|

市场调查报告书

商品编码

1631572

多式联运:市场占有率分析、产业趋势/统计、成长预测(2025-2030)Intermodal Freight Transportation - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

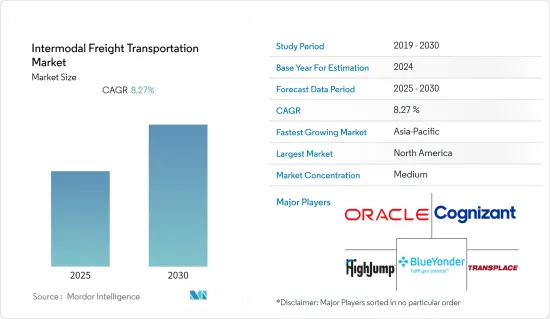

预计多式联运市场在预测期间内复合年增长率为8.27%

主要亮点

- 根据供应链管理专业委员会的物流状况报告,运输成本占总物流成本的66%。由于司机短缺和抑制生产力的货运法规等货运问题限制了未来几年的运力,主动管理运输网络可以防止这些成本上升。如果企业希望减少供应链中断、管理供应风险并降低运输成本,多式联运可能是可行的选择。将多式联运纳入运输组合中可以显着节省成本。将多种运输方式纳入运输公司的基础设施中可以减少对单一运力来源的依赖。使用多式联运的供应链领导者可以透过利用每种运输方式的能力,在短期和长期内受益。

- 此外,美国环保署 (EPA) 报告称,与单独使用卡车运输相比,使用多式联运进行超过 1,000 英里的运输可减少多达 65% 的燃料使用和温室气体排放。一辆将 40,000 磅货物从洛杉矶运送到波士顿的卡车排放约 4.35 吨二氧化碳。透过多式联运铁路运输同样 40,000 磅的货物,产生的碳排放将显着减少至 1.75 吨。多式联运可以有效减少企业的碳排放。美国环保署估计,透过铁路而不是高速公路运输每吨英里的货物可以减少三分之二的温室气体排放。这对于企业继续努力减少碳排放以遵守环境法规并实现企业永续性目标至关重要。

- 大型多式联运铁路设施受到重型卡车运输的挑战,卡车通常按照到达起重机的顺序进行维修,这不是最理想的。按照货柜的堆迭顺序将卡车召唤到起重机上,而不是按照先到先服务的方式将箱子转移到服务卡车上,可以提高效率。这大大减少了交易卡车驾驶人联繫终端的需要,并允许终端了解计费流程和事件。在卡车驾驶人到达门口之前检查运单是否指定等项目可以藉助行动软体应用程式进行管理。此功能可帮助驾驶员执行高级入住和退房、完成服务请求、验证单位位置以及从行动电话接收停车位置更新。

- 在Covid-19大流行期间,世界各国政府都限制非公民和非居住者入境,或对入境人员实施长时间隔离,包括锁门、严格保持社交距离和人与人接触,从而限制了传播。追踪措施的同时,对病毒进行追踪。这些对跨国和过境货运的过度限制,进一步加剧了疫情衝击对全球经济的经济和社会影响。

- 该市场正在进行多家公司的大规模併购,以扩大其影响力。去年6月,全球供应链、工业和零售生态系统协作SaaS软体解决方案供应商非专利 Group宣布,透过非专利 TMS和GCR(非专利 Collaborative Replenishment)解决方案的SaaS实施,协助食品业的主要参与者利马格兰集团对其运输和供应业务进行了转型。

多式联运市场趋势

铁路和道路运输预计将占据较大份额

- 多式联运以合理的成本提供可靠的货运,并有可能融入当前的货运基础设施。美国铁路业每人运输货物超过40吨,多式联运往往采用53英尺长的货柜进行。据CSX称,一趟联运列车可运输280卡车的货物。在决定是否使用多式联运时,托运人会考虑与精确规划铁路 (PSR) 相关的低效率、运输设备可用性、装载价格以及驾驶人等各种问题。

- 随着对更高效、更快捷的货运需求的增加,铁路业努力透过精准规划铁路来加强营运。 PSR是指在铁路网规划的直达线路上,用更少的车厢和机车运输相同数量的货物。传统列车满载时才载货,但有了PSR,无论是否有货物,列车都会在指定时间开始行驶。 PSR 的目标是实现更高的速度、更长的列车编组和更短的终点站停留时间。然而,随着铁路业向PSR过渡,现有运输车道受到影响,设备和人员减少。

- 美国和邻国的铁路营运商努力升级设备、运输时间表、装卸时间和车道数量,以适应大量的配送点。墨西哥拥有完善的铁路基础设施,覆盖全国大部分地区,与美国边境附近有完善的铁路连接。加拿大有两条主要铁路:加拿大国家铁路(CN)和加拿大太平洋铁路(CPR)。

- 科技和多式联运铁路正在帮助托运人应对运输环境的挑战。 CSX 运输拥有超过 40 个航站楼的网路。多式联运业务服务于密西西比河以东的主要市场,并透过大量货柜运输产品,为公司提供运输超过 500 英里的卡车式服务。 CSX CSX Transport 对运输管理系统供应商进行了调查,以深入了解多式联运铁路运输。多式联运铁路的重点是降低运能和成本。托运人可以透过添加运输管理系统、开始向多式联运过渡或两全其美来实现其目标。

北美预计将占据很大份额

- 北美地区的多式联运货运市场越来越依赖消费经济的需求。区域铁路产业致力于创造可与地面运输相媲美的新型多式联运服务。去年二月,Mullen Group Ltd. 宣布其完全子公司APPS Cartage Inc. 和 APPS Cargo Terminals Inc. 已与 CN 签订协议,在指定期限内继续向 APPS Transport 提供多式联运服务。

- 根据IANA预测,2022年多式联运总量为17,716,445辆,较2021年下降3.9%。儘管拖车数量减少23.8%至924,259辆,但国内货柜吞吐量增加1.6%至8,147,044辆。国内设备整体销售量下降1.8%至9,071,303台。

该地区也有一些值得注意的新参与企业。例如,去年 11 月,连接汽车托运人和承运人的数位平台 RunBuggy OMI Inc. 宣布推出其顺风车运输管理解决方案 (TMS)。这种云端基础的解决方案使车辆托运人能够透过合作伙伴或自己的方式无缝整合和连接他们当前的运输资产,并与 RunBuggy 的市场(一个由 17,000 名检验的司机组成的全国网路)连接,以扩展您的运输能力。

多式联运产业概况

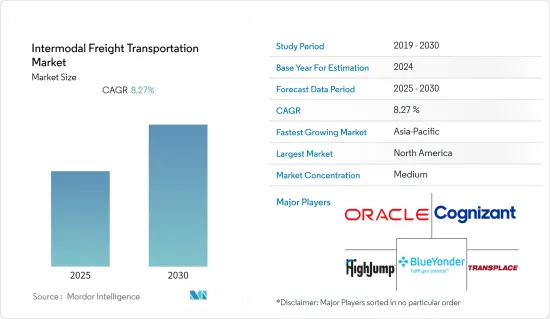

多式联运市场适度分散,进入市场的公司提供与支援多式联运方式相关的各种软体和服务。此外,收购多年来一直是主要的市场趋势。主要参与者包括 Oracle Corporation、Cognizant Technology Solutions Corp.、HighJump (Korber AG) 和 Blue Yonder Group, Inc.。

2022 年 4 月,为了进一步多元化,Lietuvos Gelezinkeliai (LTG) 的货运部门 LTG Cargo 推出了前往德国杜伊斯堡的多式联运服务。客户将可以透过铁路到达欧洲最重要的工业丛集之一的内河港口。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 新进入者的威胁

- 买家/消费者的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争公司之间敌对关係的强度

- COVID-19 造成的影响评估

第五章市场动态

- 市场驱动因素

- 全球供应链对有效且具成本效益的运输的需求日益增长

- 减少碳足迹的意识不断增强

- 市场挑战

- 由于缺乏有效的规划和沟通,运输成本增加

第六章 市场细分

- 按成分

- 软体

- 服务

- 按运输方式

- 铁路/道路运输

- 空运/道路运输

- 海运/道路运输

- 其他交通工具

- 最终用户产业

- 工业/製造

- 石油和天然气

- 消费品/零售

- 饮食

- 建设业

- 其他最终用户产业

- 地区

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东/非洲

第七章 竞争格局

- 公司简介

- Oracle Corporation

- Cognizant Technology Solutions Corp

- HighJump(Korber AG)

- Blue Yonder Group, Inc.(JDA Software)

- Transplace, Inc.

- GE Transportation(Wabtec Corporation)

- The Descartes Systems Group Inc.(Descartes Aljex)

- Motorola Solutions, Inc.

- Elemica, Inc.(Eyefreight BV)

- Envase Technologies

第八章投资分析

第9章市场的未来

The Intermodal Freight Transportation Market is expected to register a CAGR of 8.27% during the forecast period.

Key Highlights

- Transportation accounts for 66% of overall logistics expenses, according to the Council of Supply Chain Management Professionals' State of Logistics Report. Management of the transportation network proactively may prevent these costs from rising as trucking issues such as driver shortages and productivity-stifling trucking rules limit capacity in the coming years. Intermodal may be a strong option if the company wants to reduce supply chain interruption, manage supply risk, and lower transportation expenses. Including multimodal transportation in the transportation mix results in significant cost reductions. By incorporating several means of transportation into the carrier base, the reliance on a single source of capacity is reduced. Supply chain leaders that use multimodal freight moves may gain in the short and long term by utilizing the capabilities of each mode of transportation.

- Moreover, the U.S. Environmental Protection Agency (EPA) reports that using intermodal transport for shipments over 1,000 miles can cut fuel use and greenhouse gas emissions by as much as 65% relative to truck transport alone. A truck that can transport 40,000 lbs from Los Angeles to Boston produces approximately 4.35 tons of carbon emissions. The same 40,000 pounds, which could be shipped via intermodal rail, produces 1.75 tons of carbon emissions, significantly less. Intermodal transportation can effectively help reduce a company's carbon footprint. The EPA estimates that every ton-mile of freight moved by rail instead of highway can reduce greenhouse emissions by two-thirds. This is essential as companies continually work to reduce their carbon footprint to comply with environmental regulations and meet their corporate sustainability goals.

- Extensive intermodal rail facilities are challenged by high truck volume and often serve the trucks in the order they arrive at a crane, which is not optimal. Efficiencies can be gained by calling the trucks to the crane to match the containers' stacking order rather than shuffling boxes to serve the trucks on a first-come, first-served basis. This makes the trucker with transactions significantly reduce the need to contact the terminal, helping terminals capture billable processes and events. Items such as checking whether a waybill is in place well before a trucker's arrival at the gate could be managed with the help of a mobile software application. This capability could help drivers perform advanced check-in and check-out, complete service requests, confirm unit locations, and receive parking location updates from a mobile phone.

- During the COVID-19 pandemic, the government globally restricted its borders to non-citizens and non-residents or imposed on those entering extended periods of self-isolation to limit the spread of the virus while implementing lockdowns, strict social distancing, and contact tracing measures. These often-excessive restrictions to cross-border and transit freight transport further aggravated the economic and social impacts of the pandemic shock on the global economy.

- The market is witnessing significant mergers and acquisitions by multiple companies to increase its presence. In June last year, Generix Group, a global provider of collaborative SaaS Software solutions for the Supply Chain, industrial, and retail ecosystems, assisted Jacquet Brossard, a Limagrain Group company and a major player in the food industry, in the transformation of its transport and supply operations through the SaaS implementation of Generix TMS and GCR (Generix Collaborative Replenishment) solutions.

Intermodal Freight Transportation Market Trends

Rail and Road Transport is Expected to Hold Significant Share

- Intermodal transportation offers dependable freight shipment at a reasonable cost and might be incorporated into the current freight transportation infrastructure. The rail industry in the United States transports over 40 tons of freight per capita, and intermodal shipments are often made in 53-foot-long containers. According to CSX, one intermodal train can transport the same amount of freight as 280 trucks. Shippers examine various issues when deciding whether to use intermodal transportation, including the inefficiencies associated with railroad conversions to precision planned railroading (PSR), the availability of shipping equipment, load price, and the ongoing truck driver shortage.

- While the demand for more efficient and rapid goods shipping has risen, the rail industry has strived to enhance operations using precision-planned railroading. PSR refers to transporting the same amount of freight with fewer railcars and locomotives along a planned direct line over a rail network. Conventional trains move freight when full, but under PSR, trains start moving at a specified time regardless of whether or not the freight is there. PSR aims to enable faster speeds, longer trains, and shorter terminal dwell times. However, as the rail industry has moved to PSR, it has impacted existing shipping lanes and decreased equipment and staff.

- Railway operators in the United States and neighboring countries have strived to enhance equipment, shipping schedules, loading and unloading times, and the number of lanes to handle numerous delivery locations. The intermodal rail system in the United States stretches across the country, connecting every major port and providing some coast-to-coast service faster than the truck.Mexico has an outstanding rail infrastructure covering most of the country, with well-established rail connections near the US border. Canada has two main coast-to-coast railroads: the Canadian National Railway (CN) and the Canadian Pacific Railway (CPR).

- Technology and intermodal rail support shippers in meeting the transportation environment's difficulties. CSX Transportation has a network of more than 40 terminals. The intermodal business serves major markets east of the Mississippi and the transportation of products in numerous containers, providing corporations with service similar to trucking for shipments traveling more than 500 miles. CSX CSX Transportation surveyed transportation management system suppliers to get insight into intermodal rail transportation. Intermodal railways are more concerned with capacity and cost reductions. Adding a transportation management system, starting a multimodal conversion path, or ensuring the best use of both can help shippers achieve their goals.

North America is Expected to Hold Significant Share

- The intermodal freight transportation market in the North American region is increasingly dependent on the consumer economy's demand. The regional rail industry is concentrating on creating new intermodal services that can successfully rival over-the-road options. In February last year, Mullen Group Ltd. announced that its wholly owned subsidiaries, APPS Cartage Inc. and APPS Cargo Terminals Inc., had signed an agreement with CN to continue supplying intermodal services to APPS Transport for a period of time.

- According to IANA, overall intermodal volume will be 17.716,445 in 2022, a 3.9% decrease from 2021.Trailers dropped by 23.8% to 924,259, while domestic container volume increased by 1.6% to 8,147,044 units. Domestic equipment as a whole declined by 1.8% to 9,071,303.

The region is also witnessing significant new players entering the market. For instance, in November last year, RunBuggy OMI Inc., a digital platform that connects car shippers and transporters, announced the availability of its Hitch Transportation Management Solution (TMS). The cloud-based solution enables car shippers to seamlessly integrate and connect with their current transportation assets, whether through partners or in-house, and expand their transportation capacity with access to RunBuggy's Marketplace, a nationwide network of 17,000 verified drivers.

Intermodal Freight Transportation Industry Overview

The intermodal freight transportation market is moderately fragmented, as a few players are entering the market to provide various software and services related to supporting intermodal transportation methods. Moreover, acquisitions have been a key trend in the market over the years. Some of the key players include Oracle Corporation, Cognizant Technology Solutions Corp., HighJump (Korber AG), Blue Yonder Group, Inc. (JDA Software), etc.

In April 2022, to further diversify, LTG Cargo, the freight division of the Lietuvos Gelezinkeliai (LTG) company, introduced intermodal freight services to Duisburg, Germany. Customers will have rail access to one of Europe's most vital industrial clusters and the inland waterway port.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Threat of New Entrants

- 4.2.2 Bargaining Power of Buyers/Consumers

- 4.2.3 Bargaining Power of Suppliers

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Assessment on the impact due to COVID-19

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing need for effective and cost-efficient means of transportation by global supply chains

- 5.1.2 Rising awareness regarding the reduction of carbon footprint

- 5.2 Market Challanges

- 5.2.1 Lack of effective effective planning and communication can increase transportation costs

6 MARKET SEGMENTATION

- 6.1 By Component

- 6.1.1 Software

- 6.1.2 Service

- 6.2 By Transportation Mode

- 6.2.1 Rail and Road Transport

- 6.2.2 Air and Road Transport

- 6.2.3 Maritime and Road Transport

- 6.2.4 Other Transportation Modes

- 6.3 End-User Industry

- 6.3.1 Industrial and Manufacturing

- 6.3.2 Oil and Gas

- 6.3.3 Consumer and Retail

- 6.3.4 Food & Beverage

- 6.3.5 Construction

- 6.3.6 Other End-User Industries

- 6.4 Geography

- 6.4.1 North America

- 6.4.2 Europe

- 6.4.3 Asia-Pacific

- 6.4.4 Latin America

- 6.4.5 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Oracle Corporation

- 7.1.2 Cognizant Technology Solutions Corp

- 7.1.3 HighJump (Korber AG)

- 7.1.4 Blue Yonder Group, Inc. (JDA Software)

- 7.1.5 Transplace, Inc.

- 7.1.6 GE Transportation (Wabtec Corporation)

- 7.1.7 The Descartes Systems Group Inc. (Descartes Aljex)

- 7.1.8 Motorola Solutions, Inc.

- 7.1.9 Elemica, Inc. (Eyefreight BV)

- 7.1.10 Envase Technologies