|

市场调查报告书

商品编码

1630381

东南亚可再生能源 -市场占有率分析、产业趋势与统计、成长预测(2025-2030)Southeast Asia Renewable Energy - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

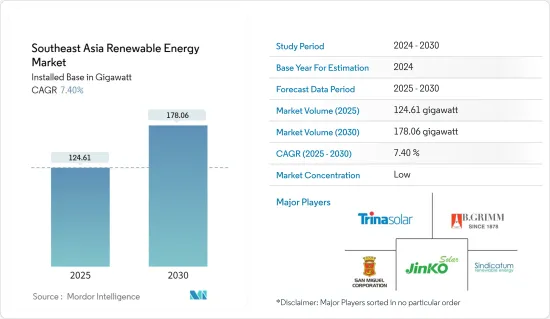

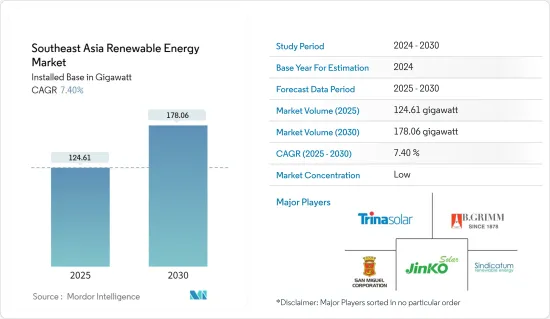

东南亚可再生能源市场规模(装置量)预计将从2025年的124.61吉瓦扩大到2030年的178.06吉瓦,预测期间(2025-2030年)复合年增长率为7.4%。

主要亮点

- 燃煤发电是东南亚的主流。然而,近年来可再生能源发电和电池的成本大幅下降,加上燃煤发电厂的资金枯竭。预计这将在预测期内推动东南亚可再生能源产业的发展。

- 然而,国际公司投资的缺乏和计划实用化的延迟预计将阻碍市场成长。

- 东南亚地区的石化燃料资源不足以满足不断增长的能源需求,这为可再生能源装置解决该地区不断增长的能源需求创造了巨大的机会。

- 越南具有很高的可再生能源潜力,将在预测期内主导该地区的可再生能源市场。

东南亚可再生能源市场趋势

太阳能板块实现显着成长

- 东南亚是成长最快的太阳能市场之一,使其成为全球太阳能产业扩张最有前景的地区之一。 2023 年,越南和泰国将走在这项运动的最前沿,安装该地区最新的太阳能发电能力。 2023年,越南太阳能发电装置容量为1,707万千瓦,泰国装置容量为318千万瓦。

- 不断增长的电力需求、该地区丰富的太阳能资源以及有利的可再生能源倡议正在支持该地区太阳能产业的成长。

- 此外,该地区各国的政策制定者正在加紧努力,确保能源领域走上安全、负担得起和永续的道路,包括努力促进对太阳能和基础设施的投资。

- 2024年4月,菲律宾能源部(DoE)宣布计划将太阳能发电量转换为2GW。政府预计到 2024 年至少将有 4,165 兆瓦的发电工程运作,混合使用可再生和传统能源。其中包括1,985兆瓦太阳能光电发电容量的商业调试,其中约495兆瓦已处于检查和试运行阶段,另外966.3兆瓦预计将于6月上线。

- 然而,到 2024 年,东南亚的累积光伏发电容量可能会增加到 35.8 吉瓦 (GW)。这得到了各国设定的高太阳能发电目标的支持。随着新兴国家希望显着增加可再生能源在其电力结构中的份额,预计该地区未来 5 至 15 年将会增加浮体式太阳能发电厂 (PV) 的发展。此外,开发计画正在进行中,特别是在泰国和越南,印尼、新加坡和缅甸已提案开发小型浮体式太阳能发电厂。

- 因此,鑑于上述几点,太阳能预计在预测期内东南亚可再生能源市场将显着成长。

越南主导市场

- 越南在可再生能源方面具有巨大潜力,包括水力发电、太阳能、风电、生质能和废弃物。生物质和水力发电是越南目前使用的两种主要可再生能源。政府计划在2025年安装11GW风电和20GW太阳能,预计将推动市场成长。

- 围绕燃煤发电厂和大型水电厂发展的环境问题和资金筹措限制、天然气工业发展缓慢以及政府暂停核能发电计划的决定都导致了太阳能发电量的下降预计这将是风力发电的成长机会。此外,该国的可再生能源产业过去一直依靠外国投资而成长,因为外国投资法规不适用于越南可再生能源计划的开发。

- 越南是亚洲成长最快的经济体之一,因此国内电力需求也不断增加。工业蓬勃发展和人口成长推动的电力需求预计未来将超过新发电厂的建设,导致严重的电力短缺。到2030年,预计将安装1.3亿千瓦的发电设施,是目前5,400万千瓦的两倍多。

- 越南的能源需求预计在未来五年内每年增长10%,所需发电能力将增加一倍,因此该国正在采取措施实现能源结构多元化,其中包括增加可再生能源发电的计划正在取得进展。屋顶太阳能发电市场预计将在帮助越南满足其庞大的能源需求方面发挥关键作用。

- 2024年1月,越南电力(EVN)在河内举行的第46届越老双边合作政府间委员会会议上宣布,将向寮国26座水力发电厂采购2,689兆瓦电力,并签署19份购电协议。该协议的签署标誌着越南与寮国电力合作的深入发展。

- 综上所述,预计越南将在预测期内主导该地区的可再生能源市场。

东南亚可再生能源产业概况

东南亚的可再生能源市场适度细分。市场主要企业包括(排名不分先后)Sindicatum Renewable Energy Company Pte Ltd、天合光能、晶科能源控股、B.Grimm Group 和 San Miguel Corporation。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 调查范围

- 市场定义

- 研究场所

第二章调查方法

第三章执行摘要

第四章市场概况

- 介绍

- 东南亚可再生能源结构(2023)

- 2029年可再生能源装置容量及预测(单位:GW)

- 最新趋势和发展

- 政府政策、目标、法规和政策

- 市场动态

- 促进因素

- 增加对可再生能源发电的投资

- 政府有利措施

- 抑制因素

- 可再生能源的初始成本较高

- 促进因素

- 供应链分析

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间敌对关係的强度

第五章市场区隔

- 按类型

- 阳光

- 风力

- 水力发电

- 生质能源

- 其他的

- 按地区

- 越南

- 印尼

- 菲律宾

- 泰国

- 马来西亚

- 其他东南亚地区

第六章 竞争状况

- 併购、合资、联盟、协议

- 主要企业策略

- 公司简介

- Canadian Solar Inc.

- JinkoSolar Holding Co. Ltd

- Sindicatum Renewable Energy Company Pte Ltd

- Trina Solar Co. Ltd

- San Miguel Corporation

- B.Grimm Group

- Thanh Thanh Cong(TTC)Group

- BCPG Public Company Limited(BCPG)

- Gulf Energy Development PCL

- 市场排名/份额(%)分析

第七章市场机会与未来趋势

- 东南亚离岸风力发电潜力与计划

简介目录

Product Code: 70308

The Southeast Asia Renewable Energy Market size in terms of installed base is expected to grow from 124.61 gigawatt in 2025 to 178.06 gigawatt by 2030, at a CAGR of 7.4% during the forecast period (2025-2030).

Key Highlights

- Coal-fired power generation is the dominant form of power generation in Southeast Asia. However, renewable power generation and battery costs registered a significant decline in recent years, combined with the drying up of the finances for coal-fired power plants. This is expected to drive the renewable energy sector in Southeast Asia during the forecast period.

- However, the lack of international companies' investments and the delay in the practical deployment of projects are expected to hinder the market's growth.

- The Southeast Asian region has insufficient indigenous fossil fuel resources to meet its growing energy demand, thus creating significant opportunities for renewable energy installations, which can then solve the region's ever-increasing energy demand.

- Vietnam has a high potential for renewable energy, thus creating its dominance in the region's renewable energy market during the forecast period.

Southeast Asia Renewable Energy Market Trends

Solar Energy Segment to Witness Significant Growth

- Southeast Asia is becoming one of the fastest-growing solar energy markets and one of the most promising regions in the global expansion of the solar energy industry. In 2023, Vietnam and Thailand were at the forefront of this movement, with the region's highest amount of new PV capacity installed. In 2023, Vietnam's installed solar energy capacity stood at 17.07 GW, while Thailand's installed solar capacity stood at 3.18 GW.

- The increasing demand for electricity, the abundance of solar resources in the region, and favorable renewable-related policies are some of the factors that have been favoring the growth of the solar industry in the region.

- In addition, policymakers across different countries in the region have been intensifying their efforts to ensure a secure, affordable, and sustainable pathway for the energy sector, which includes activities to facilitate investment in solar power generation and infrastructure.

- In April 2024, the Philippines Department of Energy (DoE) announced its plans to switch to 2 GW of solar power generation. The government expects at least 4,165 MW of power projects to come online in 2024 in a mix of renewable and conventional sources. This includes the start of commercial operation of 1,985 MW of solar capacities, of which some 495 MW are already in the testing and commissioning stage, and an additional 966.3 MW should come online by June.

- However, Southeast Asia's cumulative solar photovoltaic (PV) capacity could increase to 35.8 gigawatts (GW) by 2024. The high solar power generation targets set by various nations lend support to this. The region is expected to witness the development of floating solar photovoltaic (PV) power plants over the next 5 to 15 years, as countries in the region are looking to substantially increase their share of renewable energy in the power mix. Moreover, development plans are in progress, particularly in Thailand and Vietnam, while smaller utility-scale floating PV developments are being proposed in Indonesia, Singapore, and Myanmar.

- Therefore, owing to the points listed above, solar energy is expected to witness significant growth in the Southeast Asian renewable energy market during the forecast period.

Vietnam to Dominate the Market

- Vietnam has a high potential for renewable energy, including hydro, solar, wind, biomass, and waste. Biomass and hydropower are the two major sources of renewable energy currently used in Vietnam. The government aims to install 11 GW of wind power and 20 GW of solar power capacity by 2025, which is expected to foster the growth of the market.

- The environmental concerns and constraints in financing over the development of coal-fired and large-scale hydropower plants, the slow development of the natural gas industry, and the government's decision to suspend nuclear power projects are expected to provide an opportunity for the growth of solar and wind power in the country. Moreover, the renewable energy sector in the country has witnessed growth in the past, owing to investment from overseas, as there are no foreign ownership restrictions that apply to the development of renewable energy projects in Vietnam.

- Vietnam is one of the fastest-growing economies in Asia, and thus, the power demand in the country is increasing. The nation's demand for electricity, pushed up by its booming industry and a growing population, is expected to outstrip the construction of new power plants in the future, causing severe power shortages. By 2030, the country is expected to install 130 GW of electricity generation facilities, more than double the 54 GW currently installed.

- With Vietnam's energy demand projected to increase by 10% annually in the next five years and the required power capacity to double, the country has been taking initiatives to diversify its energy mix, including plans to generate more power from renewable sources. The rooftop solar market is expected to play a crucial role in helping Vietnam meet its massive energy needs.

- In January 2024, State utility Vietnam Electricity (EVN) entered 19 power purchase agreements for the acquisition of 2,689 MW of electricity from 26 hydropower plants in Laos during the 46th meeting of the Vietnam-Laos Intergovernmental Committee for Bilateral Cooperation in Hanoi. The signing of the agreements demonstrated deeper cooperation in electricity between Vietnam and Laos.

- Thus, owing to the points listed above, Vietnam is expected to dominate the renewable energy market in the region during the forecast period.

Southeast Asia Renewable Energy Industry Overview

The Southeast Asian renewable energy market is moderately fragmented. Some of the major companies in the market (in no particular order) include Sindicatum Renewable Energy Company Pte Ltd, Trina Solar Co. Ltd, Jinko Solar Holding Co. Ltd, B.Grimm Group, and San Miguel Corporation.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of Study

- 1.2 Market Definiton

- 1.3 Study Assumptions

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Southeast Asia Renewable Energy Mix, 2023

- 4.3 Renewable Energy Installed Capacity and Forecast in GW, till 2029

- 4.4 Recent Trends and Developments

- 4.5 Government Policies, Targets, and Regulations

- 4.6 Market Dynamics

- 4.6.1 Drivers

- 4.6.1.1 Increasing Investments in Renewable Energy Generation

- 4.6.1.2 Favorable Government Policies

- 4.6.2 Restraints

- 4.6.2.1 Initial Cost of Renewable Energy Is High

- 4.6.1 Drivers

- 4.7 Supply Chain Analysis

- 4.8 Industry Attractiveness - Porter's Five Forces Analysis

- 4.8.1 Bargaining Power of Suppliers

- 4.8.2 Bargaining Power of Consumers

- 4.8.3 Threat of New Entrants

- 4.8.4 Threat of Substitute Products and Services

- 4.8.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 By Type

- 5.1.1 Solar

- 5.1.2 Wind

- 5.1.3 Hydro

- 5.1.4 Bioenergy

- 5.1.5 Other Types

- 5.2 By Geography

- 5.2.1 Vietnam

- 5.2.2 Indonesia

- 5.2.3 Philippines

- 5.2.4 Thailand

- 5.2.5 Malaysia

- 5.2.6 Rest of Southeast Asia

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Canadian Solar Inc.

- 6.3.2 JinkoSolar Holding Co. Ltd

- 6.3.3 Sindicatum Renewable Energy Company Pte Ltd

- 6.3.4 Trina Solar Co. Ltd

- 6.3.5 San Miguel Corporation

- 6.3.6 B.Grimm Group

- 6.3.7 Thanh Thanh Cong (TTC) Group

- 6.3.8 BCPG Public Company Limited (BCPG)

- 6.3.9 Gulf Energy Development PCL

- 6.4 Market Ranking/Share (%) Analysis

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Southeast Asia's Offshore Wind Potential and Projects

02-2729-4219

+886-2-2729-4219