|

市场调查报告书

商品编码

1643199

亚太地区一次电池-市场占有率分析、产业趋势和成长预测(2025-2030 年)Asia-Pacific Primary Battery - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

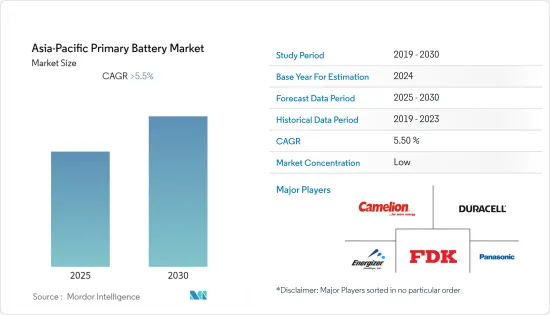

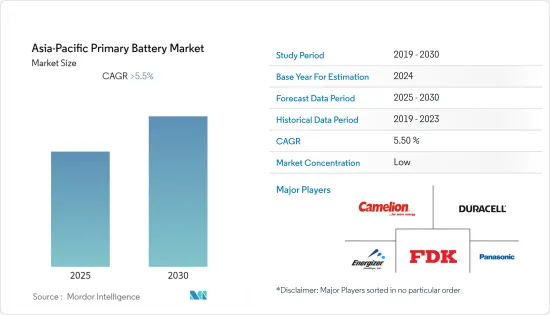

预测期内,亚太地区一次电池市场预计将以超过 5.5% 的复合年增长率成长。

2020年,新冠肺炎疫情对市场产生了负面影响。目前市场已恢復至疫情前的水准。

关键亮点

- 由于一次电池具有成本低、广泛应用于手电筒、计算器、手錶、烟雾侦测器等家用电子电器产品等诸多优点,全球对一次电池的需求将长期维持高位。预计军事应用对一次电池的需求增加以及家用电子电器的需求增加等因素将在预测期内推动市场发展。

- 另一方面,二次电池的使用范围不断扩大可能会减缓市场成长。

- 国内一次电池的生产以及碱性电池对碳锌电池的替代品可能会在未来几年为一次电池市场创造巨大的机会。

中国是可携式电子设备的主要製造和出口中心,因此需求应该很大。

亚太地区一次电池市场趋势

碱性一次电池占据市场主导地位

- 碱性一次电池是不可充电电池市场上最受欢迎的电池化学成分之一。它们比能量高、成本低、环保,即使完全放电也不会洩漏。碱性电池的保质期长达10年,安全性较高,可以携带上飞机,不受联合国运输法规或其他限制。碱性电池是使用锌和二氧化锰作为电极的一次性电池。碱性电解使用氢氧化钾或氢氧化钠。这些电池电压稳定,能量密度和抗漏液性比碳锌电池更好。

- 此外,碱性一次电池已成为日常生活中不可或缺的必需品,尤其是在低能耗产品中。碱性电池有家用电子电器尺寸,包括 AAA、AA 和 9V。另一方面,微型碱性纽扣电池被用于一些工业和医疗应用。

- 碱性电池是环保的,可以当作垃圾处理。此外,无需主动收集或回收。不过,目前几乎所有主要製造商生产的电池都不含汞,因此不存在环境污染或处置的风险。这对这些电池产生了积极的需求,因为其他家用充电电池必须妥善收集和回收。

- 2021年日本电池产业碱性一次电池销量较2020年增加3,000万隻(+2.42%)。 2021年销量为12.7亿台。

- 此外,2021 年 12 月,Volt Resources Ltd. 与先进的一次碱性电池製造商 Urban Electric Power (UEP) 建立策略合作伙伴关係,以开发新技术来提高碱性电池的性能并降低其成本。 Volt Resources 和 Urban Electric Power (UEP) 将合作开发一项新技术,该技术可能会使用非球形纯石墨来提高导电性,并使用超纯石墨基涂层来提高碱性电池的性能。

中国:预计需求旺盛

- 亚太地区正在经历显着的经济成长,随之而来的是家用电子电器产品的销售量很高,对一次电池的需求预计会增加。此外,预计预测期内该地区尤其是中国将成为电池製造设备的主要热点。

- 从国家层级来看,中国长期以来一直主导着全球电池市场,预计在预测期内仍将保持主导地位。中国崛起为製造业强国,消费性电子产品製造业的强劲成长,预计很快将推动该国一次电池市场的成长。

- 2021年,一次电池数量将大幅增加,但速度比二次电池慢。此外,碱性电池预计将加强其在一次电池市场的主导地位,并继续保持最快的成长速度,这主要归因于对锌基电池的需求不断增加。

- 而且,中国的军费开支从2020年的2,579.7亿美元增加到2021年的2,933.5亿美元。中国预计将在预测期内进一步增加国防开支以增强军事实力,从而推动军事相关便携式设备对一次电池的需求。

- 2022年1月,中国科学院合肥物质科学研究院和东华大学联合研究,将奈米级零价铁与导电碳漆整合在一起,创建了一次电池奈米系统,发现该奈米复合材料可以快速去除水中的镉(II)。

- 此外,FDK株式会社于2022年3月宣布,将把国内大容量圆柱形一次锂电池生产工厂集中到一处,加强生产体制。 FDK 将停止鹫津工厂的生产,并将生产业务整合至鸟取工厂。鸟取工厂的生产设施预计于2022年6月底搬迁后恢復营运。

- 因此,根据我们目前的讨论,中国一次电池市场在未来几年可能会大幅成长。

亚太地区一次电池产业概况

亚太地区一次电池市场呈现细分化。主要参与企业(不分先后顺序)包括 Camelion Battery、Duracell Inc.、Energizer Holdings Inc.、FDK Corporation 和 Panasonic Corporation。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究范围

- 市场定义

- 调查前提

第二章调查方法

第三章执行摘要

第四章 市场概况

- 介绍

- 2027 年市场规模及需求预测(十亿美元)

- 最新趋势和发展

- 政府法规和政策

- 市场动态

- 驱动程式

- 限制因素

- 供应链分析

- 波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

第五章 市场区隔

- 类型

- 碱性一次电池

- 镍镉 (NiCD) 电池

- 镍氢 (NiMH) 电池

- 其他的

- 地区

- 中国

- 印度

- 日本

- 韩国

- 其他亚太地区

第六章 竞争格局

- 併购、合资、合作与协议

- 主要企业策略

- 公司简介

- Camelion Battery Co. Ltd

- Duracell Inc.

- Energizer Holdings Inc.

- FDK Corporation

- GP Batteries International Ltd

- Panasonic Corporation

- Saft Groupe SA

- Spectrum Brands Holdings Inc.(Energizer Holdings Inc.)

- Toshiba Corporation

第七章 市场机会与未来趋势

The Asia-Pacific Primary Battery Market is expected to register a CAGR of greater than 5.5% during the forecast period.

In 2020, COVID-19 negatively impacted the market. Presently, the market has reached its pre-pandemic level.

Key Highlights

- Over the long term, the demand for primary batteries remains high worldwide, owing to the numerous advantages of primary batteries, such as their low cost and wide range of applications in consumer electronics, including flashlights, calculators, clocks, and smoke alarms. Factors such as rising demand for primary batteries in military applications and increased demand for consumer electronics are expected to drive the market over the forecast period.

- On the other hand, the growing use of secondary batteries is likely to slow the growth of the market.

- The domestic production of primary batteries and the replacement of carbon-zinc batteries with alkaline batteries can create immense opportunities for the primary battery market in the coming years.

China should see a lot of demand because it is a major centre for making and exporting portable electronic devices.

APAC Primary Battery Market Trends

Primary Alkaline Battery to Dominate the Market

- Primary alkaline batteries are among the most popular battery chemistries in the non-rechargeable battery market. It has a high specific energy and is cost-effective, environment-friendly, and leak-proof, even when fully discharged. Alkaline can be stored for up to 10 years, has a good safety record, and can be carried on an aircraft without being subject to UN Transport and other regulations. Further, alkaline batteries are the type of disposable batteries that have zinc and manganese dioxide as electrodes. The alkaline electrolyte used in these batteries is either potassium or sodium hydroxide. These batteries have a steady voltage, offering better energy density and leakage resistance than carbon-zinc batteries.

- In addition, primary alkaline batteries have become an indispensable part of daily life, especially for products with low energy demands. Alkaline batteries come in various sizes ranging from AAA, AA, 9V, and others, where AAA and AA are suited for low-drain applications like consumer electronic remotes, whereas C, D, and 9V are used for high-drain applications. Micro alkaline coin cells and button cells, on the other hand, are used in a few industrial and medical applications.

- Alkaline batteries are environment-friendly and can be disposed of as trash. Moreover, they do not require active collection and recycling. However, the batteries made currently by almost all major manufacturers are mercury-free and, hence, do not pose any environmental pollution or disposal hazards. This creates a positive demand for these batteries since other rechargeable consumer batteries must be appropriately collected and recycled.

- In 2021, the sales quantity of primary alkaline batteries in Japan's cells and batteries industry increased by 0.03 billion units (+2.42%) from 2020. In total, the sales quantity amounted to 1.27 billion units in 2021.

- Moreover, in December 2021, Volt Resources Ltd. entered a strategic collaboration with advanced primary alkaline battery producer Urban Electric Power (UEP) to develop new technologies to improve alkaline battery performance and reduce costs. Volt Resources and Urban Electric Power (UEP) work together to create new technologies that are likely to use non-spherical pure graphite for conductivity enhancement and ultra-high-purity graphite-based coatings to improve alkaline battery performance.

China to Witness Significant Demand

- Asia-Pacific, being home to a few of the fastest-growing economies, is expected to witness high sales of consumer electronics, resulting in an increased demand for primary batteries. Further, the region, especially in China, is expected to be a major hotspot for battery manufacturing units over the forecast period.

- On a country level, China has dominated the entire global battery market for a very long time and is expected to maintain the leading position in the market during the forecast period as well. China's rise as a manufacturing powerhouse and its bullish consumer electronic product manufacturing growth are expected to drive the growth of the primary battery market in the country soon.

- In the future, the sale of primary batteries will increase enormously, but at a slower rate than secondary batteries, through 2021. Further, alkaline batteries are expected to strengthen their dominance in the primary battery market and continue to witness the fastest growth, primarily due to the growing demand for zinc-based batteries.

- In addition, China's military spending increased to USD 293.35 billion in 2021 from USD 257.97 billion in 2020.China is expected to increase its defence spending further to strengthen its military during the forecast period, which will drive the demand for primary batteries for military-related portable devices.

- In January 2022, Hefei Institutes of Physical Science (HFIPS), the Chinese Academy of Sciences (CAS), and Donghua University collaborated to integrate nanoscale zero-valent iron with conductive carbon paint to fabricate a primary battery nanosystem and found that the nanocomposite removed Cd(II) from water quickly.

- Moreover, in March 2022, FDK Corporation announced the consolidation of domestic production plants to strengthen its production system for high-capacity cylindrical-type primary lithium battery production plants at a single location. FDK will terminate production at Washizu Plant and consolidate the production plant at Tottori Plant. The restart of operations at the production facilities at the Tottori Plant after the relocation is expected by the end of June 2022.

- So, based on the things we've talked about so far, the primary battery market in China is likely to see a lot of growth over the next few years.

APAC Primary Battery Industry Overview

The Asia-Pacific primary battery market is fragmented. Some of the major players (in no particular order) include Camelion Battery Co. Ltd, Duracell Inc., Energizer Holdings Inc., FDK Corporation, and Panasonic Corporation.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD billion, till 2027

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.2 Restraints

- 4.6 Supply Chain Analysis

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes Products and Services

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Type

- 5.1.1 Primary Alkaline Battery

- 5.1.2 Nickel-cadmium (NiCD) Battery

- 5.1.3 Nickel-Metal Hydride (NiMH) Battery

- 5.1.4 Other Types

- 5.2 Geography

- 5.2.1 China

- 5.2.2 India

- 5.2.3 Japan

- 5.2.4 South Korea

- 5.2.5 Rest of Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Camelion Battery Co. Ltd

- 6.3.2 Duracell Inc.

- 6.3.3 Energizer Holdings Inc.

- 6.3.4 FDK Corporation

- 6.3.5 GP Batteries International Ltd

- 6.3.6 Panasonic Corporation

- 6.3.7 Saft Groupe SA

- 6.3.8 Spectrum Brands Holdings Inc. (Energizer Holdings Inc.)

- 6.3.9 Toshiba Corporation