|

市场调查报告书

商品编码

1628764

北美油漆和涂料:市场占有率分析、行业趋势和成长预测(2025-2030)North America Paints and Coatings - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

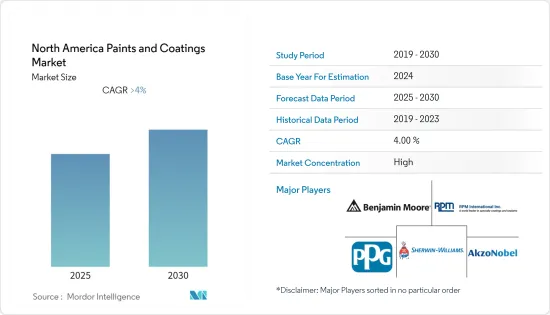

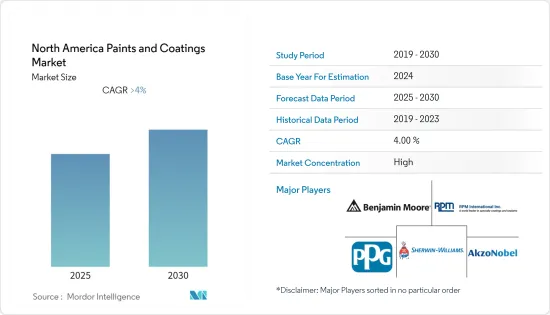

北美油漆和涂料市场预计在预测期内将以超过 4% 的复合年增长率成长

主要亮点

- 该地区工业和基础设施建设的快速成长正在推动预测期内的市场成长。

- 另一方面,原材料价格上涨预计将阻碍市场成长。

- 预计建筑业在预测期内将主导该地区的市场。

- 奈米技术在油漆和涂料中的应用预计将成为未来市场成长的机会。

北美油漆和涂料市场趋势

建筑业需求不断增长

- 油漆和涂料广泛应用于建筑领域的外部和内部应用。油漆和涂料应用于住宅的外部,使其焕然一新,并保护住宅免受明媚的夏季、寒冷的冬季、倾盆大雨和日常紫外线照射(防止外部褪色、剥落和开裂)。

- 建筑涂料旨在保护和装饰表面特征。它用于粉刷建筑物和住宅。大多数用于特定用途,例如屋顶油漆或墙壁油漆。

- 建筑涂料的范围从办公大楼、仓库、便利商店、购物中心等商业用途到住宅用途。这些涂料适用于外表面和内表面,还可以包括密封剂和特殊产品。建筑涂料主要分为内墙涂料和外墙涂料。

- 由于家庭的快速形成和住宅建设的增加,北美的建设产业正在崛起,这推动了该地区对建筑涂料的需求。

- 该地区正在进行多个建设计划,这可能会增加预测期内建筑油漆和涂料的消耗。

- 例如,2022年11月,三星宣布计画在德克萨斯州奥斯汀兴建耗资170亿美元的半导体製造厂。这增加了预测期内该地区对建筑涂料的需求。

- 此外,美国建筑涂料的消费量正在显着成长。 DIY产业在美国建筑涂料消费量中的份额已达39%。

- 上述因素预计将在预测期内推动北美建筑业油漆和涂料市场的发展。

美国主导市场

- 由于其国内基础设施发达,美国是世界领先的油漆和涂料消费国和生产国之一。

- 美国是北美地区最大的建筑业国家。该国人均GDP为25,350美元,预计2022年与前一年同期比较增长3.7%。

- 由于强劲的经济和良好的商业房地产市场基本面,以及联邦和州对公共工程和机构建筑津贴的增加,美国建设产业持续扩张。

- 美国在北美建设产业中占有主要份额。根据美国人口普查局的数据,2022年美国新建设年度金额为17,929亿美元,较2021年的1,6264亿美元成长超过10%。

- 该国正在进行多个建设计划,预计将在预测期内增加对油漆和涂料的需求。例如,在美国,大都会公园园区将在两栋 22 层 LEED 认证建筑中容纳 210 万平方英尺的亚马逊办公空间,预算约为 25 亿美元。

- 由于这些因素,预计该地区对油漆和涂料的需求在预测期内将会增加。

北美油漆和涂料行业概况

北美油漆和涂料市场本质上是整合的。该市场的主要参与者包括宣伟公司、PPG 工业公司、RPM 国际公司、本杰明摩尔公司和阿克苏诺贝尔公司。

其他好处:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第一章简介

- 调查先决条件

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 促进因素

- 商业建设活动增加

- 其他司机

- 抑制因素

- 原物料价格上涨

- 其他限制因素

- 产业价值链分析

- 波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

第五章市场区隔

- 依树脂类型

- 丙烯酸纤维

- 醇酸

- 环氧树脂

- 聚酯纤维

- 聚氨酯

- 其他树脂

- 依技术

- 水系统

- 溶剂型

- 粉末涂料

- 紫外线固化涂料

- 按最终用户

- 建筑学

- 车

- 木头

- 防护漆

- 一般工业

- 运输

- 包装

- 按地区

- 美国

- 加拿大

- 墨西哥

- 其他北美地区

第六章 竞争状况

- 併购、合资、联盟、协议

- 市场占有率(%)**/排名分析

- 主要企业策略

- 公司简介

- 3M

- Akzo Nobel NV

- Axalta Coatings Systems

- BASF SE

- Beckers Group

- Benjamin Moore & Co.

- Cloverdale Paint Inc.

- Diamond Vogel

- Dunn-Edwards Corporation

- Hempel A/S

- Kelly-Moore Paints

- Masco Corporation

- Parker Hannifin Corp

- PPG Industries, Inc.

- RPM International Inc.

- The Sherwin-Williams Company

第七章 市场机会及未来趋势

- 奈米技术在油漆和涂料的应用

简介目录

Product Code: 53400

The North America Paints and Coatings Market is expected to register a CAGR of greater than 4% during the forecast period.

Key Highlights

- The rapid growth of industries and infrastructural construction in the region is fueling the market's growth during the forecast period.

- On the other hand, increasing raw material prices are expected to hinder market growth.

- The architectural segment is expected to dominate the regional market during the forecast period.

- Using nanotechnology in paints and coatings is expected to act as an opportunity for future market growth.

North America Paints and Coatings Market Trends

Increasing Demand from the Architectural Industry

- Paints and coatings are extensively used in the architectural sector for exterior and interior applications. Paints and coatings are applied on the house's exterior to give them a new look and protect it from blistering summers, freezing winters, soaking rain, and daily exposure to UV radiation (without fading, peeling away, and cracking the exteriors).

- Architectural coatings are meant to protect and decorate the surface features. These are used to coat buildings and homes. Most are for specific uses, such as roof coatings, wall paints, etc.

- Architectural coatings range from commercial purposes, such as office buildings, warehouses, retail convenience stores, and shopping malls, to residential buildings. Such coatings can be applied on outer and inner surfaces and include sealers or specialty products. Architectural coatings can be mainly divided into interior and exterior coatings.

- The construction industry in North America is increasing in response to rapid household formation and growing residential construction, which, in turn, is boosting the demand for architectural coatings in the region.

- Several construction projects are going on in the region, likely increasing the consumption of architectural paints and coatings during the forecast period.

- For instance, in November 2022, the company Samsung announced its plans to construct a USD 17 billion semiconductor fabrication facility in Austin, Texas. Thus, creating the demand for architectural coating in the region during the forecast period.

- Moreover, in the United States, the consumption of architectural paint is growing significantly. The DIY sector accounted for the major architectural paint consumption accounting for a 39% share of the total architectural paint consumption in the United States.

- All the factors above are expected to drive the North American paints and coatings market in the architectural industry during the forecast period.

United States to Dominate the Market

- The United States is one of the major consumers and producers of paints and coatings globally, owing to the growing infrastructure in the country.

- The United States is the largest country for construction activities in the North American region. The country had a GDP of USD 25,350 per capita, with an expected growth rate of 3.7% Y-o-Y in 2022.

- The construction industry in the United States continued to expand, owing to a strong economy and positive market fundamentals for commercial real estate, along with increased federal and state funding for public works and institutional buildings.

- The United States holds a major share of the construction industry in North America. According to the US Census Bureau, the annual value for new construction put in place in the United States accounted for USD 1,792.9 billion in 2022, a more than 10% increase compared to USD 1,626.4 billion in 2021.

- Several construction projects are going on in the country, expected to boost the demand for paints and coatings during the forecast period. For instance, in the United States, the Metropolitan Park campus plans to house 2.1 million sq ft of office space for Amazon in two 22-story LEED-certified buildings with a nearly USD 2.5 billion budget.

- Owing to all these factors, the demand for paints and coatings in the region is expected to increase during the forecast period.

North America Paints and Coatings Industry Overview

The North America Paints & coatings market is consolidated in nature. Some of the major players in the market include Sherwin-Williams Company, PPG Industries, Inc., RPM International Inc., Benjamin Moore & Co., and Akzo Nobel N.V., among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Increasing Commercial Construction Activities

- 4.1.2 Other Drivers

- 4.2 Restraints

- 4.2.1 Increasing Raw Material Prices

- 4.2.2 Other Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Value)

- 5.1 Resin Type

- 5.1.1 Acrylics

- 5.1.2 Alkyd

- 5.1.3 Epoxy

- 5.1.4 Polyester

- 5.1.5 Polyurethane

- 5.1.6 Other Resin Types

- 5.2 Technology

- 5.2.1 Water-borne

- 5.2.2 Solvent-borne

- 5.2.3 Powder Coating

- 5.2.4 UV-cured Coating

- 5.3 End-user

- 5.3.1 Architectural

- 5.3.2 Automotive

- 5.3.3 Wood

- 5.3.4 Protective Coatings

- 5.3.5 General Industrial

- 5.3.6 Transportation

- 5.3.7 Packaging

- 5.4 Geography

- 5.4.1 United States

- 5.4.2 Canada

- 5.4.3 Mexico

- 5.4.4 Rest of North America

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%) **/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 3M

- 6.4.2 Akzo Nobel N.V.

- 6.4.3 Axalta Coatings Systems

- 6.4.4 BASF SE

- 6.4.5 Beckers Group

- 6.4.6 Benjamin Moore & Co.

- 6.4.7 Cloverdale Paint Inc.

- 6.4.8 Diamond Vogel

- 6.4.9 Dunn-Edwards Corporation

- 6.4.10 Hempel A/S

- 6.4.11 Kelly-Moore Paints

- 6.4.12 Masco Corporation

- 6.4.13 Parker Hannifin Corp

- 6.4.14 PPG Industries, Inc.

- 6.4.15 RPM International Inc.

- 6.4.16 The Sherwin-Williams Company

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Use of Nano Technology in Paints and Coatings

02-2729-4219

+886-2-2729-4219