|

市场调查报告书

商品编码

1629805

堆垛机:市场占有率分析、产业趋势、成长预测(2025-2030)Palletizer - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

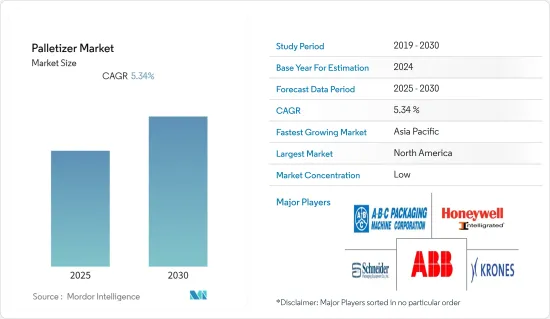

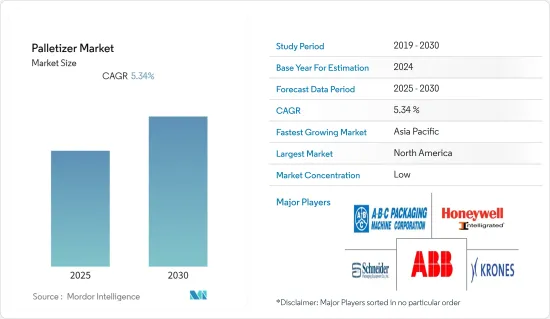

堆垛机市场预计在预测期内复合年增长率为 5.34%

主要亮点

- >堆垛机是自动化物料输送系统中最重要的设备之一。根据您的需求,传统堆垛机或机器人堆垛机用于自动化仓库、配送和製造设施中的托盘建造过程。

- 2011 年 FDA 食品安全现代化法案 (FSMA) 的颁布更加重视防止美国食品供应中的污染。 SCARA机器人堆垛机机常用于食品加工。它们的低成本、占地面积小和高吞吐率对寻求效率的製造商具有吸引力。 SCARA 机器人堆垛机通常比正交堆垛机更快。

- 製药业在堆垛机产业中也发挥着重要作用。全自动堆垛机用于无人值守的药品生产。在欧洲和亚太製药业的支持下,该产业正在蓬勃发展。在中东和非洲,人们对清真认证美容产品的兴趣和需求不断增加,推动了化妆品产业堆垛机的成长。在亚太地区,韩国美容趋势以其异想天开和创新的包装推动了个人护理领域的堆垛机成长。

- 有

- 。

- 根据包装器材工业协会 (PMMI) 预测,到 2024 年,美洲包装器材市场预计价值 161 亿美元。

- 预计以义大利和德国为首的欧洲也将温和成长。

- 。

- 根据德国联邦统计局统计,约250家企业(主要是中型企业)生产了价值约73亿欧元的包装器材,与前一年同期比较成长了2%。事实证明,义大利政府的工业 4.0 激励计画也支持义大利包装器材和堆垛机的发展。

- 甚至在新冠肺炎 (COVID-19) 爆发之前,仓库和物流中心(DC) 中机器人、自动化物料输送设备、人工智慧和其他先进技术的采用就已经推动了数位商务所产生的不断变化的需求。有限且日益昂贵的劳动力资源满足并同时管理高速营运的需求正在上升,从而推动了受访市场的成长。

堆垛机市场趋势

食品饮料产业具有成长潜力

- 食品和饮料行业一直是堆垛机市场收益增加的重要贡献者。随着零售商之间的竞争持续加剧以及政府监管变得更加严格,零售商的需求持续增加。因此,为了在食品和饮料行业取得成功,对码垛机器人的需求比以往任何时候都更大。

- 堆垛机成本低、占地面积小、吞吐量高,最适合食品和饮料包装。码垛系统是包装线最终流程中的有用元素,对于製药、化学品、个人护理、化妆品等任何行业来说都是一项重要操作。

- 由于设施内的空间有限,中央码垛概念是最实用的选择。该系统的要求包括中性的正销货成本回报、减少生产线周围的堆高机流量、提高工作品质(尤其是人体工学)以及实施稳健可靠的系统。

- 考虑到与食品工业相关的全球趋势和技术创新,选择性顺应组装机械臂(SCARA)的引入不仅在製造业将有助于降低能源成本,而且在不久的将来,仅包装器材也将有帮助于降低能源成本。

- 乳製品加工商表达了改进加工设备的愿望。如果实施得当,堆迭自动化可以比人类工人所需的劳动密集、重复性动作更有效率。根据 PMMI 报告,三分之二的製造地点已经安装、计划安装或正在其码垛业务中添加码垛机器人。

- 此外,随着COVID-19大流行的爆发,快速消费品产业的各个製造工厂面临越来越大的加速生产的压力。因此,市场在预测期内可能会成长。

北美占据主要市场占有率

- 美国是采用新型创新码垛解决方案的最大、最发达的市场之一。拥有大量港口交通、电子商务活性化和关键製造指标的强劲经济有望带来显着的製造业成长并推动该国对码垛解决方案的需求。

- 零售、汽车、食品饮料和製药等行业是该国码垛解决方案的最大需求来源。在 COVID-19 之前,预计到 2025 年,美国瓦楞纸出货量每年将超过 4,700 亿平方英尺。在食品和饮料行业的产品运输中,需要保持具有成本效益的运输 SKU,导致各种规模的组织广泛采用堆迭解决方案。

- 大流行后,由于对更安全、更卫生的实体产品的需求增加,这一数字预计将超过估计。

- 电商数据显示,截至2020年6月的财年,国内电商零售额成长25%,反映出消费者向电商的转变。随着电商产业的成长,电商产业在该国的实际份额预计将高于先前的预测,从而导致各仓库和配送中心对堆垛机的需求大幅增加。

- 在美国,我们看到工业环境中对自动化和机器人(包括机器人堆垛机)的需求。为此,在美国推出了多种产品。例如,2021年9月,Quest Industrial将在PACK EXPO 2021上推出机器人堆垛机Box Bot-QB300系列。 Box Bot 是一款节省空间的机器人堆垛机,占地面积小,让操作员能够快速轻鬆地设计和製造从袋子到盒子和其他产品类型的精确托盘图案。

- 美国国际贸易委员会资料显示,2020年1月至8月美国商品进口量年减11%,但工业机器人进口成长5%。

堆垛机银行业概况

堆垛机市场分散且竞争激烈。主要参与企业包括 ABC Packaging Machine Corp、ABB Ltd、Honeywell Intelligerated、Krones AG 和 Schneider Packaging Equipment Co.。维持市场占有率的持续竞争、国内消费和快速都市化等因素正在吸引许多新参与企业。我们将介绍一些最近的市场发展趋势。

- 2021 年 8 月 - Geek+ 宣布推出与智慧仓库管理工具供应商 WSR Solutions 合作开发的智慧混合箱堆迭新解决方案。此解决方案将Geek+的自主移动机器人与WSR的智慧码垛演算法结合,帮助仓库业者以安全、高效、灵活的方式系统地处理多个出库订单的处理。

- 2020 年 10 月 - Robotiq Inc. 宣布推出新的机器人堆迭解决方案。这种特定于应用的技术由完全连接、即插即用的软体和具有预选功能的硬体组成。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买家/消费者的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间的敌对关係

- 产业价值链分析

- COVID-19 对市场的影响

第五章市场动态

- 市场驱动因素

- 市场限制因素

第六章 市场细分

- 副产品

- 传统堆垛机

- 高位堆垛机

- 低位堆垛机

- 机器人堆垛机

- 传统堆垛机

- 按行业分类

- 饮食

- 药品

- 个人护理和化妆品

- 化学品

- 由其他行业

- 地区

- 北美洲

- 美国

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 欧洲其他地区

- 亚太地区

- 中国

- 日本

- 印度

- 其他亚太地区

- 拉丁美洲

- 巴西

- 阿根廷

- 墨西哥

- 其他拉丁美洲

- 中东/非洲

- 阿拉伯聯合大公国

- 沙乌地阿拉伯

- 南非

- 其他中东/非洲

- 北美洲

第七章 竞争格局

- 公司简介

- ABC Packaging Machine Corp.

- ABB Ltd.

- BEUMER Group GmbH & Co. KG

- Honeywell Intelligrated

- KION Group AG

- Krones AG

- Schneider Packaging Equipment Co. Inc.

- Sidel

- YASKAWA Electric Corp.

- Barry-Wehmiller Companies, Inc.

- Arrowhead Systems Inc.

第八章投资分析

第九章 市场机会及未来趋势

简介目录

Product Code: 57245

The Palletizer Market is expected to register a CAGR of 5.34% during the forecast period.

Key Highlights

- >

- Palletizer is one of the most significant equipments among the automated material handling systems. Depending on the need, conventional palletizers or robotic palletizers are used to automate the pallet building process in a warehouse, distribution, or manufacturing facility. Depending upon the palletizer, many different technologies could also be employed to help the manufacturer make the perfect pallet.

- With the implementation of the FDA Food Safety Modernization Act (FSMA) in 2011, increased focus has been placed on preventing contamination in the US food supply. SCARA robotic palletizers are typically used for food processing. Their low cost, small footprint, and high throughput rates make them attractive to manufacturers looking to increase their efficiency. SCARA robotic palletizers are generally faster than Cartesian palletizers.

- The pharmaceutical sector also plays an essential role in the palletizer industry. Fully automatic palletizers are used for unattended pharmaceutical production. Supported by the European & APAC pharmaceutical industries, the sector is booming. The growing interest and demand for Halal certified beauty products in the MEA region drive the growth of palletizer in the cosmetic industry. In APAC, the growth of palletizer in the personal care sector is fueled by the K-beauty trends with its whimsical and innovative packaging.

- Among all the regions, North America accounts for the largest market share due to the high penetration of packaging machinery in the region. According to Packaging Machinery Manufacturers Institute (PMMI), the Americas market for packaging machinery is estimated to be worth USD 16.1 billion in 2024.

- Driven by Italy and Germany, Europe is also expected to witness a moderate rate. According to the Germany's Federal Statistical Office, the approximately 250 companies, mainly medium-sized organizations produced packaging machinery worth around EUR 7.3 billion, an increase of 2% from previous year. The Italian government's Industry 4.0 incentive scheme is also proving to be aiding the growth of packaging machinery as well as palletizers in Italy.

- Even before the COVID-19 reared its formidable spikes, the adoption of robotics, automated material handling equipment, AI, and other advanced technologies into warehouses and distribution centers (DCs) was on the rise, propelled by the need to manage high-velocity operations with limited and increasingly expensive labor resources while meeting the ever-changing demands generated by digital commerce, thereby driving the studied market growth .

Palletizer Market Trends

Food & Beverages Industry Offers Potential Growth

- The food and beverage industry has always been a key contributor to enhancing the market revenue of palletizers. As the competition between retailers continues to intensify and government regulations become more stringent, the retailer demands continue to increase. Thus, the need for palletizing robots has never been more imperative for success in the food and beverage industry.

- Among all of the machinery products in packaging, a palletizer is the most preferred and beneficial for packaging food and beverage items due to its low cost, small footprint, and high throughput rate. Palletizing systems are useful elements at the end of a packaging line, a vital task for every industry, including pharmaceutical, chemical, personal care, and cosmetics.

- Due to space limitations within the facility, the centralized palletizing concept was the most practical option. The system's requirements included a neutral to a positive return on the cost of goods sold, a reduction in the forklift traffic around the production lines, improvements in the quality of work, especially ergonomics, and the installation of a robust and reliable system.

- Considering all the trends and innovations that are taking place worldwide related to the food processing industry with the implementation of selective compliance assembly robot arm (SCARA) as well as in the manufacturing industry, contributing to the decrease in energy costs, it can be concluded that it is braced for advancements in the packaging machinery as well as palletizer sector in the near future.

- Dairy processors are indicating a requirement for processing equipment improvements. Properly implemented palletizing automation increases productivity over the labor-intensive repeated motions required of human workers. According to the PMMI report, 2 out of 3 manufacturing locations either have palletizing robots installed, plan to install, or add them to their palletizing operations.

- Further, with the outbreak of the COVID-19 pandemic, various manufacturing facilities in the FMCG sector have been witnessing increased pressure for speeding up production. Hence, the market is likely to grow over the forecast period.

North America to Occupy Significant Market Share

- The United States is one of the largest and most developed markets for adopting new and innovative palletizing solutions. The strong economy, with notable port traffic, increased e-commerce activity, and key manufacturing indices, results in significant growth in manufacturing and is poised to drive the demand for palletizing solutions in the country.

- Sectors, including retail, automotive, food and beverage, and pharmaceutical, are the largest sources of demand for such solutions in the country. Prior to COVID-19, it was estimated that the US shipments of corrugated packaging exceeded 470 billion square feet by 2025 annually. The need for transportation of the products for the food and beverage industry to maintain an SKU that is cost-effective for shipping has resulted in the widespread adoption of the organization's palletizing solutions irrespective of their size.

- Post pandemic, this number is expected to be higher than the estimated owing to the increased demand to keep the actual product safer and highly sanitized.

- According to CBRE, the e-commerce retail sales grew by 25% during the quarter ending June 2020 in the country, reflecting the consumer shift to e-commerce, while grocery stores and building and garden suppliers each saw a 13% growth over this period. With such an increase in the e-commerce industry, it is expected that the actual share would surpass the previously predicted value in the e-commerce industry in the country, which would significantly increase the demand for palletizers across warehouses and DCs.

- The United States has been witnessing demand for automation and robots, including robotic palletizers in industrial settings. The country has seen a few product launches owing to this. For instance, in September 2021, Quest Industrial is set to launch a robotic palletizer Box Bot - the QB300 series at PACK EXPO 2021. Box Bot is a space-saving robotic palletizer having a small footprint that enables an operator to design and produce exact pallet patterns quickly and easily from bags to boxes and other product types.

- According to data from the US International Trade Commission, United States goods imports contracted by 11% in the first eight months of 2020 compared with the same period the previous year, whereas imports of industrial robots increased by 5%.

Palletizer Industry Overview

The palletizer market is fragmented and competitive. Some of the key players are A-B-C Packaging Machine Corp, ABB Ltd, Honeywell Intelligrated, Krones AG, Schneider Packaging Equipment Co. Inc., etc. amongst others. Factors such as relentless competition to maintain market shares, domestic consumption, and rapid urbanization have attracted many new players. Some of the recent developments in the market are:

- August 2021 - Geek+ announced the launch of a new solution for Smart Mixed Case palletizing, developed by partnering with WSR Solutions, an intelligent warehouse management tools provider. The solution combined Geek+ autonomous mobile robots and WSR's smart palletizing algorithm to help warehouse operators systematically handle the processing of multiple outbound orders in a safe, efficient, and flexible way.

- October 2020 - Robotiq Inc. introduced a new robotic palletizing solution, especially for lower throughput applications requiring frequent task and box or pallet size changes. This application-focused technology consists of fully connected, plug-and-play software and hardware with pre-selected functions.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHT

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Force Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers/Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 COVID-19 Impact on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.2 Market Restraints

6 MARKET SEGMENTATION

- 6.1 By Product

- 6.1.1 Conventional Palletizer

- 6.1.1.1 High-Level Palletizer

- 6.1.1.2 Low-Level Palletizer

- 6.1.2 Robotic Palletizer

- 6.1.1 Conventional Palletizer

- 6.2 By End-user Vertical

- 6.2.1 Food & Beverages

- 6.2.2 Pharmaceuticals

- 6.2.3 Personal Care & Cosmetics

- 6.2.4 Chemicals

- 6.2.5 Other End-user Verticals

- 6.3 Geography

- 6.3.1 North America

- 6.3.1.1 United States

- 6.3.1.2 Canada

- 6.3.2 Europe

- 6.3.2.1 Germany

- 6.3.2.2 United Kingdom

- 6.3.2.3 France

- 6.3.2.4 Italy

- 6.3.2.5 Rest of Europe

- 6.3.3 Asia Pacific

- 6.3.3.1 China

- 6.3.3.2 Japan

- 6.3.3.3 India

- 6.3.3.4 Rest of Asia Pacific

- 6.3.4 Latin America

- 6.3.4.1 Brazil

- 6.3.4.2 Argentina

- 6.3.4.3 Mexico

- 6.3.4.4 Rest of Latin America

- 6.3.5 Middle East and Africa

- 6.3.5.1 United Arab Emirates

- 6.3.5.2 Saudi Arabia

- 6.3.5.3 South Africa

- 6.3.5.4 Rest of Middle East and Africa

- 6.3.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 A-B-C Packaging Machine Corp.

- 7.1.2 ABB Ltd.

- 7.1.3 BEUMER Group GmbH & Co. KG

- 7.1.4 Honeywell Intelligrated

- 7.1.5 KION Group AG

- 7.1.6 Krones AG

- 7.1.7 Schneider Packaging Equipment Co. Inc.

- 7.1.8 Sidel

- 7.1.9 YASKAWA Electric Corp.

- 7.1.10 Barry-Wehmiller Companies, Inc.

- 7.1.11 Arrowhead Systems Inc.

8 INVESTMENT ANALYSIS

9 MARKET OPPORTUNITIES AND FUTURE TRENDS

02-2729-4219

+886-2-2729-4219