|

市场调查报告书

商品编码

1628815

拉丁美洲的 AMH 和储存系统:市场占有率分析、行业趋势和成长预测(2025-2030 年)LA AMH and Storage Systems - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

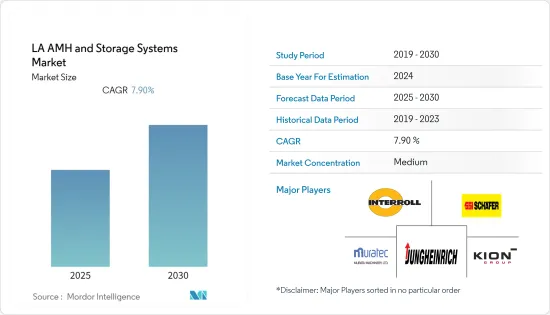

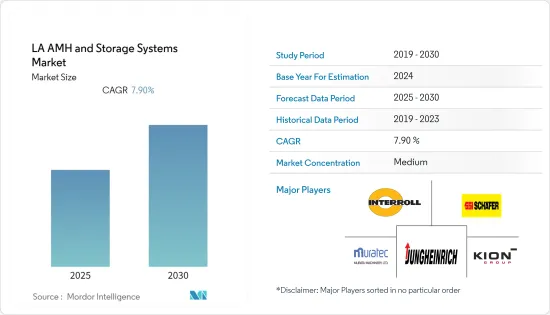

拉丁美洲 AMH 和储存系统市场预计在预测期内复合年增长率为 7.9%

主要亮点

- 库存单位 (SKU) 的快速成长使得批发商和经销商难以就业务做出明智的决策。这一因素推动了对劳动力、设备和技术的更智慧使用的需求。推动自动化物料输送系统需求的主要因素是降低成本、劳动效率和空间限制。

- 目前的市场状况正在增加可用产品的数量,并增加对更频繁和更小规模交付的需求。此外,自动导引车 (AGV) 和仓库管理系统 (WMS) 等先进技术在食品和饮料仓储和生产业务中不断普及,为製造商带来了多种好处。

- 受支援设施内自动化系统之间协作的工业 4.0 的启发,拉丁美洲的仓库经理现在正在寻求在公司范围内实施自动化。透过在公司范围内的部署,仓库员工每天都可以使用 AGV,并透过与自动储存和搜寻系统 (AS/RS) 以及仓库管理系统通讯,促进与其他技术系统的整合。

- 拉丁美洲地区成长的主要驱动力是都市化进程的加速、电子商务销售的增加以及技术提供者的强大存在。这些公司投资研发活动,提供创新解决方案,以便在竞争激烈的市场环境中生存。

拉丁美洲 AMH 和储存系统市场趋势

自动驾驶汽车预计将获得显着的市场占有率

- 拖车/拖拉机/拖车式 AGV 是物流业务的关键要素。它可以用于精细定制的多种任务,例如仓库半自动收集、原材料运输到生产线、最终产品运输(装卸)。然而,根据墨西哥汽车客车生产协会的数据,包括拖拉机在内的大型车辆产量大幅下降至 65,080 辆。

- 此外,投资正在推动拉丁美洲地区的市场成长。例如,2020年10月,亚马逊宣布投资1亿美元在墨西哥开设新的物流仓库,其中包括其在人口稠密的大都会区之外的第一个配送中心,以提供更快的送货服务。新地点包括两个履约中心,一个靠近北部城市蒙特雷,另一个靠近中部城市瓜达拉哈拉。此外,该公司正在向巴西扩张,最近在该国开设了第五个也是最大的履约中心,面积达 100,000平方公尺。所有这些投资预计将推动 AGV 在仓库中的使用。

- 与大型製造商相比,需要处理较小负载的中型工业和实验室的自动化蓬勃发展是推动单元货载型 AGV 需求的主要因素。

- 此外,该地区不断增加的研发支出和不断增加的生产设施正在推动全球中端市场产业对自动化的需求,特别是在医疗保健和製药业。

- 此外,该地区的消费者要求更快的交货时间,增加了 AGV 在仓库和配送中心的应用。此外,技术进步使 AGV 变得更好、更小,成本降低以及某些地区的劳动力短缺正在推动所研究市场的成长。

巴西市场预计将显着成长

- 随着工业自动化任务的要求越来越高,COVID-19 的爆发增加了巴西对自主物料输送的需求。同时,企业面临劳动力短缺和实施新的社交距离要求的挑战,这促使市场公司投资于产品创新。

- 该国正在进行各种扩张。例如,2020 年 1 月, 物料输送 Clark Brasil 将总部迁至坎皮纳斯技术中心。这项策略性倡议旨在建立巴西市场未来成长的能力,并在巴西建立生产设施。坎皮纳斯位于圣保罗以北约100公里处,是重要的工商业中心,经济活动广泛。预计也将满足该国对克拉克型物料输送车辆不断增长的需求。

- 此外,由于初始成本较高,受访市场中的供应商提供了更灵活的轮播,以满足客户的特定要求。此类产品创新预计将推动 Carousel 在该地区的采用。

- 支持 Carousel 的供应商正在推动需求。例如,SSI Schaefer 提供的传送带每小时可执行 1,000 次拣选,储存密度提高了 50%。 SSI 转盘是处理小型零件和中低速产品的合适解决方案。这包括药品、化妆品、电子元件、媒体、食品、标准尺寸小零件等。

- 促进托盘搬运的自动化物料输送设备和车辆的推出预计也将对该地区各个仓库的托盘适应性产生正面影响。然而,根据巴西汽车製造商协会的数据,2020年巴西生产了约95,000辆卡车,比2019年减少了19%,这可能会在相当长的时间内抑制市场。

拉丁美洲 AMH 和储存系统产业概况

拉丁美洲 AMH 和储存系统市场竞争中等,存在大量区域和全球公司。市占率较大的主要厂商都在註重技术创新、併购、伙伴关係、扩大海外基本客群。公司正在利用策略合作措施来提高盈利。

- 2021 年 7 月 - S&H Systems 透过创新的 Interroll 交叉带分类机和输送机产品扩展了其自动化产品线,为仓库业务提供多功能性。与 Interroll 的伙伴关係使 S&H 能够为客户提供更灵活和模组化的产品,使他们能够在客户主导的环境中提供选择。

- 2020年8月,村田机械株式会社与Alpen签约,打造首座3D机器人仓库系统Alphabot。此外,阿尔彭集团主要的物流中心阿尔彭小牧物流中心将引进alphabot,以补充储存能力,并将拣选、分类和包装工作减少约60%。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间敌对关係的强度

- COVID-19 对工业生态系的影响

第五章市场动态

- 市场驱动因素

- 技术进步不断推动市场成长

- 电子商务的快速成长导致仓库自动化

- 工业 4.0 投资推动对 AMH 和储存系统的需求

- 市场挑战

- 缺乏技术纯熟劳工

- 高资本要求

第六章 市场细分

- 依产品类型

- 软体

- 硬体

- 服务

- 一体化

- 依设备类型

- 移动机器人

- 自动导引运输车(AGV)

- 自动堆高机

- 自动拖车/拖拉机/标籤

- 单元货载

- 组装

- 自主移动机器人(AMR)

- 自动化仓库系统(ASRS)

- 固定飞弹

- 旋转木马

- 垂直升降模组

- 自动输送机

- 腰带

- 滚筒

- 调色盘

- 开卖

- 堆垛机

- 传统的

- 机器人

- 分类系统

- 移动机器人

- 按最终用户

- 飞机场

- 车

- 饮食

- 零售/仓库/配送中心/物流中心

- 一般製造业

- 药品

- 小包裹

- 电子/半导体製造

- 其他最终用户

- 按国家/地区

- 巴西

- 阿根廷

- 墨西哥

- 哥伦比亚

- 秘鲁

- 智利

第七章 竞争格局

- 公司简介

- JBT Corporation

- KION Group AG

- SSI SCHEFER AG

- Daifuku Co. Limited

- Kardex Group

- Beumer Group GMBH & Co. KG

- Jungheinrich AG

- Murata Machinery Limited

- Interroll Group

- System Logistics

第八章投资分析

第9章市场的未来

简介目录

Product Code: 54941

The LA AMH and Storage Systems Market is expected to register a CAGR of 7.9% during the forecast period.

Key Highlights

- With the rapid growth in stock-keeping units (SKUs), wholesalers and distributors are finding it difficult to make informed decisions about the operations. This factor is driving the need for smarter usage of labor, equipment, and technology. The major factors driving the need for automated material-handling systems are cost savings, labor efficiency, and space constraints.

- In the current market landscape, there is an increase in the number of available products and demand for more frequent and smaller deliveries. Also, advanced technologies, like automatic guided vehicles (AGVs) and warehouse management systems (WMS), continued to increase in the food and beverage warehouses and production operations, providing several benefits to the manufacturers.

- Inspired by Industry 4.0, which supports collaboration between automated systems within facilities, warehouse managers in Latin America are now interested in incorporating enterprise-wide automation. The company-wide deployment will increase AGVs' accessibility to warehouse employees daily and encourage integration among other technological systems, as AGVs communicate with automated storage and retrieval systems (AS/RS) and warehouse management systems.

- The primary driving forces for the growth of the Latin America regional segment are the rising urbanization, rising e-commerce sales, and the significant presence of technology providers. These players are investing in research and development activities to offer innovative solutions to stay in the competitive market landscape.

Latin America AMH & Storage Systems Market Trends

Automated Guided Vehicle Expected to Witness Significant Market Share

- The tow/tractor/tug type of AGV is a key element in intralogistics operations. It can be used for multiple tasks with minor customizations, such as a semi-automatic pickup in warehouses, transporting raw materials to the production line, or dispatching end-products for transportation (loading and unloading). However, According to Asociacion Nacional de Productores de Autobuses, Camiones y Tractocamiones Mexico witnessed a significant decrease by 65.08 thousand production units in heavy production vehicles, including tractors.

- Further, the investments are driving the market growth in the Latin American region. For instance, In October 2020, Amazon announced a USD 100 million logistics investment in opening new warehouses in Mexico, including its first shipping centers outside the populous capital area, to offer faster deliveries. The new sites include two fulfillment centers, one near the northern city of Monterrey and another near the central city of Guadalajara. Additionally, the company is also striving to make inroads in Brazil, where it recently opened its fifth and biggest fulfillment center in the country, with 100,000 square meters. All these investments are expected to drive the utilization of AGV in the warehouse.

- The boom of automation in the medium-sized industries and laboratories that need to handle smaller loads, compared to the large-scale manufacturers, is the primary factor driving the demand for Unit load type of AGVs.

- Further, the continuously increasing R&D expenditure and the rising number of production establishments in the region are driving the demand for automation in the mid-range industries worldwide, especially in the healthcare and pharmaceutical sectors.

- Moreover, the consumers in the region seek shorter delivery times, increasing the application of AGV in warehouses and distribution centers. In, addition advancements in technology have made AGV's better and smaller; lower costs and shortage of labor in some places have fueled the growth of the market studied.

Brazil Expected to Witness Significant Growth in the Market

- Due to the outbreak of COVID-19, the need for autonomous material handling has been becoming more significant in Brazil as more demanding tasks in industrial automation increase. At the same time, companies are facing labor shortages and challenges in implementing new social distancing requirements, thereby driving the market players to invest in product innovation.

- The country is witnessing various expansions. For instance, in January 2020, Material Handling Clark Brazil relocated its corporate headquarters to the Campinas Technology Centre. The strategic step aims to future growth in the Brazilian market and builds capacity for establishing a production facility in Brazil. Campinas, about 100 kilometers north of So Paulo, is a significant industrial and commercial center with various economic activities. Also, the company is expected to meet the country's increasing demand for Clark materials handling vehicles.

- Moreover, due to the high initial cost, vendors in the market studied have been providing more flexible carousels to cater to client-specific requirements. Such innovations in terms of products are expected to boost the adoption of carousels in the region.

- The market vendors catering to carousels are driving demand. For instance, SSI Schaefer offers carousels that can perform 1,000 picks per hour and 50% higher storage density. The SSI Carousel is a suitable solution for handling small parts along with medium to slow-moving products. These include pharmaceutical products, cosmetics, electronics components, media, and food, along with standard-sized and small parts.

- The launch of automated material handling equipment and vehicles, which increases the ease of handling pallets, is also expected to positively impact the adaptability of pallets by various warehouses in the region. However, In 2020, according to Associacao Nacional dos Fabricantes de Veiculos Automotores, approximately 95 thousand trucks were produced in Brazil, a decrease of 19% compared to 2019, which could restrain the market for a considerable period.

Latin America AMH & Storage Systems Industry Overview

The Latin America Automated Material Handling and Storage Systems Market is moderately competitive, with a considerable number of regional and global players. The major vendors with a prominent share in the market are focusing on innovations, mergers and acquisitions, partnerships, and expanding customer base across foreign countries. The companies are leveraging on strategic collaborative initiatives to increase their profitability.

- July 2021 - S&H Systems expanded their automation product line with innovative Interroll crossbelt sorter and conveyor products that provide versatility for warehouse operations. The partnership with Interroll enables S&H to offer more flexible and modular products to clients, providing them with options in a customer-driven environment.

- August 2020 - Murata Machinery Ltd signed a contract with Alpen Co. Ltd to construct the first 3D robot warehousing system, alphabot. Further, alphabot will be introduced at the Alpen Komaki Distribution Center, one of Alpen Group's main distribution centers, to complement its storage capacity and reduce picking, sorting, and packaging operations by approximately 60%.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Impact of COVID-19 on the Industry Ecosystem

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Technological Advancements Aiding Market Growth

- 5.1.2 Rapid Growth in E-commerce Leading to Warehouse Automation

- 5.1.3 Industry 4.0 Investments Driving the Demand for Automated Material Handling and Storage Systems

- 5.2 Market Challenges

- 5.2.1 Unavailability for Skilled Workforce

- 5.2.2 High Capital Requirements

6 MARKET SEGMENTATION

- 6.1 By Product Type

- 6.1.1 Software

- 6.1.2 Hardware

- 6.1.3 Services

- 6.1.4 Integration

- 6.2 By Equipment Type

- 6.2.1 Mobile Robots

- 6.2.1.1 Automated Guided Vehicle(AGV)

- 6.2.1.1.1 Automated Forklift

- 6.2.1.1.2 Automated Tow/Tractor/Tug

- 6.2.1.1.3 Unit Load

- 6.2.1.1.4 Assembly Line

- 6.2.1.2 Autonomous Mobile Robots(AMR)

- 6.2.2 Automated Storage and Retrieval System(ASRS)

- 6.2.2.1 Fixed Asile

- 6.2.2.2 Carousel

- 6.2.2.3 Vertical Lift Module

- 6.2.3 Automated Conveyor

- 6.2.3.1 Belt

- 6.2.3.2 Roller

- 6.2.3.3 Pallet

- 6.2.3.4 Overhead

- 6.2.4 Palletizer

- 6.2.4.1 Conventional

- 6.2.4.2 Robotic

- 6.2.5 Sortation System

- 6.2.1 Mobile Robots

- 6.3 By End-User

- 6.3.1 Airport

- 6.3.2 Automotive

- 6.3.3 Food and Beverage

- 6.3.4 Retail/Warehousing/Distribution Centers/Logistic Centers

- 6.3.5 General Manufacturing

- 6.3.6 Pharmaceuticals

- 6.3.7 Post and Parcel

- 6.3.8 Electronics and Semiconductor Manufacturing

- 6.3.9 Other End-Users

- 6.4 By Country

- 6.4.1 Brazil

- 6.4.2 Argentina

- 6.4.3 Mexico

- 6.4.4 Colombia

- 6.4.5 Peru

- 6.4.6 Chile

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 JBT Corporation

- 7.1.2 KION Group AG

- 7.1.3 SSI SCHEFER AG

- 7.1.4 Daifuku Co. Limited

- 7.1.5 Kardex Group

- 7.1.6 Beumer Group GMBH & Co. KG

- 7.1.7 Jungheinrich AG

- 7.1.8 Murata Machinery Limited

- 7.1.9 Interroll Group

- 7.1.10 System Logistics

8 INVESTMENT ANALYSIS

9 FUTURE OF THE MARKET

02-2729-4219

+886-2-2729-4219