|

市场调查报告书

商品编码

1628731

亚太地区数位电子看板:市场占有率分析、产业趋势与成长预测(2025-2030 年)APAC Digital Signage - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

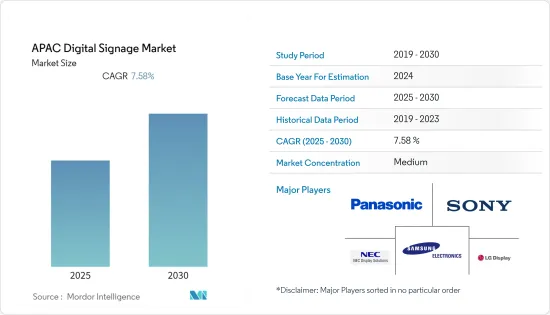

亚太地区数位电子看板市场预计在预测期内复合年增长率为 7.58%。

由于印度和新加坡等新兴国家以及中国和日本等已开发国家越来越多地使用电视墙和数位广告看板进行品牌行销,预计该市场将稳定成长。

主要亮点

- 数位数位电子看板已成为影响购买决策的关键因素,政府、医疗保健、公共交通和零售商店等机构现在正在大量转向数位电子看板位看板,以将讯息传达给目标受众。

- 预计未来几年,数位电子看板位看板将在各个新兴经济体中蓬勃发展,因为内容和讯息可以在电子萤幕和数数位电子看板上显示,并且可以在不对实体标牌进行任何更改的情况下进行修改。随着技术进步和价格下降,数位电子看板的采用变得越来越普遍和主流。

- 提供数位电子看板解决方案的供应商不断投资于产品创新。例如,三星宣布在全球推出 The Wall Luxury,这是其模组化 MicroLED 萤幕的最新版本。此类技术创新和全球广告支出的增加预计将推动需求。

- COVID-19 疫情的爆发在最初阶段对所研究的市场产生了影响,因为製造工厂关闭,在家工作的趋势也反映在需求减少上。然而,这种场景扩大了许多行业的数位电子看板行销范围,特别是医院和公共场所,它们利用该技术来显示重要资讯。

亚太地区数位电子看板看板市场趋势

OLED显示器显着成长

- OLED 技术显着提高了影像质量,并为创新的新型消费显示器提供了潜力。 OLED 通常被称为数位显示器和萤幕的未来。

- OLED 是唯一克服传统显示器限制的技术,加上其动态形式,增强了真实感。由于OLED基于自发光光源,因此具有出色的光线和色彩表现力。其灵活性和透明度是创新有机发光二极体材料开发的结果。

- 越南等国家正在推广有机发光二极体数位电子看板的应用。例如,2021年8月,该国在胡志明市西贡会展中心举办了国际LED/OLED数位电子看板展。

- 此外,LG Electronics India 最近在德里最大的购物中心安装了 OLED数位电子看板,采用了 63 个定製曲面 55 吋 OLED 面板。 8米高的OLED显示器呈环形排列,以便从任何角度都可以观看。此外,我们也为德里古尔冈的另一个 Ambience Mall交付OLED指示牌。

印度所占份额最高

- 去年,在 COVID-19 大流行期间,儘管全球经济低迷,该地区的数位电子看板采用率仍显着增加。

- 据 Scala 称,印度是最大的宝石和珠宝饰品市场之一,占全球珠宝消费的 29%。该产业对印度经济的贡献率为7%,为4万多人提供就业机会。

- 购买珠宝是印度传统和文化的一部分。然而,大多数顾客更喜欢在商店购物,因此个人化对于提高顾客满意度和建立品牌忠诚度至关重要。疫情期间,全国各地的珠宝店都选择了「实体」方式来接触更多顾客,保持高收益,同时确保安全、无缝的购物体验。

- 例如,印度最值得信赖的珠宝品牌 Tanishq 正在推出一项新技术堆栈,旨在弥合实体店和点击之间的差距,融合视讯通话、无尽通道、虚拟珠宝试戴和实时实时协助聊天等功能我们宣布推出phygital 功能。此外,零售终端用户正在采用数位电子看板,进一步增加了该国对店内指示牌解决方案的需求。

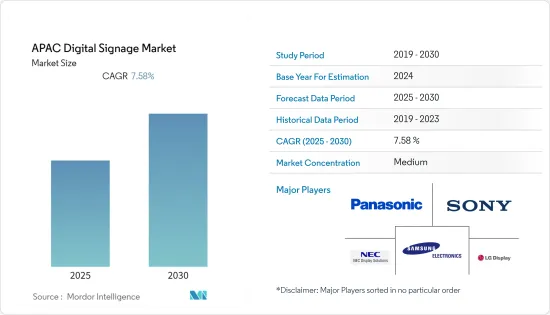

亚太地区数位电子看板产业概况

亚太地区数位电子看板看板市场部分分散,由多家大型企业组成。从市场占有率来看,目前只有少数大公司占据市场主导地位。然而,创新和永续的包装正在帮助许多公司赢得新契约和开拓新市场,从而提高市场占有率。

- 2020年9月-公司举办CPS/IoT展会线上展会「CEATEC 2020 ONLINE」(以下简称「CEATEC」)。在“综合展区”,该公司利用影片、简报资料、即时聊天功能等方式,介绍了多款与新常态社会工作模式和安全相关的数位化解决方案和概念影片。

其他好处:

- Excel 格式的市场预测 (ME) 表

- 分析师支援 3 个月

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 市场概况

- 评估 COVID-19 对产业的影响

- 市场驱动因素

- 零售和医疗保健等最终用户行业的成长

- 由于营运成本降低和标牌更换变得容易,采用率提高

- 市场限制因素

- 初始设定成本高

- 价值链分析

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买方议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间敌对关係的强度

第五章市场区隔

- 按类型

- 电视墙

- 视讯萤幕

- 亭

- 透明液晶萤幕

- 数位海报

- 其他类型

- 按成分

- 硬体

- 液晶/LED显示

- OLED显示器

- 媒体播放机

- 投影机/投影萤幕

- 其他硬体

- 软体

- 服务

- 硬体

- 按尺寸

- 32吋以下

- 32英寸至52英寸

- 52吋或以上

- 按地点

- 店内

- 户外的

- 按用途

- 零售

- 运输

- 款待

- 公司

- 教育

- 政府机构

- 其他用途

- 按国家/地区

- 中国

- 日本

- 印度

- 韩国

- 其他亚太地区

第六章 竞争状况

- 公司简介

- NEC Display Solutions Co. Ltd

- LG Display Co. Ltd

- Samsung Electronics Co. Ltd

- Panasonic Corporation

- Sony Corporation

- Stratacache

- Planar Systems Inc.

- Hitachi Ltd

- Barco NV

- Cisco Systems Inc.

第七章 投资分析

第八章市场的未来

The APAC Digital Signage Market is expected to register a CAGR of 7.58% during the forecast period.

The market is expected to have a steady growth owing to the increased application of video walls and digital billboards for brand marketing in developing nations such as India, Singapore and developed countries such as China and Japan.

Key Highlights

- Digital signage has played an important factor in influencing the purchase decision, and institutions, like the government, healthcare, public transit, and retail stores, are now heavily relying on digital signages to better engage their targeted audiences to communicate their message.

- As digital signage enables content and messages to be displayed on an electronic screen or digital sign and can be changed without modification to the physical sign, aggressive growth over the next few years across various emerging economies is anticipated. The adoption of digital signage is becoming more popular and mainstream with the technological advancements and decrease in price.

- The vendors offering digital signage solutions are continuously investing in product innovations. For instance, Samsung announced the global launch of The Wall Luxury, which is the latest version of its modular MicroLED screen, which can be tailored to any size and aspect ratio. Such innovations and the global increase in ad spending are expected to drive the demand.

- The COVID-19 outbreak has affected the studied market, as the manufacturing facilities were closed in the initial phase and work from home trends also reflected the demand decrease. However, the scenario expanded the scope of marketing through digital signage across many industries, especially in hospitals and public places, which utilized the technology for displaying important information.

APAC Digital Signage Market Trends

OLED to Show Significant Growth

- OLED technology holds the promise of significantly enhanced picture quality, with the potential for innovative new consumer display presentations. It is often hailed as the future of digital displays and screens.

- It is the only technology that overcomes the limitations of conventional displays, as it offers enhanced reality combined with a dynamic form. OLED provides superior light and color expression, as it is based on self-emitting light sources. Its flexibility and transparent nature are the results of the development of innovative OLED materials.

- A country such as Vietnam is marketing the application of OLED digital signage boards in the country. For instance, in August 2021, the country hosted the International LED/OLED and Digital Signage Show at Saigon Exhibition and Convention Center Ho Chi Minh.

- Moreover, LG Electronics India recently installed OLED digital signage at the largest shopping mall in Delhi, utilizing 63 custom-made curved 55-inch OLED panels. Standing eight meters tall, the OLED displays are installed in a ring so that they can be observed at any angle. Additionally, the tech giant supplied OLED signage at another Ambience Mall in Gurgaon, Delhi.

India to Hold the Highest Market Share

- Last year, amidst the COVID-19 pandemic, the adoption of digital signage increased significantly in the region despite a decline in the global economy as businesses sought innovative ways to reach their target audience better.

- According to Scala, India represents one of the largest gems and jewelry sector markets and contributed 29% of global jewelry consumption. This sector contributes 7% to the Indian economy and provides jobs to more than 40 lakh people.

- Purchasing jewelry has been an inherent part of Indian tradition and culture. However, Personalisation is vital in increasing customer satisfaction and building brand loyalty as most customers prefer to purchase jewelry in-store. During the pandemic, jewelers across the country have opted for a 'phygital' approach to reach more customers and keep their revenues high while ensuring a safe and seamless shopping experience.

- For example, India's most trusted jewelry brand, Tanishq, announced the launch of new phygital features, a tech stack that would bridge the gap between bricks and clicks - incorporating features such as video calling, endless aisle, virtual jewelry try on, and real-time, live assisted chat in more than 200 stores across the country. Several other Retail end-users are implementing digital signage, which is further increasing the demand for in-store signage solutions in the country.

APAC Digital Signage Industry Overview

The Asia Pacific Digital Signage market is partially fragmented and consists of several major players. In terms of market share, few of the major players currently dominate the market. However, with innovative and sustainable packaging, many of the companies are increasing their market presence by securing new contracts and by tapping new markets.

- September 2020 - The company made an online exhibition of its CPS/IoT Exhibition 'CEATEC 2020 ONLINE' ('CEATEC'). The company introduced many digital solutions and concept videos related to work styles and security for the new normal society utilizing videos, presentation materials, and real-time chat function in the 'General Exhibit Area.'

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Assessment of Impact of COVID-19 on the Industry

- 4.3 Market Drivers

- 4.3.1 Growth Of End-user Verticals, such as Retail and Healthcare

- 4.3.2 Increasing Adoption due to less operating cost and ease of change in signage

- 4.4 Market Restraints

- 4.4.1 High initial setup costs

- 4.5 Industry Value Chain Analysis

- 4.6 Industry Attractiveness - Porter's Five Force Analysis

- 4.6.1 Bargaining Power of Suppliers

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Threat of New Entrants

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 By Type

- 5.1.1 Video Wall

- 5.1.2 Video Screen

- 5.1.3 Kiosk

- 5.1.4 Transparent LCD Screen

- 5.1.5 Digital Poster

- 5.1.6 Other Types

- 5.2 By Component

- 5.2.1 Hardware

- 5.2.1.1 LCD/LED Display

- 5.2.1.2 OLED Display

- 5.2.1.3 Media Players

- 5.2.1.4 Projector/Projection Screens

- 5.2.1.5 Other Hardware

- 5.2.2 Software

- 5.2.3 Services

- 5.2.1 Hardware

- 5.3 By Size

- 5.3.1 Below 32"

- 5.3.2 32"-52"

- 5.3.3 Above 52"

- 5.4 By Location

- 5.4.1 In-Store

- 5.4.2 Outdoor

- 5.5 By Application

- 5.5.1 Retail

- 5.5.2 Transportation

- 5.5.3 Hospitality

- 5.5.4 Corporate

- 5.5.5 Education

- 5.5.6 Government

- 5.5.7 Other Applications

- 5.6 By Country

- 5.6.1 China

- 5.6.2 Japan

- 5.6.3 India

- 5.6.4 South Korea

- 5.6.5 Rest of Asia Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 NEC Display Solutions Co. Ltd

- 6.1.2 LG Display Co. Ltd

- 6.1.3 Samsung Electronics Co. Ltd

- 6.1.4 Panasonic Corporation

- 6.1.5 Sony Corporation

- 6.1.6 Stratacache

- 6.1.7 Planar Systems Inc.

- 6.1.8 Hitachi Ltd

- 6.1.9 Barco NV

- 6.1.10 Cisco Systems Inc.