|

市场调查报告书

商品编码

1631599

中东和非洲智慧型手机:市场占有率分析、行业趋势和统计数据、成长预测(2025-2030)Middle East and Africa Smartphones - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

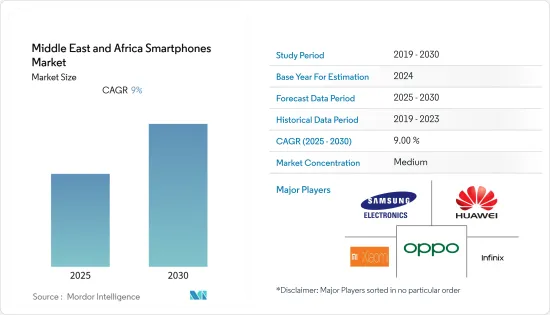

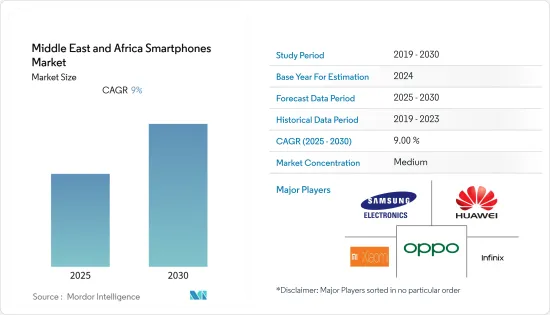

中东和非洲智慧型手机市场预计在预测期内复合年增长率为 9%

主要亮点

- 此外,截至2020年10月,中国智慧型手机製造商Realme的目标是在未来两年内成为海湾合作委员会国家的领先厂商之一。该公司于 1 月进入海湾合作委员会地区,但由于 COVID-19 和封锁而被迫放慢行销。该公司将在市场上推出九款车型,并专注于线上和线下通路。产品价格从 399 迪拉姆到 1,199 迪拉姆不等。

- 5G 是该地区智慧型手机市场成长的关键驱动力之一。根据爱立信行动报告,2024年,中东和非洲地区5G服务用户数可能达到6,000万,约占该地区所有行动用户的3%。 GSMA 也估计,到 2025 年,中东和北非地区将有约 5,000 万个 5G 连接,其中光是阿拉伯国家就有 2,000 万个。

- 因此,5G技术的发展和行动互联网的日益普及预计将为这些地区的先进智慧型手机创造巨大需求。 Vodacom 于 2020 年 5 月在约翰内斯堡、比勒陀利亚和开普敦运作了5G 行动网络,并计划在该国其他地区进一步推出。该公司还提供了LG V50 5G智慧型手机和华为5G CPE PRO FWA路由器等支援5G的设备,让客户在20个现场站点的覆盖范围内体验5G网路。

- 因此,该地区的通讯业者正在与设备提供商合作,鼓励使用 5G 技术并减少摩擦。此外,支持设备製造商生产价格实惠的 5G 设备的政府政策也可能加速该地区的 5G 采用。

中东和非洲智慧型手机市场趋势

Android预计将大幅成长

- Android 智慧型手机最近赶上了人工智慧和虚拟援助软体,其中包括 Google Assistant,用户可以向其传递语音命令,使其可与 iPhone 上的 Siri 相媲美。有了这样的功能,Android 随着时间的推移变得越来越复杂,因为他们试图整合不同版本的功能,以帮助改进整个产品。

- 由于希望透过引入最新功能来占领市场的参与者之间的竞争日益激烈,该地区的产品创新不断增加。该地区许多国家都在加强投资力度,扩大商用 5G 网路的覆盖范围。 Etisalat 和 Ooredoo 都在速度、设备、延迟和波束控制(讯号距离)方面对 5G 进行现场测试,并考虑到商业化。

- 2020 年 6 月,OPPO 准备在阿联酋推出全新高阶旗舰智慧型手机。该公司的产品Find X2 Pro与Etisalat合作推出,主要为阿联酋带来新一代的卓越性能、卓越的摄影和公司的卓越技术。为了给用户无缝的 5G 体验,该产品还整合了 Smart 5G 技术,可智慧导航并选择最佳网络,以最大限度地提高速度和电池寿命。

- 此外,2021年3月,OPPO宣布将在海湾合作委员会推出最新的Reno5系列5G智慧型手机。该公司首款全5G机型包括Reno5 Pro 5G、Reno5 5G、Reno5 Z 5G三款机种。基于「科技造福人类,善待世界」的2021年主题,该公司相信5G将为人们提供互联的生活,让他们享受科技增强的世界的好处。

- 同样在 2021 年 6 月,以智慧型手机闻名的中国科技公司小米在沙乌地阿拉伯开设了第一家零售店。该公司非常看好沙乌地阿拉伯市场,并期待未来在该地区开设更多门市。

- 此外,据传多款 Android 手机将于 2021 年发布,包括 OnePlus Nord CE(5G)、Google Pixel 5a、荣耀 50、诺基亚 X50、Folding Google Pixel 和 Oppo 折迭手机,但这表明了 Android 作业系统和事实证明,这款作业系统是中东国家各个用户中最受欢迎的。

预计非洲在预测期内将大幅成长

- 失业率上升和新冠肺炎 (COVID-19) 疫情的出现导致经济不确定性,继续将消费者的购买模式转向更实惠、功能丰富的产品。儘管非洲地区正遭受经济困难,但智慧型手机正在成为消费者的必需品,使其成为一个富有弹性的市场。

- 在非洲,智慧型手机的高昂成本意味着大多数人无法使用智慧型手机。为了解决这些问题,2020 年 9 月,作为 GSMA Thrive Africa 2020 活动阵容的一部分,Orange 宣布推出 Sanza touch,这是 Orange 独家的智慧型手机,也是我做过的最实惠的 4G Android 设备之一。

- 该公司表示,该设备的零售价约为 30 美元,这一超实惠的价格分布旨在促进数位包容性并让更多人能够访问行动互联网,并表示其旨在成为市场上最容易访问的设备。

- 此外,根据 GSMA 的数据,该地区智慧型手机的普及率继续大幅上升,预计到 2020 年将达到总连接数的 50% 左右,这主要是由于市场上出现了更便宜的设备。智慧型手机融资模式也越来越受欢迎,Safaricom 和Google最近合作允许低收入消费者每天为新的 4G 设备付款就证明了这一点。

- 非洲智慧型手机市场竞争也非常激烈,但专为非洲客户设计的设备很少。中国传音公司很早就认识到这个问题,这使其近年来成为该地区的知名企业。据传音控股称,该公司已在非洲地区销售了超过1.3亿块Tecno和Itel电池。

- 该地区的公司提供附加服务来扩大其业务。例如,2021年6月,三星在南非推出了智慧型手机、平板电脑和手錶的到府维修服务。该服务允许客户从家中或企业收集和返还需要维修的智慧型手机。

- 此外,2021 年 3 月,无晶圆厂半导体公司联发科重申其致力于提供新技术解决方案,以实现南非市场部署面向未来的智慧型手机。该公司宣布推出高阶游戏晶片 MediaTek Helio G95,以及 G90T、G85、G80、G70、G35 和 G25 晶片等一系列产品。这些产品针对高阶 4G 游戏智慧型手机市场。该公司还与 Oppo 小米和 Infinix 等多个智慧型手机品牌合作,将于 2021 年推出多达 10 款搭载联发科技 Helio G 系列的优质且功能丰富的智慧型手机。

中东和非洲智慧型手机产业概况

由于全球智慧型手机製造商众多,智慧型手机製造商之间的竞争非常激烈。主要智慧型手机巨头包括三星、华为和小米,它们都在争夺全部区域的市场占有率。近年来,智慧型手机的需求已经达到顶峰。这导致人们更加关注客户维繫和创新,将其视为维持竞争优势和市场占有率的关键策略。

其他好处:

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 竞争公司之间的敌对关係

- 替代品的威胁

- 市场驱动因素

- 市场挑战

- COVID-19 对产业的影响

- 价格分析

第五章市场区隔

- 按作业系统

- Android

- iOS

- 其他的

- 按国家/地区

- 沙乌地阿拉伯

- 阿拉伯聯合大公国

- 南非

- 埃及

- 东非(肯亚、坦尚尼亚、乌干达)

- 西非(尼日利亚、加纳)

- 土耳其

- 其他中东和非洲

第六章 竞争状况

- 供应商市场占有率分析 (2020) 海湾合作委员会、非洲、东非、西非

- 三星、OPPO、华为、小米、Infinix、传音等公司简介(业务概况、产品系列、策略、近期趋势)

第七章 市场展望

The Middle East and Africa Smartphones Market is expected to register a CAGR of 9% during the forecast period.

Key Highlights

- Moreover, as of Oct 2020, Chinese smartphone manufacturer Realme was aiming to become one of the prominent player in the GCC countries within the next two years. The company entered the GCC region in January but had to slow down its marketing efforts owing to Covid-19 and lockdowns. The company has launched nine of its models in the market and will be focusing on both online as well as offline channel. The product prices range between AED 399 and AED 1,199.

- 5G is one of the major drivers for the growth of smartphones market in the region. According to Ericsson Mobility Report, in the Middle East & Africa, the number of subscribers for 5G services in the MEA region may reach 60 million by 2024, representing about 3% of all mobile subscriptions in the region. GSMA also estimates that there may be around 50 million 5G connections across MENA, of which 20 million connections could be in the Arab States alone, by 2025.

- Hence, the development of 5G technologies and the increasing usage of mobile internet is expected to create significant demand for advanced smartphones in these regions. Vodacom, in May 2020, switched on its live 5G mobile network in Johannesburg, Pretoria and Cape Town, with further rollouts planned for other parts of the country. The company also offered 5G enabled devices, such as LG V50 5G smartphone, and Huawei 5G CPE PRO FWA router, which customers could use to experience the 5G network within the coverage area of the 20 live sites.

- Thus, telecoms in the region are partnering with device providers to encourage and reduce the friction in the usage of 5G technology. Further, government policies to enable device manufacturers to manufacture affordable 5G devices will also facilitate faster 5G adoption in the region.

MEA Smartphones Market Trends

Android is Expected to Grow Significantly

- Android smartphones have also recently caught up to Artificial intelligence and virtual assistance software with google assistants that allow the user to pass voice command and gives equal coemption to Siri in iPhones. With such features, android is becoming more and more sophisticated over time as it sought to integrate after features with different versions that help in refining the products as a whole.

- The region is witnessing increased product innovations owing to the increased competition between players to introduce the latest features and capture the market. Many states in the region are increasingly investing in expanding the scope of commercial 5G networks. Both Etisalat and Ooredoo have been undertaking live 5G trials on speed, equipment, latency, and beam steering (for signal distance), with commercial launches in mind.

- In Jun 2020, OPPO was gearing up to bring its new premium flagship smartphone in the UAE. The company's product Find X2 Pro was launched in partnership with Etisalat, primarily offering a new generation of superior performance, excellent photography, and company's technological excellence to the UAE. Also, in order to deliver a seamless 5G experience to its users, the product integrates Smart 5G technology to intelligently navigate and choose the most suitable network in order to maximize speed and battery life.

- Further, in Mar 2021, OPPO announced the launch of its latest Reno5 Series of 5G smartphones in the GCC. The company's first all-5G launch includes three models, Reno5 Pro 5G, Reno5 5G and Reno5 Z 5G. Driven by its 2021 theme of Technology for Mankind, Kindness for the World, the company believes that 5G will empower people to live connected lives and reap the benefits of a technology-powered world.

- Also, in Jun 2021, China's technology company Xiaomi, that is known for its smartphones, opened its first retail store in Saudi Arabia. The company is very optimistic about the Saudi market, voicing its hope that more company stores will be opened in the future in the region.

- Furthermore, the rumored launches of various android phones such as OnePlus Nord CE (5G), Google Pixel 5a, Honor 50, Nokia X50, Folding Google Pixel, Oppo folding phone in 2021 indicate the penetration of Android OS in the smartphones and prove that the OS is the most preferred among various users from Middle Eastern countries.

Africa is Expected to Grow Substantially during the Forecast Period

- The rising unemployment rate and the economic uncertainty caused by the emergence of the COVID-19 pandemic is continuing to shift consumer buying patterns towards more affordable and feature-rich products. The African region has been struggling with economic hardships, but smartphones have been becoming an essential consumer item, making it a resilient market.

- The higher cost of a smartphone in Africa has been making smartphones largely inaccessible to the majority of the population. In order to tackle these issues, in Sep 2020, as part of the line-up of activities for the GSMA Thrive Africa 2020, Orange announced the launch of Sanza touch, which is an exclusive Orange smartphone and one of the most affordable 4G Android devices.

- The company stated that the device will retail around USD 30, and this ultra-affordable price point was intended to make it the most accessible device on the market with the ultimate goal of driving digital inclusion and providing much more people with access to mobile internet.

- Also, according to GSMA, smartphone adoption is continuing to rise significantly in the region, primarily reaching around 50% of the total connections in 2020, as cheaper devices have become available in the market. The smartphone financing models are also gaining traction, demonstrated by the recent partnership between Safaricom and Google, enabling low-income consumers to pay for the new 4G devices in daily instalments.

- The smartphone market in Africa is also highly competitive, however, fewer devices are designed with African customers in mind. This issue was something the Chinese company Transsion recognized early, which largely enabled it to become a prominent player in the region over the last few years. According to Transsion Holdings, it has sold more than 130 million Tecno and Itel cells in the African region.

- The companies in the region in order to expand its presence have been offering additional services. For instance, in Jun 2021, Samsung launched its door-to-door repair service in South Africa for its smartphones, tablets and watches. The service will enable customers who require repairs to have their smartphone collected from their house or business, and returned, provided the property is within 40km of a customer centre.

- Additionally, in Mar 2021, MediaTek, a fabless semiconductor company, reiterated its commitment towards providing new technology solutions in order to enable the rollout of future ready smartphones in the South African market. The company announced the launch of its premium gaming chip, MediaTek Helio G95, along with its offerings across the spectrum, including G90T, G85, G80, G70, G35, and G25 chips. The products were aimed at the premium 4G gaming smartphone segment. The company has also associated with various smartphone brands such as Oppo Xiaomi, and Infinix in order to launch up to ten premium, feature-rich smartphones, powered by MediaTek Helio G series in 2021.

MEA Smartphones Industry Overview

The competitive rivalry amongst the smartphone manufacturers is very high, owing to the presence of various smartphone manufacturers across the globe. Some of the major smartphone giants are Samsung, Huawei, Xiaomi, and many more, competing for market shares across the region. The demand for smartphones has plateaued in recent years, due to the massive smartphone penetration across the countries. This has led to an increased focus on customer retention and innovation as key strategies to maintain competitive advantage and market share.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness -Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Intensity of Competitive Rivalry

- 4.2.5 Threat of Substitute Products

- 4.3 Market Drivers

- 4.4 Market Challenges

- 4.5 Impact of COVID-19 on the Industry

- 4.6 Pricing Analysis

5 MARKET SEGMENTATION

- 5.1 By Operating System

- 5.1.1 Android

- 5.1.2 iOS

- 5.1.3 Others

- 5.2 By Country

- 5.2.1 Saudi Arabia

- 5.2.2 United Arab Emirates

- 5.2.3 South Africa

- 5.2.4 Egypt

- 5.2.5 East Africa (Kenya,Tanzania and Uganda)

- 5.2.6 West Africa (Nigeria and Ghana)

- 5.2.7 Turkey

- 5.2.8 Rest of Middle East and Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share Analysis (2020) GCC, Africa, East Africa, and West Africa

- 6.2 Key Vendor Profiles (Business Overview, Product Portfolio, Strategies, and Recent Developments)Companies such as Samsung, OPPO, Huawei, Xiaomi, Infinix, and Transsion, etc. will be analyzed as A part of this section.