|

市场调查报告书

商品编码

1630313

交易监控系统:市场占有率分析、产业趋势/统计、成长预测(2025-2030)Trade Surveillance Systems - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

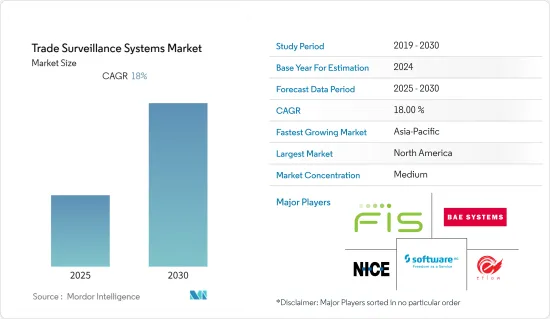

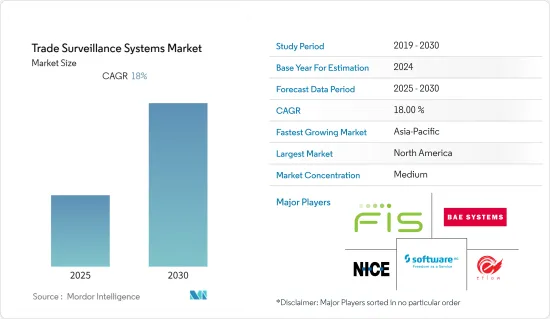

交易监控系统市场预计在预测期内复合年增长率为 18%。

主要亮点

- 推动市场成长的主要因素是全球市场运作和诈欺的增加。这些诈欺和操纵行为对公众造成了巨大损失。因此,金融机构主动和事后监控交易活动的需要是市场成长的驱动力。此外,强制性监管合规需求的不断增长也进一步推动了市场的成长。此外,随着社群媒体使用的扩大,其对世界各地企业的影响也扩大。因此,密切监控与市场趋势相关的风险的需求增加,进一步刺激市场成长。

- 例如,去年,印度第一家加密货币独角兽和该国最安全的加密货币交易所 CoinDCX 宣布任命 Solidus Labs 为其战略合规合作伙伴。透过与Solidus 合作,CoinDCX 在其平台上建立了更大的信任和透明度,加强了其作为印度数位资产交易所的领导地位,并保护用户免受已知的市场滥用行为和许多现在可以保护的新兴加密货币特定风险的影响。然而,由于交易监控系统基础设施复杂,缺乏技术专业知识预计将阻碍市场成长。中小企业(尤其是新兴经济体的中小企业)缺乏认识也可能是抑制市场成长的主要因素。

- 受监管的金融公司正在寻求更复杂的监控解决方案,以有效监控更复杂的结构性产品的交易。此外,各种交易监控提供者正在开发新产品和功能更新,以满足监管机构和最终用户的需求。例如,Trillium Labs 去年宣布为其 Surveyor Trade 监控平台推出最佳执行解决方案模组。 Surveyor 的最佳执行解决方案预计将突出显示关键指标,以有效监控执行品质并为客户提供易于理解的视觉化效果。此外,您还可以识别价格异常值并深入研究订单和填充资料。

- 据 LexisNexis Risk Solutions 称,COVID-19 大流行给最终用户带来了新的挑战。其中许多公司仍然需要正式的流程来识别和追踪新出现的威胁。该公司还表示,其技术优先策略可以降低成本并改善整体规业务。

交易监控系统的市场趋势

云端基础的平台预计将显着成长

- 由于数位化和易于存取所带来的便利,云端基础的交易活动正在迅速发展。然而,随着云端基础的交易活动的扩大,贸易监控的需求也在增加。由于其优势,云端基础的交易监控系统比本地交易监控系统迅速普及。

- 合规技术和资料分析公司 SteelEye 去年推出了一套新的通讯合规解决方案,为中小型金融公司提供记录管理和监控工具。中小型企业可以透过灵活且经济高效的平台促进通讯资料,从而更好地满足监管要求。

- 云端基础的平台和解决方案提供扩充性的效能和稳定的环境来开发这些解决方案。此外,人工智慧技术提供了一种标准化、有效的方式来预测所获取资料的模式、监控交易活动并确保行业合规性。供应商正在采用先进技术来实现先进创新,以实现任务和工作流程自动化,改善法规遵循和风险管理,并提高整体业务效率。

- 例如,去年,NICE 透过先进的人工智慧、云端可扩展性和风险检测覆盖率改进了其 SURVEIL-X 行为监控解决方案。此外,更好的自然语言处理技术可以实现通讯资料和市场监测资料更快的自动连动,加快贸易重建进程。

预计北美将主导市场

- 由于该地区已建立交易服务,预计北美将在预测期内主导交易监控系统市场。由于北美是最重要的交易市场,诈欺和操纵的风险很高,因此建立交易监控系统就显得格外重要。

- 据美国联邦贸易委员会称,去年美国报告了从社交媒体开始的加密货币诈骗损失,其中大部分是 2021 年以来的投资诈骗,所有加密货币诈骗损失中有 5.75 亿美元来自虚假投资机会。任何其他类型的诈骗。

- 此外,各种规模的企业对云端基础的交易监控系统的高采用率以及地方政府的监管预计将进一步促进市场成长。此外,北美总是最早采用新技术,这推动了交易监控系统市场的成长。

- 例如,去年,IBM 的合作伙伴生态系统透过 IBM Cloud Satellite 向任何环境提供了混合云服务。它使组织能够跨本地、公有云和边缘部署和运行託管即服务应用程式。该平台在任何工作负载运行的环境中扩展了 IBM Cloud 的安全性和开放式架构,有助于解决跨多个领域操作的挑战并支援客户的合规性需求。

- 此外,根据最近的一篇报导,纳斯达克正在测试人工智慧监控系统,以监控美国股市是否出现新的汇率操纵案例。该系统基于机器学习通讯协定来发现异常交易模式并向交易所工作人员发送警报。这使得工作人员能够调查情况并可能删除诈欺的库存订单。

交易监控系统产业概况

由于全球范围内越来越多地采用解决方案,交易监控系统市场的竞争格局正在走向碎片化。然而,由于市场仍在发展,市场相关人员关注的是持续的技术创新。公司正在设计创新和技术整合的解决方案,以获得超越竞争对手的优势。此外,许多新兴企业已经进入市场,并正在资金筹措和投资,以顺利占据市场的最大份额。

- 2022 年 9 月:NICE(纳斯达克股票代码:NICE)旗下公司 NICE Actimize 宣布推出Compliancentral,云端基础的端到端通讯监控和交易合规平台。 NICE Actimize 的Compliancentral 协助买方、卖方、线上交易平台、保险和财富管理公司了解和分析所有类型的员工沟通、交易和行为,以发现隐藏的行为风险。

- 2022年7月,策略产业的高价值企业AI SaaS供应商SymphonyAI宣布收购BAE Systems旗下金融犯罪侦测领导者NetReveal。此次收购是Symphony AI金融垂直扩大策略的重要一步。此外,该公司将于 2021 年底开发并推出 SymphonyAI Sensa Sensa 平台,为金融犯罪检测带来基于人工智慧的分析和见解。 NetReveal 是 SymphonyAI 金融业务的成员,继续使用 Sensa AI 技术提供突破性创新和强大的新产品,以更好地发现异常活动、减少误报并控製成本。

- 2022 年 3 月,e-Flow World 和 GRSS 加强了合作,提供託管监控解决方案。 eFlow 表示,eFlow 和 GRSS 的伙伴关係建立在有效合规性的基础上,这种合规性源自于强大的技术和现实知识的结合。

此外,GRSS 还提供经验丰富的合规和交易监控专家,他们分析公司监控系统的产出并向合规负责人提供可操作的报告。 Eflo 的 TZ 系统于 2004 年首次推出,近 20 年来一直帮助合规专业人士进行彻底的市场滥用监控。同时,eflow 表示,新的伙伴关係关係使其市场滥用服务比以往任何时候都更加重要。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买方议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间的敌对关係

- 产业价值链分析

- COVID-19 市场影响评估

第五章市场动态

- 市场驱动因素

- 市场监管和监管合规性的需求不断增加

- 使用进阶分析、人工智慧、机器学习等进行复杂的交易监控。

- 市场挑战

- 复杂的基础设施和诈欺的动态性质

第六章 市场细分

- 按成分

- 解决方案

- 服务

- 按发展

- 本地

- 在云端

- 按地区

- 北美洲

- 美国

- 加拿大

- 欧洲

- 英国

- 德国

- 义大利

- 法国

- 俄罗斯

- 其他欧洲国家

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳洲和纽西兰

- 其他亚太地区

- 拉丁美洲

- 巴西

- 墨西哥

- 其他拉丁美洲

- 中东/非洲

- 北美洲

第七章 供应商市场占有率

第八章 竞争格局

- 公司简介

- Software AG

- Nice Ltd.

- BAE Systems, Inc.

- eFlow Ltd.

- Fidelity National Information Services, Inc.

- Nasdaq, Inc.

- SIA SPA

- Aquis Technologies

- B-Next Group

- ACA Compliance Group Holdings, LLC

- Trillium Management LLC

第九章投资分析

第10章市场的未来

The Trade Surveillance Systems Market is expected to register a CAGR of 18% during the forecast period.

Key Highlights

- The primary factor driving market growth is the increasing instances of market manipulation and fraud worldwide. These frauds and manipulations incur enormous losses for the overall public. Hence, the need for financial institutions to pre- and post-monitor trading activities is driving market growth. Also, the increasing demand for mandatory regulatory compliance further augments market growth. Furthermore, as social media usage grows, so does its impact on businesses worldwide. As a result, the need for careful monitoring of the risks involved in market trends is increasing, further stimulating market growth.

- For instance, the previous year, CoinDCX, India's first crypto unicorn and the country's safest crypto exchange, announced it had appointed Solidus Labs as a strategic compliance partner. Partnering with Solidus enabled CoinDCX to forge greater trust and transparency on its platform, cement its leadership as India's digital asset exchange, and protect its users from known market abuse and many emerging crypto-specific risks. However, market growth is expected to be hampered by a lack of technical expertise due to the complex infrastructure of trade surveillance systems. Lack of awareness, especially among small and medium-sized businesses (SMEs) in developing economies, is likely to be another major factor that slows the growth of the market.

- Regulated financial companies demand more sophisticated surveillance solutions to monitor the trades of more complex structured product offerings effectively. Furthermore, various trade surveillance providers are developing new products and feature updates to fulfill regulatory and end-user needs. For instance, last year, Trillium Labs announced its "best execution solution module" for its "surveyor's trade surveillance platform." Surveyor's best execution solution is expected to offer customers easy-to-understand visualizations, highlighting key metrics to monitor execution quality effectively. Additionally, it could identify pricing outliers and further drill down into order and execution data.

- According to LexisNexis Risk Solutions, the COVID-19 pandemic created new challenges for end users, as most of these firms still need a formal process for identifying and tracking emerging threats. The company also said that a strategy that puts technology first can lower costs and improve operations across the compliance spectrum.

Trade Surveillance Systems Market Trends

Cloud-based Platforms Expected to Grow Significantly

- Cloud-based trading activities are rapidly evolving due to the convenience afforded by digitalization and ease of access. However, as cloud-based trading activities expand, the need for trading surveillance grows. Because of their advantages, cloud-based trade surveillance systems are rapidly gaining traction over on-premise trade surveillance systems.

- SteelEye, a compliance technology, and data analytics firm, launched a new suite of communication compliance solutions in the previous year to provide smaller financial firms with access to record-keeping and oversight tools. SMBs can better meet regulatory requirements by facilitating communication data through a flexible and cost-effective platform.

- Cloud-based platforms or solutions provide highly scalable performance and a stable environment for developing these solutions. Furthermore, AI technology predicts patterns in captured data, allowing for a standardized and efficient method of monitoring trade activities and ensuring industry compliance.Vendors are embracing sophisticated technology innovations powered by advanced technologies to automate tasks and workflows, improve regulatory compliance and risk management, and improve overall operational efficiency.

- NICE, for example, improved its SURVEIL-X conduct surveillance solution last year with advanced AI, cloud scalability, and risk detection coverage. Also, better NLP techniques make it possible to automatically link communications and market surveillance data faster, which speeds up the trade reconstruction process.

North America is Expected to Dominate the Market

- North America is expected to dominate the trade surveillance system market in the forecast period, owing to the well-established trading services in the region. With the most important trading market in North America, there is a high risk of fraud and manipulation, which makes it even more important to set up a trade surveillance system.

- According to the Federal Trade Commission, in the previous year, the United States reported crypto fraud losses that began on social media, the majority of which were investment scams since 2021, with USD 575 million of all crypto fraud losses involving bogus investment opportunities, far outnumbering any other type of fraud.

- Also, the high adoption of cloud-based trade surveillance systems by enterprises of all sizes and the regulations imposed by the regional governments are expected to augment market growth further. North America has also always been the first to adopt new technologies, which has helped the market for trade surveillance systems grow.

- For instance, in the previous year, IBM's partner ecosystem brought hybrid cloud services to any environment with IBM Cloud Satellite. It will enable the organization to deploy and run managed-as-a service applications across on-premises, public clouds, and at the edge. The platform extends the security and open architecture of IBM Cloud in any environment where workloads run to help clients address their challenges when operating across multiple domains and support clients' compliance readiness needs.

- Furthermore, according to a recent article, Nasdaq is testing an artificial intelligence surveillance system to monitor its United States stock market for new instances of exchange manipulation. The system will find unusual trading patterns and send an alert to exchange staff based on a machine-learned protocol. This will allow staff to look into the situation and, in some cases, remove fraudulent equity orders.

Trade Surveillance Systems Industry Overview

The competitive landscape of the trade surveillance systems market is moving towards fragmentation due to the increasing adoption of the solution worldwide. However, the market players see continuous innovation since the market is still developing. They are designing innovative and technologically integrated solutions to stay ahead of their competitors. Also, many startup companies are raising funds and investing in them to enter the market and attract maximum market share smoothly.

- September 2022: NICE Actimize, a NICE (NASDAQ: NICE) business, announced the launch of Compliancentral, a cloud-based, end-to-end communications monitoring and trade compliance platform for financial services firms. Compliancentral from NICE Actimize helps buy-side, sell-side, online trading platforms, insurance, and wealth management firms capture and analyze all types of employee communications, trades, and behaviors to find hidden conduct risk.

- In July 2022, SymphonyAI, a provider of high-value enterprise AI SaaS for strategic industries, announced that it had acquired BAE Systems' financial crime detection leader NetReveal. This acquisition is a significant step forward in SymphonyAI's financial vertical expansion strategy. Furthermore, the SymphonyAI Sensa Sensa platform was developed and launched by the company in late 2021, bringing AI-based analytics and insights to financial crime detection. NetReveal, a member of SymphonyAI's financial vertical, continues to use Sensa AI technology to deliver transformative innovations and powerful new products that better uncover anomalous activity, reduce false positives, and control costs.

- In March 2022, eFLOW Global and GRSS strengthened their collaboration to provide a managed surveillance solution. According to eFlow, the partnership between eFlow and GRSS is built on effective compliance, which comes from combining powerful technology with real-world knowledge.

Moreover, GRSS provides experienced compliance and trade monitoring specialists who analyze the output of a company's surveillance systems and present actionable reports to the compliance officer. For nearly two decades, eflow's TZ system, which debuted in 2004, has assisted compliance professionals in providing intense market abuse surveillance. On the other hand, eflow said that its market abuse services are more important than ever with this new partnership.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porters Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Assessment of Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Need for Market Surveillance and growing regulatory compliance

- 5.1.2 Growing Sophistication of Trade Surveillance via Advanced Analytics, AI, ML, etc.

- 5.2 Market Challenges

- 5.2.1 Complex Infrastructure and Dynamic Nature of the Frauds

6 MARKET SEGMENTATION

- 6.1 By Component

- 6.1.1 Solutions

- 6.1.2 Services

- 6.2 By Deployment

- 6.2.1 On-Premise

- 6.2.2 On-Cloud

- 6.3 By Geography

- 6.3.1 North America

- 6.3.1.1 United States

- 6.3.1.2 Canada

- 6.3.2 Europe

- 6.3.2.1 United Kingdom

- 6.3.2.2 Germany

- 6.3.2.3 Italy

- 6.3.2.4 France

- 6.3.2.5 Russia

- 6.3.2.6 Rest of Europe

- 6.3.3 Asia-Pacific

- 6.3.3.1 China

- 6.3.3.2 India

- 6.3.3.3 Japan

- 6.3.3.4 South Korea

- 6.3.3.5 Australia and New Zealand

- 6.3.3.6 Rest of Asia Pacific

- 6.3.4 Latin America

- 6.3.4.1 Brazil

- 6.3.4.2 Mexico

- 6.3.4.3 Rest of Latin America

- 6.3.5 Middle East and Africa

- 6.3.1 North America

7 VENDOR MARKET SHARE

8 COMPETITIVE LANDSCAPE

- 8.1 Company Profiles

- 8.1.1 Software AG

- 8.1.2 Nice Ltd.

- 8.1.3 BAE Systems, Inc.

- 8.1.4 eFlow Ltd.

- 8.1.5 Fidelity National Information Services, Inc.

- 8.1.6 Nasdaq, Inc.

- 8.1.7 SIA S.P.A.

- 8.1.8 Aquis Technologies

- 8.1.9 B-Next Group

- 8.1.10 ACA Compliance Group Holdings, LLC

- 8.1.11 Trillium Management LLC