|

市场调查报告书

商品编码

1631616

东南亚空气清净机市场:份额分析、产业趋势/统计、成长预测(2025-2030)Southeast Asia Air Purifier - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

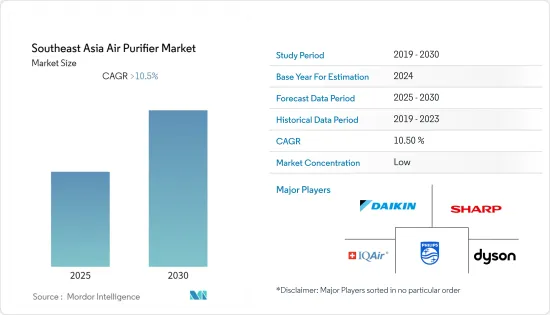

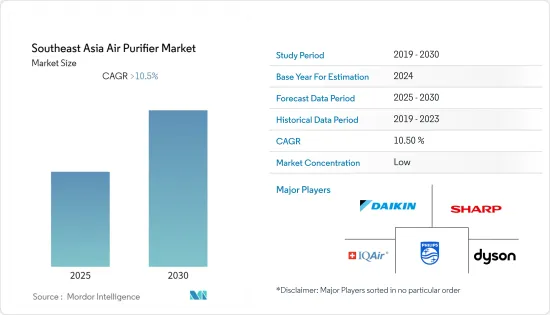

预计东南亚空气清净机市场在预测期内将维持超过10.5%的复合年增长率。

COVID-19 的爆发对市场产生了负面影响。目前,市场已达到疫情前水准。

主要亮点

- 空气传播疾病的增加和消费者健康意识的增强等因素正在推动市场的发展。工业造成的空气污染不断出现,不仅对环境而且对个人健康构成重大威胁。近年来,由于空气品质恶化和对健康问题的日益担忧,对空气清净机的需求不断增加。

- 儘管技术不断发展,但由于安装和维护成本高昂,空气清净机在欠发达经济体和新兴经济体中仍被视为奢侈品,特别是在商业和住宅领域。预计这将阻碍预测期内的市场成长。

- 空气清净机系统发展的技术进步和升级预计将在未来几年为东南亚空气清净机市场带来巨大机会。

- 由于人们越来越多地采用空气净化器,空气清净机的销量增长了数倍,预计印尼将在预测期内主导市场。

东南亚空气清净机市场趋势

高效颗粒空气(HEPA)预计主导市场

- 机械空气过滤器(例如 HEPA 过滤器)透过将颗粒捕获在过滤材料中来去除颗粒。捕捉空气中的大颗粒,例如灰尘、花粉、霉菌孢子、动物皮屑以及含有尘螨和蟑螂过敏原的颗粒。

- HEPA 过滤器是一种膨胀表面过滤器,具有较大的表面积,能够有效去除空气中的颗粒,无论其大小如何。此外,这种类型的空气过滤器比折迭式滤网更有效地去除可吸入颗粒。

- HEPA 空气清净机所需的两个最常见的标准包括去除大于 0.3微米颗粒的能力,即 99.95%(欧洲标准)或 99.97%(ASME 标准)。

- 此外,HEPA过滤器在工业和商业空间的应用导致东南亚国家对相同产品的高需求。具有先进整合技术、设计和新概念的新型 HEPA 过滤器的推出可能会增加对相同产品的需求。空气污染的加剧和气候条件的恶化可能会刺激工作需求,并在未来几年推动 HEPA 滤网市场的发展。

- 在过去的十年中,HEPA 过滤器已被证明可以在各种医疗设施和生命科学应用中减少空气中的颗粒和生物体(例如病毒和细菌)的传播。此外,许多专业工程协会建议在医院、感染控制诊所和其他医疗机构中使用 HEPA 过滤器,以去除微生物和其他危险颗粒。

- 因此,基于上述因素,高效颗粒空气(HEPA)技术预计将在预测期内主导市场。

预计印尼将主导市场

- 截至2021年,印尼在全球污染最严重的国家中排名第17位,人口加权平均PM2.5浓度为34.3微克/立方公尺。根据《世界空气品质报告》,印尼是 2021 年东南亚污染最严重的国家。

- 此外,截至2021年,泗水、万隆和雅加达是该国污染最严重的三个城市,其中雅加达的年平均PM2.5浓度最高(PM2.5浓度39.2μg/m3)。

- 季节性农业刀耕火种、季节性森林火灾、快速城市发展、生活垃圾露天焚烧以及对煤炭能源的依赖是印尼颗粒物污染的主要原因。

- 儘管 COVID-19 大流行改善了全球空气质量,但印尼雅加达等城市的 PM2.5 水平仍然居高不下,而我所在城市附近运作的燃煤发电厂更是加剧了这种情况。此外,印尼计划在雅加达建造更多燃煤发电厂,这可能会导致进一步的空气污染和空气清净机的广泛使用。

- 因此,由于上述因素,印尼预计将在预测期内主导东南亚地区的空气清净机市场。

东南亚空气清净机产业概况

东南亚空气清净机市场区隔。主要参与企业包括(排名不分先后)Daikin Industries, Ltd.、Sharp Corporation、Koninklijke Philips NV、IQAir 和 Dyson Ltd.。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 调查范围

- 市场定义

- 研究场所

第 2 章执行摘要

第三章调查方法

第四章市场概况

- 介绍

- 至2028年市场规模及需求预测(单位:十亿美元)

- 最新趋势和发展

- 政府法规和措施

- 市场动态

- 促进因素

- 抑制因素

- 供应链分析

- 波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间敌对关係的强度

第五章市场区隔

- 过滤技术

- 高效能颗粒空气 (HEPA)

- 其他过滤技术(静电除尘设备(ESP)、离子产生器、臭氧产生器等)

- 类型

- 独立的

- 感应

- 最终用户

- 住宅

- 商业的

- 工业的

- 地区

- 印尼

- 马来西亚

- 泰国

- 越南

- 菲律宾

- 新加坡

- 其他东南亚地区

第六章 竞争状况

- 併购、合资、联盟、协议

- 主要企业策略

- 公司简介

- Daikin Industries, Ltd.

- Sharp Corporation

- LG Electronics Inc.

- Unilever PLC

- Dyson Ltd

- Panasonic Corporation

- Koninklijke Philips NV

- IQAir

- Samsung Electronics Co., Ltd.

- WINIX Inc.

- Xiaomi Corp.

- Amway(Malaysia)Holdings Berhad

第七章 市场机会及未来趋势

简介目录

Product Code: 72357

The Southeast Asia Air Purifier Market is expected to register a CAGR of greater than 10.5% during the forecast period.

The outbreak of COVID-19 had a negative effect on the market. Currently, the market has reached pre-pandemic levels.

Key Highlights

- Factors such as increasing airborne diseases and growing health consciousness among consumers are driving the market. Air pollution from industries is constantly emerging as a big threat to the health of individuals as well as the environment. Due to deteriorating air quality and rising concerns about health issues, the demand for air purifiers has increased in recent years.

- Despite the various technological developments, air purifiers have been perceived as a luxury item in both underdeveloped and emerging economies, particularly in the commercial and residential segments, owing to the high installation and maintenance costs. This, in turn, is expected to hinder the growth of the market studied during the forecast period.

- Technological advancements and upgrades in developing air purifier systems are expected to create immense opportunities for the Southeast Asian air purifier market in the coming years.

- With sales of air purifiers increasing by several folds due to the public's increasing adoption of air purifiers, Indonesia is expected to dominate the market during the forecast period.

Southeast Asia Air Purifier Market Trends

High-Efficiency Particulate Air (HEPA) Expected to Dominate the Market

- Mechanical air filters, such as HEPA filters, remove particles by capturing them on filter materials. It captures large airborne particles, such as dust, pollen, mold spores, animal dander, and particles containing dust mite and cockroach allergens.

- HEPA filters are a type of extended-surface filter with a larger surface area and higher efficiencies for removing larger and smaller airborne particles. Moreover, these types of air filters remove respirable particles more efficiently than pleated filters.

- The two most common standards required for HEPA air purifiers include the capability to remove particles, i.e., 99.95% (European Standard) or 99.97% (ASME Standard), which have a size greater than or equal to 0.3 micrometers.

- Furthermore, HEPA filter applications in industrial and commercial spaces have led to high demand for the product across Southeast Asian countries. The advent of newer HEPA filters with advanced integrated technologies, designs, and new concepts is likely to increase demand for the product. The rising air pollution and worsening climatic conditions fuel the need for the work, which may boost the HEPA filter market in the coming years.

- For the last 10 years, HEPA filters have been proven across a wide range of healthcare facilities and life science applications to control the spread of airborne particles and organisms, such as viruses and bacteria. Moreover, many professional engineering organizations recommend HEPA filters in hospitals, infection control clinics, and other healthcare facilities to eliminate microbes and other dangerous particles.

- Therefore, based on the above-mentioned factors, high-efficiency particulate air (HEPA) technology is expected to dominate the market during the forecast period.

Indonesia Expected to Dominate the Market

- As of 2021, Indonesia stood in the seventeenth position in terms of the most polluted country globally, with an average of 34.3 µg/m3 PM2.5 concentration weighted by population. According to the World Air Quality Report, in 2021, Indonesia was the most polluted country in Southeast Asia.

- Moreover, as of 2021, Surabaya, Bandung, and Jakarta were the three most polluted cities in the country, with the highest annual average of PM2.5 concentrations coming from Jakarta (39.2 µg/m3 PM2.5 concentration).

- Seasonal agricultural burning practices, seasonal forest fires, rapid urban development, open burning of household waste, and reliance on coal-based energy are the primary sources of particulate pollution in Indonesia.

- Although the COVID-19 pandemic led to an improvement in global air quality, cities such as Jakarta, Indonesia, consistently recorded high PM2.5 levels, which were exacerbated by coal-fired plants working in the vicinity of the city. Moreover, Indonesia is set to build more coal-fired power plants in Jakarta, which may lead to more air pollution and increase the adoption of air purifiers.

- Therefore, based on the above-mentioned factors, Indonesia is expected to dominate the air purifier market in the Southeast Asian region during the forecast period.

Southeast Asia Air Purifier Industry Overview

The Southeast Asia air purifier market is fragmented. Some of the major players include (in no particular order) Daikin Industries, Ltd., Sharp Corporation, Koninklijke Philips N.V., IQAir, and Dyson Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD billion, till 2028

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.2 Restraints

- 4.6 Supply Chain Analysis

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitute Products and Services

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Filtration Technology

- 5.1.1 High-efficiency Particulate Air (HEPA)

- 5.1.2 Other Filtration Technologies (Electrostatic Precipitators (ESPs), Ionizers and Ozone Generators, etc.)

- 5.2 Type

- 5.2.1 Stand-alone

- 5.2.2 In-duct

- 5.3 End-User

- 5.3.1 Residential

- 5.3.2 Commercial

- 5.3.3 Industrial

- 5.4 Geography

- 5.4.1 Indonesia

- 5.4.2 Malaysia

- 5.4.3 Thailand

- 5.4.4 Vietnam

- 5.4.5 Philippines

- 5.4.6 Singapore

- 5.4.7 Rest of Southeast Asia

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Daikin Industries, Ltd.

- 6.3.2 Sharp Corporation

- 6.3.3 LG Electronics Inc.

- 6.3.4 Unilever PLC

- 6.3.5 Dyson Ltd

- 6.3.6 Panasonic Corporation

- 6.3.7 Koninklijke Philips N.V.

- 6.3.8 IQAir

- 6.3.9 Samsung Electronics Co., Ltd.

- 6.3.10 WINIX Inc.

- 6.3.11 Xiaomi Corp.

- 6.3.12 Amway (Malaysia) Holdings Berhad

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

02-2729-4219

+886-2-2729-4219