|

市场调查报告书

商品编码

1690909

大尺寸印表机 (LFP):市场占有率分析、产业趋势与统计资料、成长预测(2025-2030 年)Large Format Printers (LFP) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

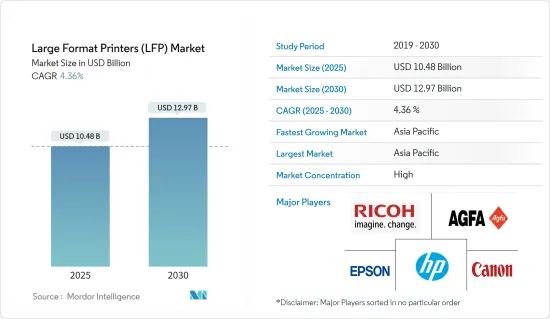

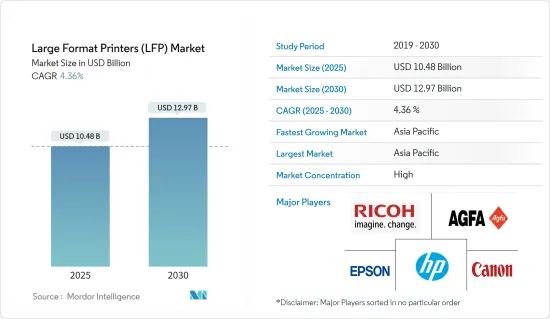

预计大尺寸印表机市场规模将在 2025 年达到 104.8 亿美元,在 2030 年达到 129.7 亿美元,预测期内(2025-2030 年)的复合年增长率为 4.36%。

关键亮点

- 广告、包装和纺织品是全球市场收益成长的主要贡献产业。许多本地和国际品牌和公司都依赖大尺寸印表机来辅助户外广告宣传。此外,媒体尺寸较大,这意味着从远处就可以看到它。使用大型广告看板、横幅、标誌和建筑包装进行广告宣传可以吸引目标受众并增加销售额和收益。

- 大尺寸印表机主要用于列印较大的图案或材料,这些图案或材料因尺寸而无法在标准印表机上列印。这些印表机有时被称为「宽幅印表机」。大尺寸印表机用于满足需要在较大尺寸基材上列印的各种列印需求。这些印表机是列印纺织品、标誌、 CAD、技术列印、广告海报等的理想解决方案。

- 印刷技术的进步和市场上各种油墨的供应增加了大尺寸印表机的应用,从而促进了市场的成长。此外,预计对大格式和技术图形的日益关注将推动 2024 年至 2029 年的市场成长。

- 大尺寸印表机主要用于列印标誌,这将在 2024 年为市场收益做出贡献。广告看板是企业和公司户外广告的主要形式,在行销产品、服务和公司方面非常有用。此外,室内标牌用于各种行销和非行销目的,包括销售点广告以及警告和指示标誌。随着时间的推移,技术的进步促进了印表机的发展,从而提高了列印速度和生产率。因此,越来越重视快速列印服务的客户正透过这些高速印表机得到满足。

- 市场在地化程度不断提高导緻小批量包装的需求增加。这使得公司能够向专业产品製造商和当地零售商提供利基包装,帮助最终用户开拓新市场并增加销售收益。这些印表机用于各种行业领域的大尺寸包装应用,包括食品和饮料、电气和电子、休閒和家具。预计这些产业的持续成长和产品需求的持续成长将在 2024 年至 2029 年期间推动对大尺寸印表机的需求。

- 大尺寸印表机需要在初始安装、营运成本和维护方面进行大量投资。大尺寸列印也要求使用多种列印材料。此外,大尺寸印表机消耗大量电力。大尺寸印表机的高运作成本主要是由于印表机设计复杂以及墨水价格高,这限制了市场的成长。

大尺寸印表机(LFP)市场趋势

预计紫外线固化油墨和基于 CAD 的解决方案的使用将刺激市场需求

- 包装和纺织品是全球市场收益成长的主要贡献产业。日本和海外的各种品牌和公司都在使用大尺寸印表机进行户外广告宣传。此外,媒体尺寸较大,这意味着从很远的地方就可以看到它。使用大型广告看板、横幅、标誌和建筑包装进行广告宣传可以吸引目标受众,从而增加销售额和收益。

- 折迭式纸盒、软包装和标籤印刷是三种需要印刷和切割的包装应用,其中折迭式纸盒增加了一些文件准备(结构 CAD 文件)和整理(模切、折迭式、粘合)工序。此外,预计纸板消费将推动市场成长。据拥有百年历史的巴西跨国公司Suzano称,未来十年纸板需求量预计将进一步增长,从2024年的5,600万吨增至2032年的6,600万吨。

- 印表机技术的进步带动了大尺寸印表机许多领域的发展。其中之一就是在更短的时间内製作出高品质的印刷品。最终用户对更短交货时间的需求不断增加,这促使市场开发商开发能够更快列印的印表机。此外,一些印表机的自动化流程消除了列印过程中的手动劳动,缩短了整个列印过程。

- 持续的技术进步对于客户扩张和公司的持续成长至关重要。许多公司正在不断加大力度製造先进的印表机。例如,2024年2月,佳能为亚太市场推出了三款采用新型LUCIA PRO II颜料墨水的imagePROGRAF GP系列(GP-526S/546S/566S)印表机。

- 此外,紫外线固化喷墨印表机的出现彻底改变了市场。紫外线固化油墨是完全配製的油墨,除非暴露在强紫外线下才会变硬,否则会保持液态。这些油墨不含溶剂,因此无法被基材吸收并干燥。因此,油墨固化后就会干燥。这种墨水可以用更少的时间和成本产生高品质的图像。紫外线固化油墨正在推动大尺寸印表机市场的发展,因为它们可用于多种应用。

- 电脑辅助设计 (CAD) 印表机非常复杂,需要准确、精确的列印技术。这些设计主要由设计复杂、大型结构的建筑师和工程师使用。公司正在向市场推出专门针对这些印刷应用的新产品。

- 例如,2023 年 2 月,佳能印度推出了 ImagePrograf TC~20,扩展了其印刷产品组合。这是该公司第一款具有 A1-plus 功能的桌上型四色颜料墨水大尺寸印表机。 TC-20 的设计旨在满足当今建筑师的多样化需求。它外形时尚、结构紧凑,适合小型工作空间和家庭办公室。儘管体积小,TC-20 仍能在大型蓝图和图纸上输出生动、多彩、高品质的输出。因此,预计此类印刷技术将在 2024 年至 2029 年期间推动市场成长。

亚太地区预计将成为市场成长最快的部分

- 亚太地区是全球最重要的大尺寸印表机市场之一。中国、印度和日本等国家对该地区的全球份额做出了巨大贡献。预计该地区在 2024 年至 2029 年间也将实现最快的成长。

- 新冠肺炎疫情对该地区的经济造成了严重影响。随着 2020 年市场完全关闭数月,零售、汽车、BFSI 等行业见证了客户与品牌和产品互动方式的巨大转变。数位商务也在成长。根据印度品牌资产基金会的数据,到 2025 年,印度的电子商务市场预计将成长到 1,114 亿美元。因此,亚太地区主要经济体数位化的提高预计将阻碍该地区大尺寸印表机市场的成长。

- 由于大尺寸印表机在图形印刷、服装纺织品印刷、电脑辅助设计 (CAD) 和技术印刷应用中的使用日益增多,亚太地区对大幅面印表机的需求很高。亚太地区被视为全球经济的主要成长引擎。日本、韩国等国家已发展成为新兴经济体,而中国在过去二十年中一直是全球成长最快的经济体。

- 此外,亚太地区是服装和纺织产品的重要生产地,预计该领域也将稳定成长。尤其是印度,受印度良好经济情势的推动,其广告和指示牌应用大尺寸印表机市场可能会显着成长。

大尺寸印表机(LFP)市场概览

大尺寸印表机市场适度整合,少数全球参与企业占大部分份额。公司为保持竞争力而采取的对研发、新产品发布、市场倡议、併购、联盟和其他关键成长策略的高投资包括:市场的主要企业是佳能、惠普公司、理光和爱普生。

- 2024 年 1 月,Canon宣布推出其广受欢迎的 12 色 imagePROGRAF PRO大尺寸印表机的改良系列。新系列专为摄影和美术市场设计,包括三种型号:60 吋/1524 mm imagePROGRAF PRO-6600、44 吋/1118 mm PRO-4600 和 24 吋/610 mm PRO-2600,分别取代 imagePROGRAF PRO-6100、PRO-4100 和 PROimagePROGRAF PRO-6100、PRO-4100 和 PROimagePROGRAF PRO-6100、PRO-4100 和 PROimagePROGRAF PRO-6100、PRO-4100。与新型颜料墨水套装「LUCIA PRO II」搭配使用,新的 12 色系列可提供 imagePROGRAF 印表机最高的相片列印品质。此次推出的产品满足了人们对提高影像耐久性和耐光性的需求,提高了印刷品的长期存檔质量,同时也提供了新的环境效益。 imagePROGRAF PRO系列将在2024年德鲁巴展会展出,佳能摊位位于8A展间B41-1至B41-8。

- 2023 年 12 月,惠普印度公司推出了新系列 36 吋 HP DesignJet 印表机,旨在满足在混合环境中工作的建筑、工程和施工 (AEC) 专业人士的列印需求。这些高品质的印表机旨在提供无论身在何处的无缝列印体验。此外,这些设备可以帮助影印店更好地满足其 AEC 客户的需求。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概览

- 产业价值链分析

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争强度

第五章市场动态

- 市场驱动因素

- 包装、广告和纺织业的需求不断增长

- 印表机和油墨基础的进步,例如在印刷中使用紫外线固化油墨和基于 CAD 的解决方案

- 市场限制

- 来自基于数位广告的媒体的强大威胁。

第六章市场区隔

- 按类型

- 印表机

- 喷墨印表机

- 以碳粉为基础的印表机

- 软体服务

- 印表机

- 按油墨类型

- 水性油墨

- 溶剂墨水

- UV固化油墨

- 热昇华墨水

- 按最终用户产业

- 服装纺织品

- 招牌

- 广告

- 装饰

- CAD 和技术印刷

- 其他的

- ***按地区

- 北美洲

- 美国

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 亚洲

- 澳洲和纽西兰

- 北美洲

第七章竞争格局

- 公司简介

- Hewlett-Packard

- Canon Inc.

- Seiko Epson Corporation

- Mimaki Engineering Co. Ltd

- Roland DG Corporation

- Ricoh Company Ltd

- Agfa-Gevaert NV

- Kyocera Corporation

第八章投资分析

第九章:市场的未来

The Large Format Printers Market size is estimated at USD 10.48 billion in 2025, and is expected to reach USD 12.97 billion by 2030, at a CAGR of 4.36% during the forecast period (2025-2030).

Key Highlights

- Advertising, packaging, and textiles are the key industries that contribute to revenue growth in the global market space. Various national and international brands and corporations utilize large format printers to assist them in their out-of-home advertising effort. Moreover, the large size of the media makes it visible from a distance. Advertising using large hoardings, banners, signages, and building wraps is used to attract the target audience and subsequently increase their sales and revenue.

- A large format printer is essentially used for printing large designs and materials that cannot be printed using the standard printer due to their large size. These printers are sometimes referred to as 'wide format printers.' Large format printers are used for various printing needs that require the print to be done on a substrate with larger dimensions. These printers are ideal solutions for printing textiles, signages, CAD and technical printing, advertisement posters, and others.

- The advancement in printing technologies and the availability of various inks in the market have increased the number of applications of large format printers, which, in turn, is resulting in the growth of the market. Further, the growing emphasis on large and technical graphics is estimated to propel the market growth between 2024 and 2029.

- Large format printers are primarily used for printing signages, contributing to the market revenue in 2024. Signages are a key form of outdoor advertising efforts of businesses or corporations and are highly useful for marketing the products, services, and the company. Additionally, indoor signages are used for various marketing and non-marketing purposes, including POS advertising and signages with warnings and directions. Technological advancements over time led to the development of printers that offer increased speed and productivity of printing. As such, the growing customer emphasis on quick printing services is satisfied by these fast-processing printers.

- The growing localized nature of the market resulted in an increased demand for short-run packaging. It enables the companies to provide niche packaging to specialty product manufacturers or local retailers, enabling the end users to go after new markets and increase their sales revenues. These printers find their applications in large format packaging across various industrial sectors, including food and beverage, electrical and electronics, leisure, and furniture. Continuous growth and increasing demand for products from these sectors are anticipated to bolster the demand for large format printers between 2024 and 2029.

- Large format printers require high initial installation, operating costs, and maintenance investments. Large-format printing necessitates the use of a variety of printing materials. Furthermore, large format printers consume a lot of electricity, and the high running costs of large format printers are largely due to the printers' design complexity and high ink prices, which restrict the market growth.

Large Format Printers (LFP) Market Trends

The Use of UV-curable inks and CAD-based solutions is Expected to boost the Market Demand

- Packaging and textiles are the key industries contributing to revenue growth in the global market. Various national and international brands and corporations utilize large format printers to assist them in their out-of-home advertising effort. Moreover, the large size of the media makes it visible from a distance. Advertising using large hoardings, banners, signages, and building wraps attracts the target audience and subsequently increases its sales and revenue.

- Folding cartons, flexible packaging, and label printing are the three packaging applications that require printing and cutting, with folding cartons adding a few more processes to the file preparation (structural CAD files) and finishing (die-cutting, folding, and gluing). Moreover, the consumption of carton boards is expected to drive the growth of the market. According to Suzano, a Brazilian multinational company with a 100-year history, the demand for carton boards is expected to increase further over the next decade, reaching 66 million tons by 2032, up from 56 million tons in 2024.

- Technological advancements in printers have led to the development of large format printers in various aspects. One of these aspects is producing a good quality print in less time. The increasing demand for faster turnaround times from end users has encouraged the market players to develop printers capable of producing print quickly. Moreover, automated processes in several printers have eliminated the need for manual intervention in printing, thereby shortening the entire printing process.

- Continuous technological advancements are crucial for customer expansion and the company's continued growth. Several companies are continuously increasing their efforts to manufacture advanced printers. For instance, in February 2024, Canon launched three new imagePROGRAF GP Series (GP-526S/546S/566S) printers using the new LUCIA PRO II pigment ink for the Asia-Pacific market.

- Moreover, the advent of UV-curable inkjet printers transformed the market. UV curing inks are entirely formulated inks that remain in the liquid state unless exposed to intense UV light for curing. These inks do not contain solvents and, therefore, do not get absorbed into the substrates for drying. As such, the ink is dried after curing. This type of ink provides high-quality images with less time and cost. UV-curable ink can cater to many applications, driving the market for large format printers.

- Computer-aided Design (CAD) printers are complex and require precise and accurate printing technology, especially when printing on larger formats, as the designs are easily visible. These designs are primarily used by architects and engineers who design complex, large-scale structures. Companies are introducing new products in the market that specifically cater to such printing applications.

- For instance, in February 2023, Canon India expanded its printing portfolio by introducing the ImagePrograf TC-20. This is the company's first desktop four-color pigment ink large format printer with A1 plus capability. The TC-20 is designed to meet the versatile needs of today's architects. It is sleek and compact, making it suitable for small workspaces or home offices. Despite its size, the TC-20 delivers vibrant, colorful, and high-quality output for large designs and blueprints. Therefore, such printing technologies are expected to drive market growth between 2024 and 2029.

Asia-Pacific is Expected to be the Fastest Growing Segment in the Market

- Asia Pacific is one of the most important markets for large format printers worldwide. Countries such as China, India, and Japan are the key contributors to the region's global share. The region is also anticipated to register the fastest growth between 2024 and 2029.

- The COVID-19 pandemic severely impacted the economies across the region. With markets completely shut down for several months during 2020, industries such as retail, automotive, and BFSI, among others, witnessed drastic changes concerning how customers engage with the brands and products. Besides, digital commerce also saw growth. According to the India Brand Equity Foundation, the e-commerce market in India is expected to grow to USD 111.40 billion by 2025. As such, the growing digitalization across key economies in Asia-Pacific is anticipated to impede the growth of the regional large format printer market.

- There is a high demand for large-format printers in Asia-Pacific due to their increasing use in graphics printing, apparel and textile printing, computer-aided design (CAD), and technical printing applications. Asia Pacific is considered a major growth engine for the global economy. Countries like Japan and South Korea have already developed strong economies, and China has been the world's fastest-growing economy for the past two decades.

- Additionally, Asia-Pacific is a significant producer of apparel and textiles, and this sector is expected to grow steadily in the region. There is likely to be significant growth in the market for large format printers, particularly in advertising and signage applications in India, driven by its booming economy.

Large Format Printers (LFP) Market Overview

The large format printer market is moderately consolidated, with a majority share acquired by a few global players. High investments in R&D, new product launches, market initiatives, mergers and acquisitions, partnerships, and collaborations are the prime growth strategies adopted by companies to sustain the competition. Key players in the market are Canon, HP Inc., Ricoh, and Epson.

- In January 2024, Canon introduced an improved series of its popular 12-color imagePROGRAF PRO large format printers. The new series is designed for the photography and fine art markets and includes three models: the 60"/1524mm imagePROGRAF PRO-6600, the 44"/1118mm PRO-4600, and the 24"/610mm PRO-2600, replacing the imagePROGRAF PRO-6100, PRO-4100, and PRO-2100, respectively. Along with a new pigment ink set, LUCIA PRO II, the new 12-color series offers the highest photo print quality of any imagePROGRAF printer. This launch addresses the demand for greater image durability and light resistance to improve long-term print storage while providing new environmental benefits. The imagePROGRAF PRO series is expected to be showcased at Drupa 2024 on the Canon stand in Hall 8A, B41-1 - B41-8.

- In December 2023, HP India launched a new range of 36-inch HP DesignJet printers designed to meet the printing needs of architecture, engineering, and construction (AEC) professionals who work in a hybrid environment. These high-quality printers aim to provide a seamless printing experience, irrespective of location. Additionally, these devices will help copy shops better serve the needs of AEC customers.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products or Services

- 4.3.5 Intensity of competitive Rivalry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Rising Demand from Packaging, Advertising, and Textile Industries

- 5.1.2 Printer and Ink-based Advancements, Such as the Use of UV- Curable Inks and CAD -based Solutions in Printing

- 5.2 Market Restraints

- 5.2.1 Strong Threat from Digital Advertising-Based Media, as It Allows for Greater Flexibility and Engagement

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 Printers

- 6.1.1.1 Inkjet-based Printers

- 6.1.1.2 Toner-based Printers

- 6.1.2 Allied Software and Services

- 6.1.1 Printers

- 6.2 By Ink Type

- 6.2.1 Aqueous Ink

- 6.2.2 Solvent Ink

- 6.2.3 UV-curable Ink

- 6.2.4 Dye Sublimation Ink

- 6.3 By End-user Industry

- 6.3.1 Apparel and Textiles

- 6.3.2 Signage

- 6.3.3 Advertising

- 6.3.4 Decor

- 6.3.5 CAD and Technical printing

- 6.3.6 Other End-user Industries

- 6.4 ***By Geography

- 6.4.1 North America

- 6.4.1.1 United States

- 6.4.1.2 Canada

- 6.4.2 Europe

- 6.4.2.1 United Kingdom

- 6.4.2.2 Germany

- 6.4.2.3 France

- 6.4.3 Asia

- 6.4.4 Australia and New Zealand

- 6.4.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Hewlett-Packard

- 7.1.2 Canon Inc.

- 7.1.3 Seiko Epson Corporation

- 7.1.4 Mimaki Engineering Co. Ltd

- 7.1.5 Roland DG Corporation

- 7.1.6 Ricoh Company Ltd

- 7.1.7 Agfa-Gevaert NV

- 7.1.8 Kyocera Corporation