|

市场调查报告书

商品编码

1628763

中东和非洲的纸包装:市场占有率分析、产业趋势和成长预测(2025-2030)Middle East and Africa Paper Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

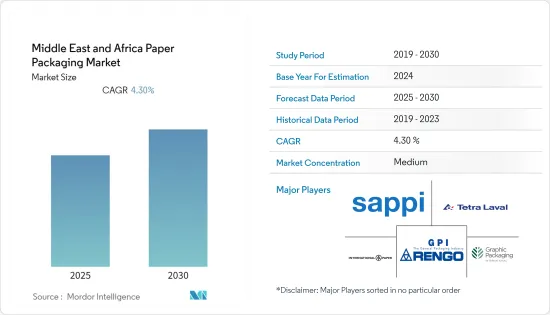

中东和非洲纸包装市场预计在预测期内复合年增长率为4.3%

主要亮点

- 零售和电子商务行业的崛起以及对环保包装材料日益增长的需求是当前市场扩张的驱动力。随着网路购物平台的快速成长,对二、三级纸包装产品的需求急剧增加。

- 尤其是在食品领域,对包装食品、蔬菜和水果等产品的需求强劲。已调理食品是采用纸箱和其他纸质包装作为二次包装的主要企业之一。 Hotpack Global执行董事表示,2020年阿联酋食品包装产业价值为100亿迪拉姆,预计未来五年将成长至140亿迪拉姆。

- 奥贝坎投资集团、海湾纸箱工厂公司和东方包装有限公司等国内知名公司的存在推动了所研究的市场成长。奥贝坎投资集团为数百个本地和跨国品牌生产坚固且有吸引力的结构包装。该公司是沙乌地阿拉伯最大的折迭纸盒加工商之一,最近建成的现代化生产设施年产能为 5 万吨。

- 硬木浆用于外层,因为它影响表面性能,而软木浆则需要赋予纸板产品足够的强度。由于纸浆生产的产量较低,化学纸浆比机械纸浆更昂贵。而且,化学浆的纯浓缩并不以不添加机械浆而开发硬纸板为前提。

中东和非洲纸包装市场趋势

食品和饮料行业是纸包装成长的关键因素之一。

- 在中东和非洲,食品工业是纸包装的最大消费者之一。由于快速都市化以及喜欢更安全加工食品的游客和旅行者的增加,该地区包装食品的消费率很高。此外,该地区对食品和饮料有严格的包装法规。

- 此外,纸板箱也用于将产品运送到线上零售商的仓库或「履约中心」。订阅盒和餐套件服务的出现,以每週或每月的订阅方式直接向消费者提供特色食品,催生了新的纸板供应商,其格式适合在模切内饰内交付产品,我们为您提供了巨大的机会。

- 沙乌地阿拉伯消费者对食品和饮料越来越了解,推动了对更注重健康的新产品的需求。网路购物和食品宅配服务的激增相结合,预计将加速对麻袋、牛皮纸、折迭纸盒和液体包装的需求。根据沙乌地阿拉伯投资总局 (SAGIA) 的预测,未来五年食品服务支出预计将以每年 6% 的速度成长,到 2021年终食品消费将达到 2,210 亿沙特里亚尔。

- 最近的疫情进一步加速了日本食品和饮料的网路购物需求。 Choueiri Group 2020年5月对2,800名沙乌地阿拉伯参与者进行的一项调查显示,疫情期间沙乌地阿拉伯消费者活性化。

- 2020 年 4 月,亚马逊旗下的线上零售商 Souq 宣布将向食品储藏室装货,以防止商店和超市过度拥挤,从而导致食品杂货和其他必需品的购买量增加,尤其是在斋月临近之际。埃及对纸箱的季节性需求是由斋戒月期间的食品和其他必需品库存所推动的。

沙乌地阿拉伯向纸包装过渡

- 2020 年 4 月,沙乌地阿拉伯阿西尔市政府要求餐厅安全可靠地包装餐食,以透过提供安全包装来保护顾客免受新冠肺炎 (COVID-19) 的感染。据 Choueiri Group 称,沙乌地阿拉伯 68% 的受访者表示,与 COVID-19 爆发之前相比,网路购物杂货、食品和饮料。因此,该地区对食品和饮料纸包装的需求不断增加。

- 这些盒子有不同类型的凹槽,纸板中间的瓦楞纸层赋予它们刚性、强度和可堆迭性。最常用的是C型槽,具有良好的印刷表面、抗压性能和抗压性能,可固定玻璃製品、食品等产品。此外,盒子还按板型分类,如单面、单壁、双壁、三壁。为了满足这些需求,Gulf Carton Factory 提供从 A 到 F 的瓦楞纸箱,以及 BC 和 EB 等瓦楞组合。

- 瓦楞纸箱是沙乌地阿拉伯最常用的纸包装之一,因为它们需要将医疗产品和药品运送到各个分销点。用于药品包装的纸板具有多种优点,例如可轻鬆读取二维资料矩阵程式码的编码性能,以及可增强产品保护的高硬度和耐用性。

- 在国内,工作的女性比以往任何时候都多,这导致了可支配收入的增加,并推动了更多优质化妆品品牌产品的销售。据估计,在沙乌地阿拉伯等国家,女性每年在个人保健产品上的平均花费超过 15,000 沙特里亚尔。此外,经济独立的女性将近 70-80% 的工资花在化妆品上。

- 随着厂商的加强度以及政府的支持,预计国内工业生产将大幅增加,对各种硬体的需求也将大幅增加,这将对工业纸包装的需求产生正面影响。

中东和非洲纸包装产业概况

由于该行业拥有来自多个国家和地区的参与企业,中东和非洲纸包装市场预计将逐步整合。

- 2021 年 1 月 - 利乐与顶级纸板製造商推出新的联合创新方法,以解决食品包装行业的永续性问题。传统的线性供应链营运模式正在发生变化,新的合作伙伴生态系统模式正在出现,整个产业密切合作。这将生产者和供应商以及研究机构、大学和新兴企业聚集在一起,寻找解决方案。

- 2021 年 1 月 - Mondi 确认所有条件均已满足,并以总计 6,600 股的价格向 International Paper已发行股份,收购已完成100万欧元。 100%企业价值约8,800万欧元。

- 2021 年 6 月 - Smurfit Kappa 宣布在其位于英国北安普顿的新电子商务包装工厂开设国际安全运输协会 (ISTA) 认证实验室。这扩大了 Smurfit Kappa 的包装测试实验室和中心网络,使零售商和生产商能够以最小的风险和可靠的实施来开发、测试和推动颠覆性的电子商务包装解决方案。亚马逊、阿里巴巴、eBay 等线上商业平台通常需要 ISTA 认证。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 竞争公司之间的敌对关係

- 替代品的威胁

- 产业价值链分析

第五章市场动态

- 市场驱动因素

- 食品和饮料领域的强劲需求

- 市场限制因素

- 原物料价格波动

第六章 COVID-19 对市场的影响

第七章 市场区隔

- 副产品

- 折迭式纸盒

- 瓦楞纸箱

- 有槽的容器

- 模切容器

- 5面板资料夹盒

- 设定盒

- 其他的

- 按最终用户产业

- 食物

- 饮料

- 个人护理和居家医疗

- 电器产品

- 其他的

- 按国家/地区

- 沙乌地阿拉伯

- 以色列

- 阿拉伯聯合大公国

- 埃及

- 南非

- 其他的

第八章 竞争格局

- 公司简介

- Tetra Laval

- International Paper Company

- Rengo

- Graphic Packaging International Corporation

- Sappi Limited

- DS Smith

- Amcor

- Mondi Group

- Oji Paper

- Smurfit Kappa

- Metsa Group

第九章投资分析

第10章 未来展望

简介目录

Product Code: 53378

The Middle East and Africa Paper Packaging Market is expected to register a CAGR of 4.3% during the forecast period.

Key Highlights

- The rising retail and e-commerce industries and the growing need for environmentally friendly packaging materials are currently driving the market's expansion. The demand for secondary and tertiary paper packaging products has increased dramatically as online shopping platforms have grown rapidly.

- There is a strong demand for products like packaged foods, vegetables, and fruits in the food sector, among others. Ready-to-eat meal products are among the top adopters of cartons and other forms of paper-based packaging as the secondary form of packaging. According to the managing director of Hotpack Global, the food packaging industry in the UAE was valued at AED 10 billion in 2020 and is expected to grow to AED 14 billion in the next five years.

- The presence of some of the country's prominent companies includes Obeikan Investment Group, Gulf Carton Factory Company, Eastern Pak Limited., among others are augmenting the studied market growth. Obeikan Investment Group produces strong and attractive structural packaging for hundreds of local and multinational brands. The company has an annual production capacity of 50,000 tons in its recently completed modern production facility and is one of the largest folding carton converters in Saudi Arabia.

- Hardwood pulps are used in the outer layers because of their effect on surface properties, whereas softwood pulps are needed to get enough strength to the paperboard product. Chemical pulps are more expensive than mechanical pulps because of the lower yields in pulp production. Pure concentrations of chemical pulp also do not premise the development of stiff paperboard without the addition of mechanical pulp.

MEA Paper Packaging Market Trends

Food and Beverage Industry is one of the Significant Factor for Growth of Paper Packaging

- The food industry is one of the largest consumers of paper packaging in the Middle East and Africa region. The region has a high rate of packaged food consumption, owing to rapid urbanization and an increasing number of tourists and expiates that often prefer safer processed foods. Also, the region has stringent packaging regulations in terms of food and beverages.

- Further, corrugated cases are used to ship goods to an online retailer warehouse or 'fulfillment center. The emergence of a subscription box and meal kit services that offer direct-to-consumer delivery of specialist food using a weekly or monthly subscription provides a new opportunity for corrugated board suppliers with delivery-friendly formats containing goods within a die-cut interior.

- Saudi Arabian consumers are increasingly becoming savvy regarding food and beverages as their demand for new products with a stronger health focus is growing. Online shopping of food combined with the growing proliferation of food delivery services is expected to accelerate the demand for sacks, kraft papers, folding cartons, and liquid cartons. According to the Saudi Arabian General Authority for Investment (SAGIA) forecasts, the spending on foodservices is expected to grow by 6% per annum over the next five years, with food consumption reaching SAR 221 billion by the end of 2021.

- The demand for online shopping for food and beverages further accelerated in the country owing to the recent effects of the pandemic. According to a study conducted by Choueiri Group in May 2020, which involved inputs of 2,800 Saudi participants, consumers in Saudi Arabia ramped up their online purchases of food and beverages during the pandemic; about 55% of the population purchased grocery items online in April, which exponentially higher compared to the 6% before the outbreak.

- In April 2020, Souq, an Amazon-owned online retailer, loaded its pantry to prevent crowds in stores and supermarkets, especially as Ramadan approaches, resulting in increased food purchases and other essentials. The seasonal demand for folding cartons in Egypt is driven by food and other needed stockings during Ramadan.

Saudi Arabia adoption to Paper Packaging

- In April 2020, Saudi Arabia's Asir Municipality ordered restaurants to safely and securely package meals for delivery to protect the customers from COVID-19 by delivering safe packages. According to Choueiri Group, 68 percent of respondents in Saudi Arabia reported an increase in their online shopping of groceries, food, and beverages compared to before the COVID-19 pandemic in 2020. This has increased the demand for folding carton packaging for food and beverages in the region.

- The boxes come in different types of flutes, a wavy layer of paper in the middle of a corrugated board that gives rigidity, strength, and stackability. These flutes range from A to F. The most frequently used is the C flute, which offers a good printing surface, crush resistance, and compression properties to secure products like glassware, food products, etc. In addition, the boxes are also classified based on board styles such as single surface, single wall, double wall, and triple wall. To meet such requirements, Gulf Carton Factory offers corrugated boxes ranging from A to F and a combination of flutes together, such as BC and EB.

- As corrugated boxes are required to ship healthcare products, as well as pharma medicines, to various places in distribution, it is one of the most used paper packaging types in Saudi Arabia. Paperboard used in pharmaceutical packaging has benefits, such as performance in code-ability, allowing 2D Datamatrix codes to be easily read, high stiffness and durability for increased product protection, etc.

- More women are now working in the country than ever before, leading to a rise in disposable income and driving the sales of more premium cosmetic brand products. It is estimated that in countries, like Saudi Arabia, on average, women spend over SAR 15,000 annually on personal care products. Also, it is found that financially independent women spend almost 70-80% of their salary on cosmetics products annually.

- With the growing efforts of the vendors along with government push, the industrial production in the country is expected to increase significantly along with various hardware demands, which is expected to positively impact the demand for paper packaging in the industry.

MEA Paper Packaging Industry Overview

With many country's and regional players in the industry, the Middle East and Africa Paper Packaging market expect to be moderately consolidated.

- Jan 2021 - Tetra Pak has launched a new collaborative innovation approach with top paperboard manufacturers to address the food packaging industry's sustainability issues. The conventional linear supply chain operating model has altered, and a new partner ecosystem model is emerging, in which the entire sector collaborates closely. This brings together not only producers and suppliers but also research institutions, universities, and start-ups in an attempt to find solutions

- Jan 2021 -Mondi confirms that all conditions have been satisfied, and it has completed the acquisition of 90.38% of the outstanding shares in Olmuksan International Paper Ambalaj Sanayi ve Ticaret A.S ('Olmuksan' or the 'Company') from International Paper for a total consideration of EUR 66 million. The implied enterprise value on a 100% basis would amount to around EUR 88 million.

- June 2021 - Smurfit Kappa has announced opening a new International Safe Transit Association (ISTA) certified lab at its new eCommerce packaging plant in Northampton, UK. This brings with it an extension of Smurfit Kappa's network of packaging testing labs and centers that assist retailers and producers in developing, test, and drive disruptive packaging solutions for eCommerce at minimum risk and with reliable implementation. ISTA certification is often required by online business platforms such as Amazon, Alibaba, or eBay.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Intensity of Competitive Rivalry

- 4.2.5 Threat of Substitute Products

- 4.3 Industry Value Chain Analysis

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Strong Demand from the Food and Beverage Sector

- 5.2 Market Restraints

- 5.2.1 Fluctuating Raw Material Prices

6 IMPACT OF COVID-19 ON THE MARKET

7 MARKET SEGMENTATION

- 7.1 By Product

- 7.1.1 Folding Cartons

- 7.1.2 Corrugated Boxes

- 7.1.3 Slotted Containers

- 7.1.4 Die Cut Container

- 7.1.5 Five Panel Folder Boxes

- 7.1.6 Setup Boxes

- 7.1.7 Other Product Types

- 7.2 By End-User Industry

- 7.2.1 Food

- 7.2.2 Beverage

- 7.2.3 Personal Care and Home Care

- 7.2.4 Electrical Goods

- 7.2.5 Other End-user Industries

- 7.3 By Country

- 7.3.1 Saudi Arabia

- 7.3.2 Israel

- 7.3.3 United Arab Emirates

- 7.3.4 Egypt

- 7.3.5 South Africa

- 7.3.6 Others

8 COMPETITIVE LANDSCAPE

- 8.1 Company Profiles

- 8.1.1 Tetra Laval

- 8.1.2 International Paper Company

- 8.1.3 Rengo

- 8.1.4 Graphic Packaging International Corporation

- 8.1.5 Sappi Limited

- 8.1.6 DS Smith

- 8.1.7 Amcor

- 8.1.8 Mondi Group

- 8.1.9 Oji Paper

- 8.1.10 Smurfit Kappa

- 8.1.11 Metsa Group

9 INVESTMENT ANALYSIS

10 FUTURE OUTLOOK

02-2729-4219

+886-2-2729-4219