|

市场调查报告书

商品编码

1630269

密封包装:市场占有率分析、产业趋势与统计、成长预测(2025-2030)Hermetic Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

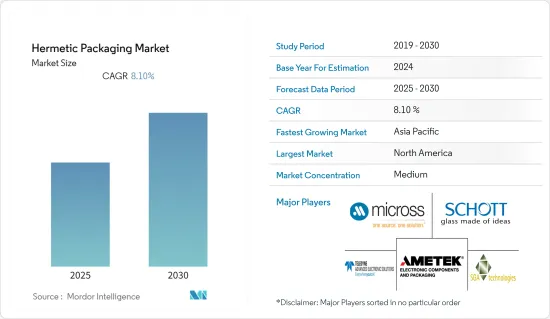

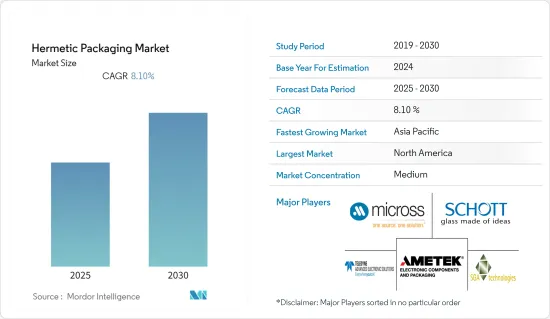

预计气密包装市场在预测期内复合年增长率为 8.1%

主要亮点

- 在所有需要保护电子元件免受腐蚀环境并确保使用寿命的应用中,都需要密封包装。空间电子元件要求极高的可靠性,常采用气密封装。在中低功率等级下,采用玻璃金属密封的金属封装是常见的解决方案。由于标准气密封装中使用的金属导热性差且导电性有限,因此开发了直接键合铜解决方案。

- 电子塑胶包装在低温清洁环境下使用寿命可达20年。然而,在高温高压的腐蚀性气氛中,它们会在几天内失效。封装电子装置的保护取决于封装中所使用的材料的气体介电常数。气体介电常数的差异在塑胶侧和玻璃/陶瓷/金属侧之间存在数量级差异。

- 此外,防止内部组件与空气中的氧气和水分反应的密封封装技术对于感测器、电池、超级电容器、能源采集和其他能源系统等众多微型技术至关重要。随着这些设备市场的不断扩大,开发适合这些微型技术的封装策略将变得越来越重要。

- 例如,由于电动车、新型物联网 (IoT)、医疗设备等的推动,微电池市场预计在 2019 年至 2025 年间将成长约五倍。儘管如此,目前的密封封装技术仍将微型电池的能量密度限制为大型电池的一小部分。微型和宏观尺寸电池具有不同能量密度的原因之一是封装在内部组件的体积和质量中占主导地位,因此广泛使用的宏观尺寸密封封装技术不能直接应用于微型电池。

气密包装市场趋势

铅玻璃预计将占有较大份额

- 磁簧玻璃可在数百万次开关週期内可靠地封装磁簧开关。

- 许多电子应用将玻璃管用于需要保护、绝缘和密封的分立电子元件。然而,这种玻璃通常用作被动元件的电隔离或气密密封。

- 铅玻璃用于汽车中控锁系统、热水锅炉开关、皮带感测器等。簧片开关开启和关闭电路,无需外部机械影响。

- 当弱磁场将薄玻璃管内的两个金属接触片推在一起时,就会建立接触。簧片开关作为功耗非常低的设备非常重要,因为它们在静态时不需要任何电源。

- 由于没有机械控制,磁簧开关可以经历数百万次的通断循环而不会磨损。

- 金属刀片无尘,必须用高公差的惰性气体密封在玻璃管中,以确保功能。

预计北美将占据最大份额

- 该地区各国政府增加在航太和国防领域的支出预计将在预测期内推动密封包装市场的发展。此外,航空业对新飞机的依赖将推动对气密包装的需求,从而加强气密包装产业。 2020年,美国军事开支估计达7,780亿美元,比2019年成长4.4%。 (来源:SIPRI)。

- 消费者在家用电器上的支出不断增长,加上智慧型手机等智慧型通讯设备的普及率不断提高,预计将在预测期内推动对密封包装的需求。根据2021年零售额预测,美国消费性电子零售额达4,420亿美元。智慧型手机是家用电子电器领域零售额最大的产品,2020年零售额达790亿美元。 (资料来源:消费者科技协会)。

- 另外,美国是世界上一些最大的汽车製造商的所在地,并且正在投资电动车和自动驾驶的潜力。 2016年,光是美国就生产了约1,750万套ADAS(高级驾驶辅助系统)。到 2021 年,这一数字预计将增加约 150 万台。 (资料来源:阿美特克)。在汽车产业,密封件用于确保倾翻装置和安全气囊装置的感测器功能。因此,随着安全气囊设备的增加,市场将潜在地需求气密包装。

- 这是拉动半导体硅片市场需求的主要因素之一。例如,2020年12月,全球锂离子应用硅碳复合材料供应商Group14 Technologies获得由SK Materials主导的1,700万美元B轮资金筹措。

气密包装产业概况

由于以下主要企业的存在,密封包装市场中竞争公司之间的对抗非常激烈: Schott AG、SGA Technologies、Kyocera 等公司不断创新产品和服务的能力使他们能够透过策略合作伙伴关係、併购以及研发活动来获得竞争优势。

- 2020 年 4 月 - NanoRetina 宣布其采用 Schott Primocerar 玻璃雷射黏合技术的 NR600 视网膜假体装置取得了初步成功结果。 NanoRetina 在建立视网膜植入方面迈出了里程碑式的一步,该植入物可能成为退化性视力丧失的解决方案。 SCHOTT Primoceler 的气密密封玻璃晶圆微接合用于超小型全玻璃封装元件。

其他好处:

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 市场概况

- 市场驱动因素

- 保护敏感电子元件的需求日益增加

- 市场限制因素

- 对包装材料的严格规定

- 产业吸引力-波特五力分析

- 新进入者的威胁

- 买家/消费者的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争公司之间的敌对关係

- 技术简介

- 玻璃金属密封(GTMS)

- 陶瓷金属密封 (CERTMS)

- 玻璃微接合

- COVID-19 市场影响评估

第五章市场区隔

- 按类型

- 钝化玻璃

- 铅玻璃

- 应答器玻璃

- 按最终用户产业

- 石化

- 航太/国防

- 汽车工业

- 卫生保健

- 消费性电子产品

- 其他最终用户产业

- 按地区

- 北美洲

- 美国

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 西班牙

- 义大利

- 其他欧洲国家

- 亚太地区

- 中国

- 日本

- 韩国

- 印度

- 其他亚太地区

- 拉丁美洲

- 中东/非洲

- 北美洲

第六章 竞争状况

- 公司简介

- Schott AG

- Ametek Inc.

- Kyocera Corporation

- Micross Components Inc.

- Willow Technologies Ltd.

- SGA Technologies limited

- CompleteHermetics

- Special Hermetics products Inc.

- Materion Corporation

- Teledyne Technologies Incorporated

- Egide SA

第七章 投资分析

第八章市场的未来

简介目录

Product Code: 66646

The Hermetic Packaging Market is expected to register a CAGR of 8.1% during the forecast period.

Key Highlights

- Hermetic packaging is a requirement for all applications where electronic components must be protected from corrosive environments to ensure acceptable service life. Extremely high reliability is required for space electronics, often utilizing hermetic packages. Metal packages with glass to metal seals are the common solution for low to medium power levels. Due to poor thermal conductivity and limited electric conductivity of metals used in standard hermetic packages, direct bond copper solutions have been developed.

- Electronic plastic packages can survive 20 years in clean environments at lower temperatures. The same can fail in a few days in a corroding atmosphere at higher temperatures or higher pressure. The protection of encapsulated electronics is important for the permittivity of gases of the materials used for packaging. The difference of gas permittivity span over orders of magnitude for plastics on the side and glass/ceramic and metals on the other side.

- Further, hermetic packaging technologies that prevent internal components from reacting with oxygen or moisture in the air are critical for numerous microscale technologies, including sensors, batteries, super-capacitors, energy harvesters, and other energy systems. Creating suitable packaging strategies for these microscale technologies is of growing importance as the markets for these devices continue to increase.

- The micro battery market, for example, is expected to grow nearly five times between 2019 and 2025 as a result of electric vehicles, a new Internet of Things (IoT), and medical devices. Still, current hermetic packaging technologies limit micro battery energy densities to a fraction of macroscale batteries. One reason for the divergent energy densities of micro-and macroscale batteries is that widely used macroscale hermetic packaging technologies cannot be directly applied to micro-batteries as the packaging dominates the volume and mass of the internal components.

Hermetic Packaging Market Trends

Reed Glass is Expected to Hold Significant Share

- Reed Glasses provide Highly reliable encapsulation of reed switches over millions of switching cycles.

- The numerous electronic applications involve using Glass tubes where some discrete electronic components demand protection, isolation, or being sealed. However, the function of this glass many a time is to insulate passive components electrically, or it functions as a hermetic seal.

- Reed glass has found its applications in the centralized locking systems of automobiles, as switches in hot water boilers or as belt sensors. The reed switches, without any mechanical influence from the outside, opens and closes the electrical circuits.

- Contact is established when a weak magnetic field presses two metal contact blades together inside a thin glass tube. A reed switch, when in resting-state, does not require power which makes this important for the devices consuming very little power.

- As they possess no mechanical control, reed switches can handle millions of make-and-break cycles without any wear.

- The metal blades should be free of dust and hermetically sealed inside the glass tubes with inert gas with high tolerances to ensure functionality.

North America is Expected to Hold the Largest Share

- The increased government spending on the aerospace and defense sector by the government in the region is expected to boost the hermetic packaging market over the forecast period. Also, the aviation industry fuels the demand for hermetic packaging owing to its reliance on new aircraft, thereby strengthening the hermetic packaging industry. In 2020, the US military expenditure reached an estimated USD 778 billion, representing an increase of 4.4 % over 2019. (source: SIPRI).

- The increased consumer spending in consumer electronics, coupled with the increased penetration of smart communication devices like smartphones, is expected to fuel the demand for hermetic packaging over the forecast period. Based on the projected retail sales for 2021, consumer electronics retail sales in the United States reached USD 442 billion. Smartphones were the products accounting for the largest retail revenue within the consumer electronics sector, comprising USD 79 billion in 2020. (source: Consumer Technology Association).

- Apart from this, the United States is home to some of the world's major automotive players, investing in electric vehicles and in the self-driving potential of cars, which demand high-performance ICs. Approximately 17.5 million advanced driver assistance systems (ADAS) were manufactured in the United States alone during 2016. By 2021, that number is expected to increase by about 1.5 million units. (source: AMETEK). The automotive industry uses hermetic to ensure sensor functionality in rollover devices and airbag equipment. Hence, with the increasing airbag equipment, the market would potentially demand hermetic packaging.

- This is one of the major factors to drive the demand for the semiconductor silicon wafers market. For instance, in December 2020, Group14 Technologies, a global provider of silicon-carbon composite materials for lithium-ion applications, secured USD 17 million in Series B funding led by SK materials.

Hermetic Packaging Industry Overview

The competitive rivalry in the hermetic packaging market is quite high owing to the presence of some key players such as Schott AG, SGA technologies, Kyocera and many more. Their ability to continually innovate their products and services has allowed them to gain a competitive advantage over other players. Through strategic partnerships, mergers & acquisitions and research and development activities the players are able to attain a strong foothold in the market.

- April 2020 - The NanoRetina announced successful preliminary results for its NR600 Artificial Retina Device using SCHOTT Primoceler's glass laser bonding technology. NanoRetina has taken a monumental step forward in establishing its retinal implant that could represent an answer to degenerative vision loss. SCHOTT Primoceler's hermetic glass wafer micro bonding was used for the ultra-miniature, all-glass encapsulation of the device.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increasing Need to Protect Highly Sensitive Electronic Components

- 4.3 Market Restraints

- 4.3.1 Strict Rules and Regulations Regarding Packaging Materials

- 4.4 Industry Attractiveness - Porter's Five Force Analysis

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Buyers/Consumers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

- 4.5 Technology Snapshot

- 4.5.1 Glass to Metal Sealing (GTMS)

- 4.5.2 Ceramics to Metal Sealing (CERTMS)

- 4.5.3 Glass Micro Bonding

- 4.6 Assessment of the COVID-19 Impact on the Market

5 MARKET SEGMENTATION

- 5.1 Type

- 5.1.1 Passivation Glass

- 5.1.2 Reed Glass

- 5.1.3 Transponder Glass

- 5.2 End-user Industry

- 5.2.1 Petrochemical

- 5.2.2 Aerospace and Defense

- 5.2.3 Automotive Industry

- 5.2.4 Healthcare

- 5.2.5 Consumer Electronics

- 5.2.6 Other End-user Industry

- 5.3 Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.2 Europe

- 5.3.2.1 United Kingdom

- 5.3.2.2 Germany

- 5.3.2.3 France

- 5.3.2.4 Spain

- 5.3.2.5 Italy

- 5.3.2.6 Rest of Europe

- 5.3.3 Asia Pacific

- 5.3.3.1 China

- 5.3.3.2 Japan

- 5.3.3.3 South Korea

- 5.3.3.4 India

- 5.3.3.5 Rest of Asia Pacific

- 5.3.4 Latin America

- 5.3.5 Middle East and Africa

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Schott AG

- 6.1.2 Ametek Inc.

- 6.1.3 Kyocera Corporation

- 6.1.4 Micross Components Inc.

- 6.1.5 Willow Technologies Ltd.

- 6.1.6 SGA Technologies limited

- 6.1.7 CompleteHermetics

- 6.1.8 Special Hermetics products Inc.

- 6.1.9 Materion Corporation

- 6.1.10 Teledyne Technologies Incorporated

- 6.1.11 Egide SA

7 INVESTMENT ANALYSIS

8 FUTURE OF THE MARKET

02-2729-4219

+886-2-2729-4219