|

市场调查报告书

商品编码

1630411

南美洲一次电池:市场占有率分析、产业趋势、成长预测(2025-2030)South America Primary Battery - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

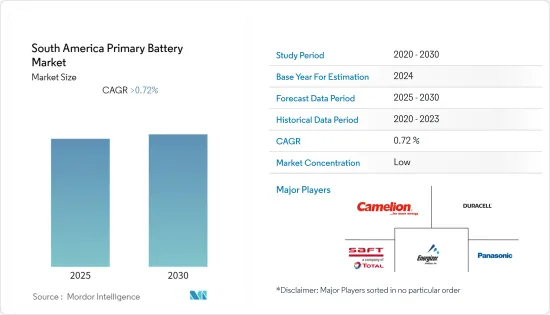

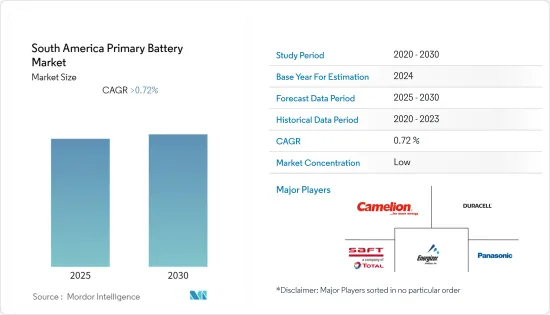

预计南美一次电池市场在预测期内的复合年增长率将超过0.72%。

COVID-19 对 2020 年市场产生了中等影响。目前,市场已达到疫情前水准。

主要亮点

- 军事应用对一次电池的需求增加以及家用电子电器的需求增加等因素预计将在预测期内推动市场发展。

- 另一方面,二次电池的日益普及预计将抑制市场成长。

- 一次电池的国内生产以及碱性电池替代碳锌电池可能会在未来几年为一次电池市场创造巨大的机会。

- 由于都市化进程的加速和国内生产总值的增长,预计巴西未来几年的需求将很大。

南美洲一次电池市场趋势

碱性一次电池占据市场主导地位

- 碱性一次电池将在 2022 年占据市场主导地位,并预计在预测期内将继续保持主导地位。这类电池比能量高,性价比高,环保,完全放电不会漏液。碱性电池的储存时间长达 10 年,安全性高,可装载到飞机上,无需遵守联合国运输法规或其他法规。

- 自 1960 年以来,碱性电池作为碳锌电池的替代品被引入,因为它们比碳锌电池具有更高的能量输出、更长的保质期和更长的使用寿命。

- 此外,碱性一次电池在日常生活中已变得不可或缺,特别是对于能量需求较低的产品。碱性电池有多种尺寸,包括AAA、AA和9V;AAA和AA适用于家用电子电器遥控器等低消耗应用,而C、D和9V则用于高消耗应用。然而,其他尺寸(例如微碱性纽扣电池和纽扣电池)也用于少数工业和医疗应用。

- 虽然碱性电池的价格比锌碳电池高,但碱性电池较长的使用寿命使其更受欢迎。碱性电池的生命週期越长,其实用价值就越高,这是其采用的主要因素。

- 近几十年来,碱性电池的性能取得了长足的进步。这些进步是包装和製造技术变化的结果,而不是基本化学系统改进的结果。

- 此外,碱性电池是环保的,可以丢进垃圾箱。此外,无需主动收集或回收。然而,製造的电池不含汞,因此在处理时不会造成任何环境污染或危险。这对这些电池产生了巨大的需求,因为其他可充电电池需要正确收集和回收。

- 因此,基于这些因素,一次碱性电池在预测期内可能会出现巨大的需求。

巴西预计需求量大

- 从长远来看,由于都市化程度的提高和 GDP 的正增长,巴西的经济前景预计将会改善。同时,国内每户可支配所得也可望增加。都市化,加上可支配收入的增加,预计将增加使用一次电池的家用电器的需求。家用电子电器市场预计短期内将温和成长,但长期可能会扩大。

- 根据ABINEE(巴西电气电子设备协会)统计,巴西电气电子设备产业收益达418亿美元,与前一年同期比较成长22%,令人印象深刻。预计2022年将达455.3亿美元。

- 2021年,我国都市化取得进展。该国约87.1%的人口居住在都市区,而上年度则为86.8%。此外,中国的都市化预计将继续上升,但速度将放缓。

- 在新政府雄心勃勃的改革议程的支持下,宪法修正案获得通过,限制联邦政府的非利息支出。全国GDP增速1.06%,正成长1.1%。

- 巴西一次电池的主要供应商是中国、美国和德国。巴西一次电池进口额远超过出口额,显示一次电池需求高度依赖进口。巴西的一次电池市场需求由外国製造商的经销网路和通路合作伙伴负责处理。

- 因此,基于上述因素,预计巴西一次电池市场在预测期内将出现巨大需求。

南美洲一次电池产业概况

南美洲一次电池市场适度细分。主要企业(排名不分先后)包括 Camelion Battery、Duracell Inc.、Energizer Holdings Inc.、Saft Groupe SA 和 Panasonic Corporation。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 调查范围

- 市场定义

- 研究场所

第二章调查方法

第三章执行摘要

第四章市场概况

- 介绍

- 至2028年市场规模及需求预测(单位:十亿美元)

- 最新趋势和发展

- 政府法规和措施

- 市场动态

- 促进因素

- 抑制因素

- 供应链分析

- 波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间的敌对关係

第五章市场区隔

- 类型

- 碱性一次电池

- 镍镉 (NiCD) 电池

- 镍氢 (NiMH) 电池

- 其他的

- 地区

- 巴西

- 阿根廷

- 哥伦比亚

- 南美洲其他地区

第六章 竞争状况

- 併购、合资、联盟、协议

- 主要企业策略

- 公司简介

- Camelion Battery Co. Ltd

- Duracell Inc.

- Energizer Holdings Inc.

- Panasonic Corporation

- Saft Groupe SA

- Spectrum Brands Holdings Inc.(Energizer Holdings Inc.)

- Toshiba Corporation

第七章市场机会与未来趋势

简介目录

Product Code: 71175

The South America Primary Battery Market is expected to register a CAGR of greater than 0.72% during the forecast period.

COVID-19 moderately impacted the market in 2020. Presently the market has now reached pre-pandemic levels.

Key Highlights

- Factors such as rising demand for primary batteries in military applications and increased demand for consumer electronics are expected to drive the market over the forecast period.

- On the other hand, the increasing adoption of secondary batteries is expected to restrain the market's growth.

- The domestic production of primary batteries and the replacement of carbon-zinc with alkaline batteries can create immense opportunities for the primary battery market in the coming years.

- Brazil is expected to witness significant demand due to its increased urbanization and GDP growth rate in the coming years.

South America Primary Battery Market Trends

Primary Alkaline Battery to Dominate the Market

- The primary alkaline battery is expected to dominate the market in 2022 and is expected to continue its dominance over the forecast period. These types of batteries have high specific energy and are cost-effective, environment-friendly, and leak-proof, even when fully discharged. Alkaline can be stored for up to 10 years, has a good safety record, and can be carried on an aircraft without being subject to the United Nations transport and other regulations.

- Alkaline batteries offer higher energy output, longer shelf life, and last longer than carbon-zinc batteries, and have emerged as a replacement for carbon-zinc batteries, since 1960.

- In addition, primary alkaline batteries have become an indispensable part of daily lives, especially for products with low energy demand, and alkaline batteries come in various sizes ranging from AAA, AA, 9V, and others, where AAA and AA are suited for low drain applications like consumer electronic remotes, whereas, C, D, and 9V are used for high drain applications. However, other sizes such as micro alkaline coin cells and button cells are used in few industrial and medical applications..

- The price of alkaline batteries is higher, as compared to zinc-carbon batteries, but the prolonged longevity of the alkaline batteries makes it more popular. The longer lifecycle of alkaline batteries improves their utility value, which is a major factor behind their adoption.

- There have been major advancements in alkaline cell performance over the recent decades. These advancements have been a result of changes in packaging and manufacturing techniques, rather than any improvements to the basic chemical system.

- Moreover, alkaline batteries are environment-friendly, which can be disposed as trash. Also, they do not require active collection and recycling. However, the batteries that were made are mercury-free and hence, do not pose any environmental pollution or hazard on disposal. This creates a positive demand for these batteries since other rechargeable consumer batteries need to be properly collected and recycled.

- Therefore, based on these factors, primary alkaline battery is likely to witness significant demand over the forecast period.

Brazil to Witness Significant Demand

- In the long term, Brazil's economic outlook is expected to be better, with increased urbanization and a positive GDP growth rate. At the same time, the domestic disposable income per household is likely to increase. Urbanization, when coupled with higher disposable income, is consequently expected to increase the demand for household gadgets which use primary batteries. The consumer electronics market is expected to grow at a slow pace in the short term, but it is likely to increase in the long run.

- According to ABINEE (the Brazilian Electrical and Electronics Association), revenues generated by the Brazilian electrical and electronics industry reached USD 41.8 billion, displaying an impressive 22% year-on-year growth. It is projected that the revenues will reach USD 45.53 billion in FY 2022.

- The country witnessed an increase in urbanization in 2021. Around 87.1% of the country's population lived in urban cities, which was 86.8% in the previous year. Furthermore, the urbanization rate is expected to increase in the country, but at a modest rate.

- Supported by an ambitious reform agenda by the new government, a constitutional amendment has been passed, which caps non-interest federal spending. The country witnessed a positive GDP growth rate of 1.06% and 1.1%.

- The major supplier countries for primary batteries in Brazil include China, the United States, and Germany. The import values of primary batteries in Brazil is way higher than the export, which signifies the high dependency on imports to meet the requirements of primary batteries. Distributor networks and channel partners of overseas manufacturing firms cater to the market demand for primary batteries in Brazil.

- Therefore, based on the above-mentioned factors, Brazil is expected to witness significant demand for the primary battery market during the forecast period.

South America Primary Battery Industry Overview

The South America Primary Battery Market is moderately fragmented. Some of the major players (not in a particular order) include Camelion Battery Co. Ltd, Duracell Inc., Energizer Holdings Inc., Saft Groupe SA, and Panasonic Corporation.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD billion, till 2028

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.2 Restraints

- 4.6 Supply Chain Analysis

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes Products and Services

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Type

- 5.1.1 Primary Alkaline Battery

- 5.1.2 Nickel-cadmium (NiCD) Battery

- 5.1.3 Nickel-metal Hydride (NiMH) Battery

- 5.1.4 Other Types

- 5.2 Geography

- 5.2.1 Brazil

- 5.2.2 Argentina

- 5.2.3 Colombia

- 5.2.4 Rest of South America

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Camelion Battery Co. Ltd

- 6.3.2 Duracell Inc.

- 6.3.3 Energizer Holdings Inc.

- 6.3.4 Panasonic Corporation

- 6.3.5 Saft Groupe SA

- 6.3.6 Spectrum Brands Holdings Inc. (Energizer Holdings Inc.)

- 6.3.7 Toshiba Corporation

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

02-2729-4219

+886-2-2729-4219