|

市场调查报告书

商品编码

1639451

亚太包装检测:市场占有率分析、产业趋势与成长预测(2025-2030 年)Asia-Pacific Package Testing - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

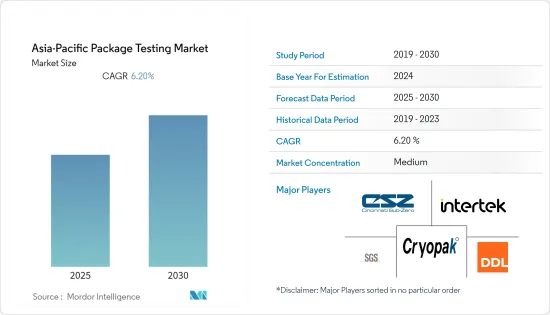

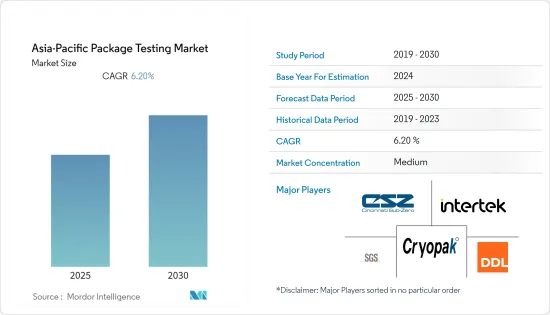

预计预测期内亚太地区包装检测市场复合年增长率将达到 6.2%。

主要亮点

- 包装检验在亚太地区几乎每条供应链中都发挥着至关重要的作用。包装检查可确保您的企业的包装符合规格,避免昂贵的产品损坏、法律问题和不良的使用者体验。包装测试解决了多个问题,包括包装成本节约、包装材料在现实环境条件和运输场景下的性能、品管洞察、包装扩充性以及认证、规范和法规等合规性问题。机会。

- 包装对于保护产品起着至关重要的作用。在亚太地区,人们对永续包装的认识和需求不断增长、零售业对包装产品的需求不断增加以及新技术的出现等因素正在推动这一增长。此外,对更长产品保质期的需求正在推动亚太地区包装测试产业的成长。因此,许多公司正在投资永续包装。

- 随着消费者食品安全意识的增强以及亚洲国家对包装和标籤要求的提高,餐饮业预计将实现成长。包装和加工食品以及食品和饮料备受关注。由于全球消费品和包装食品的消费量不断增加,该行业预计将会扩张。

- 中国医疗健康产业的特点是药品和医疗设备销售额迅速成长,分销体係不断发展,渴望打入海外市场,实现规模经济。根据中国海关总署发布的贸易伙伴资料显示,2021年上半年,对口腔设备及材料、其他消毒及实验室设备等高度专业化产品需求旺盛的国家的关注度有所提升。

- 2021年上半年,中国对非洲出口医用口罩1.82亿美元,出口医用防护衣4,400万美元,出口呼吸器3,800万美元。这较 2020 年而言大幅下降。相反,医用手套、诊断剂的出货比例却增加。根据中国国家统计局统计,上年度中国医疗设备海外出口额约181.3亿美元,与前一年同期比较增加52.2亿美元。

- 随着2020年1月和2月冠状病毒席捲中国,世界各国担心无法获得中国的重要物资供应。疫情爆发导致中国对这些产品的需求大幅增加。为了收治新冠肺炎患者,中国白手起家建造了整座医院。据来访的世界卫生组织代表团称,仅广东省的诊所就进行了 32 万次检测。

- 儘管中国政府今年 3 月正式否认禁止医疗产品出口的媒体报道,但人们的担忧仍然存在。中国企业发行的「不可抗力」证明数量创下了历史新高,甚至允许它们违反与国际供应商签订的合约。此外,俄罗斯和乌克兰之间的战争正在影响整个包装生态系统。

亚太地区包裹检测市场趋势

塑胶包装有望更加普及

- 由于食品、医疗保健、工业、个人和家庭等终端用户行业中各种包装类型的塑胶使用越来越多,因此提供塑胶包装测试服务的第三方供应商也越来越多。然而,这些供应商仍然面临拥有自己的内部测试设施的封装巨头的竞争。然而,为了适应日益增多的测试,技术、法规和标准的变化预计将改变该地区的市场竞争。预计预测期内市场将变得更加分散。

- 而且,随着包装食品需求的不断增加,食品业可以透过创新的食品包装材料获得更长的保质期。包装可保护食品免受外部环境的影响,并保持其完整性、卫生和有机特性以及保质期。产品包装可保护食品免受可能的机械应力和外部污染源的影响。即使在包装、销售和消费之间的不利条件下,包装也能保存食物。

- 包装行业的变化直接影响塑胶包装检测,因为塑胶包装检测市场面临来自纸质和生物分解性包装的材料竞争。然而,由于生物聚合物(来自农业废弃物而非石化产品等永续来源的生物基塑胶)的发展,塑胶预计将继续成长。

- 目前,在薄膜、碳酸饮料瓶等多个包装领域进行了成功示范,并有多个生产设施接近商业化生产。随着这些发展,预计私人供应商和政府将加强支持。

食品和饮料市场预计将大幅成长

- 近期疫情的影响进一步加速了食品和饮料的网路购物需求。例如,根据韩国统计资料院的数据,2021年第一季网路食品饮料销售交易额约为6.3兆韩元。多年来,交易量不断增加。

- 水果和蔬菜的软质包装应用正在快速成长,推动了研究市场的发展。需求趋势是由不断增长的下降趋势所驱动,这支持了从硬包装到软包装的转变。

- 消费者正在寻找方便的包装解决方案,并且越来越关注永续性。因此,零售商和製造商正在寻求减少进入垃圾垃圾掩埋场的垃圾量。先进的包装包括减少每个瓶子中使用的玻璃量以及可堆肥的生质塑胶。

- 新鲜水果和蔬菜包装的创新有几个核心目的,包括保护产品、延长保质期和防护卫生。新冠疫情和电子商务的重新运作正在增加功能性包装的价值。人们也越来越需要提供客製化的包装解决方案来保持各种水果和蔬菜的新鲜度。

亚太地区包装检测产业概况

亚太地区包装检测市场适度整合,有几个主要参与者,包括 TDDL Inc.、Intertek、SGS、CSZ 测试服务实验室、CRYOPAK、Advance Packaging 和 Nefab。各公司不断投资于策略伙伴关係和产品开发,以扩大市场占有率。

- 2023 年 2 月-ALS 宣布已签署买卖协议 (SPA),将其 Asset Care 业务出售给 SRG World。金额为 8,000 万澳元(约 5,539 万美元),分两期支付:签署 SPA 时支付 1,000 万澳元(约 692 万美元),完成后支付 7,000 万澳元(约 4,847 万美元)。

- 2023 年 1 月-SGS 赢得一份合同,为 Green Tech Mining & Services (GTMS) 进行尾矿废弃物分析、遗留矿石堆场分析和环境水监测。这些服务将与 Bishara、Rakka(原第 10 区块)和 Al Jah Tailings(原第 4 区块)GTMS计划一起提供。这些服务使 GTMS 能够回收目标残留矿物并修復环境损害。这一机会也将有助于保持该公司作为阿曼和中东自然资源领域顶级实验室服务区域供应商的地位。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概况

- 产业价值链分析

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

- 技术简介

- 包装完整性测试

- 包装强度测试

- 包装有效期限测试

- 包裹验证

- 包装测试需求

第五章 市场动态

- 市场驱动因素

- 严格的管理规定和管理/资格要求

- 各种条件下对产品长期储存的需求

- 市场挑战

- 包裹检查高成本

- COVID-19 市场影响评估

第六章 产业政策

- ASTM 标准

- ISO 标准

- ISTA 标准

第七章 市场区隔

- 按主要材料

- 玻璃

- 纸

- 塑胶

- 金属

- 按测试类型

- 体能表现测试

- 化学测试

- 环境检查

- 按最终用户产业

- 饮食

- 卫生保健

- 工业产品

- 个人及家居用品

- 其他最终用户产业

- 按地区

- 中国

- 印度

- 日本

- 其他亚太地区

第八章 竞争格局

- 公司简介

- DDL Inc.

- Intertek Group PLC

- SGS SA

- CSZ Testing Services Laboratories

- Cryopak

- Advance Packaging

- Nefab Group

- National Technical Systems

- Turner Packaging Limited

- ALS limited

第九章投资分析

第十章:市场的未来

简介目录

Product Code: 49951

The Asia-Pacific Package Testing Market is expected to register a CAGR of 6.2% during the forecast period.

Key Highlights

- Package testing plays a prominent role in almost every supply chain in the Asia-Pacific region. Package testing ensures the business's packaging is up to specifications and avoids costly product damage, legal situations, and poor user experiences. Packaging testing identifies opportunities in several areas, such as savings on packaging costs, the performance of packaging materials in realistic environmental conditions and transportation scenarios, quality control insights, scalability of packaging, and compliance issues, such as certifications, specifications, and regulations.

- Packaging plays an essential part in the protection of products. In Asia-Pacific, factors such as the growing awareness of and demand for sustainable packaging, growth of the retail industry with increasing demand for packed products, and the emergence of new technologies are driving the growth. Moreover, the requirement for a longer shelf-life of products helps drive the growth of the packaging testing industry in Asia-Pacific. As a result, several companies are investing in sustainable packaging.

- The F&B segment is expected to grow due to increased food safety awareness among consumers and a rise in the number of packaging and labeling mandates in Asian countries. Packaged and processed foods and beverages are gaining prominence. With the increased consumption of consumer goods and packaged food worldwide, the industry is anticipated to expand.

- The healthcare industry in China is characterized by rapidly expanding sales of pharmaceuticals and medical devices and an evolving distribution system eager to reach foreign markets and achieve economies of scale. According to data on trading partners issued by the General Administration of Customs of China, nations with strong demand for highly specialized commodities such oral equipment and materials, other disinfection, and laboratory instruments are more focused in the first half of 2021.

- Medical masks in China in the first half of 2021 Exports to Africa totaled 182 million dollars, medical protective apparel exports reached 44 million dollars, and exports of ventilation equipment totaled 38 million dollars. This is a considerable drop from 2020. Conversely, the percentage of medical gloves and diagnostic reagent shipments rose. According to the China National Bureau of Statistics, China's medical instruments and equipment exports to other countries were approximately USD 18.13 billion in the previous year, which increased by USD 5.22 billion YoY.

- The rest of the globe feared being cut off from crucial Chinese supplies in January and February 2020 as the coronavirus swept throughout China at precisely the wrong time. The outbreak led to a substantial increase in demand for these products in China. To treat COVID-19 patients, China built entire hospitals from the ground up. According to the World Health Organization mission to China, clinics in Guangdong Province alone performed 320,000 tests.

- Fears persisted despite the Chinese government formally disputing media reports in March that it had prohibited the export of medical supplies. In order to allow Chinese enterprises to breach contracts, even those with international suppliers, China had granted a record number of "force majeure" certificates. There has also been an impact of the Russia-Ukraine war on the overall packaging ecosystem.

Asia-Pacific Package Testing Market Trends

Plastic Packaging is Expected to Witness Significant Adoption

- The increasing use of plastic in various packaging types from end-user industries such as food, healthcare, industrial, personal, and household is resulting in a growing number of third-party vendors that provide plastic package testing as a service. However, these vendors still face competition from industry giants in the packaging industry who have their in-house testing facilities. But with changing technology, regulations, and standards to comply with an increasing number of tests to be conducted, single packaging is expected to change the market competitiveness in the region. The market is likely to incline toward fragmentation during the forecast period.

- Moreover, with the rising demand for packaged food, the food industry can obtain longer shelf lives through innovative food packaging materials. The packaging protects food from the outside environment, preserving its integrity, hygienic and organoleptic properties, and shelf life. The product's packaging defends it from possible mechanical stresses and external contamination sources. Packaging preserves food between packaging, marketing, and consumption, even in adverse environmental conditions.

- As any change in the packaging industry directly impacts plastic package testing, the plastic package testing market is also facing competition from paper and biodegradable packaging in terms of material. However, plastic is expected to continue growing due to evolutions in biopolymers with bio-based plastics sourced from sustainable resources like agricultural waste rather than petrochemicals.

- Several production facilities are now approaching commercial-level production, having been successfully demonstrated in several packaging segments, including films and carbonated soft drink bottles. These developments are expected to be followed by increasing support from private vendors and the government.

Food and Beverage is Expected to Witness Significant Growth in the Market

- The demand for online shopping for food and beverages further accelerated due to the recent effects of the pandemic. For instance, according to Korean Statistical Information Service, the transaction value of online food and beverage sales was approximately KRW 6.03 trillion in the first quarter of 2021. Over the years, the transaction value has continuously increased.

- Flexible packaging applications for fruits and vegetables are increasing rapidly, driving the studied market. The demand trends can be attributed to the rising trend of down-gauging, which has supported the shift from rigid to flexible packaging.

- Consumers are looking for conveniently packaged solutions and are becoming more concerned about sustainability. As a result, retailers and manufacturers have been looking to reduce the amount of garbage transported to landfills. Packaging advances range from reducing the quantity of glass used in each bottle to compostable bioplastic.

- Innovations in fresh fruit and vegetable packaging have several core aims, including product protection, shelf life enhancement, and hygiene defense. The COVID-19 pandemic and a reinvigorated e-commerce boom are increasing functional packaging's value. There has also been a need to provide customized packaging solutions that keep different fruits and vegetables fresh.

Asia-Pacific Package Testing Industry Overview

The Asia-Pacific package testing market is moderately consolidated, with a few major companies like TDDL Inc., Intertek, SGS, CSZ Testing Services Laboratories, CRYOPAK, Advance Packaging, and Nefab. The companies continuously invest in strategic partnerships and product developments to gain more market share.

- February 2023 - ALS stated that it had signed a Sale and Purchase Agreement (SPA) for the sale of its Asset Care business to SRG Global. The purchase price is AUD 80 million (~USD 55.39 million), which will be paid in two installments: AUD 10 million (~USD 6.92 million) upon execution of the SPA and AUD 70 million (~USD 48.47 million) upon completion.

- January 2023 - SGS was awarded contracts to conduct tailings waste analysis, analysis of legacy ore stockpiles, and environmental water monitoring for Green Tech Mining & Services (GTMS). The services will be offered in connection with the GTMS projects at Bishara, Rakkah (formerly Mining Block 10), and Arjaa Tailings (previously Mining Block 4). With the use of these services, GTMS will be able to collect any targeted residual minerals and repair the harm done to the environment. This opportunity also helps it maintain its position as the region's top supplier of laboratory services to the Sultanate of Oman and the Middle Eastern natural resources sector.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Technology Snapshot

- 4.4.1 Package Integrity Testing

- 4.4.2 Package Strength Testing

- 4.4.3 Package Shelf-life Studies

- 4.4.4 Package Validation

- 4.5 Package Testing Needs

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Rigorous Control Regulations and Administration and Qualification Demands

- 5.1.2 Demand for Longer Shelf Life of the Products Under Varying Conditions

- 5.2 Market Challenges

- 5.2.1 High Costs Associated with Package Testing

- 5.3 Assessment of the Impact of COVID-19 on the Market

6 INDUSTRY POLICIES

- 6.1 ASTM Standards

- 6.2 ISO Standards

- 6.3 ISTA Standards

7 MARKET SEGMENTATION

- 7.1 Primary Material

- 7.1.1 Glass

- 7.1.2 Paper

- 7.1.3 Plastic

- 7.1.4 Metal

- 7.2 Type of Testing

- 7.2.1 Physical Performance Testing

- 7.2.2 Chemical Testing

- 7.2.3 Environmental Testing

- 7.3 End-user Industry

- 7.3.1 Food and Beverage

- 7.3.2 Healthcare

- 7.3.3 Industrial

- 7.3.4 Personal and Household Products

- 7.3.5 Other End-user Industries

- 7.4 Geography

- 7.4.1 China

- 7.4.2 India

- 7.4.3 Japan

- 7.4.4 Rest of Asia-Pacific

8 COMPETITIVE LANDSCAPE

- 8.1 Company Profiles

- 8.1.1 DDL Inc.

- 8.1.2 Intertek Group PLC

- 8.1.3 SGS SA

- 8.1.4 CSZ Testing Services Laboratories

- 8.1.5 Cryopak

- 8.1.6 Advance Packaging

- 8.1.7 Nefab Group

- 8.1.8 National Technical Systems

- 8.1.9 Turner Packaging Limited

- 8.1.10 ALS limited

9 INVESTMENT ANALYSIS

10 FUTURE OF THE MARKET

02-2729-4219

+886-2-2729-4219