|

市场调查报告书

商品编码

1687211

一次电池:市场占有率分析、行业趋势和统计、成长预测(2025-2030 年)Primary Battery - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

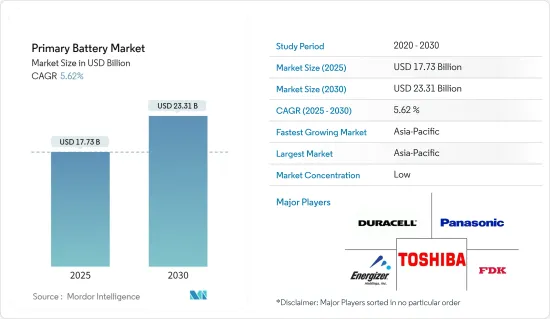

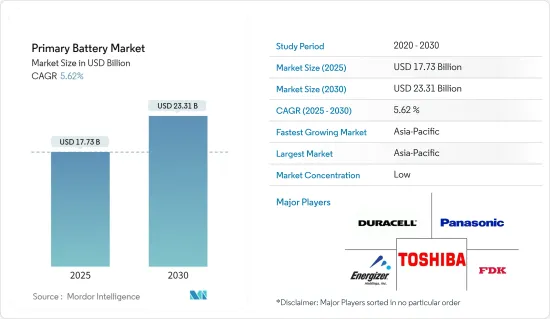

2025 年一次电池市值预估为 177.3 亿美元,预计到 2030 年将达到 233.1 亿美元,预测期内(2025-2030 年)的复合年增长率为 5.62%。

主要亮点

- 从中期来看,预计预测期内消费性电子、军事和医疗保健应用对一次电池的需求增加等因素将推动市场发展。

- 另一方面,一次电池的份额不断扩大,可能会抑制市场成长。

- 然而,一次电池在可携式和物联网(IoT)设备中的日益普及为一次电池市场提供了巨大的成长机会。

- 预计预测期内亚太地区将大幅成长,其中中国和印度等国家将推动大部分需求。

一次电池市场趋势

碱性一次电池可望占据市场主导地位

- 碱性一次电池是不可充电电池市场上最受欢迎的电池化学成分之一。它们比能量高、成本低、环保,即使完全放电也不会洩漏。碱性电池的保质期长达10年,安全性较高,可以携带上飞机,不受联合国运输法规或其他限制。

- 碱性电池是使用锌和二氧化锰作为电极的一次性电池。这些电池中使用的碱性电解是氢氧化钾或氢氧化钠。这些电池电压稳定,能量密度和抗漏液性比碳锌电池更好。

- 此外,碱性一次电池已成为日常生活中必不可少的一部分,尤其是在低能耗产品中。碱性电池有多种尺寸,包括 AAA、AA 和 9V。 AAA和AA尺寸适用于家用电器遥控器等低功率应用,而C,D和9V尺寸则适用于高功率应用。然而,其他尺寸的电池如微型碱性纽扣电池和钮扣电池也用于一些工业和医疗用途。

- 碱性电池的主要需求是由家用电器、医疗设备和国防工业的消费成长所推动的。例如,根据财务省和日本电池工业的预测,2022年日本电池产业碱性一次电池的销售量将达到约12.5亿隻(较2020年成长0.8%)。

- 碱性电池是环保的,可以当作垃圾处理。也不需要主动收集或回收。然而,目前几乎所有主要製造商生产的电池都是无汞的,因此处理时不会造成环境污染或危害。这对这些电池产生了积极的需求,因为其他可充电电池必须妥善收集和回收。

- 在预测期内,一次碱性电池市场预计比二次电池成长速度相对较慢。然而,碱性电池的易于处理以及大多数家用电器仍然使用一次性碱性电池等因素预计将推动市场发展。

亚太地区可望主导市场

- 亚太地区一直处于前列。预计该地区在预测期内仍将是一次电池市场的关键地区之一,因为它是玩具、遥控器、手錶等电子设备以及血糖仪和血压计等医疗设备的製造热点。

- 中国是可携式电子设备的主要製造地和出口国之一。随着年度可支配所得的增加,预测期内消费电子产品的需求预计将大幅增长。例如,根据世界银行的数据,中国的人均购买力平价(PPP)自2012年以来持续上升,预计2022年将达到21,475.6美元,显示可支配收入或购买力大幅提升。

- 根据中国国家统计局的数据,2021年中国家电及消费性电子产品零售贸易额为1,270亿美元,与前一年同期比较去年同期成长6.16%。

- 预计这一趋势将促进该国的家用电器销售。因此,未来几年家电市场可能主导中国一次电池销售领域。

- 同样地,一次电池通常用于为电视遥控器供电。根据中国国家统计局统计,2021年,我国每百户家庭拥有彩色电视119台,电视已成为最常见的家庭用品之一。

- 日本是世界主要家电消费国之一。日本的快速都市化和人口可支配收入的提高推动了该地区家用电器消费量的增加。此外,该地区的技术进步导致当地家电製造商数量增加,从而导致对一次电池的需求增加。

- 根据日本电子情报技术产业协会统计,2022年日本电子产业总产值将达到近779.3亿美元,这些产品包括消费性电子产品、工业电子产品以及电子元件及设备。

- 作为日本电子产业的一部分,家用电器在 2022 年的销售额约为 26 亿美元。消费性电子与工业设备和电子元件并列为该产业最重要的细分市场之一。

- 因此,鑑于上述情况,预计亚太地区将在预测期内主导一次电池市场。

一次电池产业概况

一次电池市场比较分散。该市场的主要企业(不分先后顺序)包括金霸王公司、劲量控股公司、FDK 公司、松下公司、东芝公司等。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究范围

- 市场定义

- 调查前提

第 2 章执行摘要

第三章调查方法

第四章 市场概况

- 介绍

- 2028 年市场规模与需求预测(美元)

- 最新趋势和发展

- 政府法规和政策

- 市场动态

- 驱动程式

- 消费性电子产品市场的成长

- 医疗保健领域越来越多地采用一次电池

- 限制因素

- 与二次电池的竞争

- 驱动程式

- 供应链分析

- 波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争强度

第五章 市场区隔

- 类型

- 碱性一次电池

- 锂一次电池

- 其他类型

- 地区

- 北美洲

- 美国

- 加拿大

- 北美其他地区

- 欧洲

- 德国

- 法国

- 英国

- 俄罗斯

- 其他欧洲国家

- 亚太地区

- 中国

- 日本

- 泰国

- 印尼

- 马来西亚

- 印度

- 其他亚太地区

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 中东和非洲

- 沙乌地阿拉伯

- 阿拉伯聯合大公国

- 南非

- 其他中东和非洲地区

- 北美洲

第六章 竞争格局

- 併购、合资、合作、协议

- 主要企业策略

- 公司简介

- Camelion Battery Co. Ltd

- Duracell Inc.

- Energizer Holdings Inc.

- Ultralife Corporation

- FDK Corporation

- GP Batteries International Ltd

- Panasonic Corporation

- Saft Groupe SA

- Toshiba Corporation

第七章 市场机会与未来趋势

- 对携带式和物联网 (IoT) 设备的需求不断增长

简介目录

Product Code: 56585

The Primary Battery Market size is estimated at USD 17.73 billion in 2025, and is expected to reach USD 23.31 billion by 2030, at a CAGR of 5.62% during the forecast period (2025-2030).

Key Highlights

- Over the medium term, factors such as rising demand for consumer electronics and primary batteries in military and healthcare applications are expected to drive the market during the forecast period.

- On the other hand, the increasing share of secondary batteries that replace primary battery functions is likely to restrain the market's growth.

- Nevertheless, the increasing popularity of primary batteries in portable and Internet of Things (IoT) devices offers a significant growth opportunity for the primary battery market.

- Asia-Pacific is expected to grow significantly during the forecast period, with countries like China and India driving most of the demand.

Primary Battery Market Trends

Primary Alkaline Battery Expected to Dominate the Market

- Primary alkaline batteries are among the most popular battery chemistries in the non-rechargeable battery market. It has a high specific energy and is cost-effective, environment-friendly, and leak-proof, even when fully discharged. Alkaline can be stored for up to 10 years, has a good safety record, and can be carried on an aircraft without being subject to UN Transport and other regulations.

- Alkaline batteries are the type of disposable batteries that have zinc and manganese dioxide as electrodes. The alkaline electrolyte used in these batteries is either potassium or sodium hydroxide. These batteries have a steady voltage, offering better energy density and leakage resistance than carbon-zinc batteries.

- In addition, primary alkaline batteries have become an indispensable part of daily lives, especially for products with low energy demand. Alkaline batteries come in various sizes ranging from AAA, AA, and 9V, where AAA and AA are suited for low-drain applications like consumer electronic remotes, and C, D, and 9V are used for high-drain applications. However, other sizes, such as micro alkaline coin cells and button cells, are used in a few industrial and medical applications.

- The primary alkaline battery demand is driven by the growing consumption of consumer electronics, medical devices, and the defense industry. For instance, according to the Ministry of Finance Japan and the Battery Association of Japan, in 2022, the sales quantity of primary alkaline batteries in Japan's cells and batteries industry registred about 1.25 billion units (+0.8%) compared to 2020.

- Alkaline batteries are environmentally friendly and can be disposed of as trash. Moreover, they do not require active collection and recycling. However, the batteries made currently by almost all major manufacturers are mercury-free and hence, do not pose any environmental pollution or hazard on disposal. This creates a positive demand for these batteries since other rechargeable consumer batteries must be appropriately collected and recycled.

- The primary alkaline battery market is expected to witness growth during the forecast period at a relatively slower rate than secondary batteries. However, factors such as the easy disposal of alkaline batteries and most of the consumer electronics still operating on primary alkaline batteries are anticipated to drive the market.

Asia-Pacific Expected to Dominate the Market

- Asia-Pacific has been at the forefront in the past. It is likely to continue its dominance as one of the major regions in the primary battery market during the forecast period as well due to the region being the hotspot for the manufacturing of toys, electronic devices, like remote controls, watches, and medical equipment, like glucose monitors and blood pressure monitors.

- China is one of the major manufacturing hubs and exporters of portable electronic devices. With increasing annual disposable income, the demand for consumer electronics is expected to witness considerable growth during the forecast period. For instance, according to the World Bank, purchasing parity per capita (PPP) in China has increased since 2012 and reached USD 21,475.6 in 2022, indicating a substantial increase in disposable income or buying power.

- According to the National Bureau of Statistics of China, retail trade revenue for household appliances and consumer electronics in China was USD 127 billion in 2021, with a growth rate of 6.16% from the previous year.

- The trend is expected to drive consumer electronics sales in the country. As a result, the consumer electronics market is likely to dominate the primary battery sales segment in China in the coming years.

- Similarly, primary batteries are commonly used to power TV remote controls. According to the National Bureau of Statistics of China, in 2021, there were almost 119 color TV sets per hundred households in China, making TVs one of the most common household items.

- Japan is one of the largest consumers of consumer electronics products in the world. The rapid urbanization of Japan and the increase in its citizens' disposable income have contributed to the increased consumption of consumer electronics products in the region. Also, technological advances in the region have increased the number of local consumer electronics manufacturers, leading to increased demand for primary batteries.

- According to the Japan Electronics and Information Technology Industries Association, the total production value of the electronics industry in Japan reached close to USD 77.93 billion in 2022. These products include consumer electronics, industrial electronics, and electronics components and devices.

- As part of the Japanese electronics industry, consumer electronics equipment accounted for approximately USD 2.6 billion in 2022. Consumer electronics is one of the industry's most significant segments, alongside industrial equipment and electronics components.

- Therefore, owing to the above-mentioned points, Asia-Pacific is expected to dominate the primary battery market during the forecast period.

Primary Battery Industry Overview

The primary battery market is fragmented. Some of the major players operating in this market (in no particular order) include Duracell Inc., Energizer Holdings Inc., FDK Corporation, Panasonic Corporation, and Toshiba Corporation.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast, in USD, till 2028

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 Growing Consumer Electronics Market

- 4.5.1.2 Increasing Adoption of Primary Batteries in the Healthcare Sector

- 4.5.2 Restraints

- 4.5.3 Competition from Secondary Batteries

- 4.5.1 Drivers

- 4.6 Supply Chain Analysis

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitute Products and Services

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Type

- 5.1.1 Primary Alkaline Battery

- 5.1.2 Primary Lithium Battery

- 5.1.3 Other Types

- 5.2 Geography

- 5.2.1 North America

- 5.2.1.1 United States

- 5.2.1.2 Canada

- 5.2.1.3 Rest of North America

- 5.2.2 Europe

- 5.2.2.1 Germany

- 5.2.2.2 France

- 5.2.2.3 United Kingdom

- 5.2.2.4 Russia

- 5.2.2.5 Rest of Europe

- 5.2.3 Asia-Pacific

- 5.2.3.1 China

- 5.2.3.2 Japan

- 5.2.3.3 Thailand

- 5.2.3.4 Indonesia

- 5.2.3.5 Malaysia

- 5.2.3.6 India

- 5.2.3.7 Rest of Asia-Pacific

- 5.2.4 South America

- 5.2.4.1 Brazil

- 5.2.4.2 Argentina

- 5.2.4.3 Rest of South America

- 5.2.5 Middle East and Africa

- 5.2.5.1 Saudi Arabia

- 5.2.5.2 United Arab Emirates

- 5.2.5.3 South Africa

- 5.2.5.4 Rest of Middle East and Africa

- 5.2.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Camelion Battery Co. Ltd

- 6.3.2 Duracell Inc.

- 6.3.3 Energizer Holdings Inc.

- 6.3.4 Ultralife Corporation

- 6.3.5 FDK Corporation

- 6.3.6 GP Batteries International Ltd

- 6.3.7 Panasonic Corporation

- 6.3.8 Saft Groupe SA

- 6.3.9 Toshiba Corporation

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Growing Demand for Portable And Internet Of Things (IoT) Devices

02-2729-4219

+886-2-2729-4219