|

市场调查报告书

商品编码

1630458

印度空气清净机市场:份额分析、产业趋势/统计、成长预测(2025-2030)India Air Purifier - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

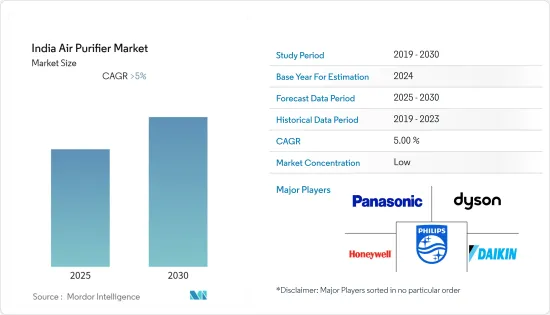

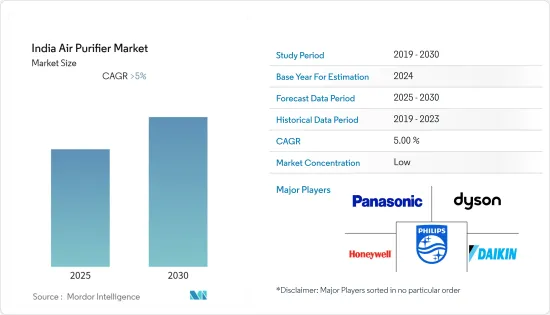

印度空气清净机市场预计在预测期内复合年增长率将超过 5%。

由于区域封锁导致需求减少,市场受到疫情的负面影响。近期市场已恢復至疫情前水准。

主要亮点

- 印度的空气清净机市场可能是由空气品质不佳及其对人们健康的影响所推动的。

- 印度空气清净机市场预计将因一些净化器产生臭氧和其他危险产品而受到阻碍。

- 印度政府正在加大国家清洁空气计画(NCAP)等行动,以预防、控制和减少不健康的空气污染,并提供可呼吸空气的蓝图,预计将在机械市场创造多个机会。

印度空气清净机市场趋势

高效颗粒空气 (HEPA) 领域预计将主导市场

- HEPA 过滤器是一种扩展表面过滤器,具有较大的表面积,能够有效去除空气中的颗粒,无论其大小如何。此外,此空气过滤器比褶皱折迭式滤网更有效地去除可吸入颗粒。

- 空气污染是该国疾病的主要危险因素,而且呈上升趋势。空气品质差是农村和都市区的一个问题。由于工业活动增加,该国许多城市都面临危险的污染水平,预计这将推动该地区的空气清净机市场。

- 2021年,印度二氧化碳排放总量约为27.97亿吨,高于该地区2020年的排放244,494吨。该国二氧化碳排放的增加是由于该国严重依赖煤炭、石油和天然气的各种用途,这些煤炭、石油和天然气在燃烧时会向大气中释放二氧化碳和其他有害气体,这反映了一个事实。发射到

- 高效颗粒空气 (HEPA) 过滤器和其他类型的机械空气过滤器透过将颗粒捕获在过滤材料中来去除颗粒。 HEPA 过滤器可捕捉空气中的大颗粒,例如灰尘、花粉、霉菌孢子、动物皮屑、尘螨和蟑螂过敏原。

- 由于所有这些因素,高效颗粒空气 (HEPA) 领域很可能在未来五年内引领印度空气清净机市场。

空气污染加剧预计将推动市场发展

- 随着能源需求飙升以及向大气排放大量有害气体和污染物的商业和工业运作不断增加,预计印度将对市场产生积极影响。

- 全球20个污染最严重的城市中,超过一半位于印度。快速的都市化、建设、对煤炭能源来源的依赖、车辆污染和灰尘都导致污染程度上升。预计污染范围将在预测期内扩大,并可能推动该国空气清净机市场的发展。

- 印度2021年的煤炭消费量为20.09艾焦耳,高于2020年的消费量。印度煤炭消费量,在燃烧过程中会释放二氧化碳和其他气体,这可能会推动该国的空气清净机市场,因为它直接影响该国的空气品质。

- 近年来,印度政府和其他相关人员加强了污染防治的力道。近年来,政府推出了多项措施来减少空气污染。这正在推动该国空气清净机市场的发展。

- 因此,鑑于上述情况,空气污染水平的上升预计将在预测期内推动印度空气清净机市场的发展。

印度空气清净机产业概况

印度的空气清净机市场较为分散。该市场的主要企业(排名不分先后)包括大金工业有限公司、戴森有限公司、皇家飞利浦公司、霍尼韦尔国际公司和松下公司。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 调查范围

- 市场定义

- 研究场所

第 2 章执行摘要

第三章调查方法

第四章市场概况

- 介绍

- 至2028年市场规模及需求预测(单位:百万美元)

- 最新趋势和发展

- 政府法规和措施

- 市场动态

- 促进因素

- 抑制因素

- 供应链分析

- PESTLE分析

第五章市场区隔

- 过滤技术

- 高效能颗粒空气 (HEPA)

- 其他的

- 类型

- 独立的

- 感应型

- 最终用户

- 住宅

- 商业的

- 工业的

第六章 竞争状况

- 合併、收购、联盟和合资企业

- 主要企业策略

- 公司简介

- Daikin Industries Ltd.

- Honeywell International Inc.

- LG Electronics Inc.

- Unilever PLC(erstwhile BlueAir AB)

- Dyson Ltd.

- Whirlpool Corporation

- Panasonic Corporation

- Koninklijke Philips NV

- IQAir

- Samsung Electronics Co. Ltd.

- Xiaomi Corp

第七章 市场机会及未来趋势

简介目录

Product Code: 71576

The India Air Purifier Market is expected to register a CAGR of greater than 5% during the forecast period.

The market was negatively impacted by the outbreak due to a decline in demand caused by regional lockdowns. The market has recently rebounded to pre-pandemic levels.

Key Highlights

- The Indian air purifier market is likely to be driven by things like the air getting worse and how that affects people's health.

- The Indian air purifier market is expected to be held back by the fact that some purifiers give off ozone and other dangerous byproducts.

- The Indian government taking increasing actions, such as the National Clean Air Program (NCAP), which provides a roadmap to prevent, control, and reduce unhealthy air pollution to make air breathable, is expected to create several opportunities for the India air purifier market in the future.

India Air Purifier Market Trends

High-Efficiency Particulate Air (HEPA) Segment Expected to Dominate the Market

- HEPA filters are a type of extended-surface filter with a larger surface area and higher efficiencies for removing larger and smaller airborne particles. Moreover, these air filters remove respirable particles more efficiently than pleated filters.

- Air pollution is a major and growing risk factor for illness in the country, and it contributes a lot to the number of people who get sick. Poor air quality is a problem in both rural and urban areas.Many cities in the country are suffering from dangerous pollution levels due to increasing industrial activities, which is likely to drive the air purifier market in the region.

- In 2021, the total carbon dioxide emission in India was about 2797 million metric tons (MT), which was higher than the region's release in 2020, 2494 MT. The increase in carbon dioxide emissions in the country reflects the fact that the country is heavily dependent on the usage of coal, crude oil, and natural gas for various purposes, which, when burned, release carbon dioxide and other harmful gasses into the atmosphere.

- High-efficiency particulate air (HEPA) filters and other types of mechanical air filters get rid of particles by catching them on the filter material.Large airborne particles like dust, pollen, mold spores, animal dander, and allergens from dust mites and cockroaches are caught by HEPA filters.

- Due to all of these factors, the high-efficiency particulate air (HEPA) segment is likely to lead the India air purifier market over the next five years.

Increasing Air Pollution Expected to Drive the Market

- India, due to the rapidly increasing energy demand and an increasing number of commercial and industrial operations that cause the release of a large number of harmful gases and pollutants into the air, is expected to have a positive impact on the market.

- India is a country with more than half of the world's 20 most polluted cities. Rapid urbanization, construction, dependence on coal for energy, vehicular pollution, and dust all contribute to rising pollution levels. The pollution charts are expected to grow in the forecast period, which is likely to drive the country's air purifier market.

- In 2021, India's coal consumption was 20.09 exajoules, which was higher than the 2020 consumption of 17.40 exajoules. India's increasing share of coal consumption, which releases carbon dioxide and other gases on burning, directly affects the country's air quality and is likely to drive the air purifier market in the country.

- In recent years, there has been an increasing focus on addressing household air pollution in India by the government and other stakeholders. Several government initiatives have been launched in the past few years to reduce air pollution. This is likely going to drive the air purifier market in the country.

- Hence, owing to the above points, increasing air pollution levels are expected to drive the India air purifier market during the forecast period.

India Air Purifier Industry Overview

The India air purifier market is fragmented. Some of the key players in this market (in no particular order) include Daikin Industries Ltd, Dyson Ltd, Koninklijke Philips NV, Honeywell International Inc., and Panasonic Corporation.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD million, till 2028

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.2 Restraints

- 4.6 Supply Chain Analysis

- 4.7 PESTLE Analysis

5 MARKET SEGMENTATION

- 5.1 Filtration Technology

- 5.1.1 High-efficiency Particulate Air (HEPA)

- 5.1.2 Other Technologies

- 5.2 Type

- 5.2.1 Stand-alone

- 5.2.2 In-duct

- 5.3 End-User

- 5.3.1 Residential

- 5.3.2 Commercial

- 5.3.3 Industrial

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers, Acquisitions, Collaboration and Joint Ventures

- 6.2 Strategies Adopted by Key Players

- 6.3 Company Profiles

- 6.3.1 Daikin Industries Ltd.

- 6.3.2 Honeywell International Inc.

- 6.3.3 LG Electronics Inc.

- 6.3.4 Unilever PLC (erstwhile BlueAir AB)

- 6.3.5 Dyson Ltd.

- 6.3.6 Whirlpool Corporation

- 6.3.7 Panasonic Corporation

- 6.3.8 Koninklijke Philips NV

- 6.3.9 IQAir

- 6.3.10 Samsung Electronics Co. Ltd.

- 6.3.11 Xiaomi Corp

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

02-2729-4219

+886-2-2729-4219