|

市场调查报告书

商品编码

1630307

美国自动化物料输送:市场占有率分析、产业趋势、统计与成长预测(2025-2030)United States Automated Material Handling - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

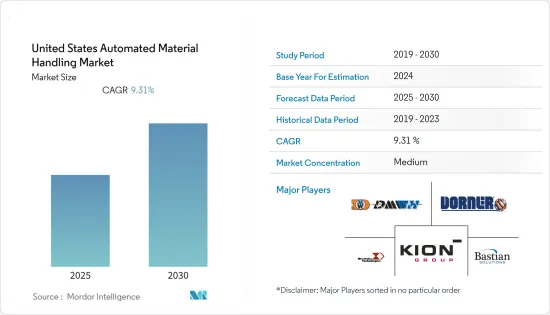

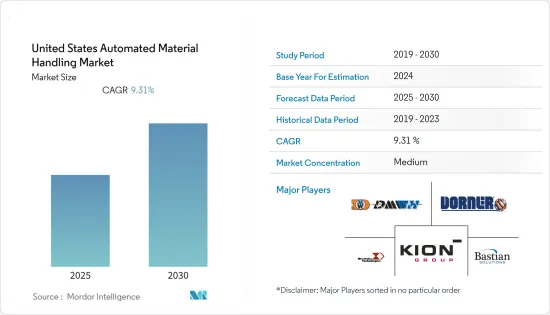

美国自动化物料输送(AMH) 市场预计在预测期内复合年增长率为 9.31%

主要亮点

- 美国是世界上最发达的经济体。该国的製造业是AMH市场的庞大需求来源,依赖主导的美国经济,美国经济占该地区经济产出的82%。

- 此外,由于该地区 AMH 製造商的技术进步率很高,例如自动化、人工智慧和机器学习,美国是全球 AMH 市场的主要投资者和创新者之一,这些技术正在迅速推动该行业的发展。 。在北美,对先进自动化物料输送系统的需求不断增长,加上人事费用持续上升以及僱用体力劳动的不便,进一步推动了美国AMH市场的发展。

- 该国的现代化製造设施依靠新技术和创新,以更快的速度和更低的成本生产更高品质的产品。事实证明,引入创新的软体和硬体是当今竞争激烈的市场中生存的唯一可行方法。

- 例如,FDA 食品安全现代化法案 (FSMA) 将把重点从应对食源性疾病和掺假转向预防,从而改变食品公司。因此,清洗和卫生已成为美国皮带製造商的首要任务。不銹钢也已成为该国流行的食品加工带类型。美国邮局在采用滚筒输送机后,在小包裹处理应用中实现了 60% 的节能。

- 此外,该国的物料输送行业因大流行的爆发而受到严重干扰。製造工厂和配送中心的部分营运推迟了新 AMH 系统的订单。在疫情最严重的时候,依赖人工拣货的仓库不得不关闭,严重影响了全球供应链。 DHL 报告称,美国祇有 5-10% 的履约中心使用自动化系统。

- 然而,供应商在疫情期间努力增强其 AMH 产品。例如,2020年10月,创新供应链解决方案供应商StoecklinLogistics推出了动态MASterStacker Cranes(单元货载ASRS)产品线。该起重机具有高加速度和行进速度、更高的能源效率和模组化结构,从而显着提高了性能和高水准的可用性。新型起重机还具有更合规、更快的车轮和起吊装置、不同起重机和负载容量的更高标准化、更快的组装和製造时间、更轻的结构以及更容易获取零件以进行维护。

美国自动化物料输送市场趋势

自主移动机器人(AMR)预计将占据主要市场占有率

- 在物流应用中,AMR 正在取代 AGV。这是因为,与 AGV 不同,AMR 配备了与惯性测量单元 (IMU)、雷射扫描测距仪、2D 和 3D 彩色相机以及马达控制器相结合的更复杂的机载电脑。此类 AMR 不需要在工厂或仓库安装追踪带。

- 此外,AMR预计将逐渐取代堆高机。此外,Mobile Industrial Robots Inc.倡议设计了 MiR1,000 AMR。它可承受1000公斤的承重能力,并配备六个雷射扫描器、一个3D相机和一个人工智慧相机。

- 虽然许多物流业务仍然依赖手动或纸质拣选系统,但自主移动机器人现在可以消除大量不必要的步行。根据美国人口普查局的资料分析,仓库工人平均每年浪费近 7 週时间在不必要的移动上,造成超过 43 亿美元的劳动成本。

- 此外,北美机场业是世界上最大的机场业之一。它每年为大约 10.115 亿国内和国际乘客提供服务。它也是世界上最大的机场之一的所在地,预计将加强自动化的采用力度,以防止经营模式崩坏。例如,全球自动化行李处理系统供应商 Crisplant 设计、製造并安装了与加拿大航空运输安全局 (CATSA) 在加拿大哈利法克斯国际机场部署的安全检查设备整合的全自动行李处理系统。

- 此外,所研究市场的供应商正在透过併购策略扩大其在该地区的足迹。例如,2020年5月,Geek+与Conveyco达成策略伙伴关係关係,加速AMR(自主移动机器人)解决方案在北美尤其是美国。 Geek+解决方案经过验证的效率、可扩展性和成本节约将透过这种伙伴关係为该地区所有行业的客户带来巨大的价值,实现灵活的物流。

零售业预计将占据主要市场占有率

- 美国零售和电子商务领域的显着成长以及仓储扩张正在成为市场成长的关键驱动力。该地区的大多数零售商计划实现仓库自动化,而不是在昂贵的租赁环境中扩大仓库。根据Robo Business仓库自动化报告,美国近80%的仓库仍由人工操作。只有 15% 的仓库实现了机械化,自动化程度不到 5%。这为 AMH 市场在预测期内在美国各地持续成长提供了一条漫长的道路。

- 此外,美国是该地区的主要零售市场之一。据估计,每年全国三分之二以上的GDP来自零售消费。该国的电子商务部门的销售额持续超过实体店。随着自动化成为关键的差异化因素,线上零售商和全通路零售商之间的竞争日益加剧。

- 零售业是对输送机等自动物料输送系统有至关重要要求的主要产业之一。输送机极大地帮助线上零售商移动货物并提高配送效率。此外,越来越多的零售商正在投资扩大仓库空间。例如,黑石集团投资 187 亿美元建造 1.79 亿平方英尺的仓库空间,以满足美国不断增长的零售需求。亚马逊公司是另一个例子,利用自动化技术来解决仓库激增的问题。近年来,该公司引进了自动物料输送机,并为其仓库增添了许多先进的输送机技术。

- 为了满足电子商务通路不断增长的需求,多家公司正在该地区推出履约物流中心。例如,2020年12月,PFS宣布在达拉斯地区开设一个新的履约物流中心,以经营四个品牌的履约计画。履约中心通常配备多个输送机系统以有效地输送产品,这些扩张活动预计将对美国输送机市场产生积极影响。

- 然而,由于 COVID-19 疫情的爆发,2020 年 3 月、4 月和 5 月的零售销售疲软。这些因素对这几个月美国零售业中自动化物料输送的使用产生了负面影响。然而,零售业在 2020 年下半年出现了大幅成长,恢復了 AMH 等自动化系统的使用。

美国自动化物料输送产业概况

美国自动化物料输送市场细分且竞争激烈。产品推出、高额研发投入、伙伴关係与收购是国内企业维持激烈竞争所采取的主要成长策略。

- 2021 年 1 月 - TGW Logistics Group 计划将美国输送机资产出售给 Material Handling Systems, Inc. (MHS)。两家公司已签署协议,收购预计将于 2021年终生效。林肯国际公司在整个併购过程中为 TGW 提供指导。透过此次出售,TGW 将调整其策略性投资组合,专注于其在北美不断成长的综合业务。

- 2020 年 7 月 - 范德兰德开发了 HOME PICK,这是一种独特的 3D、基于穿梭机的自动存储和搜寻系统(AS/RS),该系统基于由ADAPTO 提供支援的货到人(GtP) 拣选解决方案。非常适合食品零售商透过集中履约中心 (CFC) 实现规模经济。使用 ADAPTO 和模组化工作站,HOMEPICK 的可扩充性是面向未来的。有序订单可确保每个配送路线的正确订单和最大的配送效能,从而节省大量时间和成本。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买方议价能力

- 新进入者的威胁

- 竞争公司之间的敌对关係

- 替代品的威胁

- 产业价值链分析

- COVID-19 市场影响评估

第五章市场动态

- 市场驱动因素

- 增加製造复杂性和技术可用性

- 对提高订单准确性和增加 SKU 的需求不断增长

- 智慧城市物流的出现以及机器人技术在仓储应用上的普及

- 市场限制因素

- 供应链技能差距与劳动力短缺

- 初始成本高

第六章 市场细分

- 依产品类型

- 硬体

- 软体

- 服务

- 依设备类型

- 自动导引运输车(AGV)

- 自动堆高机

- 自动拖车/拖拉机/标籤

- 单元货载

- 组装

- 特殊用途

- 自主移动机器人(AMR)

- 雷射导引车

- 自动储存和搜寻系统(ASRS)

- 固定通道(堆垛机高机+穿梭系统)

- 轮播(水平轮播+垂直轮播)

- 垂直升降模组

- 自动输送机

- 腰带

- 滚筒

- 调色盘

- 开卖

- 堆垛机

- 常规型(高电位+低电位)

- 机器人

- 分类系统

- 自动导引运输车(AGV)

- 按最终用户产业

- 飞机场

- 车

- 饮食

- 零售/仓库/配送中心/物流中心

- 一般製造业

- 药品

- 小包裹

- 其他的

第七章 竞争格局

- 公司简介

- Kion Group AG

- Bastian Solutions Inc.

- DMW&H

- Westfalia Technologies Inc.

- Dorner Manufacturing Corporation

- Cornerstone Automation Systems LLC

- Oceaneering International Inc.

- Aethon Inc.

- Daifuku Co. Ltd

- Remtec Automation

- Siggins Company

- Honeywell Intelligrated

- Vanderlande Industries BV

第八章投资分析

第九章 市场机会及未来趋势

简介目录

Product Code: 67237

The United States Automated Material Handling Market is expected to register a CAGR of 9.31% during the forecast period.

Key Highlights

- The United States is the most advanced economies in the world. The country's manufacturing sector, which is a huge source of demand for the AMH market, hinges on the dominant US economy, accounting for 82% of the region's economic output.

- Moreover, United States is one of the major investors and innovators in the global AMH market owing to the high rate of technological advancements among regional AMH manufacturers, such as automation, AI, and machine learning, and are rapidly driving the industry forward. Increasing demand for advanced automated material handling systems and ever-increasing labor costs with the inconvenience of employing a manual workforce in North America is further driving the United States AMH market.

- Modern manufacturing facilities in the country rely on new technologies and innovations to produce higher quality products at faster speeds, with lower costs. Implementing innovative software and hardware proves the only feasible way to survive in the current competitive market.

- For instance, the FDA Food Safety Modernization Act (FSMA) transforms food companies by shifting the focus from responding to foodborne illness and foreign material contamination to preventing it. As a result, cleanability and sanity have become the biggest priorities of belt manufacturers in the US. Stainless steel also emerged as a popular belt type for food processing in the country. The US post offices also witnessed a 60% energy savings in parcel-handling applications after employing roller conveyors.

- Furthermore, the material handling industry in the country has been significantly disrupted due to the pandemic outbreak. Partial operations within manufacturing facilities and distribution centers have resulted in delayed orders for new AMH systems. During the peak pandemic, warehouses that used manual picking had to halt their operations, thus severely impacting the global supply chain. DHL reported that only 5-10% of the fulfillment centers in the United States are using automated systems already.

- However, vendors strived to enhance their AMH product offerings during the pandemic. For instance, in October 2020, StoecklinLogistics, a supplier of innovative supply chain solutions, introduced a line of dynamic MASTerStacker Cranes (unit load ASRS) that feature high acceleration and moving speeds, improved energy efficiency, and modular construction that delivers vastly improved performance and high levels of availability. The new cranes also have more straightforward and faster wheels and hoists, greater standardization across different cranes and load-carrying capacities, shorter assembly and manufacturing times, lighter construction, and improved accessibility to components for maintenance.

US Automated Material Handling Market Trends

Autonomous Mobile Robots (AMR) is Expected to Hold Significant Market Share

- AMRs are replacing AGVs in logistical applications. This is because, unlike AGVs, AMRs incorporate more sophisticated onboard computers that are coupled to inertial measurement units (IMU), laser scanning range finders, 2D and 3D color cameras, and motor controllers. Such AMRs do not require tracking strips to be placed in a factory or warehouse.

- Moreover, it is expected that AMRs would gradually replace forklifts in particular too. Further, Mobile Industrial Robots Inc. has taken the first initiative to design the MiR1000 AMR. It can tolerate a payload of 1000kg and equip with six laser scanners, 3D cameras, and an artificially intelligent camera.

- While many logistics operations still rely on manual and paper-based picking systems, autonomous mobile robots can now eliminate a lot of unnecessary walking. According to US Census Bureau data analysis, the average warehouse worker wastes nearly seven weeks per year in unnecessary motion, accounting for more than USD 4.3 billion in labor.

- Moreover, the North American airport industry is one of the largest airport industries in the world. It provides services to about 1,011.5 million domestic and international passengers every year. It is also home to some of the world's biggest airports and is expected to bolster the adoption of automation to ensure no disruptions in the business model. For instance, Crisplant, a foremost global supplier of automated baggage handling systems, designed, manufactured, and installed fully automated baggage handling systems, integrated with the security screening equipment deployed by the Canadian Air Transport Security Authority (CATSA), in Canada's Halifax International Airport.

- Further, vendors in the studied market are expanding their foothold in the region by the merger and acquisition strategy. For instance, in May 2020, Geek+ and Conveyco entered into a strategic partnership to accelerate access to AMR (Autonomous Mobile Robot) solutions in North America, especially in the United States. The demonstrated efficiency, scalability, and cost-saving of Geek+ solutions will bring significant value and enable flexible logistics for customers across industries in the region through this partnership.

Retail Industry is Expected to Hold Significant Market Share

- The significant growth of the United States retail and e-commerce sector and warehouse expansion is becoming a primary driver of market growth. Most of the region's retailers plan to automate their warehouse establishments rather than expand in a high-priced rental environment. According to the Robo Business Warehouse Automation Report, almost 80% of the United States' warehouses are still manually operated. Only 15% of all the warehouse establishments were mechanized, and not more than 5% were automated. This provides a long runway for the AMH market to grow consistently across the country over the forecast period.

- Moreover, the United States stands to be one of the major retail markets in the region. It is estimated that more than two-thirds of the country's GDP is generated from retail consumption every year. In the country's e-commerce sector, the sales growth continues to increase more than the physical stores. With automation being the key differentiating factor, there is increasing competition between online and omnichannel retailers.

- Retail is one of the major industries, wherein the requirement for automated material handling systems such as conveyors is essential. It immensely helps online retailers with the movement of goods and increases good delivery efficiency. Furthermore, retailers are increasingly investing in expanding warehouse space. For example, Blackstone Group invested USD 18.7 billion on 179 million square feet of US warehouse space to cater to the country's growing retail demand. Amazon.com Inc is another such example, adopting automation techniques to solve its warehouse growing problems. In recent years, the company has been rolling out automated material handling machines and has added many advanced conveyor technologies to its warehouses.

- Multiple companies in the region are starting fulfillment distribution centers with the growing demand from e-commerce channels. For instance, in December 2020, PFS announced its new fulfillment distribution center in the Dallas area and operated e-commerce fulfillment programs for four brands. The fulfillment centers are generally equipped with several conveyor systems to efficiently transport products, and such expansion activities are expected to impact the conveyor market in the United States positively.

- However, the outbreak of COVID-19 dented the retail sales in March, April, and May in 2020. Such factors negatively impacted the usage of automated material handling in the United States' retail landscape in those months. However, the retail sector witnessed a significant surge in late 2020, which bounced back the usage of automated systems such as AMH.

US Automated Material Handling Industry Overview

The United States automated material handling market is fragmented and highly competitive. Product launches, high expense on research and development, partnerships and acquisitions, etc., are the prime growth strategies adopted by the companies in the country to sustain the intense competition.

- January 2021 - TGW Logistics Group planned to sell certain US conveyor assets in Norton Shores (Michigan) to Material Handling Systems, Inc. (MHS). The contract between the two companies has been signed, and the acquisition is expected to take effect by the end of 2021. Lincoln International guided TGW through the whole M&A process. With the sale, TGW adjusts its strategic portfolio and focuses on the growing integration business in North America.

- July 2020 - Vanderlande created the HOME PICK, based on a goods-to-person (GtP) picking solution that makes use of ADAPTO and is a unique 3D, shuttle-based automated storage and retrieval system (AS/RS). It is ideal for food retailers to realize economies of scale through centralized fulfillment centers (CFCs). By using ADAPTO and modular workstations, HOMEPICK's scalability also makes it future-proof. The sequenced orders ensure the proper order per delivery route and maximum delivery performance, which results in significant time and cost savings.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Intensity of Competitive Rivalry

- 4.2.5 Threat of Substitutes

- 4.3 Industry Value Chain Analysis

- 4.4 Assessment of the Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Manufacturing Complexity and Technology Availability

- 5.1.2 Increasing Demand for Improving Order Accuracy and SKU Proliferation

- 5.1.3 Emergence of Smart City Logistics and Wide Adoption of Robotics in Warehouse Applications

- 5.2 Market Restraints

- 5.2.1 Gap in Supply Chain Skills and Workforce Shortage

- 5.2.2 High initial costs

6 MARKET SEGMENTATION

- 6.1 By Product Type

- 6.1.1 Hardware

- 6.1.2 Software

- 6.1.3 Services

- 6.2 By Equipment Type

- 6.2.1 Automated Guided Vehicle (AGV)

- 6.2.1.1 Automated Forklift

- 6.2.1.2 Automated Tow/Tractor/Tug

- 6.2.1.3 Unit Load

- 6.2.1.4 Assembly Line

- 6.2.1.5 Special Purpose

- 6.2.2 Autonomous Mobile Robots (AMR)

- 6.2.3 Laser Guided Vehicle

- 6.2.4 Automated Storage and Retrieval System (ASRS)

- 6.2.4.1 Fixed Aisle (Stacker Crane + Shuttle System)

- 6.2.4.2 Carousel (Horizontal Carousel + Vertical Carousel)

- 6.2.4.3 Vertical Lift Module

- 6.2.5 Automated Conveyor

- 6.2.5.1 Belt

- 6.2.5.2 Roller

- 6.2.5.3 Pallet

- 6.2.5.4 Overhead

- 6.2.6 Palletizer

- 6.2.6.1 Conventional (High Level + Low Level)

- 6.2.6.2 Robotic

- 6.2.7 Sortation System

- 6.2.1 Automated Guided Vehicle (AGV)

- 6.3 By End-user Vertical

- 6.3.1 Airport

- 6.3.2 Automotive

- 6.3.3 Food and Beverage

- 6.3.4 Retail/Warehousing/ Distribution Centers/Logistic Centers

- 6.3.5 General Manufacturing

- 6.3.6 Pharmaceuticals

- 6.3.7 Post and Parcel

- 6.3.8 Other End-Users

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Kion Group AG

- 7.1.2 Bastian Solutions Inc.

- 7.1.3 DMW&H

- 7.1.4 Westfalia Technologies Inc.

- 7.1.5 Dorner Manufacturing Corporation

- 7.1.6 Cornerstone Automation Systems LLC

- 7.1.7 Oceaneering International Inc.

- 7.1.8 Aethon Inc.

- 7.1.9 Daifuku Co. Ltd

- 7.1.10 Remtec Automation

- 7.1.11 Siggins Company

- 7.1.12 Honeywell Intelligrated

- 7.1.13 Vanderlande Industries B.V.

8 INVESTMENT ANALYSIS

9 MARKET OPPORTUNITIES AND FUTURE TRENDS

02-2729-4219

+886-2-2729-4219