|

市场调查报告书

商品编码

1628738

北美包装检测:市场占有率分析、行业趋势和成长预测(2025-2030)North America Package Testing - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

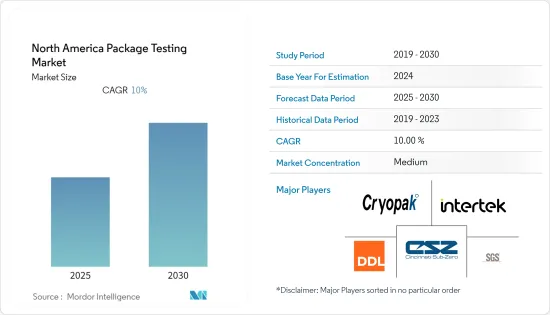

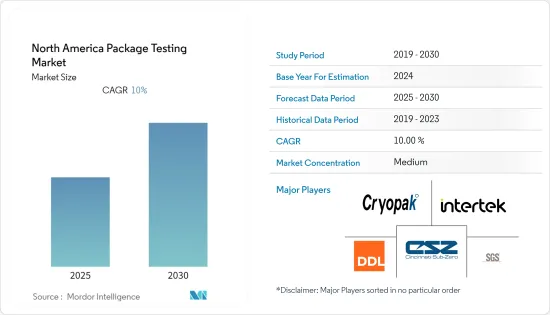

北美包装检测市场预计在预测期内复合年增长率为 10%

主要亮点

- 在过去的几十年里,消耗品的包装发生了巨大的变化,重点是延长保质期以降低与损坏物品相关的成本。这种关注增加了包装检测市场对有效包装检测的需求。

- 对于某些产品,食品、药品和医疗设备法规要求包装检查。这包括设计资格确认、定期复检和包装过程控制。过程可以由各种品管系统控制,例如 HACCP、统计过程控制、验证通讯协定和 ISO9000。

- 对永续包装的认识和需求的提高、零售业的成长以及对包装产品的需求的增加以及新技术的出现等因素正在推动成长。对更长产品保质期的需求正在推动包装检测行业的成长。

- 封装尺寸不适当的一个显着原因是所采用的实验室测试类型。极其苛刻的实验室测试(不能准确反映供应链中发现的实际风险)可能会导致过度包装,从而增加物流和包装成本。如果测试在某些方面过于严格,并且完全错过了分销中常见的某些损坏输入,则可能导致高损坏率和过度包装,从而导致更高的成本。

北美包装检测市场趋势

玻璃产业逐渐成长

- 在包装行业,用于包装的玻璃必须经过各种性能测试,如容量和顶空、镀膜评估、抗衝击性、耐外压性、耐热衝击性、耐垂直载荷等。各种领域。

- 这些测试确定产品是否符合相关国际、国家、工业和内部标准和规范。这些测试包括衝击、热衝击、内部压力、垂直负载、微波炉、清洗和其他要求的测试。

- 包装检测在整个产品生命週期中不断增长的优势也推动了该地区玻璃包装检测市场的发展。

- 长期以来,品牌一直在寻找提高产品货架效果的方法,而玻璃尤其适合併越来越受消费者欢迎。 2020年6月,业界最注重碳足蹟的非感官居家护理品牌Supernatural推出了玻璃瓶装洗手液。与塑胶不同,玻璃可以保护产品在受热时免受毒性,还可以消除传统干洗手剂造成的一次性塑胶废弃物。

食品是市场成长的关键因素之一

- 果酱、蛋黄酱和腌菜等包装食品通常储存在由各种类型的密封塑胶盖保护的瓶子中。随着工作人口的增加,对易于准备的包装食品的需求显着增加。根据《全球有机贸易指南》,到2026年,该地区有机包装食品消费预计将达到213.9亿美元。预计这将在预测期内推动塑胶瓶盖市场的成长。

- 由于 COVID-19 的爆发,许多工作成年人和其他人出于安全目的依赖包装食品。据国际食品资讯委员会称,由于 COVID-19 大流行,大约 36% 的美国人声称在 2020 年购买的包装食品数量与先前在 COVID-19 大流行期间相同或更多。

- 电子商务行业正在主导该地区的在线食品配送趋势,并且由于在线食品配送平台数量的增加而经历了激增,鼓励行业公司通过註册此类平台来获得更重要的立足点。这导致越来越多地使用盖子和封口来进行有效的食品包装。

- 奈米技术在简便食品製造的应用在改善储存程序、包装方法和成品加工等关键功能方面发挥着重要作用。预计这项技术将在不久的将来在增加包装食品容器的使用方面发挥重要作用。

北美包装检测产业概况

北美包装测试市场适度整合,主要企业包括 TDDL Inc.、Intertek、SGS、CSZ 测试服务实验室、CRYOPAK、Advance Packaging 和 Nefab。公司不断投资于策略伙伴关係和产品开发,以获得更高的市场占有率。近期市场发展趋势包括:

- 2021 年 10 月,Nefab Group AB 收购了全球主要企业的永续热成型缓衝材料供应商 Reflex Packaging Group,以进一步加强其供应链中资源节约的承诺。在耐帆集团内,Reflex Packaging 将继续作为独立公司运作。

- 2021 年 7 月,提供全面品质保证服务的知名公司之一 Intertek Group PLC 宣布收购 JLA Brasil Laboratorio de Analises de Alimentos SA。 JLA Brazil 成立于巴西,是食品、农业和环境测试解决方案领先的独立供应商之一。

其他好处:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 产业价值链分析

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间的敌对关係

- 技术简介

- 包装完整性测试

- 包装强度测试

- 包装有效期限测试

- 包验证

- 包装检验需求

第五章市场动态

- 市场驱动因素

- 严格的管理规定和管理/资格要求

- 各种条件下产品长期储存的需求

- 市场挑战

- 与包裹检查相关的高成本

- COVID-19 对市场的影响

第六章产业政策

- ASTM标准

- ISO标准

- ISTA标准

第七章 市场区隔

- 按主要材质分

- 玻璃

- 纸

- 塑胶

- 金属

- 按考试类型

- 体能测试

- 化学测试

- 环境测试

- 按最终用户产业

- 饮食

- 卫生保健

- 工业产品

- 个人/家居用品

- 其他最终用户产业

- 按国家/地区

- 美国

- 加拿大

第八章 竞争格局

- 公司简介

- DDL Inc.

- Intertek

- SGS

- CSZ Testing Services Laboratories

- CRYOPAK

- Advance Packaging

- Nefab

- National Technical Systems

- Turner Packaging

- Caskadetek

第九章投资分析

第10章市场的未来

简介目录

Product Code: 52607

The North America Package Testing Market is expected to register a CAGR of 10% during the forecast period.

Key Highlights

- The packaging of consumable products has witnessed a drastic transformation over the past few decades, with a higher focus on enhancing the shelf life to reduce the costs associated with damaged goods. This emphasis has created robust demand for effective package testing in the package testing market.

- For some products, package testing is mandated by regulations about food, pharmaceuticals, medical devices, etc. This might cover the design qualification, periodic retesting, and control of packaging processes. Processes might be controlled by various quality management systems, such as HACCP, statistical process control, validation protocols, ISO 9000, etc.

- Factors such as growing awareness and demand for sustainable packaging, growth of the retail sector with increasing demand for packed products, and the emergence of new technologies are driving growth. The requirement for a longer shelf-life of products helps drive the growth of the package testing industry.

- One of the prominent reasons for inappropriately large package size is the type of laboratory tests employed. Significantly harsh laboratory tests (ones that don't accurately reflect the actual hazards found within the supply chain) can cause excessive packaging, thus increasing the logistics and packaging costs. If tests are overly harsh in certain respects and completely miss specific damaging inputs commonly found in distribution, it would result in high damage rates and excessive packaging, thus, resulting in higher costs.

North America Package Testing Market Trends

Glass Segment Observing Gradual Growth

- With increasing applications of glass in the packaging industry due to various reasons such as low reactivity with the product, reusability and recyclability are growing and leading to an increase in packaging testing vendors as the glass used for packaging has to undergo various performance tests, such as capacity and headspace, coating assessment, impact resistance, external pressure resistance, thermal shock resistance, and vertical load resistance.

- These tests determine the product's suitability against relevant international, national, industrial, or in-house standards and specifications. They include tests for impact, thermal shock, internal pressure, vertical load, microwave, dishwasher, and other requirements.

- The increasing benefits of package testing throughout the product lifecycle are also driving the region's glass packaging testing market.

- Brands have long sought ways to enhance their products' shelf appeal, an area where glass is particularly well suited and is also experiencing popularity among consumers. In June 2020, Supernatural, the extrasensory home care brand focused on having the smallest carbon footprint in the industry, launched hand sanitizer in a glass bottle. The glass protects the product from toxicity when exposed to heat, unlike plastic, and also eliminates the single-use plastic waste caused by traditional hand sanitizers.

Food Among the Significant Factors for Market Growth

- Packaged food products, such as jams, mayonnaise, pickles, etc., are usually stored in bottles that are protected using various kinds of airtight plastic closures. With an increase in the working population, there has been a substantial increase in the demand for easy-to-cook and packaged food. According to Global Organic Trade Guide, organic packaged food consumption value in the region is expected to reach USD 21.39 billion by 2026. This is expected to fuel the growth of the plastic caps and closures market over the forecast period.

- With the outbreak of COVID-19, many working professionals and others have been depending on packaged food for safety purposes. According to International Food Information Council, due to the COVID-19 pandemic, in 2020, around 36% of Americans claimed to have purchased the same or higher amount of packaged foods during the COVID-19 pandemic than before.

- The e-commerce industry led to the trend of online food delivery in the region, experiencing an upsurge due to the rising number of online food delivery platforms, enabling industry players to gain a more significant foothold by registering on such platforms. This has led to the increased usage of caps and closure for the effective packaging of food.

- The addition of nanotechnology in convenience food manufacturing has been playing a crucial role in improving critical functions, including preservation procedures, packaging methods, and finished goods processing. This technology is anticipated to play a significant role in increasing the use of containers for packaged food products in the near future.

North America Package Testing Industry Overview

The North American package testing market is moderately consolidated, with a few major companies like TDDL Inc., Intertek, SGS, CSZ Testing Services Laboratories, CRYOPAK, Advance Packaging, and Nefab. The companies are continuously investing in strategic partnerships and product developments to gain a higher market share. Some of the recent developments in the market include:

- In October 2021, to further enhance its commitment to saving resources in supply chains, Nefab Group AB acquired Reflex Packaging Group, the world's leading company for sustainable thermoformed cushioning. Within the Nefab Group, Reflex Packaging will continue to function as a distinct entity.

- In July 2021, Intertek Group PLC, one of the prominent providers of Total Quality Assurance services, reported the acquisition of JLA Brasil Laboratorio de Analises de Alimentos SA. JLA Brazil, established in Brazil, is one of the leading independent providers of food, agricultural, and environmental testing solutions.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Technology Snapshot

- 4.4.1 Package Integrity Testing

- 4.4.2 Package Strength Testing

- 4.4.3 Package Shelf Life Studies

- 4.4.4 Package Validation

- 4.5 Package Testing Needs

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Rigorous Control Regulations and Administration and Qualification Demands

- 5.1.2 Demand for Longer Shelf Life of Products Under Varying Conditions

- 5.2 Market Challenges

- 5.2.1 High Costs Associated with Package Testing

- 5.3 Impact of COVID-19 on the Market

6 INDUSTRY POLICIES

- 6.1 ASTM Standards

- 6.2 ISO Standards

- 6.3 ISTA Standards

7 MARKET SEGMENTATION

- 7.1 By Primary Material

- 7.1.1 Glass

- 7.1.2 Paper

- 7.1.3 Plastic

- 7.1.4 Metal

- 7.2 By Type of Testing

- 7.2.1 Physical Performance Testing

- 7.2.2 Chemical Testing

- 7.2.3 Environmental Testing

- 7.3 By End-user Industry

- 7.3.1 Food and Beverage

- 7.3.2 Healthcare

- 7.3.3 Industrial

- 7.3.4 Personal and Household Products

- 7.3.5 Other End-user Industries

- 7.4 By Country

- 7.4.1 United States

- 7.4.2 Canada

8 COMPETITIVE LANDSCAPE

- 8.1 Company Profiles

- 8.1.1 DDL Inc.

- 8.1.2 Intertek

- 8.1.3 SGS

- 8.1.4 CSZ Testing Services Laboratories

- 8.1.5 CRYOPAK

- 8.1.6 Advance Packaging

- 8.1.7 Nefab

- 8.1.8 National Technical Systems

- 8.1.9 Turner Packaging

- 8.1.10 Caskadetek

9 INVESTMENT ANALYSIS

10 FUTURE OF THE MARKET

02-2729-4219

+886-2-2729-4219