|

市场调查报告书

商品编码

1651023

中东和非洲 AMH 和储存系统 -市场占有率分析、行业趋势和统计、成长预测(2025-2030 年)MEA AMH and Storage Systems - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

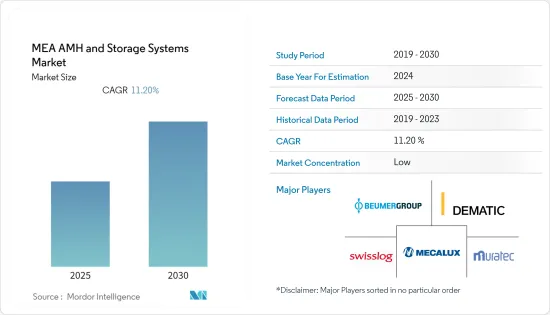

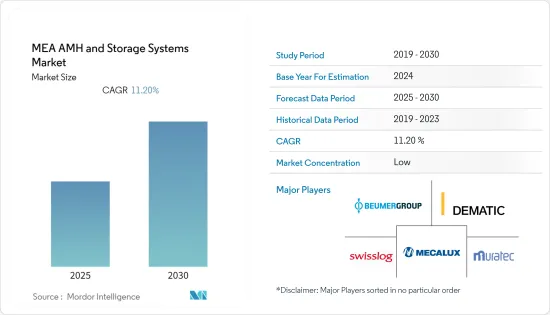

中东和非洲 AMH 和储存系统市场预计在预测期内实现 11.2% 的复合年增长率

关键亮点

- 采用技术 4.0 和物联网的国家所推动的趋势正在推动市场的发展。由机器人技术推动的工业 4.0 正在彻底改变物料输送。机器人技术在仓库和配送设施中变得越来越普遍。除了挑选和包装订单外,机器人还可以用于装卸卡车和清洁仓库地板。机器人的引入提高了工作准确性和生产效率。机器人还可以透过减少所需的人工劳动量来帮助公司节省成本。工业 4.0 也利用人工智慧来影响物料输送。人工智慧机器人可以比人类更快、更准确地挑选物品。此外,机器学习可用于在仓库内有效地安排订单。

- 物联网显着减少了 AGV/AMR 维护所需的成本和时间。 AGV 由维护人员远端监控,只有出现问题时才会派人前来,因此无需定期维护。此外,AGV/AMR 由复杂的软体操作,并可透过云端基础的应用程式进行无线控制。可以远端发送指令并轻鬆解决技术问题。因此,维护既简单又经济实惠。

- 过去几年,电子商务发展迅速。为了更好地满足消费者的需求,许多企业正在从实体零售转向网路零售。该地区的主要企业已投资技术以提供可靠的消费者服务。

- COVID-19 疫情使得不同领域采用自动化的情况变得复杂。 COVID-19 疫情带来了保持社交距离和非接触式操作的独特挑战,改变了标准操作程序。组织被迫限制劳动力以应对日益增长的需求。后疫情时代,公共场所的清洁是一项挑战。事实证明,使用 UV-C 光是解决该问题的非侵入性解决方案。然而,紫外线会损害人体皮肤。 AMR 配备 UV-C 灯,可在规定区域内独立移动。机器人可以使用行动应用程式中创建的地图上的航点进行导航。然后机器人将按照路径点继续清洁。当电池电量不足时,机器人还可以无需人工帮助寻找充电站。预计此类使用案例将为所研究市场的成长提供有利可图的机会。

- 用于物料输送(例如机械臂)和储存系统的设备非常昂贵。在受调查的市场中,自动储存和搜寻系统 (ASRS) 被发现比一般物料输送设备更高成本。自动化起重机也需要大量的基础设施来维护产品。

中东和非洲的 AMH 和储存系统市场趋势

中东和非洲电子商务的成长预计将推动市场

- 中东是全球成长最快的电子商务市场之一,也是人口最年轻的地区之一。中东地区总人口为1.08亿,其中15岁至29岁的人口占总人口的28%以上。

- 这一趋势在某些国家尤其明显,包括埃及、伊拉克、黎巴嫩、摩洛哥、阿曼、突尼斯、约旦、阿尔及利亚和沙乌地阿拉伯,这些国家约有 20% 的人口年龄在 15 至 24 岁之间。许多年轻一代正在转向电子商务和智慧型手机的使用,预计电子商务将呈现上升趋势。

- 随着网路购物购者越来越喜欢客製化、个人化的产品订单,电子商务公司发现完成复杂的手动订单变得越来越困难。客户还希望以更低的价格获得客製化产品,并与常规订单同时交付。客製化订单的日益普及迫使製造商和仓库业者提高其拣选和分类流程的效率和速度,以实现经济成功。

- 该地区完善的物流网络使南非成为电子商务行业的强大平台。此外,根据世界经济论坛的报导,南非意识到贸易的潜在未来是数位化,电子商务是其中的重要组成部分,它有可能改变非洲企业的生产、销售和消费方式。预计这也将推动电子商务和物流领域的发展。预计这些因素将推动市场成长。

- 此外,阿联酋是电子商务产业的强大平台。例如,2022 年 1 月,总部位于阿联酋的电子商务履约新兴企业Shortages 在种子资金筹措中筹集了 70 万美元,以帮助国际电子商务公司进入阿联酋和海湾合作委员会市场。该资金将用于扩张和人才招聘,这是该公司增加阿联酋仓储设施策略的一部分。

- 据杜拜经济发展部称,今年销售额预测将达到 270 亿美元左右。预计 2018 年至 2022 年期间,阿联酋的电子商务销售额将以 23% 的复合年增长率成长。

沙乌地阿拉伯有望占据主要市场占有率

- 与许多中东国家一样,沙乌地阿拉伯的经济依赖石油和石化工业。据估计,如果该国石油产量下降5%,国内生产总值(GDP)成长速度将放缓80%以上。

- 就连国际货币基金组织(IMF)在其最新的《世界经济展望》中也大幅下调了沙乌地阿拉伯的GDP预测。修改的主要原因是欧佩克协议达成后石油减产的前景。

- 近年来,由于沙乌地阿拉伯推出「2030愿景」计画以减少该国对石油的依赖,该国在电子商务和物流领域的需求大幅成长。该计画包含九点策略,包括简化流程、自由化市场、私有化、加强基础设施、建立新的自由经济区、实施治理和监管改革,以最大限度地发挥其发展成为中东地区物流枢纽的战略优势。

- 随着众多製药公司预计进入沙乌地阿拉伯市场,该国有望成为製药业的热点。这可能会增加对包装解决方案的需求。预计这将自然导致输送机和堆垛机的更广泛采用。

- 此外,沙乌地阿拉伯是世界主要旅游目的地之一,吸引了许多外国游客。该国平均空中交通量的增加正在推动机场终端用户领域对 AMH 设备的需求。全球石油市场放缓和生产限制可能会减少对航空领域的投资,但预计未来几年将出现明显復苏。根据沙乌地阿拉伯民航局估计,旅游业对沙乌地阿拉伯GDP的贡献今年预计将达到2,230亿沙特里亚尔(约593.8亿美元),到2032年将持续成长至6,350亿沙特里亚尔(约1,688.9亿美元)。

中东和非洲 AMH 和储存系统产业概况

中东和非洲 AMH 和储存系统市场高度分散,主要参与者包括 Swisslog Holdings AG、Murata Machinery USA, Inc.、Beumer Group、Dematic Group 和 Mecalux SA。市场参与企业正在采取联盟、合作、併购和收购等策略来增强其产品供应并获得可持续的竞争优势。

2022年3月,SSI Schaefer与Nahdi医疗公司合作,宣布启动沙乌地阿拉伯首个自动化製药厂。该设施占地平方公尺,配备温控物流、灵活的配送中心和自动化订单处理功能,其技术和系统支援 Nahdi 确保医疗安全,符合最新的国际标准和 SFDA 最佳实践法规。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概况

- 产业价值链分析

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 竞争对手之间的竞争

- 替代品的威胁

- 产业价值链分析

- COVID-19 市场影响评估

第五章 市场动态

- 市场驱动因素

- 电子商务产业成熟

- 市场限制

- 高成本

- 技术简介

第六章 市场细分

- 设施

- 自动导引运输车系统(AGV系统)

- 单元货载运输车

- 牵引车

- 托盘车

- 组装车辆

- 堆高机

- 夹车

- 其他 AGV 系统

- 自动储存和搜寻系统 (AS/RS)

- 单元货载自动仓储系统

- 迷你公路自动仓储系统

- 旋转式 AS/RS

- 机器人自动仓储系统

- 隧道式系统

- 其他自动化立体仓库

- 输送机/分类系统

- 腰带

- 调色盘

- 拧紧

- 开卖

- 新月

- 滚筒

- 其他输送机和分类系统

- 机器人系统

- 码垛

- 拾取和放置服务

- 装箱

- 其他机器人系统

- 自动导引运输车系统(AGV系统)

- 最终用户应用程式

- 车

- 零售

- 运输和物流

- 医疗与生命科学

- 製造业

- 活力

- 其他的

- 业务类型

- 包装

- 组装

- 储存和处理

- 分配

- 运输

- 其他业务

- 国家

- 阿拉伯聯合大公国

- 沙乌地阿拉伯

- 南非

- 土耳其

- 以色列

- 其他国家

第七章 竞争格局

- 公司简介

- Swisslog Holdings AG

- Murata Machinery USA, Inc.

- Beumer Group

- Dematic Group

- Mecalux SA

- Kardex AG

- Toyota Material Handling

- Coesia Middle East DMCC(Flexlink)

- SSI Schaefer

- PCM ME(FZC)

第八章投资分析

第九章:市场的未来

The MEA AMH and Storage Systems Market is expected to register a CAGR of 11.2% during the forecast period.

Key Highlights

- The market is driven by trends caused by countries adopting technology 4.0 and IoT. Using robotics, industry 4.0 is revolutionizing material handling. In warehouses and distribution facilities, robotics has become more prevalent. In addition to picking and packaging orders, robots can be employed for loading and unloading trucks, and even cleaning the warehouse floor. Workplace accuracy and productivity can both be enhanced by robotics. Robots can also help companies save money by reducing the amount of manual work necessary. Industry 4.0 also has an impact on material handling using artificial intelligence. AI-powered robots are faster and more precise at picking orders than people. Additionally, they can use machine learning to route orders efficiently through the warehouse.

- IoT significantly reduces the cost and time needed for AGV/AMR maintenance. AGVs can be remotely monitored by maintenance personnel, who are only called in when problems emerge, eliminating the need for routine maintenance visits. Additionally, because the devices are operated by sophisticated software, cloud-based apps can control them wirelessly. Instructions can be transmitted remotely, and technical problems are easily fixed. As a result, maintenance is simple and affordable.

- E-commerce has been growing rapidly over the last few years. Many companies have moved from physical retail to online to better cater to consumer requirements. Major companies in the region have invested in technology to provide reliable consumer service.

- The COVID-19 pandemic complicated the situation of automation adoption in various sectors. It changed the standard operating procedure by bringing in unique challenges of social distancing and contactless operation. Organizations were forced to limit their workforce and deal with the increasing demand. In the post-pandemic era, cleaning public spaces is a difficult problem. The usage of UV-C light has proven to be a non-intrusive solution to this problem. However, UV light can harm a person's skin. AMRs with UV-C lamps installed can move independently through a defined region. Robots can navigate maps made by mobile apps using waypoints. The robots then proceed to clean the area while following the waypoints. When the battery is low, the robots also find the charging station without human assistance. Such use cases are anticipated to offer lucrative opportunities for the growth of the studied market.

- The equipment used for material handling (such as robotic arms) and storage systems has been highly cost-intensive. Automated storage and retrieval systems (ASRS) have been found to cost higher than the typical material-handling equipment in the market studied. Automated cranes also need a high amount of infrastructure to sustain the product.

MEA Automated Material Handling and Storage Systems Market Trends

Growing E-commerce in Middle East and Africa is Expected to Drive the Market

- The Middle East is one of the fastest-growing e-commerce markets globally, with one of the youngest populations. Out of 108 million people, more than 28% of the population in the Middle East is between the ages of 15 and 29.

- This is more prominent in specific countries, including Egypt, Iraq, Lebanon, Morocco, Oman, Tunisia, Jordan, Algeria, and Saudi Arabia, where around 20% of the total population is between the ages of 15 and 24 years. Most younger generations are shifting towards e-commerce and smartphone usage, due to which the upward trend of e-commerce is expected.

- As online shoppers' preferences for customized and personalized product orders grow, e-commerce enterprises find it increasingly challenging to fulfil complex orders using manual processes. Customers also want these customized purchases delivered at low prices and simultaneously with standard orders. Because of the growing popularity of customized orders, manufacturers and warehouse operators have been compelled to improve the efficiency and speed of their picking and sorting processes to achieve economic success.

- With well-built logistics networks in the region, South Africa is an encouraging platform for the e-commerce industry. Moreover, according to the World Economic Forum, South Africa has realized that the potential future of trade is digital, and a large component of this is e-commerce, which has the potential to transform how businesses in Africa produce, sell, and consume goods. This is also expected to drive the e-commerce and logistics sector. Such factors are expected to drive the market's growth.

- Furthermore, United Arab Emirates is an encouraging platform for the e-commerce industry. For instance, in January 2022, the UAE-based e-commerce fulfillment start-up, Shortages, raised USD 700,000 in a seed funding round to allow international e-commerce companies access the UAE and GCC markets. The raised funds would be used for expansion and recruitment as part of the company's strategy to establish more warehouse facilities across the UAE.

- According to DED (Dubai), In the current year, the forecasted value of e-commerce sales in the United Arab Emirates (UAE) was approximately USD 27 billion. E-commerce sales in the UAE were estimated to grow by an average of 23% per year between 2018 and 2022.

Saudi Arabia is Expected to Hold Major Market Share

- Like most Middle Eastern countries, Saudi Arabia's economy also typically depends on the oil and petrochemical industry. It is estimated that even a 5% reduction in oil production in the country may decelerate the pace of gross domestic product (GDP) by over 80%.

- In its World Economic Outlook update, even the International Monitory Fund (IMF) has drastically slashed its forecast for Saudi Arabia's GDP. The main argument behind that revision is the anticipated prolongation of the expurgated oil production following OPEC's agreement.

- In recent years, owing to Saudi Vision 2030, the plan launched recently to reduce the country's dependence on oil, the e-commerce and logistics sectors have witnessed a significant rise in demand. The plan encompasses a nine-point strategy of process streamlining, market liberalization, privatization, infrastructure enhancement, the establishment of new free economic zones, and governance and regulatory reforms to maximize its strategic advantage to evolve into the logistics hub of the Middle Eastern region.

- The country is expected to be a hotspot for pharmaceutical industries, as many players are expected to enter the Saudi Arabian market. This, in turn, will likely increase the need for packaging solutions. This is expected to automatically contribute toward the adoption of conveyors and palletizers.

- Moreover, the country is one of the major tourist destinations in the world and is attracting many foreign tourists. This increase in the average air traffic in the country is propelling the demand for AMH equipment in the airport end-user segment. Although the slowdown of the global oil market and restrictions on production are likely to reduce investments in the aviation sector, considerable recovery is expected in the next few years. According to the General Authority of Civil Aviation, tourism's contribution to Saudi Arabia's GDP was expected to reach SAR 223 billion (~USD 59.38 billion) by this year, and it anticipated that the contribution of the tourism industry to the Saudi economy would continue to increase to reach about SAR 635 billion (~USD 168.89 billion) by 2032.

MEA Automated Material Handling and Storage Systems Industry Overview

The Middle East and Africa Automated Material Handling and Storage Systems Market is highly fragmented with the presence of major players like Swisslog Holdings AG, Murata Machinery USA, Inc., Beumer Group, Dematic Group, and Mecalux S.A. Players in the market are adopting strategies such as partnerships, collaborations, mergers, and acquisitions to enhance their product offerings and gain sustainable competitive advantage.

In March 2022, SSI Schaefer, in cooperation with Nahdi Medical Company, announced the implementation of Saudi Arabia's first automated pharmaceutical facility. Built on an area of 250,000 sqm, the facility features temperature-controlled logistics, a flexible distribution center, and automated order fulfilment using technology and systems to support Nahdi to guarantee medical security following the latest international standards & SFDA best practice regulations.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers

- 4.3.3 Threat of New Entrants

- 4.3.4 Intensity of Competitive Rivalry

- 4.3.5 Threat of Substitute Products

- 4.4 Industry Value Chain Analysis

- 4.5 Assessment of the Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Established e-commerce Industry

- 5.2 Market Restraints

- 5.2.1 High Cost of Infrastructure set up

- 5.3 Technology Snapshot

6 MARKET SEGMENTATION

- 6.1 Equipment

- 6.1.1 Automated Guided Vehicle Systems (AGV Systems)

- 6.1.1.1 Unit Load Carriers

- 6.1.1.2 Tow Vehicles

- 6.1.1.3 Pallet Trucks

- 6.1.1.4 Assembly Line Vehicles

- 6.1.1.5 Fork Lift Vehicles

- 6.1.1.6 Clamp Vehicles

- 6.1.1.7 Other AGV Systems

- 6.1.2 Automated Storage & Retrieval Systems (AS/RS)

- 6.1.2.1 Unit Load AS/RS

- 6.1.2.2 Mini Load AS/RS

- 6.1.2.3 Carousel Type AS/RS

- 6.1.2.4 Robotic AS/RS

- 6.1.2.5 Tunnel Style Systems

- 6.1.2.6 Other AS/RS

- 6.1.3 Conveyor and Sortation Systems

- 6.1.3.1 Belt

- 6.1.3.2 Pallet

- 6.1.3.3 Screw

- 6.1.3.4 Overhead

- 6.1.3.5 Crescent

- 6.1.3.6 Roller

- 6.1.3.7 Other Conveyor and Sortation Systems

- 6.1.4 Robotic Systems

- 6.1.4.1 Palletizing

- 6.1.4.2 Pick & Place Service

- 6.1.4.3 Case Packing

- 6.1.4.4 Other Robotic Systems

- 6.1.1 Automated Guided Vehicle Systems (AGV Systems)

- 6.2 End-user Application

- 6.2.1 Automotive

- 6.2.2 Retail

- 6.2.3 Transportation & Logistics

- 6.2.4 Healthcare & Lifesciences

- 6.2.5 Manufacturing

- 6.2.6 Energy

- 6.2.7 Other End-user Applications

- 6.3 Type of Operation

- 6.3.1 Packaging

- 6.3.2 Assembly

- 6.3.3 Storage & Handling

- 6.3.4 Distribution

- 6.3.5 Transportation

- 6.3.6 Other Types of Operation

- 6.4 Country

- 6.4.1 UAE

- 6.4.2 Saudi Arabia

- 6.4.3 South Africa

- 6.4.4 Turkey

- 6.4.5 Israel

- 6.4.6 Other Countries

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Swisslog Holdings AG

- 7.1.2 Murata Machinery USA, Inc.

- 7.1.3 Beumer Group

- 7.1.4 Dematic Group

- 7.1.5 Mecalux S.A

- 7.1.6 Kardex AG

- 7.1.7 Toyota Material Handling

- 7.1.8 Coesia Middle East DMCC (Flexlink)

- 7.1.9 SSI Schaefer

- 7.1.10 PCM ME (FZC)