|

市场调查报告书

商品编码

1630446

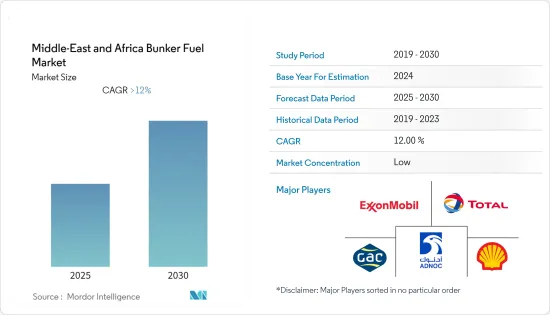

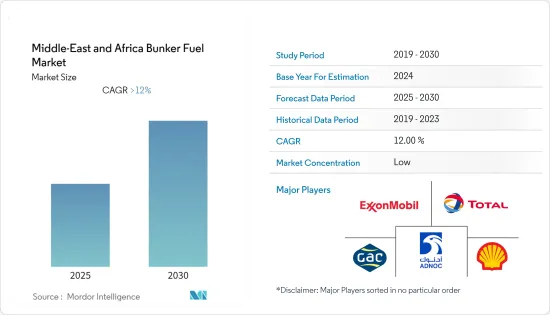

中东和非洲船用燃料:市场占有率分析、行业趋势、统计数据和成长预测(2025-2030)Middle-East and Africa Bunker Fuel - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

预计中东和非洲船用燃料市场在预测期内的复合年增长率将超过 12%。

由于 COVID-19 爆发,市场因区域封锁而受到负面影响。目前市场已恢復至疫情前水准。

主要亮点

- 对液化天然气船舶的日益偏好和液化天然气贸易的扩大是预测期内推动中东和非洲船用燃料需求的关键因素。该地区的原油生产也处于世界领先地位。随着产量的增加,船用燃料的需求也预计会增加。

- 然而,在预测期内,环境问题和有关海运业排放气体的严格法规预计将限制重质船用燃料,特别是高硫燃料油的使用。

- 阿联酋和沙乌地阿拉伯等中东国家正计划增加石油产量。随着产量的增加,航运市场在预测期内可能会迎来巨大的机会。

- 阿联酋是最大的原油出口国之一,在货柜运输领域也占有很大份额。随着贸易预计扩大,预计该国在预测期内将继续占据主导地位。

中东和非洲船用燃料市场趋势

VLSFO 实现显着成长

- 硫含量在0.5%以下的船用燃油一般称为「超低硫燃油」。从2020年1月1日起,HSFO只能在安装洗涤器以减少排放气体的船舶上使用,预计将推动对VLSFO的需求。

- 预计大部分高硫燃料油(HSFO)船用燃料油市场很快就会被低硫替代品取代。市面上贩售的大多数 VLSFO 都是由渣油和馏分油成分混合而成,并且将具有不同硫含量和黏度的各种切割剂混合以形成符合规格的产品。

- 由于全球供应链中断、一般商品和产品需求减少、大多数国家实施封锁以及全球经济放缓,VLSFO 的需求在 2020 年初略有下降。

- 2021年,沙乌地阿拉伯货柜吞吐量为955万个,较2021年成长5%。吞吐量的增加得益于红海阿卜杜拉国王港的开发。

- 预计 VLSFO 的需求将在预测期内大幅成长。

阿联酋主导市场

- 阿拉伯联合大公国是该地区主要石油生产国和出口国之一。 2018年,国家石油公司ADNOC表示,在宣布新的石油和天然气发现后,该国计划在2020年终前将石油产能提高到400万桶/日,到2030年将石油产能提高到500万桶/日。

- 随着石油和天然气产量预计增加,阿联酋与世界其他地区之间的贸易活动预计将进一步活性化。食品和製成品等其他商品也在阿联酋进行贸易,海港充当了该地区内外贸易的门户。

- 2021年货柜吞吐量约1,900万标准箱,较2020年减少70万个标准箱。货柜吞吐量下降的原因是充满挑战的宏观环境、低利润货物的流失以及阿联酋航运市场吞吐量的疲软。

- 阿联酋拥有近 13 个港口和码头,拥有为该地区运营的船舶提供船用燃料的基础设施和设施。杰贝阿里港是阿联酋及中东地区最大的港口,货柜吞吐能力达1,930万标准箱。

- 富查伊拉港是世界第二大燃料库港,也是阿联酋东岸唯一的多功能港口。除了传统的船舶加註设施外,港务局还计划引进船对船液化天然气转运设施,预计将支持国际海事组织对低硫含量燃料的规定。

- 2022年5月,新加坡海事及港口管理局(MPA)宣布,已确定受污染的船用燃料源自阿拉伯联合大公国的Khor Fakkan港。预计此类事件将严重削弱客户对 Khor Fakkan 和阿联酋船用燃料的信心,并在预测期内抑制市场成长。

中东和非洲船用燃料油产业概况

中东和非洲船用燃料市场适度细分。主要企业(排名不分先后)包括海湾代理有限公司、阿布达比国家石油公司、壳牌公司、TotalEnergies SE 和埃克森美孚公司。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 调查范围

- 市场定义

- 研究场所

第二章调查方法

第三章执行摘要

第四章市场概况

- 介绍

- 至2028年市场规模及需求预测(单位:十亿美元)

- 最新趋势和发展

- 政府法规和措施

- 市场动态

- 促进因素

- 抑制因素

- 供应链分析

- 波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间敌对关係的强度

第五章市场区隔

- 燃料类型

- 高硫燃料油(HSFO)

- 极低硫燃油(VLSFO)

- 船用轻柴油 (MGO)

- 液化天然气(LNG)

- 其他燃料

- 船型

- 容器

- 油船

- 杂货船

- 散货船

- 其他船型

- 地区

- 阿拉伯聯合大公国

- 沙乌地阿拉伯

- 奈及利亚

- 其他中东/非洲

第六章 竞争状况

- 併购、合资、联盟、协议

- 主要企业策略

- 公司简介

- Gulf Agency Company Ltd.

- Abu Dhabi National Oil Company

- Chevron Corporation

- Shell PLC

- TotalEnergies SE

- Uniper SE

- Exxon Mobil Corporation

- Aegean Bunkering SA

第七章 市场机会及未来趋势

简介目录

Product Code: 71522

The Middle-East and Africa Bunker Fuel Market is expected to register a CAGR of greater than 12% during the forecast period.

The market was negatively impacted by the outbreak of COVID-19 due to regional lockdowns. Currently, the market has rebounded to pre-pandemic levels.

Key Highlights

- The increasing preference of LNG-based vessels and growing LNG trade is one of the significant factors driving the demand for bunker fuels in the Middle East and Africa during the forecast period. The region is also a global leader in crude oil production. With the expected increase in production, the demand for bunker fuel is likely to increase.

- However, the environmental concerns and the strict regulations related to emissions from the maritime industry are anticipated to limit the usage of heavy bunker fuels, especially the high Sulfur fuel oil, during the forecast period.

- Middle-East countries like the United Arab Emirates and Saudi Arabia are planning to increase crude oil production. With increased production, the shipping market is likely to witness significant opportunities in the forecast period.

- The United Arab Emirates is one of the largest exporters of crude oil, which also has a significant share in the container shipping sector. With the expected growth in trade, the nation is likely to continue its dominance during the forecast period.

Middle East and Africa Bunker Fuel Market Trends

VLSFO to Witness Significant Growth

- Marine fuel containing less than 0.5% sulfur is generally termed "very low sulfur fuel oil." From January 1, 2020, HSFO could only be used on ships with scrubbers installed to reduce emissions, which was expected to drive the demand for VLSFO.

- Most of the high-sulfur fuel oil (HSFO) bunker fuel market is expected to be shortly replaced by low-sulfur alternatives. Most of the VLSFO available on the market is blended from residual and distillate components, which are blended with various cutters of varying sulfur and viscosity to create an on-spec product.

- The demand for VLSFO slightly declined in early 2020 due to global supply chain disruptions, a decrease in demand for general goods and products, lockdown implementation in most countries, and a global economic slowdown.

- During 2021, with 9.55 million container throughput, Saudi Arabia witnessed a 5% increase as compared to 2021. The increase in throughput was due to the development of the King Abdullah Port of the Red Sea.

- The demand for VLSFO is likely to witness significant growth during the forecast period.

The United Arab Emirates to Dominate the Market

- The United Arab Emirates is one of the major oil producers and exporters in the region. In 2018, the state-owned oil company ADNOC announced that the country planned to increase its oil production capacity to 4 million barrels per day by the end of 2020 and 5 million bpd by 2030 after new oil and gas findings.

- With the expected increase in oil and gas production, trading activities are expected to further increase between the United Arab Emirates and the rest of the world. Several other goods, such as food items and manufactured goods, get traded in the country, for which seaports act as a gateway that enables trade across the region and beyond.

- In 2021, the container throughput was around 19.0 million TEU, which decreased by 0.7 million compared to 2020. The decrease in shipping container volume was due to the challenging macro-environment, the loss of lower-margin cargo, and softer volumes in the UAE shipping market.

- There are nearly 13 ports and terminals in the United Arab Emirates that have the infrastructure and facilities to supply marine fuels to the vessels operating in the region. Jebel Ali Port is the largest port in the United Arab Emirates and the Middle East region, with a container handling capacity of 19.3 million TEU.

- Fujairah Port, the second-largest bunkering port globally, is the only multi-purpose port on the eastern seaboard of the United Arab Emirates. Apart from the conventional marine fuel supply facility, the port authority plans to introduce a ship-to-ship LNG transfer facility, which is expected to support IMO regulation towards low sulfur content fuels.

- In May 2022, the Maritime and Port Authority of Singapore (MPA) declared that it had established that the contaminated bunker fuel had originated from the port of Khor Fakkan in the UAE. Such incidents are expected to severely jeopardize client confidence in bunker fuel originating from Khor Fakkan and the UAE, which is expected to restrain the growth of the market during the forecast period.

Middle East and Africa Bunker Fuel Industry Overview

The Middle-East and Africa bunker fuel market is moderately fragmented. Some of the major companies (in no particular order) include Gulf Agency Company Ltd., Abu Dhabi National Oil Company, Shell PLC, TotalEnergies SE, and Exxon Mobil Corporation.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of Study

- 1.2 Market Definiton

- 1.3 Study Assumptions

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD billion, till 2028

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.2 Restraints

- 4.6 Supply Chain Analysis

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitute Products and Services

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Fuel Type

- 5.1.1 High Sulfur Fuel Oil (HSFO)

- 5.1.2 Very-Low Sulfur Fuel Oil (VLSFO)

- 5.1.3 Marine Gas Oil (MGO)

- 5.1.4 Liquefied Natural Gas (LNG)

- 5.1.5 Other Fuel Types

- 5.2 Vessel Type

- 5.2.1 Containers

- 5.2.2 Tankers

- 5.2.3 General Cargo

- 5.2.4 Bulk Carrier

- 5.2.5 Other Vessel Types

- 5.3 Geography

- 5.3.1 The United Arab Emirates

- 5.3.2 Saudi Arabia

- 5.3.3 Nigeria

- 5.3.4 Rest of the Middle-East and Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Gulf Agency Company Ltd.

- 6.3.2 Abu Dhabi National Oil Company

- 6.3.3 Chevron Corporation

- 6.3.4 Shell PLC

- 6.3.5 TotalEnergies SE

- 6.3.6 Uniper SE

- 6.3.7 Exxon Mobil Corporation

- 6.3.8 Aegean Bunkering SA

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

02-2729-4219

+886-2-2729-4219