|

市场调查报告书

商品编码

1628805

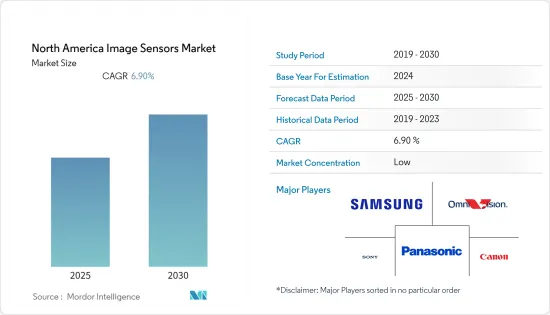

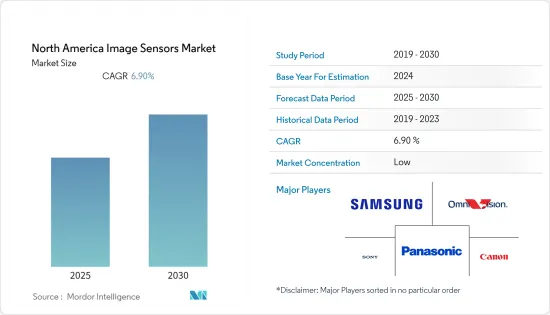

北美影像感测器:市场占有率分析、产业趋势、成长预测(2025-2030)North America Image Sensors - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

北美影像感测器市场预计在预测期内复合年增长率为 6.9%

主要亮点

- 由于智慧型手机、保全摄影机、高清摄影机、摄影机等的需求不断增加,影像感测器市场预计在预测期内将出现高成长率。该地区的製造商正在努力提高解析度、性能和像素尺寸等关键参数。

- IC 技术的进步使得透过在同一晶片上整合感测器来整合先前独立的功能成为可能。例如,标准行动电话具有独立功能,例如相机、无线连接和音乐播放功能。如今,这些功能都可以在一台设备中实现,而且由于它们的普及,CMOS 和 CCD 等影像感测器的产量有所增加。

- 在消费性电子设备中,智慧型手机已成为主要的拍照设备,压倒了静态相机和数位单眼相机。智慧型手机领域的激烈竞争促使製造商提供更好的相机以保持竞争优势,从而导致该领域对相机技术创新进行了大量投资。

- 此外,该地区的製造公司正在认识到机器视觉系统的优势,特别是在需要准确执行检查等冗余任务的领域。工业4.0刺激了机器人等在工业自动化中发挥关键作用的技术的发展,工业中的许多核心业务都由机器人来管理。机器视觉支援视觉引导机器人等新应用。

- 此外,无人机在北美广泛用于勘测,製造商一直在寻找能够从高空捕捉影像的相机。具有较高百万像素解析度和较小感测器尺寸的相机可能会受到影像衍射效应的影响。因此,这些缺点为市场上的影像感测器供应商提供了推出更大感测器的机会,这些感测器在相同解析度下表现出更好的聚光能力。

北美影像感测器市场趋势

智慧型手机等中搭载的CMOS影像感测器显着成长。

- 多个供应商正在开发 CMOS 影像感测器技术,并且越来越多地在低成本相机中采用。儘管通常与以相同价格提供卓越影像品质的电荷耦合元件 (CCD) 感测器进行比较,但 CMOS 感测器透过提供可简化相机设计的晶片功能,在低成本终端占据一席之地。

- 2022年3月,先进CMOS影像感测器供应商SmartSens推出首款50MP超高解析度1.0μm像素尺寸影像感测器产品SC550XS。此新产品采用先进的22奈米HKMG堆迭製程和SmartSens多项专有技术,包括SmartClarity-2技术、SFCPixel技术和PixGain HDR技术,提供卓越的成像性能。此外,AllPix ADAF技术提供100%全像素全向自动对焦覆盖,并配备MIPI C-PHY 3.0Gsps高速资料传输介面。它还配备了MIPI C-PHY 3.0Gsps高速资料传输介面。该产品支援旗舰智慧型手机的关键相机需求:全彩夜视成像、高动态范围和低功耗。

- 消费性电子、汽车、安全性和监控都是 CMOS 影像感测器不断成长的市场。内建前置相机和后置镜头的智慧型手机的日益普及推动了消费性电子产业的崛起。

- 此外,自动驾驶汽车的创新以及透过 ADAS 提高驾驶安全性正在刺激车载应用的扩展。 CMOS影像感测器在低光源、黑暗和低照度等不同照明条件下运作,从而增加了CMOS影像感测器在安全应用中的使用,加强了安全性和监控CMOS影像感测器市场。

预计美国将占据最大的市场占有率

- 影像感测器是智慧型手机、平板电脑和穿戴式装置等消费性电子产品的重要元件。现今消费性电子产品中内建的影像感测器采用 CCD 或 CMOS 技术。随着此类设备在该国的普及,预计在预测期内对影像感测器的需求将会增加。

- 与专为工业或科学应用设计的 CCD 相比,许多专为家庭使用而开发的 CCD 影像感测器都具有内建的抗光晕功能。

- 此外,安森美半导体也宣布推出一款新型 5000 万像素解析度 CCD 影像感测器。 KAI-50140是市售CCD影像感测器中解析度最高的行间传输CCD影像感测器,不仅适用于智慧型手机显示器检查,还适用于电路基板和机械组装检查,甚至还提供航空监控。细节和高影像均匀性。 KAI-50140 采用 2.18:1 的长宽比设计,以配合最新的智慧型手机格式,减少检查整个显示器所需的影像数量。

- 此外,过去几年该地区的消费性电子产品销售持续成长。包括智慧型手机和平板电脑在内的多种产品越来越注重增强这些产品的影像捕捉能力,导致购买各种家用电器的趋势不断增加,对市场产生了积极影响。

北美影像感测器产业概况

北美影像感测器市场较为分散,竞争公司之间竞争激烈。由于市场成长率较高,这是一个巨大的投资机会,并且新进入者正在不断进入该市场。主要企业包括Canon、三星和SONY。

- 2022 年 1 月 - LUCID Vision Labs, Inc. 是一家独特且创新的工业视觉相机设计商和製造商,宣布推出全新 Atlas SWIR IP67 标准 1.3MP 和 0.3MP 相机。 Atlas SWIR 是一款 GigE PoE+ 相机,配备宽频和高灵敏度索尼 SenSWIR 1.3 MP IMX990 和 0.3 MP IMX991 InGaAs 感测器,能够捕捉可见光和不可见频谱中的影像,像素尺寸仅为 5μm,我们对此感到自豪。

- 2021 年5 月- 先进数位成像解决方案的领先开发商OMNIVISION Technologies, Inc. 在COMPUTEX Virtual 之前支援优质窄边框笔记型电脑、平板电脑和物联网设备的全高清(HD) 视讯性能,我们宣布了业界第一个 1 /7吋、200万像素影像感测器OV02C。该感测器在最薄的 3mm 模组 Y 尺寸中以每秒 60 帧 (fps) 的速度提供出色的像素性能,适用于高萤幕占比设计。

其他好处:

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 买方议价能力

- 供应商的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间的敌对关係

- 产业价值链分析

- COVID-19 市场影响评估

第五章市场动态

- 市场驱动因素

- 汽车领域需求增加

- 降低电子设备中安装 CMOS 影像感测器的成本

- 各种应用中手势姿态辨识/控制的需求

- 市场限制因素

- 空间和电池消耗问题

- 製造成本高,市场竞争加剧

第六章 市场细分

- 按类型

- CMOS

- CCD

- 按最终用户产业

- 家用电子产品

- 卫生保健

- 工业的

- 安全和监控

- 汽车/交通

- 航太/国防

- 其他最终用户产业

- 国家名称

- 美国

- 加拿大

第七章 竞争格局

- 公司简介

- Canon Inc.

- Omnivision Technologies Inc.

- Panasonic Corporation

- Samsung Electronics Co. Ltd

- Sony Corporation

- STMicroelectronics NV

- Teledyne DALSA Inc.

- Aptina Imaging Corporation

- CMOSIS NV

- ON Semiconductor Corporation

- SK Hynix Inc.

第八章投资分析

第9章市场的未来

简介目录

Product Code: 54763

The North America Image Sensors Market is expected to register a CAGR of 6.9% during the forecast period.

Key Highlights

- Due to the growing demand for smartphones, security cameras, high-definition cameras, and camcorders, the image sensors market is expected to record a high growth rate during the forecast period. Manufacturers in the region have been striving to improve major parameters, such as resolution, performance, and pixel size.

- IC technology advancements have allowed the incorporation of previously independent functions by integrating sensors in the same chip. For example, a standard mobile phone has independent features, such as a camera, wireless connectivity, and music-playback capabilities. Now, all these functionalities are made available in a single device and have resulted in popularity, thus increasing the production volumes for image sensors, such as CMOS and CCD.

- In terms of consumer electronics, the smartphone has become the primary camera device, dominating still-cameras and DSLRs. Heavy competition in the smartphone segment has driven manufacturers to provide better cameras to have the edge over the competition, which has resulted in high investments in camera technology innovations in this field.

- Further, manufacturing firms in the region realize the benefits of machine vision systems, particularly in areas where redundant tasks, such as inspection, should be performed precisely. Industry 4.0 fueled the development of technologies, like robots playing a crucial role in industrial automation, with many core operations in industries managed by robots. Machine vision supports new applications, like vision-guided robotics, etc.

- Moreover, drones are widely used in North America to conduct surveys, and manufacturers are constantly looking for cameras that can capture images from altitudes. Cameras with higher megapixel resolution and small sensor sizes can be subject to image diffraction effects. Therefore, such disadvantages provide opportunities for the image sensor vendors in the market to introduce larger sensors that showcase better light-gathering ability at the same resolutions.

North America Image Sensors Market Trends

CMOS Image Sensor in Smartphone and Other Products to Witness Significant Growth

- CMOS image sensor technology, which several vendors are ramping, is sustaining its vigorous move into low-cost camera designs. Although often disparagingly compared to charge-coupled device (CCD) sensors with superior image quality at the same price, CMOS sensors are establishing a foothold at the low-cost end of the consumer market by offering more functions on-chip that simplify camera design.

- In March 2022, SmartSens, an advanced CMOS image sensor supplier, launched its first 50MP ultra-high-resolution 1.0μm pixel size image sensor product - SC550XS. The new product adopts the advanced 22nm HKMG Stack process and SmartSens' multiple proprietary technologies, including SmartClarity-2 technology, SFCPixel technology, and PixGain HDR technology, to enable excellent imaging performance. In addition, it can achieve 100% all pixel all-direction autofocus coverage via AllPix ADAF technology and is equipped with MIPI C-PHY 3.0Gsps high-speed data transmission interface. The product addresses the flagship smartphone's main camera requirements in night vision full-color imaging, high dynamic range, and low power consumption.

- Consumer electronics, automotive, security, and surveillance are all growing markets for CMOS image sensors. The rise of the consumer electronics sector has been spurred by the increasing popularity of smartphones with built-in front and rear cameras.

- Further, the expansion of the automotive application has been spurred by the innovation of self-driving automobiles and advancements in driver safety with the help of ADAS. The capacity of CMOS image sensors to work in various lighting conditions, including dim light, darkness, and low light, has raised the use of CMOS image sensors for security applications, bolstering the CMOS image sensor market for security and surveillance.

United States is Expected to Account for the Largest Market Share

- Image sensors are an integral part of consumer electronic products, such as smartphones, tablets, and wearables. The image sensors that are built in today's consumer electronic devices use either CCD or CMOS technology. With the growing adoption of such devices in the country, the demand for image sensors is expected to increase over the forecast period.

- Most CCD image sensors that have been developed for consumer applications possess the built-in anti-blooming capability, in contrast to most of the CCDs that have been specifically designed for industrial and scientific applications.

- Moreover, ON Semiconductor introduced a new 50-megapixel-resolution CCD image sensor. As the highest-resolution interline transfer CCD image sensor commercially available, the KAI-50140 provides the critical imaging detail and high image uniformity needed not only for the inspection of smartphone displays but also for circuit board and mechanical assembly inspection, as well as aerial surveillance. The KAI-50140 is designed in a 2.18-to-1 aspect ratio to match the format of modern smartphones, reducing the number of images captured to inspect a full display.

- Further, the region has also witnessed continuous consumer electronics sales growth over the past couple of years. The growing inclination towards purchasing various consumer electronics products is positively impacting the market as several products, including smartphones and tablets, are increasingly focusing on enhancing the image-capturing capabilities of these products.

North America Image Sensors Industry Overview

The North America Image Sensors Market is fragmented in nature due to intense competitive rivalry. Due to the high market growth rate, it is a significant investment opportunity, and therefore, new entrants are entering the market. Key players are Canon Inc., Samsung, Sony, etc.

- January 2022 - LUCID Vision Labs, Inc., a designer and manufacturer of unique and innovative industrial vision cameras, announced the launch of the new Atlas SWIR IP67-rated 1.3 MP and 0.3 MP cameras. The Atlas SWIR is a GigE PoE+ camera featuring wide-band and high-sensitivity Sony SenSWIR 1.3 MP IMX990 and 0.3 MP IMX991 InGaAs sensors, capable of capturing images across both visible and invisible light spectrums and boasting a miniaturized pixel size of 5μm.

- May 2021 - OMNIVISION Technologies, Inc., a significant developer of advanced digital imaging solutions, announced in advance of COMPUTEX Virtual the industry's first 1/7-inch, 2-megapixel image sensor, the OV02C, for full high definition (HD) video performance in thin bezel premium notebooks, tablets, and IoT devices. The sensor offers 60 frames per second (fps) and excellent pixel performance in the thinnest 3 mm module Y size for high screen-to-body ratio designs.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Buyers

- 4.2.2 Bargaining Power of Suppliers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Assessment of the Impact of COVID -19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Demand in Automotive Sector

- 5.1.2 Low-Cost Availability of CMOS Image Sensors Deployed in Electronic Devices

- 5.1.3 Demand for Gesture Recognition/Control in Various Applications

- 5.2 Market Restraints

- 5.2.1 Space and Battery Consumption issues

- 5.2.2 High Manufacturing Costs and Increased Market Competition

6 MARKET SEGMENTATION

- 6.1 Type

- 6.1.1 CMOS

- 6.1.2 CCD

- 6.2 End-User Industry

- 6.2.1 Consumer Electronics

- 6.2.2 Healthcare

- 6.2.3 Industrial

- 6.2.4 Security and Surveillance

- 6.2.5 Automotive and Transportation

- 6.2.6 Aerospace and Defense

- 6.2.7 Other End-user Industries

- 6.3 Country

- 6.3.1 United States

- 6.3.2 Canada

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Canon Inc.

- 7.1.2 Omnivision Technologies Inc.

- 7.1.3 Panasonic Corporation

- 7.1.4 Samsung Electronics Co. Ltd

- 7.1.5 Sony Corporation

- 7.1.6 STMicroelectronics N.V

- 7.1.7 Teledyne DALSA Inc.

- 7.1.8 Aptina Imaging Corporation

- 7.1.9 CMOSIS N.V.

- 7.1.10 ON Semiconductor Corporation

- 7.1.11 SK Hynix Inc.

8 INVESTMENTS ANALYSIS

9 FUTURE OF THE MARKET

02-2729-4219

+886-2-2729-4219