|

市场调查报告书

商品编码

1940727

美国智慧锁:市场占有率分析、产业趋势与统计、成长预测(2026-2031)United States Smart Lock - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

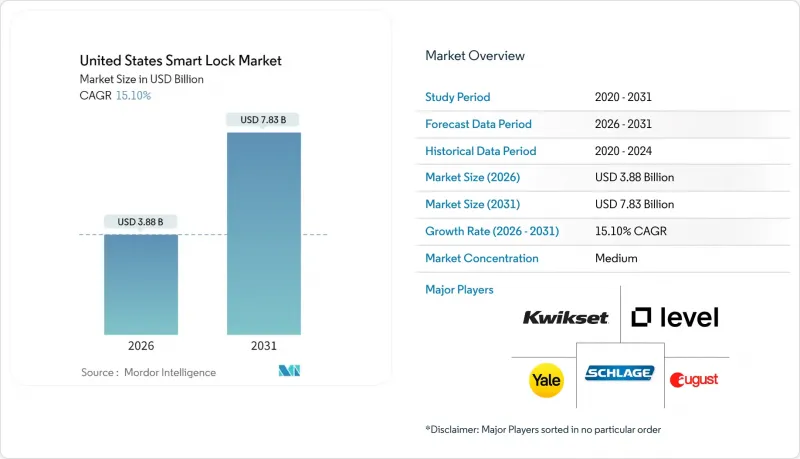

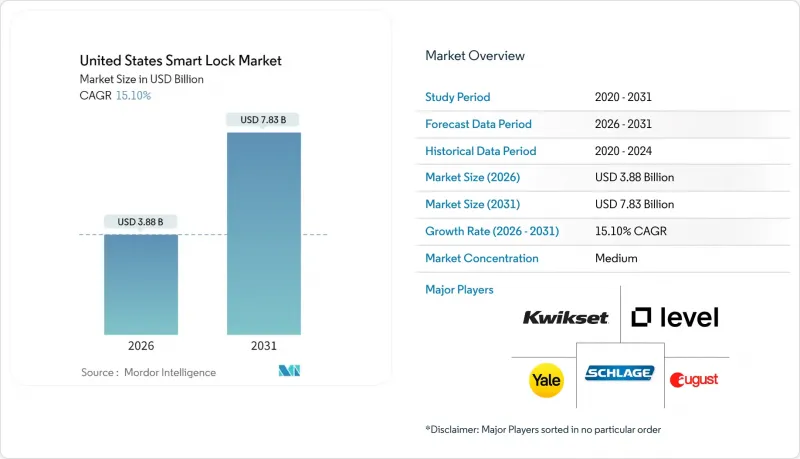

美国智慧锁市场预计将从 2025 年的 33.7 亿美元成长到 2026 年的 38.8 亿美元,到 2031 年达到 78.3 亿美元,2026 年至 2031 年的复合年增长率为 15.1%。

就出货量而言,市场规模预计将从2025年的1,746万台成长到2030年的3,903万台,在预测期间(2025-2030年)内复合年增长率(CAGR)为17.45%。此成长主要受宅配窃盗事件频繁、智慧家庭生态系统日趋成熟以及超宽频(UWB)技术融入主流智慧型手机等因素驱动。与现有门锁的兼容性推动了住宅领域的普及,而专用锁具在商业翻新领域也越来越受欢迎。租赁住宅开发商和保险公司的奖励刺激了市场需求,而主要品牌之间的策略整合则加剧了线上线下管道的竞争。

美国智慧锁市场趋势与洞察

加强与智慧家庭中心和语音助理的集成

随着製造商实现与亚马逊 Alexa、Google Home 和苹果 HomeKit 的原生相容,智慧锁的需求正在加速成长。 Matter over Thread通讯协定的出现标准化了设备通信,使智慧锁能够作为节能型网状网路节点运作。 Yale Assure Lock 2 正是这项变革的体现,它无需专用网关即可在生态系统中运作。语音解锁功能透过语音模式和上下文提示增加了多重身份验证,从而提升了安全性和便利性。每增加一台智慧型设备,整个网路的效用就会提升,随着使用者从独立解决方案转向统一存取管理,系统也会随之升级。

宅配窃盗案件的增加推动了对入户门安防的需求。

预计到2024年,将有超过2.6亿件包裹被盗,造成价值200亿美元的货物损失。智慧锁透过向送货人员发放临时密码来解决「最后一公尺安全」问题,允许他们将包裹放在室内或走廊上。亚马逊的「Key」计画提供监控访问和责任险保障,已被广泛接受。类似的功能也正在推广到清洁工和医疗助理等服务提供者,并提供审核日誌以满足保险公司和物业管理公司的要求。

持续存在的网路安全漏洞和公开骇客攻击

2024年的学术测验发现主流智慧锁存在14个零日漏洞。这些问题包括静态蓝牙GATT值、433MHz重播攻击向量和RFID克隆攻击。一些旧硬体缺乏空中升级功能,使用户面临风险。虽然新款机型增加了加密储存和更强大的加密技术,但一些备受瞩目的概念验证试验正在削弱用户信任。监管机构未能及时应对不断演变的威胁,迫使消费者依赖第三方审核,而这些审计往往也存在缺陷。

细分市场分析

预计到2025年,插芯锁将占据美国智慧锁市场61.12%的份额,因为美国製造的许多门都预先钻孔以适应这种锁具。易于改装到现有门上鼓励了DIY安装,而各大品牌的平台支援也巩固了插芯锁的优势。该细分市场受益于频繁的保险折扣和丰富的配件生态系统,包括可视门铃和感测器。随着商业维修对建筑专用五金件的需求增加,榫眼锁和槓桿锁等特殊类别正以17.43%的复合年增长率成长。这些产品整合了生物识别键盘等高级身份验证功能,从而推高了平均售价和利润率。

专业细分市场的成长主要得益于商业建筑维修、酒店改装以及对设计一致性要求较高的高端住宅应用。随着系统整合商将门禁控制与建筑自动化平台捆绑销售,美国智慧锁市场的榫眼锁解决方案预计将稳定成长。重型挂锁则满足了户外储存和建筑工地等对防风雨性能要求极高的场所的需求。儘管挂锁市场仍属于小众市场,但其提供的智慧门禁功能已超越了入口大门,从而为供应商拓展了商机。

预计到2025年,住宅将贡献88.90%的收入,主要得益于庞大的独栋住宅用户群和日益增长的DIY文化。语音助理互通性和保险折扣也支撑了住宅用户的需求。儘管电池寿命的提升延长了产品更换週期,但消费者仍积极更换到具备UWB和Matter功能的下一代产品,展现出强劲的升级意愿。同时,商业安装量正以18.28%的复合年增长率成长。物业管理公司重视集中式身分验证管理,因为它可以降低管理机械钥匙的人事费用。

云端控制面板使设施管理人员能够在几秒钟内授予或撤销数百扇门的存取权限。美国智慧锁市场规模预计将在商业应用领域快速成长,尤其是在多用户住宅和医疗保健设施领域,合规性审核将推动该技术的普及。此外,企业日益增长的ESG(环境、社会和治理)目标也在推动智慧锁的发展,这些智慧锁可以与能源管理系统和入住分析系统整合。

美国智慧锁市场报告按产品类型(插销锁、挂锁及其他)、最终用户(住宅、商业)、安装类型(维修、新建整合)和分销管道(线上、线下)进行细分。市场预测以价值(美元)和销售量(出货量)为单位。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 加强与智慧家庭中心和语音助理的集成

- 包裹窃盗事件的增加推动了对入户门安防的需求。

- 安装智慧安防系统可享保险费折扣

- 大规模开发配备智慧门锁的租赁住宅

- 互联互通解决方案的ESG/LEED奖励

- 智慧型手机上的UWB被动式门禁

- 市场限制

- 持续存在的网路安全漏洞和公开骇客攻击

- 多用户住宅维修设备的建筑标准规范

- 安全SoC晶片组供应受限

- 消费者对资料共用的隐私担忧

- 价值链分析

- 监管环境

- 技术展望

- 波特五力分析

- 供应商的议价能力

- 买方的议价能力

- 新进入者的威胁

- 竞争对手之间的竞争

- 替代品的威胁

- 定价及历史价格趋势

- 评估宏观经济对市场的影响

第五章 市场规模与成长预测

- 依产品类型

- 门栓

- 挂锁

- 其他产品类型(例如榫眼锁等)

- 最终用户

- 住宅

- 商业的

- 按安装类型

- 维修工程

- 新建时内建

- 透过分销管道

- 线上(直销和市场)

- 线下(零售商、安装商)

第六章 竞争情势

- 市场集中度

- 策略趋势

- 市占率分析

- 公司简介

- August Home Inc.(ASSA ABLOY AB)

- Yale Home(ASSA ABLOY AB)

- Kwikset(ASSA ABLOY AB)

- Schlage(Allegion Company)

- Level Home Inc.

- U-Tec Group Inc.

- Wyze Labs, Inc.

- Lockly Inc.

- Eufy Security(Anker Innovations)

- SimpliSafe, Inc.

- Sentrilock, LLC

- Gate Labs Inc.

- RemoteLock

- SwitchBot Inc.

- Onity Inc.(Carrier Global)

- Digilock Inc.

- Igloohome Pte Ltd

- Nuki Home Solutions Inc.

- PDQ Locks

- Baldwin(Part of ASSA ABLOY)

第七章 市场机会与未来展望

The United States Smart Lock Market is expected to grow from USD 3.37 billion in 2025 to USD 3.88 billion in 2026 and is forecast to reach USD 7.83 billion by 2031 at 15.1% CAGR over 2026-2031.

In terms of shipment volume, the market is expected to grow from 17.46 million units in 2025 to 39.03 million units by 2030, at a CAGR of 17.45% during the forecast period (2025-2030). Momentum stems from persistent package-theft incidents, broader smart-home ecosystem maturity, and ultra-wideband (UWB) integration in mainstream smartphones. Deadbolt compatibility with existing door hardware underpins widespread residential adoption, while specialty locks gain traction in commercial retrofits. Build-to-rent developers and insurance incentives accelerate demand, and strategic consolidation among leading brands reinforces competitive intensity across both online and offline channels.

United States Smart Lock Market Trends and Insights

Increasing Integration with Smart-Home Hubs and Voice Assistants

Smart lock demand accelerates as manufacturers achieve native compatibility with Amazon Alexa, Google Home, and Apple HomeKit. The arrival of the Matter over Thread protocol standardizes device communication and allows smart locks to function as energy-efficient mesh nodes. Yale Assure Lock 2 operates across multiple ecosystems without proprietary hubs, illustrating this shift. Voice-activated unlocking now layers authentication through voice patterns and contextual cues, improving security and convenience. Each additional smart device increases overall network utility, prompting replacement cycles as users transition from point solutions to unified access management.

Rising Package-Theft Incidents Boosting Entryway Security Demand

More than 260 million deliveries faced theft in 2024, representing USD 20 billion in lost goods. Smart locks solve last-meter security by issuing temporary codes for delivery personnel, enabling in-home or vestibule drops. Amazon's Key program demonstrated mainstream acceptance when monitored access and liability coverage are present . The same capability extends to service providers such as cleaners and healthcare aides, offering audit logs that satisfy insurers and property managers.

Persistent Cyber-Security Vulnerabilities and Public Hacks

Academic testing in 2024 revealed 14 zero-day flaws in mainstream smart locks. Issues include static Bluetooth GATT values, 433 MHz replay vectors, and RFID cloning. Some older hardware lacks over-the-air update capability, leaving users exposed. High-profile demonstrations erode trust, even as new models add encrypted storage and stronger cryptography. Regulators lag behind the threat curve, so consumers rely on third-party audits that frequently uncover gaps.

Other drivers and restraints analyzed in the detailed report include:

- Insurance Premium Discounts for Smart-Security Installations

- UWB Passive-Entry in Smartphones

- Multi-Family Building Code Restrictions on Retrofit Devices

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Deadbolt locks accounted for 61.12% of the US Smart Lock Market share in 2025 because most US doors are pre-bored for this format. Retrofit convenience encourages DIY adoption, and platform support from dominant brands reinforces deadbolt strength. The segment benefits from frequent insurance discounts and a rich accessory ecosystem that includes video doorbells and sensors. Specialty categories such as mortise and lever locks grow at a 17.43% CAGR as commercial renovations demand architecture-specific hardware. These products integrate advanced credentials such as biometric pads, which lift the average selling price and margin.

Specialty growth stems from commercial building upgrades, hospitality retrofits, and high-end residential applications that favor design continuity. The US Smart Lock Market size for mortise solutions is forecast to expand steadily as system integrators bundle access control with building automation platforms. Rugged padlocks address outdoor storage and construction needs where weather sealing is critical. Although niche, the padlock segment proves smart access utility beyond the front door, broadening vendor addressable revenue.

Residential buyers represented 88.90% of revenue in 2025 due to the enormous installed base of single-family homes and growing DIY culture. Voice-assistant interoperability and discounted insurance premiums sustain household demand. Battery life improvements lengthen replacement cycles, but upgrade intent remains high because UWB and Matter features motivate second-generation purchases. Commercial deployments, however, record an 18.28% CAGR. Property managers value centralized credential management that trims labor costs tied to mechanical key turnover.

Cloud dashboards let facilities revoke or grant access across hundreds of doors within seconds. The US Smart Lock Market size for commercial applications is forecast to rise sharply in multi-family and healthcare properties, where audit compliance drives technology adoption. Rising corporate ESG goals also favor smart locks that integrate with energy management systems and occupancy analytics.

The United States Smart Lock Market Report is Segmented by Product Type (Deadbolt, Padlock, Other Product Types), End-User (Residential, Commercial), Installation Type (Retrofit, New-Construction Integrated), and Distribution Channel (Online, Offline). The Market Forecasts are Provided in Terms of Value (USD) and Volume (Shipments).

List of Companies Covered in this Report:

- August Home Inc. (ASSA ABLOY AB)

- Yale Home (ASSA ABLOY AB)

- Kwikset (ASSA ABLOY AB)

- Schlage (Allegion Company)

- Level Home Inc.

- U-Tec Group Inc.

- Wyze Labs, Inc.

- Lockly Inc.

- Eufy Security (Anker Innovations)

- SimpliSafe, Inc.

- Sentrilock, LLC

- Gate Labs Inc.

- RemoteLock

- SwitchBot Inc.

- Onity Inc. (Carrier Global)

- Digilock Inc.

- Igloohome Pte Ltd

- Nuki Home Solutions Inc.

- PDQ Locks

- Baldwin (Part of ASSA ABLOY)

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increasing integration with smart-home hubs and voice assistants

- 4.2.2 Rising package-theft incidents boosting entryway security demand

- 4.2.3 Insurance premium discounts for smart-security installations

- 4.2.4 Build-to-rent single-family developments adopting smart locks at scale

- 4.2.5 ESG/LEED incentives for connected access solutions

- 4.2.6 UWB passive-entry in smartphones

- 4.3 Market Restraints

- 4.3.1 Persistent cyber-security vulnerabilities and public hacks

- 4.3.2 Multi-family building code restrictions on retrofit devices

- 4.3.3 Chip-set supply constraints for secure SoCs

- 4.3.4 Consumer privacy concerns over data sharing

- 4.4 Value Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Intensity of Competitive Rivalry

- 4.7.5 Threat of Substitute Products

- 4.8 Pricing and Historical Price Trends

- 4.9 An Assessment of Macroeconomic Impact on the Market

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Product Type

- 5.1.1 Deadbolt

- 5.1.2 Padlock

- 5.1.3 Other Product Types (Mortise, etc.)

- 5.2 By End-user

- 5.2.1 Residential

- 5.2.2 Commercial

- 5.3 By Installation Type

- 5.3.1 Retrofit

- 5.3.2 New-Construction Integrated

- 5.4 By Distribution Channel

- 5.4.1 Online (Direct and Marketplaces)

- 5.4.2 Offline (Retail, Installers)

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level Overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 August Home Inc. (ASSA ABLOY AB)

- 6.4.2 Yale Home (ASSA ABLOY AB)

- 6.4.3 Kwikset (ASSA ABLOY AB)

- 6.4.4 Schlage (Allegion Company)

- 6.4.5 Level Home Inc.

- 6.4.6 U-Tec Group Inc.

- 6.4.7 Wyze Labs, Inc.

- 6.4.8 Lockly Inc.

- 6.4.9 Eufy Security (Anker Innovations)

- 6.4.10 SimpliSafe, Inc.

- 6.4.11 Sentrilock, LLC

- 6.4.12 Gate Labs Inc.

- 6.4.13 RemoteLock

- 6.4.14 SwitchBot Inc.

- 6.4.15 Onity Inc. (Carrier Global)

- 6.4.16 Digilock Inc.

- 6.4.17 Igloohome Pte Ltd

- 6.4.18 Nuki Home Solutions Inc.

- 6.4.19 PDQ Locks

- 6.4.20 Baldwin (Part of ASSA ABLOY)

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment