|

市场调查报告书

商品编码

1630457

亚太地区空气清净机:市场占有率分析、产业趋势、成长预测(2025-2030)Asia-Pacific Air Purifier - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

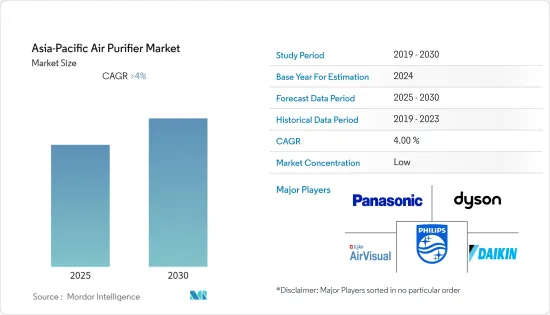

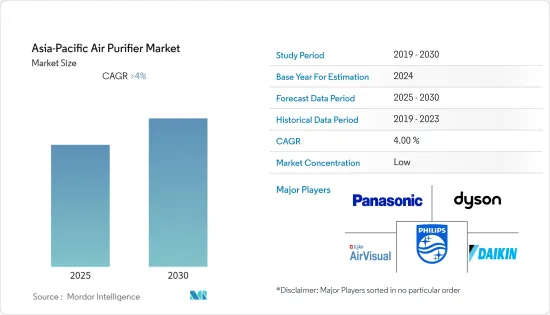

预计亚太地区空气清净机市场在预测期内的复合年增长率将超过 4%。

由于COVID-19爆发,市场受到区域性关闭的负面影响,导致空气清净机的需求下降。市场目前正在从 COVID-19 的影响中恢復。

主要亮点

- 亚太地区空气清净机市场预计将受到空气品质恶化及其对人们健康影响的推动。

- 然而,亚太地区空气清净机市场可能会因某些清净机排放臭氧和其他有害物质而受到限制。

- 随着印度和韩国等该地区国家采取越来越多的行动,使空气更加透气,亚太地区的空气清净机市场预计将在未来几年创造一些机会。

随着都市化的不断加快和人口的不断增长,中国预计将在预测期内成为亚太地区空气清净机市场的最大市场。

亚太地区空气清净机市场趋势

住宅领域预计将主导市场

- 住宅空气清净机是专为家庭使用而设计的设备。这些设备用于去除室内空气中的有害污染物。这些污染物主要包括但不限于灰尘、花粉和烟雾。

- 空气污染是该地区日益严重的健康风险因素,也是许多疾病的主要原因。空气品质差是农村和都市区的一个问题。由于工业活动的增加,该地区的许多城市都面临危险的污染水平,这可能会推动该地区的空气清净机市场。

- 亚太地区2021年二氧化碳排放总量约199.787亿吨,超过该地区2020年的排放190.477亿吨。由于煤炭、石油和天然气的用途广泛,该地区的二氧化碳排放正在增加。这是因为煤炭、原油和天然气有多种用途。当它们燃烧时,二氧化碳和其他有害气体被释放到大气中。

- 在印度,政府和其他组织近年来一直对清理家庭空气污染感兴趣。近年来,政府推出了多项措施来减少空气污染。这可能会推动该国的空气清净机市场。

由于上述原因,住宅领域预计将在预测期内引领亚太地区空气清净机市场。

预计中国将主导市场

- 中国快速增长的能源需求和不断增加的商业和工业运作正在向大气中释放大量有害气体和污染物。该国预计将成为亚太地区最大的空气清净机市场。

- 而且,过去20年来,中国製造业一直引领全世界。该国是钢铁、化工、电力和水泥行业的世界领导者,也是石化和精製行业的主要企业。这些工业向大气中释放大量二氧化碳和其他有害气体,可能导致健康相关问题。

- 2021年,中国煤炭消费量为86.17艾焦耳,约占亚太地区煤炭消费量的67.5%。中国煤炭消费比例不断增加,燃烧时会释放二氧化碳和其他气体,直接影响该国的空气质量,并可能推动该国的空气清净机市场。

- 快速的工业化和都市化导致中国主要城市的污染水平很高。环保部对北京周边28个城市製定了严格的污染控制目标,增加了这些城市大多数住宅、商业和工业设施安装的空气清净机数量。

- 综上所述,预计中国将在预测期内主导亚太空气清净机市场。

亚太地区空气清净机产业概况

亚太地区空气清净机市场较为分散。该市场的主要企业(排名不分先后)包括大金工业有限公司、戴森有限公司、皇家飞利浦公司、IQAir 和松下公司。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 调查范围

- 市场定义

- 研究场所

第 2 章执行摘要

第三章调查方法

第四章市场概况

- 介绍

- 至2028年市场规模及需求预测(单位:十亿美元)

- 最新趋势和发展

- 政府法规和措施

- 市场动态

- 促进因素

- 抑制因素

- 供应链分析

- 波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间敌对关係的强度

第五章市场区隔

- 过滤技术

- 高效能颗粒空气 (HEPA)

- 其他的

- 类型

- 独立的

- 感应型

- 最终用户

- 住宅

- 商业的

- 工业的

- 地区

- 中国

- 印度

- 日本

- 其他亚太地区

第六章 竞争状况

- 合併、收购、联盟和合资企业

- 主要企业策略

- 公司简介

- Daikin Industries Ltd.

- Honeywell International Inc.

- LG Electronics Inc.

- Unilever PLC(erstwhile BlueAir AB)

- Dyson Ltd.

- Whirlpool Corporation

- Panasonic Corporation

- Koninklijke Philips NV

- IQAir

- Samsung Electronics Co. Ltd.

- Xiaomi Corp.

- AllerAir Industries Inc

第七章 市场机会及未来趋势

The Asia-Pacific Air Purifier Market is expected to register a CAGR of greater than 4% during the forecast period.

The market was negatively impacted by the outbreak of COVID-19 due to regional lockdowns, leading to a decrease in demand for air purifiers. The market has currently rebounded from the effects of COVID-19.

Key Highlights

- The Asia-Pacific air purifier market is likely to be driven by things like air quality getting worse and how that affects people's health.

- But the Asia-Pacific air purifier market is likely to be held back by the fact that some purifiers release ozone and other dangerous byproducts.

- The increasing actions taken by the countries in the region, such as India and South Korea, to make the air breathable are expected to create several opportunities for the Asia-Pacific air purifier market in the future.

Due to its increasing urbanization, which makes the cities more populated, China is expected to be the largest market for the Asia-Pacific air purifier during the forecast period.

Asia-Pacific Air Purifier Market Trends

Residential Segment Expected to Dominate the Market

- Residential air purifiers are devices designed for domestic use. These devices are used to remove harmful contaminants from the air in the room. These contaminations mainly include but are not limited to dust, pollens, and smoke.

- Air pollution is a growing risk factor for poor health in the area, and it is a big reason why there are so many diseases. Poor air quality is a problem in both rural and urban areas. Many cities in the region are suffering from dangerous pollution levels due to increasing industrial activities, which is likely going to drive the air purifier market in the region.

- In 2021, the total carbon dioxide emission in Asia-Pacific was about 19,978.7 million metric tons (MT), which was higher than the region's release in 2020, 19,004.7 MT. Carbon dioxide emissions in the region are going up because coal, crude oil, and natural gas are used for a lot of different things. When these things are burned, they release carbon dioxide and other harmful gases into the air.

- In India, the government and other groups have paid more attention to cleaning up household air pollution in the past few years.Several government initiatives have been launched in the past few years to reduce air pollution. This is likely going to drive the air purifier market in the country.

Due to the above reasons, it seems likely that the residential segment will lead the Asia-Pacific air purifier market during the forecast period.

China Expected to Dominate the Market

- China, due to the rapidly increasing energy demand and an increasing number of commercial and industrial operations, causes the release of a large number of harmful gases and pollutants into the air. The country is likely to be the largest market for air purifiers in Asia-Pacific.

- Moreover, over the past two decades, China has been instrumental in driving the manufacturing sector globally. The country is a global leader in the steel, chemical, power, and cement industries and is among the top players in the petrochemical and refining industries. Such industries mostly release a vast amount of carbon dioxide and other harmful gases into the atmosphere, which may cause several health-related issues.

- In 2021, China's coal consumption was 86.17 Exajoules, which was about 67.5% of the total coal consumption of the Asia-Pacific. China's increasing share of coal consumption, which releases carbon dioxide and other gasses on burning, directly affects the country's air quality and is likely to drive the air purifier market in the country.

- Rapid industrialization and urbanization are leading to high pollution levels in major cities across China. The Ministry of Environmental Protection imposed stringent anti-pollution targets on 28 cities around Beijing, increasing the number of air purifiers installations in most residential, commercial, and industrial buildings across these cities.

- Hence, owing to the above points, China is expected to dominate the Asia-Pacific air purifier market during the forecast period.

Asia-Pacific Air Purifier Industry Overview

The Asia-Pacific air purifier market is fragmented. Some of the key players in this market (in no particular order) include Daikin Industries Ltd, Dyson Ltd, Koninklijke Philips NV, IQAir, and Panasonic Corporation.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD billion, till 2028

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.2 Restraints

- 4.6 Supply Chain Analysis

- 4.7 Porter's Five Force Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitute Products and Services

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Filtration Technology

- 5.1.1 High-efficiency Particulate Air (HEPA)

- 5.1.2 Other Technologies

- 5.2 Type

- 5.2.1 Stand-alone

- 5.2.2 In-duct

- 5.3 End User

- 5.3.1 Residential

- 5.3.2 Commercial

- 5.3.3 Industrial

- 5.4 Geography

- 5.4.1 China

- 5.4.2 India

- 5.4.3 Japan

- 5.4.4 Rest of Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers, Acquisitions, Collaboration and Joint Ventures

- 6.2 Strategies Adopted by Key Players

- 6.3 Company Profiles

- 6.3.1 Daikin Industries Ltd.

- 6.3.2 Honeywell International Inc.

- 6.3.3 LG Electronics Inc.

- 6.3.4 Unilever PLC (erstwhile BlueAir AB)

- 6.3.5 Dyson Ltd.

- 6.3.6 Whirlpool Corporation

- 6.3.7 Panasonic Corporation

- 6.3.8 Koninklijke Philips NV

- 6.3.9 IQAir

- 6.3.10 Samsung Electronics Co. Ltd.

- 6.3.11 Xiaomi Corp.

- 6.3.12 AllerAir Industries Inc