|

市场调查报告书

商品编码

1632067

亚太地区报关业务 -市场占有率分析、产业趋势、统计数据和成长预测(2025-2030 年)Asia-Pacific Customs Brokerage - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

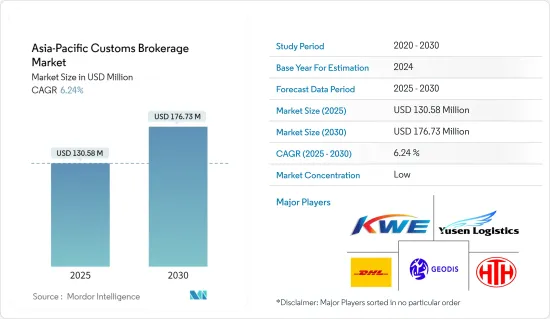

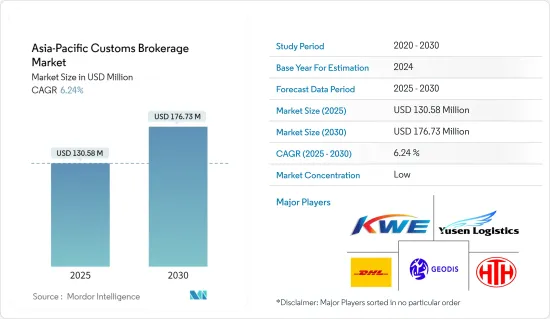

预计2025年亚太报关市场规模为1.3058亿美元,2030年将达1.7673亿美元,预测期内(2025-2030年)复合年增长率为6.24%。

主要亮点

- 截至2024年,亚太地区报关市场正经历强劲成长,这主要得益于国际贸易的激增和法规结构的调整。中国和印度等国家处于跨境贸易繁荣的最前线。

- 例如,2024年9月,中国出口3,040亿美元,进口2,220亿美元,贸易顺差817亿美元。从与前一年同期比较看,2023年9月至2024年9月,中国出口成长45.8亿美元,成长1.53%,从2,990亿美元增加至3,040亿美元。同时,进口增加7.03亿美元(0.32%),从2,210亿美元增加至2,220亿美元。这些数字证实了对熟练报关服务的需求不断增长,以确保无缝贸易业务并遵守复杂的法规。

- 为了因应不断变化的全球动态,各国政府经常修改海关政策以增强安全性和合规性。这种演变增加了对能够应对复杂监管领域的熟练报关行的需求。

- 例如,2024年11月,AEO(授权经济运营商)计划成为人们关注的焦点。这项自愿合规倡议将使印度海关能够加强货物安全。这是透过与国际供应链中的主要参与企业(包括进口商、出口商、物流提供者、码头营运商、报关行和仓库营运商)密切合作来实现的。随着公司努力满足这些严格的监管标准,报关行在确保及时、合规的清关方面的关键作用变得越来越明显。

- 透过利用数位工具和平台,报关行可以优化业务、提高准确性并减少处理时间。 2024年5月9日,全球领先的快递运输公司旗下子公司联邦快递宣布在中国大陆推出「联邦快递线上进口关税申报工具」。这项技术进步不仅提高了业务效率,也凸显了报关行在改善国际贸易公司供应链管理方面所扮演的重要角色。

- 此外,根据中国海关总署(GAC)的报告,2023年12月14日,中国和澳洲将开始透过具有授权经济经营者(AEO)资格的授权经营者进行货物交易通关便利化。此外,越南加入全面且进步的跨太平洋伙伴关係协定(CPTPP)等协议大大增强了越南的出口潜力,从而增加了对报关服务的需求。

亚太海关市场趋势

中国贸易活动快速成长推动市场成长

2024年1月至10月中国进出口总额36.2兆元(约5.5兆美元),年增5.2%。占中国对外贸易总额的64.1%。其中出口20.8兆元(2.89兆美元),成长6.7%;进口15.22兆元(2.9兆美元),成长3.2%。同期,中国加工贸易额达6.53兆元(9,300亿美元),成长4%,占贸易总额的18.1%。加工贸易出口成长1.6%至4.13兆元人民币(5,800亿美元),进口成长8.3%至2.4兆元(3,400亿美元)。

2023年,保税物流贸易达到5.9兆元(7,200亿美元),与前一年同期比较去年同期成长14%。该领域出口1.96兆元(2,800亿美元),成长11.5%,进口3.13兆元(4,400亿美元),成长15.7%。按地区划分,2024年东协将成为中国主要贸易伙伴,贸易总额达5.67兆元(8,100亿美元),成长8.8%,占中国对外贸易总额的15.7%。对东协出口成长12.5%至3.36兆元人民币(4,800亿美元),自东协进口成长3.8%至2.31兆元人民币(3,300亿美元)。中国对东协贸易顺差扩大至1.5兆元人民币(1,500亿美元),与前一年同期比较大幅成长38.2%。

总而言之,出口和进口的成长趋势反映出海关服务在亚太地区国际贸易趋势中的重要性日益增加,特别是随着中国深化与週边国家的经济联繫并加强其在世界市场的地位,凸显了这一点。

海上贸易推动市场成长

海运是国际货运的主要方式。海运不仅在通关方面处于领先地位,而且还带动了通关市场的收益。根据联合国贸易和发展会议(UNCTAD)的报告,到2024年,全球90%的运输能力将由亚洲和欧洲的公司拥有。值得注意的是,亚洲公司拥有全球一半以上的吨位,其中中国(3.1 亿载重吨)和日本(2.42 亿载重吨)持有大量股份。

新兴国家约占全球商品贸易的三分之二。 2024 年第一季的贸易成长得益于中国(成长 9%)、印度(成长 7%)和美国(成长 3%)的出口。 2024年,约40%的货柜贸易将经过连接亚洲、欧洲和美国的东西向主要航线。同时,南亚和地中海等非当地航线约占贸易量的12.9%。

2024年亚洲造船活动陷入混乱:中国成长15.5%,韩国成长8.3%,日本下降16.4%。这种变化凸显了亚洲造船业的竞争动态及其对海运物流的影响。此外,亚洲国家,特别是中国、越南、韩国和日本,继续引领全球贸易流,几乎占货柜运输量的一半。

总之,海上贸易部门对海关市场有重大影响,亚洲在全球航运和贸易动态中扮演着举足轻重的角色。随着造船和贸易航线的发展,海运物流在促进国际贸易的重要性日益凸显。

亚太地区海关产业概况

亚太报关市场分散化,报关行数量众多,竞争激烈。为了使自己脱颖而出并获得竞争优势,许多仲介正在转向先进技术,包括区块链和整合供应链解决方案。市场主要企业包括乔达物流、近铁世界快递、DHL 物流、邮船物流、HTH 物流等。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究成果

- 研究场所

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态与洞察

- 当前市场概况

- 市场驱动因素

- 国际贸易增加

- 供应链效率和成本降低

- 市场限制因素

- 监管变化

- 地缘政治风险

- 市场机会

- 跨境电商

- 数位转型

- 洞察供应链/价值链分析

- 产业吸引力-波特五力分析

- 新进入者的威胁

- 买家/消费者的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争公司之间敌对关係的强度

- 作为货运代理功能的报关业务概述

- 海关定价概述

- 地缘政治与疫情如何影响市场

第五章市场区隔

- 按运输方式

- 海运

- 空运

- 跨国陆运

- 按地区

- 中国

- 日本

- 印度

- 澳洲

- 马来西亚

- 韩国

- 其他亚太地区

第六章 竞争状况

- 市场集中度概览

- 公司简介

- DHL Group Logistics

- Geodis Logistics

- Kintetsu World Express

- HTH Corporation

- Yusen Logistics

- China International Freight Co.

- OEC Group

- Sino Shipping

- Kawasaki Rikuso Transportation Co.,Ltd.

- One Global Logistics*

- 其他公司

第七章 市场机会及未来趋势

第8章附录

- 宏观经济指标(GDP 分布,依活动划分)

- 经济统计-交通运输和仓储业对经济的贡献

- 对外贸易统计-按产品、目的地和供应来源分類的进出口金额

The Asia-Pacific Customs Brokerage Market size is estimated at USD 130.58 million in 2025, and is expected to reach USD 176.73 million by 2030, at a CAGR of 6.24% during the forecast period (2025-2030).

Key Highlights

- As of 2024, the Asia-Pacific customs brokerage market is witnessing robust growth, primarily fueled by a surge in international trade and the adaptation of regulatory frameworks. Countries such as China and India are at the forefront of this cross-border transaction boom.

- For example, in September 2024, China reported exports worth USD 304 billion and imports totaling USD 222 billion, achieving a commendable trade balance of USD 81.7 billion. A year-on-year comparison reveals that from September 2023 to September 2024, China's exports rose by USD 4.58 billion (1.53%), climbing from USD 299 billion to USD 304 billion. Simultaneously, imports saw a USD 703 million (0.32%) uptick, moving from USD 221 billion to USD 222 billion. These figures underscore the growing necessity for adept customs brokerage services to ensure seamless trade operations and adherence to intricate regulations.

- In response to evolving global dynamics, governments are frequently revising customs policies to bolster security and compliance. This evolution has heightened the demand for adept customs brokers, skilled at navigating these complex regulatory terrains.

- For instance, in November 2024, the Authorized Economic Operator (AEO) program was highlighted. This voluntary compliance initiative empowers Indian Customs to bolster cargo security. This is achieved through close collaboration with key players in the international supply chain, including importers, exporters, logistics providers, terminal operators, customs brokers, and warehouse operators. As businesses endeavor to align with these stringent regulatory benchmarks, the pivotal role of customs brokers in ensuring timely and compliant goods clearance becomes increasingly evident.

- Leveraging digital tools and platforms, customs brokers can optimize operations, enhance accuracy, and curtail processing durations. In a significant move, FedEx Express, a major player in global express transportation and a subsidiary of FedEx Corp., unveiled its FedEx Online Import Customs Declaration Tool in Mainland China on May 9, 2024. This technological advancement not only boosts operational efficiency but also underscores the vital role of customs brokers in refining supply chain management for businesses involved in global trade.

- Moreover, as of December 14, 2023, China and Australia commenced customs clearance facilitation for commodities trading through certified operators holding Authorized Economic Operator (AEO) status, as reported by China's General Administration of Customs (GAC). Furthermore, Vietnam's engagement in pacts like the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP) has notably bolstered its export potential, subsequently heightening the demand for customs brokerage services.

Asia-Pacific Customs Brokerage Market Trends

Surge in Chinese Trade Activities Bolsters Market Growth

In the first ten months of 2024, China's imports and exports totaled 36.02 trillion yuan (around USD 5.05 trillion), marking a 5.2% year-on-year rise. This volume constituted 64.1% of China's total foreign trade value. Breaking it down, exports were valued at 20.8 trillion yuan (USD 2.89 trillion), up by 6.7%, while imports reached 15.22 trillion yuan (USD 2.09 trillion), seeing a 3.2% increase as reported by China Breifing. In the same timeframe, China's processing trade hit 6.53 trillion yuan (USD 0.93 trillion), growing at 4% and making up 18.1% of the total trade. Processing trade exports were 4.13 trillion yuan (USD 0.58 trillion), up 1.6%, and imports climbed to 2.4 trillion yuan (USD 0.34 trillion), marking a robust 8.3% rise as reported by General Administration of Customs - China.

Trade via bonded logistics reached 5.09 trillion yuan (USD 0.72 trillion), showcasing a notable 14% growth from the prior year 2023. This segment saw exports at 1.96 trillion yuan (USD 0.28 trillion), up 11.5%, and imports at 3.13 trillion yuan (USD 0.44 trillion), boasting a 15.7% increase as reported by China Customs. Regionally, ASEAN topped the list as China's primary trading partner in 2024, with trade totaling 5.67 trillion yuan (USD 0.81 trillion)-an 8.8% rise, making up 15.7% of China's overall foreign trade. Exports to ASEAN were 3.36 trillion yuan (USD 0.48 trillion), up 12.5%, while imports from the region stood at 2.31 trillion yuan (USD 0.33 trillion), a 3.8% increase. China's trade surplus with ASEAN grew to 1.05 trillion yuan (USD 0.15 trillion), marking a significant 38.2% jump from the previous year 2023 as reported by Trading Economics.

In conclusion, this rising trend in both imports and exports highlights the increasing importance of customs brokerage services in the Asia-Pacific's international trade landscape, especially as China deepens its economic relationships with its neighbors and bolsters its global market standing.

Maritime Trade Driving the Growth of the Market

Maritime freight transport stands as the dominant mode for international goods transit. Sea transport not only leads in customs entries but also drives the revenue of the customs brokerage market. The United Nations Conference on Trade and Development (UNCTAD) reports that 90% of the world's shipping capacity is owned by entities in Asia and Europe in 2024. Notably, Asian companies own over half of the global tonnage, with China (310 million dwt) and Japan (242 million dwt) holding substantial stakes.

Developing countries account for approximately two-thirds of global goods trade. In Q1 2024, trade growth was buoyed by exports from China (up 9%), India (up 7%), and the US (up 3%). In 2024, about 40% of containerized trade traversed the primary East-West routes linking Asia with Europe and the US. Meanwhile, non-mainland routes, like South Asia to the Mediterranean, captured roughly 12.9% of this trade.

Shipbuilding activities in Asia showcased a mixed bag in 2024: China boosted its shipbuilding capacity by 15.5%, South Korea followed with an 8.3% uptick, but Japan faced a notable decline of 16.4%. This variance underscores the competitive dynamics of Asia's shipbuilding sector and its implications for maritime logistics. Furthermore, Asian nations, particularly China, Vietnam, South Korea, and Japan, continue to lead in global trade flows, collectively representing nearly half of all container traffic.

In conclusion, the maritime trade sector significantly influences the customs brokerage market, with Asia playing a pivotal role in global shipping and trade dynamics. The ongoing developments in shipbuilding and trade routes underscore the importance of maritime logistics in facilitating international commerce.

Asia-Pacific Customs Brokerage Industry Overview

The Asia-Pacific customs brokerage market is characterized by fragmentation and intense competition, driven by the presence of numerous customs brokers. To differentiate themselves and secure a competitive advantage, many of these brokers are turning to advanced technologies, including blockchain and integrated supply chain solutions. The major players in the market include Geodis Logistics, Kintetsu World Express, DHL Logistics, Yusen Logistics, HTH Logistics, etc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS AND DYNAMICS

- 4.1 Current Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising International Trade

- 4.2.2 Supply Chain Efficiency and Cost Reduction

- 4.3 Market Restraints

- 4.3.1 Regulatory Changes

- 4.3.2 Geopolitical Risks

- 4.4 Market Oppurtunities

- 4.4.1 Cross-Border E-Commerce

- 4.4.2 Digital Transformation

- 4.5 Insights into Supply Chain/Value Chain Analysis

- 4.6 Industry Attractiveness - Porter's Five Force Analysis

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers/Consumers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

- 4.7 Brief on Customs Brokerage as a Freight Forwarding Function

- 4.8 Overview of Customs Pricing

- 4.9 Impact of Geopolitics and Pandemic on the Market

5 MARKET SEGMENTATION

- 5.1 By Mode Of Transport

- 5.1.1 Sea

- 5.1.2 Air

- 5.1.3 Cross-Border Land Transport

- 5.2 By Geography

- 5.2.1 China

- 5.2.2 Japan

- 5.2.3 India

- 5.2.4 Australia

- 5.2.5 Malaysia

- 5.2.6 South Korea

- 5.2.7 Rest of Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration Overview

- 6.2 Company Profiles

- 6.2.1 DHL Group Logistics

- 6.2.2 Geodis Logistics

- 6.2.3 Kintetsu World Express

- 6.2.4 HTH Corporation

- 6.2.5 Yusen Logistics

- 6.2.6 China International Freight Co.

- 6.2.7 OEC Group

- 6.2.8 Sino Shipping

- 6.2.9 Kawasaki Rikuso Transportation Co.,Ltd.

- 6.2.10 One Global Logistics*

- 6.3 Other Companies

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

8 APPENDIX

- 8.1 Macroeconomic Indicators (GDP Distribution, by Activity)

- 8.2 Economic Statistics - Transport and Storage Sector Contribution to Economy

- 8.3 External Trade Statistics - Exports and Imports by Product and by Country of Destination/Origin