|

市场调查报告书

商品编码

1628745

欧洲保护性包装:市场占有率分析、产业趋势与成长预测(2025-2030)Europe Protective Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

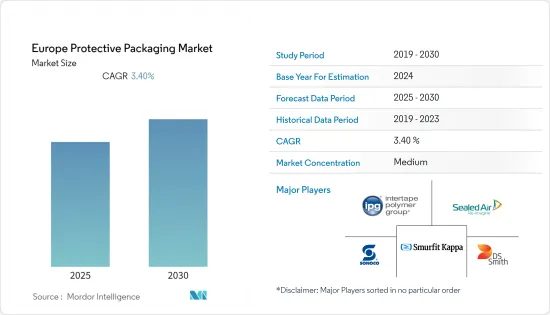

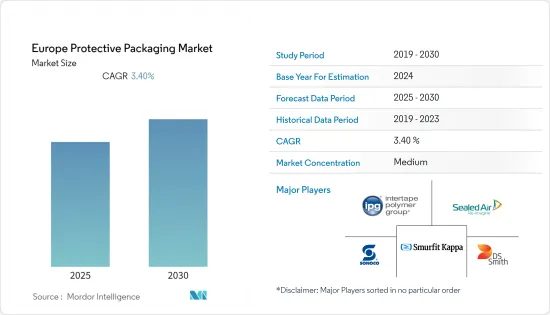

欧洲防护包装市场预计在预测期间内复合年增长率为3.4%

主要亮点

- 英国市场主要由软包装产业驱动。全球包装供应商正在向该地区扩张并收购当地公司,展示了该地区的市场潜力。例如,2020年1月,Macfarlane Group收购了防护包装解决方案提供商Armagrip,收购金额未公开。

- 该地区的美容品牌越来越注重包装和物流业务。减重和替代原材料的出现等产品创新预计将带来未来的成长机会。此外,供应商还为需要大量包装材料以维持与大批量、高价值客户的业务的行业提供包装设备和原材料。

- 此外,市场正在看到新的伙伴关係和併购活动,以应对新的挑战并推动成长。例如,全球私募股权公司 Warburg Pincus 已同意从Olympus Partners 手中收购保护性包装材料和自动化系统製造商 Pregis LLC,经过五年的所有权和一系列收购后,Pregis LLC 增加了製造地。和欧洲从14 点到22 点。

- 瓦楞包装长期以来对瓦楞包装行业产生着影响,减轻重量和适当的尺寸在该行业中发挥着至关重要的作用。除了满足买家对高效包装的需求外,在某些情况下替代较重的纸板等级可能会导致额外的保护因素,从而产生更好的整体影响。减肥在西欧已经相当成功。减轻重量在未来几年仍将很重要,因为它可以节省成本。

- 由于 COVID-19 的爆发,实施了封锁,社交距离规范促使消费者透过线上媒体订购必需品。食品和饮料领域的外带和线上配送需求也不断增长,推动了该地区保护性包装市场的成长。

欧洲防护包装市场趋势

美容和居家医疗产业推动市场成长

- 个人护理领域正在透过线上管道和电子商务实现显着成长。整装仪容已成为现代生活方式的重要组成部分。消费者愿意花更多钱来获得最好的外观和感觉,事实证明,网路购物是寻求满足护理需求的客户的热门选择。

- 包装的主要目的是保护产品免受运输和搬运过程中可能面临的任何危害。回收已成为化妆品、护肤和香水公司的重要因素。例如,英国塑胶联合会 (BPF) 与化妆品、洗护用品和香水协会 (CTPA) 以及食品和饮料联合会 (FDF) 合作,发布了有关塑胶包装应用中使用的回收材料的新指南。

- 防护邮包广泛用于运送 1-2 件淡化妆品。回收的气泡邮寄袋和回收的垫片邮寄袋解决了化妆品领域保护性包装的采用问题。两者都提供运输过程中保护个人护理用品所需的缓衝,并且 100% 可回收。

- 由于该地区香水销量的增加,二次包装的成长预计将有助于塑胶包装市场的成长。瑞士的香水产业持续发展。因此,预计将有多家二次塑胶包装供应商加入市场。

德国占有很大的市场占有率

- 德国的线上和电子商务状况可以与美国进行比较:正如 Disfold 指出的那样,德国的网路用户只有 7,900 万,占美国数位人口的比例,但德国人的财富和电子商务的使用习惯使其成为德国人的财富和电子商务的使用习惯之一。

- 多家公司正在提供保护性包装,以满足不断增长的市场需求。例如,总部位于德国的 Storopack 为电子商务提供广泛使用的保护性包装解决方案组合,包括鬆散填充、发泡聚苯乙烯、气枕和纸垫。

- 此外,供应商正在投资该地区永续且可回收的保护性包装产品。例如,Storopack 推出了 AIRplus,这是一种 50% 可回收的保护性包装,有空心膜、气泡膜和缓衝膜可供选择。

- 此外,在 2020 年 3 月的 COVID-19 危机期间,Storopack 继续为药品、医疗用品、食品和饮料、清洗和卫生材料以及兽医用品等基本产品提供保护性包装。

欧洲防护包装产业概况

欧洲保护性包装市场适度细分,由提供这些产品和解决方案的各种供应商组成。市场参与企业正专注于产品创新、併购和伙伴关係等策略性倡议,以获取市场占有率。近期市场趋势如下。

- 2021 年 7 月 - 透过 Sonoco Protective Solutions,欧洲将拥有更多包装技术。今年晚些时候,该公司将扩大其位于波兰的 Soczatsew 工厂,并利用其现有的製造基础设施开始 Sonopost 製造业务。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 市场概况

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买家/消费者的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间的敌对关係

- 市场驱动因素

- 电子商务趋势不断上升

- 市场问题

- 替代包装格式

- COVID-19 市场影响评估

第五章市场区隔

- 材料类型

- 塑胶

- 纸和纸板

- 其他材料类型

- 产品类型

- 难的

- 纸浆模塑

- 纸板保护器

- 隔热运输货柜

- 软质(邮寄袋、纸满、空气枕)

- 气泡膜

- 泡棉底座

- 难的

- 按最终用户产业

- 饮食

- 药品

- 家用电子电器产品

- 美容/居家医疗

- 其他的

- 国家名称

- 英国

- 德国

- 法国

- 义大利

- 欧洲其他地区

第六章 竞争状况

- 公司简介

- Intertape Polymer Group Inc.

- Sealed Air Corporation

- Sonoco Products Company

- Smurfit Kappa Group plc

- Huhtamaki Group

- DS Smith plc

- International Paper Company

- Storopack Hans Reichenecker Gmbh

- Crown Holdings, Inc.

- Pregis Corporation

第七章 投资分析

第八章市场的未来

简介目录

Product Code: 52819

The Europe Protective Packaging Market is expected to register a CAGR of 3.4% during the forecast period.

Key Highlights

- The market in the United Kingdom is mainly growing due to the Flexible Packaging sector. Global packaging vendors are expanding in this region, and local companies are being acquired, which is indicative of the market potential in the area. For instance, in January 2020, Macfarlane Group acquired protective packaging solutions provider Armagrip for undisclosed sums.

- Beauty brands in the region are taking greater care in packaging and logistics operations. Product innovations, such as downgauging and the emergence of alternative raw materials, are expected to translate into future growth opportunities. Moreover, for industries with a bulk need for packaging materials, the vendors also provide packaging equipment and raw materials to maintain businesses with high volume and huge value customers.

- Moreover, the market is witnessing new partnerships and M&A activities to address new challenges emerging in the market and drive growth. For example, Warburg Pincus, a global private equity firm, agreed to acquire Pregis LLC, protective packaging materials and automated systems manufacturer, from Olympus Partners, which after five years of ownership and a series of acquisitions, resulted in Pregis LLC's growth from 14 to 22 manufacturing sites in North America and Europe.

- Although light-weighting of the board has long been affecting the corrugated industry, light-weighting and proper-sizing play a critically important role in this industry, not only in response to buyer's demands for efficient packaging but also in response to buyer's demands for efficient packaging also in response to the logistics system's adoption of dimensional weight (DIM) pricing, in some scenarios, substituting a heavier board grade can provide a better impact overall as it allows for the eradication of additional protective elements. Light weighting has been quite successful in Western Europe. The importance of lightweighting will continue to be felt even in the coming years as it is cost-saving.

- Due to the outbreak of COVID-19, the lockdown enforced and social distancing norm has elevated the consumer to order their requisite through online medium. The food and beverage sector has also been witnessing rising demand for takeaway and online delivery, driving the growth of the protective packaging market in the region.

Europe Protective Packaging Market Trends

Beauty and Homecare Industry to Drive the Market Growth

- The personal care sector is witnessing significant growth through online channels and e-commerce. Grooming has become an integral part of contemporary lifestyles. Consumers are willing to spend more to look and feel at their best, and online shopping has proved to be a popular choice for customers looking to satisfy their care needs.

- Packaging primarily aims to protect the product from all hazards it can be exposed to during transport and handling. Recycling has become a significant part of cosmetics, skincare, and perfume companies. For instance, the British Plastics Federation (BPF), in conjunction with the Cosmetic, Toiletry, and Perfumery Association (CTPA) and the Food and Drink Federation (FDF), has announced the launch of new guidelines for the recycled content used in plastic packaging applications.

- Protective mailers are widely used for one or two light cosmetic product shipping. The recycled bubble mailers and recycled padded mailers cater to adopting protective packaging in the cosmetics sector. Both offer the cushioning required to protect personal care items in transit and are 100% recyclable.

- The growth of secondary packages due to increased sales of perfumes in the region would aid the plastic packaging market's growth. Switzerland boasts of an ever-growing fragrance industry. This would bring multiple secondary plastic packaging vendors into the market scenario.

Germany Holds Significant Market Share

- The German online and e-commerce landscape can be likened to the United States: although it only has 79 million internet users, as stated by Disfold, a percentage of the US digital population, the affluence of the Germans, and their habits of utilizing e-commerce make it one of the world's most sophisticated markets.

- Several companies are providing protective packaging, catering to the surging market demand. For instance, the Germany-based company Storopack provides an extensive portfolio of protective packaging solutions such as loose-fill, foam, air pillows, paper cushioning, etc., that are widely used for e-commerce purposes.

- Moreover, vendors are investing in sustainable and recyclable protective packaging offerings in the region., For example, Storopack launched AIRplus, a 50% recycled protective packaging available in void, bubble, and cushion film.

- Further, during the covid-19 crisis, in March 2020, Storopack continued to supply protective packaging materials for essential products such as pharmaceuticals, medical supplies, food and drink, cleaning and hygiene materials, and veterinary supplies, among others.

Europe Protective Packaging Industry Overview

The Europe protective packaging market is moderately fragmented and consists of various vendors providing these products and solutions. Players in the market focus on product innovations and strategic initiatives such as merger and acquisition, partnerships to capture the market share. Some of the recent developments in the market are:

- July 2021 - Europe will have more packaging technology due to the Sonoco Protective Solutions. Later this year, the business will expand its Sochaczew, Poland, facility to include a Sonopost manufacturing operation, utilizing its current manufacturing infrastructure.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers/Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Market Drivers

- 4.3.1 Increasing Trend of E-commerce

- 4.4 Market Challenges

- 4.4.1 Alternative Forms of Packaging

- 4.5 Assessment of Impact of COVID-19 on the market

5 MARKET SEGMENTATION

- 5.1 Material Type

- 5.1.1 Plastics

- 5.1.2 Paper and Paperboard

- 5.1.3 Other Material Types

- 5.2 Product Type

- 5.2.1 Rigid

- 5.2.1.1 Molded Pulp

- 5.2.1.2 Paperboard-based Protectors

- 5.2.1.3 Insulated Shipping Containers

- 5.2.2 Flexibles (Mailers, Paper Full, and Air Pillows)

- 5.2.2.1 Bubble Wraps

- 5.2.3 Foam Based

- 5.2.1 Rigid

- 5.3 End-user Vertical

- 5.3.1 Food and Beverage

- 5.3.2 Pharmaceutical

- 5.3.3 Consumer Electronics

- 5.3.4 Beauty and Homecare

- 5.3.5 Other End-user Verticals

- 5.4 Country

- 5.4.1 United Kingdom

- 5.4.2 Germany

- 5.4.3 France

- 5.4.4 Italy

- 5.4.5 Rest of Europe

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Intertape Polymer Group Inc.

- 6.1.2 Sealed Air Corporation

- 6.1.3 Sonoco Products Company

- 6.1.4 Smurfit Kappa Group plc

- 6.1.5 Huhtamaki Group

- 6.1.6 DS Smith plc

- 6.1.7 International Paper Company

- 6.1.8 Storopack Hans Reichenecker Gmbh

- 6.1.9 Crown Holdings, Inc.,

- 6.1.10 Pregis Corporation

7 INVESTMENT ANALYSIS

8 FUTURE OF THE MARKET

02-2729-4219

+886-2-2729-4219