|

市场调查报告书

商品编码

1628767

英国玻璃包装:市场占有率分析、产业趋势与成长预测(2025-2030)United Kingdom Glass Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

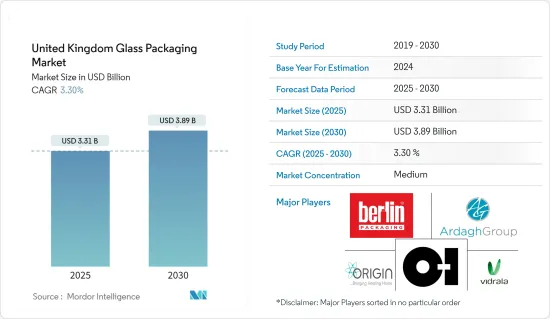

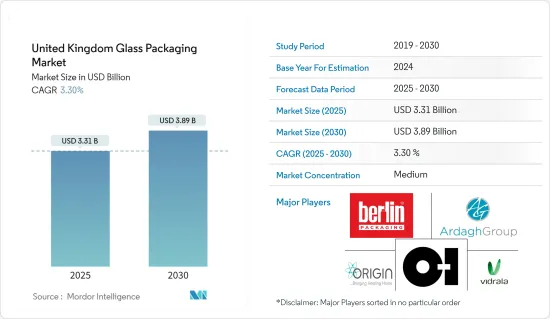

英国玻璃包装市场规模预计到2025年将达到33.1亿美元,预计2030年将达到38.9亿美元,预测期内(2025-2030年)复合年增长率为3.3%。

主要亮点

- 消费者对更安全、更健康的包装的需求不断增长,推动了玻璃包装在各个类别的扩张。压花、成型和艺术饰面等创新技术增加了玻璃包装对最终用户的吸引力。此外,对环保产品的需求不断增长,特别是在食品和饮料领域,正在推动市场成长。随着消费者越来越多地转向啤酒和葡萄酒,玻璃包装製造商正在增加产量以配合。与塑胶等替代品相比,优质食品和饮料品牌更喜欢使用玻璃作为容器,因为玻璃具有化学惰性、无孔和不渗透的特性。

- 近年来,食品包装产业的透明度趋势日益明显。玻璃容器可容纳各种食品,从即溶咖啡和加工婴儿食品到乳製品和糖渍。消费者希望在购买前看到产品,而不仅仅是成分。为了利用这一趋势,许多公司正在转向透明玻璃容器,特别是在乳製品领域。永续和环保包装的发展正在加强玻璃包装市场。根据 Trivium Packaging 的研究,约 74% 的消费者愿意为永续包装支付溢价。

- 法国玻璃瓶和容器市场呼吁建立稳定的脱碳政策框架,让製造商投资减少温室气体排放。 2023年8月,法国政府拨款1.716亿英镑(2.115亿美元)用于销毁剩余葡萄酒并支持生产商,此举与欧盟形成鲜明对比。该倡议旨在稳定价格并确保酿酒师有收入来源。预计英国也会出现类似的趋势,即所谓的“牛鞭效应”,这可能有利于研究市场。

- 2024 年 6 月,Egg 推出了一款新的烈酒瓶 Geddy's,作为其食品和饮料包装系列的一部分。以 Yenice 烈酒瓶的成功为基础,「Gediz」拥有引人注目的设计,具有宽敞的印刷和标籤面板,使其成为各种烈酒产品的理想选择。

- 能源价格的预期波动迫使企业签订长期合约,以避免原材料和能源成本波动。这对于食品和饮料行业的公司尤其重要,因为突然的价格变化可能会促使消费者转向竞争对手的品牌。例如,英国葡萄酒产业正面临酒杯短缺,导致装瓶商价格飙升。除了这些挑战之外,许多英国装瓶商还在为英国脱欧而储备库存,而品牌所有者从塑胶瓶转向玻璃瓶的显着转变进一步给市场带来压力。

英国玻璃包装市场趋势

饮料细分市场成长最快

- 玻璃瓶长期以来一直是饮料行业的首选包装,趋势保持稳定。玻璃瓶具有许多优点,包括保持产品品质和保护内容物免受外部因素的影响。

- 由于其化学无菌性和渗透性,玻璃瓶和容器主要用于酒精和非酒精饮料。玻璃是一种出色的阻隔材料,具有高包装透明度。其特性可防止二氧化碳损失和氧气进入,从而确保较长的保质期。加工和涂层的最新进展提高了玻璃瓶的翻边性,最新的轻量化技术增强了强度和易用性。

- 根据OEC(经济复杂性观察站)资料,2023年4月,英国玻璃瓶出口额为1580万英镑(1948万美元),进口额为4070万英镑(5018万美元),进口额为2490万英镑( 3070万亏损)。 2022年4月至2023年4月,英国玻璃瓶出口额减少了931,000英镑(1,147,965美元),从1,670万英镑(2,059万美元)降至1,580万英镑(1,948万美元),降幅为5.57%。同时,进口额成长了33.9%,达到1,000万英镑(12,330,456,220美元),从3,040万英镑(3,748万美元)跃升至4,007万英镑(4,940万美元)。

- 英国玻璃瓶进口的增加主要是由酒精和非酒精饮料领域的需求推动的,预计这一趋势将持续下去。

- 优质化趋势正在影响包括软性饮料在内的各种饮料领域对玻璃包装的选择。软性饮料因其广泛的吸引力和适合各种场合的多种口味而占据了很大的市场份额。特别是,根据UNESDA资料,低热量和无糖饮料占欧洲一些市场销售的30%。

化妆品板块预计将占据较大份额

- 玻璃包装是奢华香水、护肤和个人保健产品的首选。化妆品和香水中使用的玻璃主要由天然和永续材料製成,例如沙子、石灰石和碱灰。最重要的是,玻璃包装具有 100% 的回收率,可以无限期回收,而不会损失品质或纯度。令人惊讶的是,80% 的回收玻璃被回收製成新的玻璃产品。

- 在个人护理行业,玻璃是奢华的代名词。其坚固的感觉超越了替代包装材料,其高成本营造了一种奢侈品的感觉,增加了产品的感知价值。化妆品包装包括各种容器,例如用于护肤、护髮、指甲护理和化妆产品的瓶子、罐子、管瓶和安瓿。这些化妆品容器通常由玻璃製成,尤其是在奢侈品领域。玻璃罐和瓶子因其多功能性而广受欢迎,使其能够容纳各种分配器选项,包括喷射和滴入插件、发泡盖、喷嘴和泵头。

- 随着消费者越来越注重自己的外观以及防晒和防污染需求的增加,化妆品和香水市场正在经历显着增长。该领域的公司在创新方面投入巨资,特别是在成熟的类别中,目的是保持成长并每年推出新的增值产品。这一趋势正在增加消费者对预防措施和治疗的兴趣。因此,对清爽、排毒、保湿产品的需求激增。这些趋势正在推动个人护理和化妆品领域对玻璃瓶和容器的需求。

- 化妆品、盥洗用品和香水协会 (CTPA) 的资料凸显了 2023 年洗护用品和美容品领域的强劲表现,优于前一年的指标。该产业价值95.6亿英镑(约121.4亿美元),与前一年同期比较去年同期成长9.7%。随着通货膨胀率稳定以及美容和洗护用品使用频率的增加,该行业对未来几年的进一步显着增长持乐观态度,这一趋势将加强英国玻璃包装市场。

英国玻璃包装产业概况

英国玻璃包装市场竞争温和,Ardagh Packaging、Berlin Packaging 和 Owens-Illinois Inc. 等公司利用策略合作措施来提高市场占有率和盈利。 然而,由于玻璃的特性及其对饮料、化妆品和其他行业的好处,玻璃瓶和容器的采用正在增加。 供应商正致力于以环保产品玻璃取代塑胶。

2024 年 7 月 自从英国玻璃包装公司 Croxsons 为专门生产填充用护肤品的品牌 Necessary Good 推出新的初级包装解决方案以来,已经过去一年了。这种创新的玻璃包装由 Croxson 致力于生活方式、美容、健康和保健的专业部门製造。该製造商生产了两种类型的用于生活必需品的圆柱形玻璃瓶:100ml 和200ml。

2023年5月,英国Ardagh玻璃包装公司(AGP)宣布建造一座可持续的“高效熔炉”,旨在减少玻璃生产过程中的温室气体排放。该熔炉将安装在 AGP 的唐卡斯特工厂,采用先进的工业技术。该熔炉配备了先进的气体过滤系统,利用创新的过滤技术来解决并显着降低其他排放因素,达到远低于目前行业基准的水平。这个雄心勃勃的计划部分由政府工业能源转型基金(IETF)资助。 IETF 是倡议。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间的敌对关係

- 以循环经济为重点的产业生态系分析

- 法律规范

- 进出口分析

- 成本分析,包括关键驱动因素(零件和能源消耗)

- 英国日益重视玻璃回收以及目前可回收率分析

- 英国玻璃製造业整体分析

第五章市场动态

- 市场驱动因素

- 饮料业对玻璃包装的需求增加

- 优质包装市场整合进一步推动成长

- 市场问题

- 替代包装形式对市场成长构成挑战

第六章 市场细分

- 依产品类型

- 瓶子

- 管瓶

- 安瓿

- 罐

- 其他产品类型(预填充式注射器、faials、香水瓶等)

- 按行业分类

- 饮料

- 酒精饮料

- 啤酒和苹果酒

- 葡萄酒和烈酒

- 其他酒精饮料

- 非酒精性

- 碳酸饮料

- 牛奶

- 水和其他非酒精饮料(例如果汁)

- 食物

- 个人护理和化妆品

- 医疗和製药

- 其他最终用途产业

- 饮料

第七章 竞争状况

- 公司简介

- Berlin Packaging LLC

- Ardagh Packaging Group

- Owens-Illinois Inc.

- Origin Pharma Packaging

- Vidrala SA

- Beatson Clark

- Ciner Glass Ltd

- Stoelzle Flaconnage Ltd

- Beatson Clark

- Glassworks International Limited

- 热图分析

第八章投资分析

第9章市场的未来

The United Kingdom Glass Packaging Market size is estimated at USD 3.31 billion in 2025, and is expected to reach USD 3.89 billion by 2030, at a CAGR of 3.3% during the forecast period (2025-2030).

Key Highlights

- Growing consumer demand for safer and healthier packaging is driving the expansion of glass packaging across various categories. Innovative technologies, such as embossing, shaping, and artistic finishes, are enhancing the appeal of glass packaging to end users. In addition, the surging demand for eco-friendly products, particularly from the food and beverage sector, is propelling market growth. As consumers increasingly gravitate toward beer and wine, glass packaging manufacturers are adapting their production accordingly. Premium food and beverage brands favor container glass over alternatives like plastic, citing glass's chemical inertness, non-porous nature, and impermeability.

- In recent years, the food packaging industry has witnessed a growing trend toward transparency. Glass containers house a diverse array of foods, from instant coffee and processed baby foods to dairy products and sugar preserves. Beyond just ingredients, consumers want to see the product physically before buying. To leverage this trend, many companies, especially in the dairy sector, are transitioning to transparent glass containers. The push for sustainable and eco-friendly packaging bolsters the glass packaging market. Research by Trivium Packaging highlights that about 74% of consumers are willing to pay a premium for sustainable packaging.

- The glass bottles and containers market in the country seeks a stable policy framework for decarbonization, enabling manufacturers to invest in reducing greenhouse gas emissions. In August 2023, the French government, in a move contrasting with the European Union, allocated GBP 171.6 million (USD 211.5 million) to destroy surplus wine and bolster producers. This initiative aims to stabilize prices, ensuring winemakers regain revenue sources. A similar trend termed the "bullwhip effect," is anticipated in the United Kingdom, potentially benefiting the studied market.

- In June 2024, Aegg unveiled its new spirit bottle, 'Gediz,' as part of its food and drink packaging lineup. Building on the success of the 'Yenice' spirit bottle, the Gediz boasts an eye-catching design with a spacious panel for printing or labeling, making it ideal for various spirit-based products.

- Anticipated fluctuations in energy prices are pushing businesses to secure long-term contracts to shield against volatile raw material and energy costs. This is especially crucial for those in the food and beverage sector, where sudden price shifts can drive consumers to rival brands. The UK wine industry, for example, is grappling with a glass shortage, leading to steep price increases for bottlers. Beyond these challenges, many UK bottlers have been stockpiling in anticipation of Brexit, and a notable shift from plastic to glass bottles by brand owners has further strained the market.

United Kingdom Glass Packaging Market Trends

Beverage Segment is Set to Witness The Highest Growth

- Glass bottles have long been a favored packaging choice in the beverage industry, a trend that remains steadfast today. They provide numerous advantages, such as preserving product quality and shielding contents from external factors.

- Due to their chemical sterility and non-permeability, glass bottles and containers are predominantly utilized for alcoholic and non-alcoholic beverages. Glass stands out as an excellent barrier material, boasting high transparency for packaging. Its properties ensure a prolonged shelf life by resisting CO2 loss and O2 intrusion. Recent advancements in processing and coatings have enhanced the frangibility of glass bottles, while modern lightweight techniques bolster their strength and user-friendliness.

- Data from the Observatory of Economic Complexity (OEC) reveals that in April 2023, the UK exported glass bottles worth GBP 15.8 million (USD 19.48 million) and imported them at GBP 40.7 million (USD 50.18 million), leading to a trade deficit of GBP 24.9 million (USD 30.70 million). Between April 2022 and April 2023, UK glass bottle exports dipped by GBP 931,000 (USD 1,147,965), marking a 5.57% decline from GBP 16.7 million (USD 20.59 million) to GBP 15.8 million (USD 19.48 million). In contrast, imports surged by GBP 10 million (USD 12,330,456.2), a notable 33.9% increase, rising from GBP 30.4 million (USD 37.48 million) to GBP 40.07 million (USD 49.40 million).

- The rising imports of glass bottles in the United Kingdom are primarily fueled by demand from alcoholic and non-alcoholic beverage sectors, a trend anticipated to persist in the coming years.

- Trends in premiumization have influenced the choice of glass packaging across various beverage segments, including soft drinks. Given their widespread appeal and diverse flavors tailored for every occasion, soft drinks command a substantial share of the market. Notably, data from UNESDA highlights that in several European markets, low-calorie and sugar-free beverages represent up to 30% of sales.

Cosmetic Sector is Expected to Witness Significant Share

- Glass packaging is the preferred choice for exclusive fragrances, skincare, and personal care products. The glass utilized in cosmetics and fragrances is primarily derived from natural and sustainable materials, including sand, limestone, and soda ash. Notably, glass packaging boasts a 100% recyclability rate, allowing it to be recycled infinitely without any degradation in quality or purity. Impressively, 80% of recycled glass is repurposed into new glass products.

- In the personal care industry, glass is synonymous with luxury. Its heft surpasses that of alternative packaging materials, and its higher cost fosters a perception of premium quality, thereby elevating the product's perceived value. Cosmetic packaging encompasses a range of containers, including bottles, jars, vials, and ampoules, catering to skincare, haircare, nail care, and makeup products. These cosmetic containers, especially in luxury segments, prominently feature glass. Glass jars and bottles are favored for their versatility, accommodating various dispensing options like jet and drop inserts, frothing caps, spray nozzles, and pump heads.

- As consumers become more conscious of their appearance and the need for sun and pollution protection, the cosmetics and perfume market is witnessing significant growth. Companies in this sector are heavily investing in innovations, aiming to sustain growth and introduce new, value-added products annually, particularly in mature categories. This trend piques consumer interest not only in preventive measures but also in treatments. Consequently, products like refreshing, detoxifying, and moisturizing solutions are poised for a surge in demand. Such dynamics are propelling the demand for glass bottles and containers in the personal care and cosmetics arena.

- Data from the Cosmetics, Toiletry, and Perfumery Association (CTPA) highlights a robust performance in the toiletries and beauty sectors for 2023, surpassing the previous year's metrics. The industry's total valuation experienced a Y-o-Y surge of 9.7%, reaching a notable GBP 9.56 billion (equivalent to USD 12.14 billion). With inflation rates stabilizing and an uptick in the frequency of beauty and toiletry usage, the industry is optimistic about even more pronounced growth in the forthcoming years, a trend likely to bolster the glass packaging market in the United Kingdom.

United Kingdom Glass Packaging Industry Overview

The United Kingdom glass packaging market is moderately competitive, with many regional and global players such as Ardagh Packaging, Berlin Packaging, Owens-Illinois Inc., and many more. The companies are leveraging strategic collaborative initiatives to increase market share and profitability. However, the properties of glass and its benefits to beverages, cosmetics, and other industries are leading to the increased adoption of glass bottles and containers. Vendors are focusing on replacing plastic with environmentally friendly product glass.

July 2024: United Kingdom-based glass packaging firm Croxsons completed one year of the unveiling of its new primary packaging solution for Necessary Good, a brand specializing in refillable skincare essentials. This innovative glass packaging was manufactured by Croxson's dedicated division focusing on lifestyle, beauty, health, and wellness. The manufacturer produced two cylindrical glass bottle sizes for Necessary Goods, which are 100 ml and 200 ml.

May 2023: In the United Kingdom, Ardagh Glass Packaging (AGP) announced the construction of a sustainable 'Efficient Furnace' aimed at curbing greenhouse gas emissions during glass production. This furnace, set to be installed at AGP's Doncaster facility, leverages advanced industrial technology. The furnace is equipped with an advanced gas filtration system, utilizing innovative filter technology to address and significantly diminish other emission elements, achieving levels well below current industrial benchmarks. This ambitious project receives partial funding from the Government's Industrial Energy Transformation Fund (IETF), an initiative designed to assist energy-intensive businesses in their shift towards a low-carbon future.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Ecosystem Analysis with an Emphasis on Circular Economy

- 4.4 Regulatory Framework

- 4.5 Import and Export Analysis

- 4.6 Cost Analysis with Key Drivers (Components and Energy Consumption)

- 4.7 Analysis of the Increasing Emphasis on Glass Recycling and the Current Recyclability Rate in the United Kingdom

- 4.8 Analysis of the Overall Glass Manufacturing Industry in the United Kingdom

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increased Demand for Glass Packaging in Beverage Industry

- 5.1.2 Increased Integration in the Premium Packaging Market Further Drives the Growth

- 5.2 Market Challenges

- 5.2.1 Alternative Forms of Packaging is Challenging the Market Growth

6 MARKET SEGMENTATION

- 6.1 By Product Type

- 6.1.1 Bottles

- 6.1.2 Vials

- 6.1.3 Ampoules

- 6.1.4 Jars

- 6.1.5 Other Product Type (Pre-Filled Syringes, Phials, Flacons, among Others)

- 6.2 By End-use Vertical

- 6.2.1 Beverages

- 6.2.1.1 Alcoholic**

- 6.2.1.1.1 Beer and Cider

- 6.2.1.1.2 Wine and Spirit

- 6.2.1.1.3 Other Alcoholic Beverages

- 6.2.1.2 Non-alcoholic**

- 6.2.1.2.1 Carbonated Soft Drinks

- 6.2.1.2.2 Milk

- 6.2.1.2.3 Water and Other Non-alcoholic Beverages (Juices, Among others)

- 6.2.2 Food

- 6.2.3 Personal Care and Cosmetics

- 6.2.4 Healthcare and Pharmaceutical

- 6.2.5 Other End-use Verticals

- 6.2.1 Beverages

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Berlin Packaging LLC

- 7.1.2 Ardagh Packaging Group

- 7.1.3 Owens-Illinois Inc.

- 7.1.4 Origin Pharma Packaging

- 7.1.5 Vidrala SA

- 7.1.6 Beatson Clark

- 7.1.7 Ciner Glass Ltd

- 7.1.8 Stoelzle Flaconnage Ltd

- 7.1.9 Beatson Clark

- 7.1.10 Glassworks International Limited

- 7.2 Heat Map Analysis