMENS AG

- 7.1.13 Yokogawa Corporation

- 7.1.14 Infineon Technologies Ag

- 7.1.15 STMicroelectronics

- 7.2 Pressure Sensors Vendors - Market Share