|

市场调查报告书

商品编码

1630316

印刷设备:市场占有率分析、产业趋势与统计、成长预测(2025-2030)Print Equipment - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

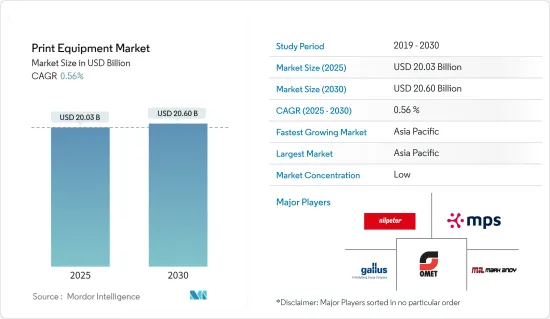

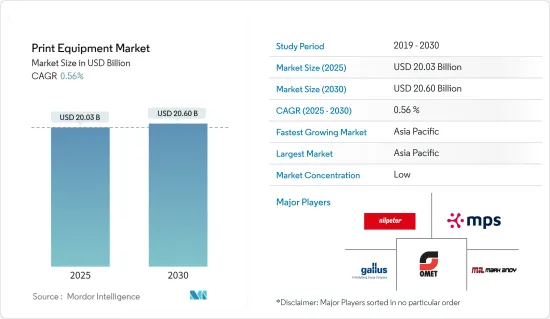

印刷设备市场规模预计到2025年为200.3亿美元,预计2030年将达到206亿美元,预测期间(2025-2030年)复合年增长率为0.56%。

主要亮点

- 公司和机构正在推动印刷设备市场的发展,将印刷用于各种应用,包括广告、书籍、包装、标籤和商业印刷。先进技术的渗透,例如更快的印刷设备和创新的墨水和碳粉解决方案,将提高生产能力并提高品质。此外,印刷技术的进步在大批量印刷的成长中发挥着至关重要的作用。

- 3D 列印使包装公司能够创造出具有 3D 纹理、浮雕效果和独特形状的产品来吸引客户,从而增加印刷材料的视觉吸引力。 3D列印的采用拓宽了频谱,使得在塑胶和金属等多种材料上进行列印成为可能,为列印设备市场开闢了创造性途径。

- 在全球范围内,工业印表机因其在大批量列印方面的成本效益和效率而受到青睐。一个显着的成长要素是对高品质印刷包装材料的需求不断增长,这对于广告和品牌推广至关重要。全球对电子商务领域包装和标籤的需求,尤其是亚马逊等采用创新设计工具的企业,正在为商业印刷市场提供重大推动力。

- 此外,广告和商业印刷等行业正在透过数位印刷的整合而转变。这项变更将使设计人员能够更快地生产客製化产品。人工智慧、机器学习、物联网和资料分析的技术进步正在显着增强个人化。数位印刷的这一发展确保了即使是大订单也能实现卓越的印刷个人化。

- 包装印刷应用需求的快速成长预计将推动未来几年的市场成长。此外,对数位印刷的需求不断增加、软包装的吸引力、成本效益和减少包装废弃物的努力预计将推动市场的发展。

- 製造商面临着升级技术以应对不断变化的趋势并保持竞争力的挑战。小规模的升级可能影响不大,但整台机器大修对企业构成了重大挑战。

印刷设备市场趋势

柔印预计将大幅成长

- 柔版印刷设备主要是由高速生产和高效印刷的需求所驱动的。结果,柔版印刷的进步为油墨开闢了广阔的市场。包装表面印刷的成长趋势,特别是在食品和消费品行业,正在推动柔印行业的成长。

- 人工智慧、机器学习和资料分析等技术正在推动个人化。特别是,物联网(IoT)连线数量预计将从2022年的29亿增加到2028年的60亿以上。柔版印刷的这种技术融合提高了印刷的个人化,特别是对于大订单。

- 柔版印刷用途广泛,可在纸张和纸板等永续基材上印刷。使用生物基薄膜和可堆肥材料等软包装材料可以减少包装对环境的影响。市场供应商正在提高柔印从设计到印刷品质的生产力、成本效率、永续性和一致性。在柔印技术中,低黏度墨水对于确保印刷单元内的墨水流畅流动至关重要。

- 柔印设备适应性强,可用于包装和标籤等行业。这种灵活性使印刷公司能够满足各种订单、扩大市场范围并保持竞争力。

亚太地区预计将出现显着成长

- 亚太地区预计将主导市场,由于包装印刷领域强劲的最终用户需求和丰富的市场发展机会,许多公司将在该地区投资。

- 在日本印刷设备市场,胶印占据压倒性地位,尤其是在书籍、杂誌、报纸等大量商业印刷领域。这家日本製造商的最新胶印设备以其精度、速度和卓越的品质而备受推崇。然而,随着需求的发展,喷墨印刷等数位技术正迅速获得关注,其在纺织应用中的兴起证明了这一点。

- 印度印刷设备市场越来越多地采用数位技术,因为它比传统方法更具成本效益、交付更快、更可客製化。从喷墨印表机到雷射印表机,数位设备的激增是由短版印刷、可变资料印刷和按需服务的需求推动的。

- 印度经济的稳定成长和零售、製药、包装、广告等行业的快速成长正在推动印刷设备的需求。随着这些行业的扩张和多元化,对高品质印刷解决方案的需求不断增长,以加强行销、品牌、包装和产品标识工作。

印刷设备产业概况

印刷设备市场分散,技术进步正在加剧国内和全球参与者之间的竞争。主要参与者包括 Mark Andy Inc.、OMET Srl、Nilpeter Holding A/S、Gallus (Heidelberger Druckmaschinen AG) 和 MPS Systems BV。

随着户外标誌、海报、黏性墙壁和地板印刷、客製化包装等的需求持续飙升,对商业印表机的需求持续成长。因此,室内外标牌製造商和包装设计师都需要高品质的商业印刷设备。这一趋势将推动市场成长。

对胶印的需求显着增加,特别是法律表格、文件、目录、小册子和日历。对胶印的日益增长的需求正在推动对相关印刷设备的需求。

其他好处:

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 生态系分析

第五章市场动态

- 市场驱动因素

- 对数位印刷技术的需求不断增长

- 加大包装印刷设备机械投入

- 市场限制因素

- 与列印相关的高设定和营运成本

- 印刷业的关键创新与发展

- 影响全球设备市场的行业标准和法规

- 列印耗材需求洞察

- 由永续性和消耗品(例如水性和 UV 墨水)的作用所驱动的创新

- 未来市场趋势及主要成长预期

第六章 市场细分

- 依技术

- 胶印轮转印刷

- 柔版印刷

- 凹版印刷

- 网版印刷

- 数位的

- 按用途

- 图书

- 商业印刷

- 广告印刷

- 安全

- 贸易印刷

- 包裹

- 标籤

- 其他用途

- 按地区

- 北美洲

- 美国

- 加拿大

- 欧洲

- 德国

- 法国

- 义大利

- 英国

- 荷兰

- 亚太地区

- 日本

- 印度

- 中国

- 澳洲/纽西兰

- 拉丁美洲

- 中东/非洲

- 北美洲

第七章 竞争格局

- 公司简介

- Mark Andy Inc.

- OMET SRL

- Nilpeter A/S

- Gallus(Heidelberger Druckmaschinen AG)

- MPS Systems BV

- Lombardiconverting Machinery SpA

- Uteco Converting SpA

- Dg Press Services BV

- Fujifilm Holdings Corporation

- Bobst Group SA

- Heidelberger Druckmaschinen AG

- Koenig & Bauer AG

- Konica Minolta Inc.

- HP Inc.

- Paper Converting Machine Company(PCMC)

- Electronics for Imaging, Inc.

- Canon Inc.

- Seiko Epson Corporation

- Edale Limited

- Brothers Industries Ltd

- Agfa-Gevaert Group

- Ricoh Company Ltd

- Manroland AG(langley)

- AB Graphic International Limited

- Durst Image Technology US LLC

第八章投资分析

第九章 市场未来展望

The Print Equipment Market size is estimated at USD 20.03 billion in 2025, and is expected to reach USD 20.60 billion by 2030, at a CAGR of 0.56% during the forecast period (2025-2030).

Key Highlights

- Businesses and facilities drive the printing equipment market, utilizing printing for diverse applications, including advertising, books, packaging, labels, and commercial printing. The penetration of advanced technologies, such as faster presses and innovative ink and toner solutions, is set to boost production capacity and enhance quality. Moreover, technological advancements in printing play a pivotal role in the growth of high-volume printing.

- Through 3D printing, packaging companies can craft products that captivate customers with three-dimensional textures, embossed effects, and distinctive shapes, enriching the visual appeal of printed materials. The adoption of 3D printing broadens the spectrum, allowing printing on diverse materials like plastics and metals, thus unveiling creative avenues for the print equipment market.

- Globally, businesses are gravitating toward industrial printers, drawn by their cost-effectiveness and efficiency in high-volume printing. A notable growth driver is the rising demand for high-quality printed packaging materials, pivotal for advertising and branding. The e-commerce sector's global appetite for packaging and labeling, especially with players like Amazon embracing innovative design tools, significantly propels the commercial printing market.

- Moreover, industries like advertising and commercial printing are undergoing a transformation with the integration of digital printing. This shift empowers designers to produce customized products at an accelerated pace. Technological strides in AI, machine learning, IoT, and data analytics have markedly enhanced personalization. This digital printing evolution ensures superior print personalization, even for large-volume orders.

- The surging demand for packaging printing applications is poised to drive market growth in the coming years. Additionally, the rising appetite for digital printing, the allure of flexible packaging, cost-effectiveness, and a push to reduce packaging waste are expected to drive the market.

- Manufacturers grapple with the challenge of staying attuned to evolving trends and upgrading technologies to maintain a competitive edge. While minor upgrades might have a subdued impact, overhauling entire machines can pose significant challenges for businesses.

Print Equipment Market Trends

Flexographic Printing Expected to Witness Major Growth

- Flexographic printing machines are primarily driven by the demand for high production speeds and efficient printing. Consequently, advancements in flexographic printing have opened up a vast market for inks. The rising trend of printing on packaging surfaces, particularly in the food and consumer goods industries, has spurred the growth of the flexographic segment.

- Technologies like AI, machine learning, and data analytics are enhancing personalization. Notably, the number of Internet of Things (IoT) connections, which stood at 2.9 billion in 2022, is projected to surpass 6 billion by 2028. This technological convergence in flexographic printing is elevating print personalization, especially for large-volume orders.

- Flexographic printing is versatile and capable of being executed on sustainable substrates like paper and cardboard. Utilizing flexible packaging materials, such as bio-based films and compostable substances, mitigates the environmental footprint of packaging. Market vendors are enhancing the productivity, cost-effectiveness, sustainability, and consistency of flexo printing, from design to print quality. In flexible printing technology, low-viscosity inks are crucial for ensuring a smooth ink flow through the printing unit.

- Flexographic printing machinery boasts adaptability and is used across industries like packaging and labeling. This flexibility empowers print businesses to cater to diverse orders, broadening their market reach and maintaining a competitive edge.

Asia-Pacific Expected to Register Major Growth

- Asia-Pacific is poised to dominate the market, with numerous firms channeling investments into the region, driven by robust end-user demand and abundant development opportunities in packaging printing.

- In the Japanese market for print equipment, offset printing holds a dominant position, particularly for high-volume commercial tasks such as books, magazines, and newspapers. Japanese manufacturers' modern offset printing presses are celebrated for their precision, speed, and superior build quality. However, as demands evolve, digital technologies, such as inkjet printing, are swiftly gaining traction, which is evident in their rising prominence in textile applications.

- India's market for print equipment is progressively embracing digital technologies, drawn by their cost-effectiveness, quicker turnaround, and enhanced customization over traditional methods. The surge in digital equipment usage, from inkjet to laser printers, is propelled by demands for shorter print runs, variable data printing, and on-demand services.

- India's steady economic ascent and its burgeoning industries, such as retail, pharmaceuticals, packaging, and advertising, are driving the demand for print equipment. As these industries expand and diversify, there is an increasing need for high-quality printing solutions to bolster marketing, branding, packaging, and product identification efforts.

Print Equipment Industry Overview

The print equipment market is fragmented, and due to technological advancements, rivalry is increasing among local and global players. Key players include Mark Andy Inc., OMET Srl, Nilpeter Holding A/S, Gallus (Heidelberger Druckmaschinen AG), and MPS Systems BV.

As the demand for outdoor billboards, posters, adhesive wall and floor prints, and customized packaging surges, the need for commercial printers becomes increasingly vital. Consequently, manufacturers of both indoor and outdoor signage, along with packaging designers, are turning to high-quality commercial printers. This trend is poised to propel market growth.

There is a notable uptick in the demand for offset printing, particularly for legal forms, documents, catalogs, brochures, and calendars. This growing appetite for offset printing is, in turn, driving the demand for associated printing equipment.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3 Industry Ecosystem Analysis

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growing Demand for Digital Printing Technology

- 5.1.2 Increasing Investment in the Packaging Printing Machinery

- 5.2 Market Restraints

- 5.2.1 High Setup and Operational Cost Associated With Printing

- 5.3 Key Innovations and Developments in the Printing Industry

- 5.4 Industry Standards and Regulations Impacting the Global Equipment Market

- 5.5 Insights on the Demand for Printing Consumables

- 5.6 Innovations Driven By Sustainability and Role of Consumables (Such as Water-based and UV Inks)

- 5.7 Future Market Trends and Key Growth Expectations

6 MARKET SEGMENTATION

- 6.1 By Technology

- 6.1.1 Web Offset Lithographic

- 6.1.2 Flexographic

- 6.1.3 Gravure

- 6.1.4 Screen Printing

- 6.1.5 Digital

- 6.2 By Application

- 6.2.1 Books

- 6.2.2 Commercial Print

- 6.2.3 Advertising Print

- 6.2.4 Security

- 6.2.5 Transactional Print

- 6.2.6 Packaging

- 6.2.7 Labels

- 6.2.8 Other Applications

- 6.3 By Geography

- 6.3.1 North America

- 6.3.1.1 United States

- 6.3.1.2 Canada

- 6.3.2 Europe

- 6.3.2.1 Germany

- 6.3.2.2 France

- 6.3.2.3 Italy

- 6.3.2.4 United Kingdom

- 6.3.2.5 Netherlands

- 6.3.3 Asia-Pacific

- 6.3.3.1 Japan

- 6.3.3.2 India

- 6.3.3.3 China

- 6.3.4 Australia and New Zealand

- 6.3.5 Latin America

- 6.3.6 Middle East and Africa

- 6.3.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Mark Andy Inc.

- 7.1.2 OMET S.R.L.

- 7.1.3 Nilpeter A/S

- 7.1.4 Gallus (Heidelberger Druckmaschinen AG)

- 7.1.5 MPS Systems B.V.

- 7.1.6 Lombardiconverting Machinery S.p.A.

- 7.1.7 Uteco Converting SpA

- 7.1.8 Dg Press Services BV

- 7.1.9 Fujifilm Holdings Corporation

- 7.1.10 Bobst Group SA

- 7.1.11 Heidelberger Druckmaschinen AG

- 7.1.12 Koenig & Bauer AG

- 7.1.13 Konica Minolta Inc.

- 7.1.14 HP Inc.

- 7.1.15 Paper Converting Machine Company (PCMC)

- 7.1.16 Electronics for Imaging, Inc.

- 7.1.17 Canon Inc.

- 7.1.18 Seiko Epson Corporation

- 7.1.19 Edale Limited

- 7.1.20 Brothers Industries Ltd

- 7.1.21 Agfa-Gevaert Group

- 7.1.22 Ricoh Company Ltd

- 7.1.23 Manroland AG (langley)

- 7.1.24 AB Graphic International Limited

- 7.1.25 Durst Image Technology U.S. LLC