|

市场调查报告书

商品编码

1629763

欧洲冷冻食品包装:市场占有率分析、产业趋势、成长预测(2025-2030)Europe Frozen Food Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

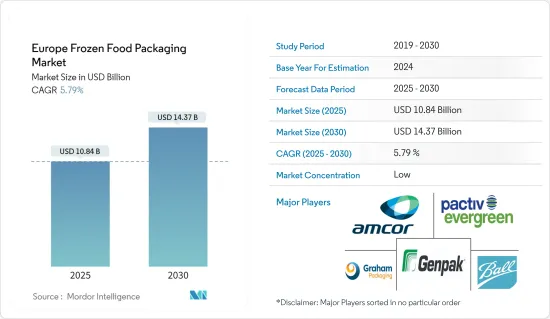

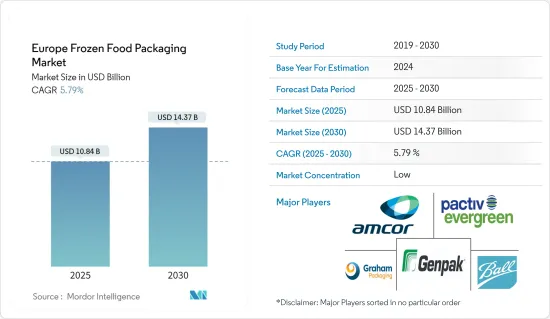

欧洲冷冻食品包装市场规模预计到2025年为108.4亿美元,预计2030年将达到143.7亿美元,预测期内(2025-2030年)复合年增长率为5.79%。

快速的都市化和快节奏的生活方式正在将消费者的偏好转向冷冻食品,冷冻食品的准备时间比传统的家常饭菜要少。

主要亮点

- 消费者对食品品质的期望不断提高,推动了对冷冻食品包装的需求。消费者对产品品质的评价也是推动市场成长的因素。此外,由于经济和生活方式的变化,欧洲对冷冻食品包装的需求正在增加。预计市场在预测期内将出现高速成长。

- 最近也开发了新的包装技术,使冷冻食品包装更加实用和安全。这些技术包括智慧包装、活性包装和工程科学。为了减少环境污染并遵守政府法规,企业正在关注环保包装,采用可回收、回收和再利用的可生物分解性包装材料。

- 此外,便利性是推动全球冷冻食品消费成长的主要因素之一。因此,领先的公司正在推出新的类型和成分,以满足消费者的区域偏好。消费者对便利产品日益增长的偏好推动了对冷冻产品的需求增加,因为与从头开始烹饪相比,冷冻产品更容易准备并节省时间。

- 此外,由于工作人群日益忙碌的生活方式,冷冻休閒食品市场正在迅速扩大,这推动了冷冻零食市场的发展,并带动了对冷冻食品包装市场的需求。

- 然而,由于欧盟委员会等机构对食品包装类型和接触材料的严格规定,预计欧洲市场仍将受到严格监管。冷冻食品包装需要强大的解决方案来防止污染、水分进入和温度波动,以维持整个供应链的食品品质和安全。

欧洲冷冻食品包装市场趋势

塑胶占据很大的市场占有率

- 在便利性、保存期限和成本效益的推动下,欧洲冷冻食品产业对塑胶包装的需求急剧增加。随着消费者倾向于即食食品和冷冻零食,塑胶包装脱颖而出。其气密性显着延长了冷冻食品必需品的保质期。防止潮湿、冷冻和氧化对于保持风味、质地和营养价值至关重要。柔性塑胶薄膜、袋子和小袋在欧洲越来越受欢迎,因为它们重量轻、易于使用并有助于保持食品品质。

- 消费者生活方式的改变进一步推动了欧洲冷冻食品市场的成长。随着现代生活的喧嚣,许多欧洲人为了方便和延长保质期而倾向于冷冻食品。单份塑胶包装的兴起,支持份量控制并最大限度地减少食物浪费,这与欧洲消费者日益增强的环保意识一致。此外,电子商务和线上杂货购物场景在欧洲蓬勃发展,增加了对坚固耐用包装的需求,以确保冷冻产品在运输过程中的完整性。

- 然而,随着塑胶的好处变得更加明显,环境问题日益影响欧洲的需求模式。作为回应,许多欧洲国家正在出台法规来遏制塑胶废弃物并支持永续包装。欧盟的永续性承诺不仅仅是一个承诺,它也是刺激包装领域创新的催化剂。其结果是可回收塑料、生物分解性塑胶,甚至植物来源塑料等进步。随着消费者环保意识的增强,製造商正在探索替代材料。它的目的是什么?满足监管义务和消费者需求,同时保持塑胶在冷冻食品包装中提供的基本功能和品质。

- 欧洲千禧世代正在推动冷冻食品包装的需求,他们更喜欢单份和外带的选择。千禧世代重视便利、份量控制和快餐,因此塑胶包装至关重要。一次性容器和软包装袋满足了这些需求,同时保持了食品的新鲜度和安全性,从而推动了冷冻食品包装中对塑胶的需求。

- 德国冷冻食品研究所称,德国冷冻食品消费量呈上升趋势,零售额预计将从 2020 年的 101.7 亿美元增至 2023 年的 125.9 亿美元。这一趋势反映了整个欧洲的转变,冷冻食品成为忙碌消费者的主食。销售量的增加直接推动了对塑胶包装的需求,这对于保持品质和延长保质期至关重要。

- 随着冷冻食品需求的成长,製造商开始转向塑胶解决方案,例如多层薄膜、托盘和袋子,因为它们具有多功能性和成本效益。为了响应欧洲对环境责任的关注,可回收和永续包装的创新也在不断涌现。

袋包装类型推动市场成长

- 对气密密封需求不断增长的背后是对具有阻隔性的袋子的需求,以长期保持含香气产品的品质。此外,由于对可重新密封和可重新闭合包装的需求,自封袋在所研究的市场中变得越来越普遍。该公司选择袋子是因为其节省空间的包装形式,推动了该细分市场在研究市场中的成长。此外,塑胶袋提供的柔韧性、抗撕裂性、透明度和防潮性等特性预计将进一步加速市场成长。

- 此外,我们的行业同行也致力于推出由 50% 再生塑胶製成的新型优质零嘴零食包装。例如,2024 年 3 月,百事公司为其英国和爱尔兰的 Sunbites 零食品牌推出由 50% 再生塑胶製成的新型优质零食包装,英力士在其中发挥了关键作用。该包装采用先进的回收工艺製造,符合欧盟食品接触包装的严格监管标准。

- 为了实现这一里程碑,整个柔性食品包装供应链的各个合作伙伴共同努力。 GreenDot 提供消费性塑胶包装废弃物,透过 Plastic Energy 的技术将其转化为 TACOIL。英力士公司使用这种热解油生产再生丙烯和原生品质的再生聚丙烯树脂。 IRPAST 使用这种树脂生产由 50% 回收材料製成的包装薄膜,Amcor 为百事可乐公司印刷这些薄膜。此次伙伴关係符合百事公司到 2030 年在包装中消除化石塑胶的承诺。

- 此外,线上杂货购物的增加正在推动对包装解决方案的需求,例如袋子,以在运输过程中保持冷冻产品的新鲜度。消费者对方便餐点准备的偏好推动了对冷冻食品的需求增加,包括家常小菜、蔬菜、水果和甜点。

- 袋装形式可以精确控製冷冻零食的份量,促进消费管理并最大限度地减少食物浪费。根据加拿大农业和食品部统计,2023年英国零嘴零食零售额最高,为143.729亿美元,其次是法国、义大利和其他欧洲国家国家。

欧洲冷冻食品包装产业概况

由于冷冻食品的便利性和多功能性,越来越多的消费者喜欢冷冻食品,这推动了该地区的市场成长。创新的包装形式和包装材料还可以改善消费者体验并有助于最大限度地减少废弃物。

欧洲冷冻食品包装市场较为分散,由几家大型企业组成,包括 Genpack LLC、Graham Packaging Company、Ball Corporation、Pactiv LLC 和 Amcor Group。该地区的公司也致力于推出用于冷冻食品的永续包装材料。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 产业价值链分析

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买方议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间敌对关係的强度

- 全球冷冻食品包装市场概况

第五章市场动态

- 市场驱动因素

- 消费者对便利包装的需求不断成长

- 欧洲可支配所得的增加与消费行为的变化

- 市场限制因素

- 透过政府监管和干预来限制市场

第六章 市场细分

- 依材料类型

- 玻璃

- 纸

- 金属

- 塑胶

- 其他的

- 依产品类型

- 包包

- 盒子

- 标籤和杯子

- 托盘

- 小袋

- 其他产品类型

- 依食物类型

- 准备好的饭菜

- 蔬菜和水果

- 肉

- 海鲜

- 烘焙点心

- 其他食品

- 按国家/地区

- 英国

- 德国

- 法国

- 西班牙

- 义大利

第七章 竞争格局

- 公司简介

- Pactiv LLC

- Amcor Group

- Genpak LLC

- Graham Packaging Company, Inc.

- Ball Corporation Inc

- Crown Holdings

- Tetra Pak International

- Placon Corporation

- Toyo Seikan Group Holdings, Ltd.

- WestRock Company

- Sealed Air Corporation

- Berry Global Inc.

第八章投资分析

第9章市场的未来

The Europe Frozen Food Packaging Market size is estimated at USD 10.84 billion in 2025, and is expected to reach USD 14.37 billion by 2030, at a CAGR of 5.79% during the forecast period (2025-2030).

The rapid growth of urbanization and fast-paced lifestyles have shifted consumers' preferences toward frozen food products, which require less time for cooking than traditional home-cooked meals.

Key Highlights

- The rise in consumer expectations related to food quality has propelled the demand for frozen food packaging. Also, consumer appreciation of the product quality is another factor driving the market growth. Additionally, with changes in the economy and lifestyles, there is an increased demand for frozen food packaging in Europe. The market is expected to grow lucratively during the forecast period.

- New packaging technologies have also developed recently, making packaging for frozen food products more practical and secure. These technologies include intelligent packaging, active packaging, and engineering science. To reduce environmental pollution and comply with government regulations, companies focus on eco-friendly packaging by employing biodegradable packaging materials that can be recycled, regenerated, and reused.

- Furthermore, convenience is one of the primary factors driving the global increase in frozen food consumption. As a result, leading players are introducing new types and ingredients to cater to consumers' regional tastes. The growing consumer preference for convenience products fuels the increasing demand for frozen products due to their ease of preparation and time savings compared to cooking from scratch.

- Moreover, the frozen snacks food market is expanding rapidly due to the increasing volume of the hectic lifestyle of the working population, which is boosting the frozen snacks market and propelling the demand for the frozen food packaging market.

- However, the European market is anticipated to remain highly regulated, owing to stringent regulations regarding food packaging types and contact materials by agencies such as the European Commission. Frozen food packaging requires robust solutions to maintain food quality and safety across the supply chain by preventing contamination, moisture intrusion, and temperature fluctuations.

Europe Frozen Food Packaging Market Trends

Plastic to Hold Significant Market Share

- In Europe, a surge in demand for plastic packaging in the frozen food sector is evident, spurred by convenience, preservation, and cost-effectiveness. Plastic packaging stands out as consumers gravitate towards ready-to-eat meals and frozen snacks. Its airtight seal capability significantly extends product shelf life, a vital feature in frozen food. Safeguarding against moisture, freezer burn, and oxidation is paramount to preserving taste, texture, and nutritional value. In Europe, flexible plastic films, bags, and pouches have gained traction, offering food quality preservation while being lightweight and user-friendly.

- Changing consumer lifestyles have further propelled the growth of Europe's frozen food market. With the hustle and bustle of modern life, many Europeans are gravitating towards frozen foods for convenience and extended shelf life. The rise of single-serve plastic packaging caters to portion control and minimizes food waste, aligning with the heightened environmental awareness among European consumers. Moreover, the burgeoning e-commerce and online grocery shopping scene in Europe amplifies the demand for robust, durable packaging, ensuring the integrity of frozen products during transit.

- Yet, as the advantages of plastic become more pronounced, environmental concerns increasingly shape Europe's demand landscape. In response, numerous European nations are rolling out regulations to curb plastic waste and champion sustainable packaging. The EU's sustainability pledge is not just a commitment but a catalyst, spurring innovations in the packaging domain. This has birthed advancements like recyclable, biodegradable, and even plant-based plastics. With a growing environmental consciousness among consumers, manufacturers are searching for alternative materials. Their goal? To align with regulatory mandates and consumer desires, all while preserving the essential functionality and quality plastic offers in frozen food packaging.

- Europe's Millennials drive demand for frozen food packaging, favoring single-serving and on-the-go options. They value convenience, portion control, and quick meals, making plastic packaging essential. Single-serve containers and flexible pouches meet these needs while keeping food fresh and secure, fueling demand for plastic in frozen food packaging.

- According to the German Frozen Food Institute, Germany's frozen food consumption is rising, with retail revenue growing from USD 10.17 billion in 2020 to USD 12.59 billion in 2023. This trend reflects a broader European shift, where frozen foods are staples for busy consumers. Increased sales directly boost demand for plastic packaging, which is crucial for preserving quality and extending shelf life.

- As frozen food demand grows, manufacturers rely on plastic solutions like multi-layer films, trays, and pouches for their versatility and cost-effectiveness. Innovations in recyclable and sustainable packaging are also emerging to address Europe's focus on environmental responsibility.

Bags Packaging Type to Drive the Market Growth

- The rising demand for airtight sealing is driven by the need for bags with high barrier properties, which retain product quality, including aroma, for a prolonged period. Furthermore, zippered bags are becoming more and more common in the market under study, driven by the demand for packaging that can be resealed and reclosed. Due to space-saving packaging formats, businesses choose bags, boosting the segment's growth in the market under study. Moreover, properties such as flexibility, tear-resistance, transparency, and moisture protection offered by plastic bags are expected to accelerate the market's growth further.

- Additionally, in line with the same players are focusing on launching new, premium-quality snack packaging containing 50% recycled plastic. For instance, in March 2024, INEOS played a pivotal role in launching new, premium quality snack packaging containing 50% recycled plastic, which PepsiCo introduced for their Sunbites snack brand in the UK and Ireland. This packaging, made through advanced recycling processes, meets strict EU regulatory standards for food contact packaging.

- Various partners collaborated across the flexible food packaging supply chain to achieve this milestone. GreenDot provided post-consumer plastic packaging waste, which was converted into TACOIL by Plastic Energy's technology. INEOS utilized this pyrolysis oil to produce recycled propylene and virgin-quality recycled polypropylene resin. IRPLAST used this resin to create packaging films with 50% recycled materials, while Amcor printed these films for PepsiCo. This partnership aligns with PepsiCo's commitment to eliminating fossil-based plastic in its packaging by 2030.

- Moreover, the growth in online grocery shopping has increased demand for packaging solutions such as bags that maintain frozen product freshness during transportation. Consumer preference for convenient meal preparation has driven increased demand for frozen foods, including ready meals, vegetables, fruits, and desserts.

- The bag format enables precise portion control for frozen snacks, facilitating consumption management and minimizing food waste. According to Agriculture and Agri-Food Canada, the retail sales of snacks in the United Kingdom in 2023 took first position with USD 14,372.9 million sales, followed by France, Italy, and many other countries across Europe.

Europe Frozen Food Packaging Industry Overview

Rising consumer preference for frozen foods due to their convenience and versatility is driving the market growth in the region. Innovative packaging formats and materials are also helping to improve consumer experience and minimize waste.

The European frozen Food packaging market is fragmented and consists of several major players, such as Genpack LLC, Graham Packaging Company, Ball Corporation, Pactiv LLC, and Amcor Group. Players in the region are also focusing on launching sustainable packaging materials for frozen food.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Force Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Overview of the Global Frozen Food Packaging Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Demand for Convenience Packaging by Consumers

- 5.1.2 Increase in Disposable Income and Changing Consumer Behavior in Europe

- 5.2 Market Restraint

- 5.2.1 Government Regulations and Interventions limit the Market

6 MARKET SEGMENTATION

- 6.1 By Material Type

- 6.1.1 Glass

- 6.1.2 Paper

- 6.1.3 Metal

- 6.1.4 Plastic

- 6.1.5 Others Material Type

- 6.2 By Product Type

- 6.2.1 Bags

- 6.2.2 Boxes

- 6.2.3 Tubs and Cups

- 6.2.4 Trays

- 6.2.5 Pouches

- 6.2.6 Other Product Types

- 6.3 By Type of Food

- 6.3.1 Readymade Meals

- 6.3.2 Fruits and Vegetables

- 6.3.3 Meat

- 6.3.4 Sea Food

- 6.3.5 Baked Goods

- 6.3.6 Others Food Types

- 6.4 By Country

- 6.4.1 United Kingdom

- 6.4.2 Germany

- 6.4.3 France

- 6.4.4 Spain

- 6.4.5 Italy

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Pactiv LLC

- 7.1.2 Amcor Group

- 7.1.3 Genpak LLC

- 7.1.4 Graham Packaging Company, Inc.

- 7.1.5 Ball Corporation Inc

- 7.1.6 Crown Holdings

- 7.1.7 Tetra Pak International

- 7.1.8 Placon Corporation

- 7.1.9 Toyo Seikan Group Holdings, Ltd.

- 7.1.10 WestRock Company

- 7.1.11 Sealed Air Corporation

- 7.1.12 Berry Global Inc.