|

市场调查报告书

商品编码

1690838

拉丁美洲报关:市场占有率分析、产业趋势与成长预测(2025-2030 年)Latin America Customs Brokerage - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

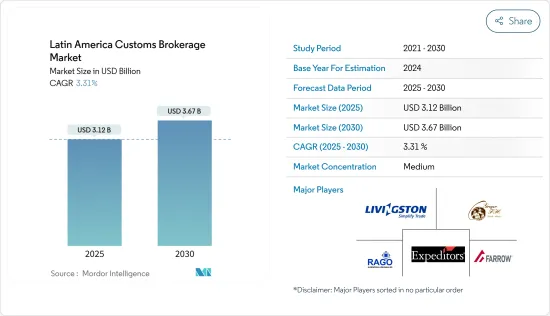

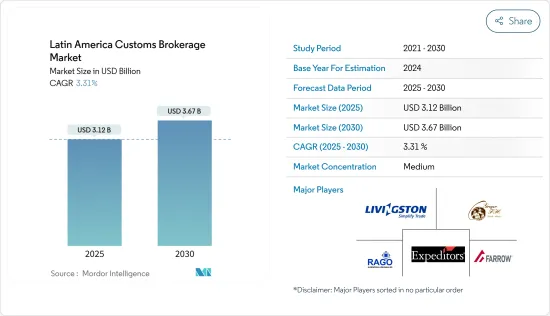

拉丁美洲报关市场规模预计在 2025 年将达到 31.2 亿美元,预计到 2030 年将达到 36.7 亿美元,预测期内(2025-2030 年)的复合年增长率为 3.31%。

各国必须加快药品、诊断试剂、套件和设备的清关和放行,以对抗这场流行病。在秘鲁、巴拿马、哥伦比亚和智利等国家,海关当局正在迅速缩短期限和程序,以避免货物积压导致法律破产。

边境摩擦对于航运公司进入拉丁美洲市场有重大影响。由于官僚主义和过时的海关程序,海关清关常常长时间延误。结果导致贪腐现象猖獗,许多海关官员要求贿赂以加快货物处理速度。

为了简化文件和清关等程序,物流公司经常采用新技术和各种最终用户软体平台。

物流仲介市场最后一公里配送和端到端配送的顺畅快速成长,是提供专业清关服务的公司数量激增的关键原因。拉丁美洲报关市场的成长受到物联网连网型设备的日益普及以及技术主导物流服务日益增长的趋势的推动。此外,电子商务领域的发展和逆向物流业务的增加也支持了市场的成长。然而,阻碍这一市场成长的是製造商对物流服务的控制需求。

拉丁美洲海关市场趋势

海运费费用增加

业内专家表示,海上物流承载全球约84%的贸易量和70%的贸易额,被视为贸易的支柱。因此,港口对于确保货物(包括食品和医疗用品等必需品)能够顺利通过供应链至关重要。

整理货物对于国内报关行和仲介来说需要花费大量的时间。结果是库存积压、海关成本高昂以及材料往往需要很长时间才能到达,导致客户不满。

货运代理和运输业者正在大力投资南美港口和物流业务。我们正在增加对该地区的服务,以适应由于供应链多样化而增加的贸易量和采购变化。 2023年9月,马士基宣布推出Grape Express。该航班预计耗时 11 天,从秘鲁的 Paita 42 飞往费城。

零售业需求不断成长

国际网上销售正在支撑零售业的成长。到2024年,跨境电商将占全球零售额的20.3%。新兴的拉丁美洲使零售商能够进入新的市场并接触新的客户。

随着行动电话的普及,拉美地区越来越多的人开始使用网路。这就是该地区电子商务蓬勃发展的原因。儘管与北美和欧洲相比,拉丁美洲市场规模较小,但预计未来五年该地区的线上销售额将成长 19% 以上。

拉丁美洲的电子商务趋势日益增长。到2022年,近65%的拉丁美洲消费者将从国际零售商购买商品。截至 2023 年,光是阿根廷巨头 Mercado Libre 就占据了拉丁美洲电子商务约 28% 的份额。

拉丁美洲报关概述

市场较为分散,国内参与者多。有些国家对贸易持开放态度,制定了简单、易于理解和执行的关税法。其他国家则利用海关作为壁垒来控制贸易和收入来源。海关不断征收新的费用和罚款。由于化学品、製药、快速消费品和包装等产业的快速成长,拉丁美洲清关产业的供应商需求旺盛。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 调查前提条件

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场动态与洞察

- 市场概况(拉丁美洲通关市场现况)

- 政府法规和措施(与物流基础设施发展相关并对其产生影响)

- 技术趋势(全球趋势和区域层面的见解) COVID-19 对市场的影响(对市场的短期和长期影响)

- 审查通关成本占物流总支出的百分比

- 清关价格概览

- 海关软体概况(全球主要软体供应商及区域市场趋势)

- COVID-19对市场的影响

- 产业吸引力-波特五力模型

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争强度

第五章市场区隔

- 运输方式

- 海上

- 空运

- 跨境陆路运输

- 最终用户

- 车

- 化学品

- FMCG(快速消费品 - 美容及个人护理、软性饮料、居家医疗等)

- 零售(大卖场、超级市场、便利商店、电商等)

- 时尚/生活风格(服装、鞋履)

- 冷藏货物(水果、蔬菜、药品、肉类、鱼类、水产品)

- 科技(家用电子电器、家用电子电器)

- 其他的

- 国家

- 墨西哥

- 巴西

- 智利

- 哥伦比亚

- 巴拿马

- 其他拉丁美洲

第六章竞争格局

- 概述(市场概况、主要企业)

- 公司简介

- Grupo Ei

- Livingston International

- Farrow

- Rota Brasil

- Ibercondor Forwarding SA de CV

- Elemar

- Grupo Coex

- Servicios de Aduanas Jimenez

- Aduana Cordero

- Deutsche Post DHL Group

- DSV Panalpina AS

- Expeditors International*

- 其他公司

第七章:市场的未来

第 8 章 附录

- 区域内主要边境口岸(国家级)

The Latin America Customs Brokerage Market size is estimated at USD 3.12 billion in 2025, and is expected to reach USD 3.67 billion by 2030, at a CAGR of 3.31% during the forecast period (2025-2030).

Countries had to speed up the clearance and release of medicines, diagnostics, kits, and equipment to combat this pandemic. To avoid the accumulation of goods in legal bankruptcy, customs administrations have quickly shortened their deadlines and procedures in countries such as Peru, Panama, Colombia, and Chile.

The friction at the border can be significant for shipping companies entering Latin America's market. There are often long delays in customs clearance due to bureaucracy and outdated clearance procedures. It has resulted in widespread corruption, and many customs officials are known to ask for bribes to process goods more quickly.

To perform efficient customs processes such as documentation and clearance, logistics companies are regularly adopting new technologies and software platforms for different end users.

Some of the main reasons for an extraordinary increase in companies offering specialized customs services as part of their portfolios are rapidly rising last-mile deliveries and smooth, fast, and end-to-end delivery on the logistics broker market. The growth of the Latin American customs brokerage market is propelled by the augmented adoption of Internet of Things-enabled connected devices and an increasing trend toward technology-driven logistics services. Moreover, the market's growth is supported by the development of the e-commerce sector and by an increase in reverse logistics operations. However, the growth of this market is hampered by a need for manufacturers' control over logistics services.

Latin America Customs Brokerage Market Trends

Increase In Ocean Freight

According to industry experts, maritime logistics is considered the backbone of trade, as it transports around 84% of the volumes traded worldwide and almost 70% of the global trade value. Thus, the port is important in ensuring that goods are distributed through supply chains, including those deemede essentia,l, like food or medical supplies.

The sorting of goods takes significant time for customs agents and brokers in the country. As a result, there is a build-up of stocks, and customs costs can be too high, leading to frustration for customers when materials often take too long to arrive.

Forwarders and carriers are investing heavily in South American ports and logistics businesses. They are adding services to the region to capitalize on growing trade volumes and sourcing shifts from diversifying supply chains. In September 2023, Maersk announced the introduction of Grape Express, which is expected to start in 42 Paita, Peru, and go to Philadelphia with a transit time of 11 days.

Growing Demand In Retail Sector

International online sales support the growth of the retail sector. By 2024, global cross-border e-commerce will account for 20.3% of retail sales. In developing regions of Latin America, retailers can penetrate new markets and attract new clients.

Due to cell phones, an increasing number of people in Latin America are accessing the Internet. It is also the reason why eCommerce has grown in this area. Although the Latin American market is small compared with North America and Europe, online sales in this region are estimated to increase by more than 19% over the coming five years.

Latin America's inclination towards e-commerce is increasing. Nearly 65% of all Latin American consumers bought from an overseas retailer in 2022. As of 2023, Mercado Libre, the Argentine giant alone, accounted for roughly 28% of ecommerce in Latin America.

Latin America Customs Brokerage Industry Overview

The market is fragmented, with the presence of many domestic companies. Some countries are open to trade with simple customs laws that are easy to understand and execute. Others use customs as a barrier to controlling trade and sources of revenue. They continually enforce new fees or penalties. The suppliers in the customs brokerage industry in Latin America are observing a high demand due to the exponential growth of industries such as chemicals, pharmaceuticals, FMCG, and packaging.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS AND DYNAMICS

- 4.1 Market Overview (Current Scenario of Customs Brokerage Market in Latin America)

- 4.2 Government Regulations and Initiatives (Related to Logistics and Logistics Infrastructure Development and Its Impact)

- 4.3 Technological Trends (Global and Regional-level Insights)Impact of COVID-19 on the Market (Short-term and Long-term Effects on the Market)

- 4.4 Review of Customs Brokerage Costs as Percentage of Total Logistics Spend

- 4.5 Overview of Customs Pricing

- 4.6 Brief on Customs Brokerage-related Software (Key Software Providers and Trends in the Global and Regional Market)

- 4.7 Impact of COVID-19 on the Market

- 4.8 Industry Attractiveness - Porter Five Forces

- 4.8.1 Bargaining Power of Suppliers

- 4.8.2 Bargaining Power of Consumers

- 4.8.3 Threat of New Entrants

- 4.8.4 Threat of Substitutes

- 4.8.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION (Market Size by Value)

- 5.1 Mode of Transport

- 5.1.1 Ocean

- 5.1.2 Air

- 5.1.3 Cross-border Land Transport

- 5.2 End User

- 5.2.1 Automotive

- 5.2.2 Chemicals

- 5.2.3 FMCG (Fast-moving Consumer Goods - Includes Beauty and Personal Care, Soft Drinks, Home Care, etc.)

- 5.2.4 Retail (Hypermarkets, Supermarkets, Convenience Stores, and E-commerce Channels)

- 5.2.5 Fashion and Lifestyle (Apparel and Footwear)

- 5.2.6 Reefer (Fruits, Vegetables, Pharmaceuticals, Meat, Fish, and Seafood)

- 5.2.7 Technology (Consumer Electronics, Home Appliances)

- 5.2.8 Other End Users

- 5.3 Country

- 5.3.1 Mexico

- 5.3.2 Brazil

- 5.3.3 Chile

- 5.3.4 Colombia

- 5.3.5 Panama

- 5.3.6 Rest of Latin America

6 COMPETITIVE LANDSCAPE

- 6.1 Overview (Market Concentration Overview, Major Players)

- 6.2 Company Profiles

- 6.2.1 Grupo Ei

- 6.2.2 Livingston International

- 6.2.3 Farrow

- 6.2.4 Rota Brasil

- 6.2.5 Ibercondor Forwarding SA de CV

- 6.2.6 Elemar

- 6.2.7 Grupo Coex

- 6.2.8 Servicios de Aduanas Jimenez

- 6.2.9 Aduana Cordero

- 6.2.10 Deutsche Post DHL Group

- 6.2.11 DSV Panalpina AS

- 6.2.12 Expeditors International*

- 6.3 Other Companies

7 FUTURE OF THE MARKET

8 APPENDIX

- 8.1 Key Border Ports in the Region (Country-level)