|

市场调查报告书

商品编码

1632097

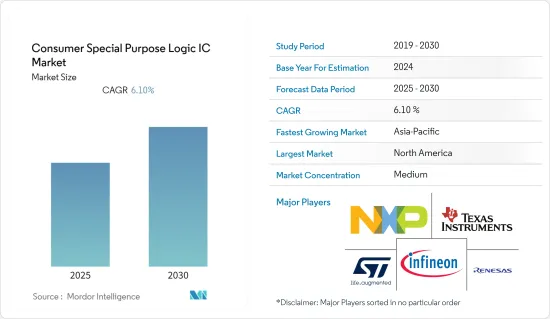

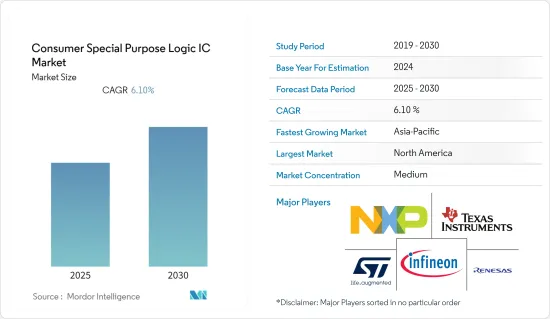

消费性专用逻辑IC:市场占有率分析、产业趋势与统计、成长预测(2025-2030)Consumer Special Purpose Logic IC - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

消费性专用逻辑 IC 市场预计在预测期内复合年增长率为 6.1%

主要亮点

- 对低成本智慧型手机的需求和互联网的普及推动了全球专用逻辑IC市场由于逻辑IC在电子以外的行业中的使用不断增加,全球专用逻辑IC市场正在增长。奥迪和丰田等主要汽车公司对整合到车辆中的电子设备的需求越来越大,推动了全球特殊用途逻辑 IC 市场的发展。

- 据日本经济产业省预计,2021 年日本逻辑积体电路(IC)金额预计约 1,305 亿日圆。金属氧化物半导体积体电路(逻辑IC)是金属氧化物半导体积体电路(MOS IC)的一种。除了逻辑 IC 之外,该类别还包括微控制器、记忆体 IC 和各种 MOS IC。如此巨大的产值预计将为专用逻辑IC的成长创造机会。

- 根据 GSMA 的数据,到 2025 年,海湾合作委员会国家的 5G 采用率(客户 5G 采用率:16%)将略高于全球平均(15%)。此外,中东和北非地区5G用户数预计将达到1.2962亿。随着5G的普及,消费性专用IC的需求预计将呈现显着成长。

- COVID-19 大流行和在家工作的情况也刺激了全球家用电子电器市场某些领域的需求。全球各市场对个人电脑和笔记型电脑的需求大幅成长。此外,游戏机和消费者健身设备在疫情期间的销售也创下了纪录。例如,由于全球消费者教育电脑的需求增加,笔记型电脑平均售价在 2020 年下降。所有主要使用类别的 PC 使用时间均大幅增加,每个家庭的 PC 数量也有所增加。

- 另一方面,在半导体工厂中,为了优化成品的产量比率,使用专用的FOUP(Front Opening Unified Pod)来维持设施内的气氛并运输晶圆,需要大量的液态氮。另外,IC基板较薄,尤其是0.2mm以下的基板,如果突出则容易变形。为了克服这项挑战,必须在基板收缩、层压参数、层定位系统等方面取得突破,以控制基板翘曲和层压厚度。

消费性专用逻辑IC市场趋势

技术的快速进步预计将推动市场成长

- AR 和 VR 的快速采用正在改变游戏产业,并为 XR 市场创造更多机会。公司正在快速开发产品和解决方案以获得市场吸引力。例如,Oculus Quest VR头戴装置最近改进了VR系统,增加了手部侦测功能,让VR用户使用手指与VR世界进行互动。

- 基于手势的计算正在被游戏、电视、电子产品、资讯亭、医疗保健、3D 列印、工程、医疗专业人员、设计师、广告商甚至身体有限制的人采用。基于手势的游戏越来越受欢迎,超越了标准游戏机,并且越来越多地用于针对年轻人的教育游戏。例如,Magic Touch Math 是第一个专注于使用独特的手势图片进行数学教学的游戏。因此,基于手势的识别现在正在传统游戏以外的领域中采用。

- 根据 Snapchat 的报告,到 2025 年,全球约 75% 的人口和几乎所有智慧型手机用户将频繁使用 AR 技术,其中超过 15 亿的用户预计是千禧世代。根据GSMA《行动经济中国2021》预测,2025年,中国智慧型手机连线数将达到约3.4亿,其中中国当地渗透率达15亿,香港为1,230万,澳门为190万,增至2,570万台及9。

- 此外,根据索尼的数据,2021 年 6 月 PlayStation 4 的全球销量达到 1.1568 亿台。 PlayStation 2也在全球售出1.5768亿台,其中在北美和欧洲售出超过5000万台,使其成为全球最受欢迎的游戏机。

- OLED 技术显着提高了影像质量,并为创新的新型消费显示器提供了潜力。 有机发光二极体通常被誉为数位显示器和萤幕的未来。例如,2022 年 4 月,LG Business Solutions 在其位于达拉斯的 AVI-SPL 办公室推出并安装了视讯“Wave Wall”,多个曲面有机发光二极体显示器形成高解析度表面。电视墙配备了 65 吋 LG 互动式数位电子看板板,可提供寻路资讯。科技的不断进步加上家用电子电器产品的激增可能会推动所研究市场的成长。

- 根据经济合作暨发展组织(OECD) 的一项研究,到 2025 年,持有电脑的家庭数量预计将增加到 12.6247 亿。拥有至少一台电脑的家庭称为电脑户。电脑普及率的显着提高为市场参与企业提供了扩展其标准逻辑 IC产品系列、扩大其在各个地区的业务并增加市场占有率的机会。

预计亚太地区市场将出现高速成长

- 根据中国国家统计局的数据,2022年4月中国成品电脑产量约3,266万台。此外,根据电子和资讯技术部的数据,2020 财年印度电脑硬体产值约为 2,150 亿印度卢比。预计 21 财年将增至 2,200 亿印度卢比。如此巨额的电脑生产支出预计将为本地电脑製造商和消费专用逻辑IC製造商创造机会扩大产品系列。

- 自2013年以来,印度等新兴国家的资料通讯成本一直在下降。因此,智慧型手机用户的数量正在增加。据 ASSOCHAM 称,该国智慧型手机用户数量预计将从 2017 年的约 4.68 亿增加一倍,达到 2022 年的 8.59 亿,复合年增长率为 12.9%。

- 此外,截至 2021 年 5 月,Google 宣布与合作伙伴 Reliance Jio 密切合作,致力于打造价格实惠的智慧型手机,而该计划的工作正在进行中。该公司先前曾在2020年以3,373.7亿卢比收购了Jio Platforms 7.7%的股份,并与Jio Platforms签署了商业协议,共同开发入门级平价智慧型手机。此类产品开发为研究市场的成长创造了机会,并使公司能够扩大其市场占有率。

- 日本旨在透过财政奖励吸引外国公司,以确保晶片供应并解决全球供不应求。日本从海外进口许多半导体,并希望为该技术建立国内供应链。例如,2021年6月,日本与台积电签署了370亿日圆的半导体研究计划,在国内开发晶片技术。包括日立高新技术在内的约20家日本公司将与台积电合作进行该计划,日本政府将承担一半以上的成本。

- 此外,印度政府针对半导体和显示器製造的7,600亿印度卢比一揽子计画预计将进一步推动亚洲市场的成长。印度电子与资讯技术部(MeitY)已于2022年1月开始接受企业在印度设立製造工厂的申请。亚太地区活性化的半导体製造生态系统预计将为研究市场提供利润丰厚的机会。

消费性专用逻辑IC产业概况

消费性专用逻辑 IC 市场是一个适度细分的市场,主要企业包括高通、NXP Semiconductors NV、德州仪器公司和 Infenion Technologies。产品创新、联盟和收购是市场参与企业经常采用的一些技术。此外,随着 IC 製造流程的进步并变得更加通用,新的市场参与企业正在扩大其在新兴国家的市场份额和足迹。

- 2022 年 2 月 - 随着新的地缘政治和技术动态改变全球半导体业务,德国和日本半导体材料製造商继续加强在台湾的业务。工业(ITRI)顾问总监马苏表示,随着台积电(TSMC)不断引进新技术,日本和德国的工厂正在寻求与台积电合作,以增加产业竞争。

- 2021 年 12 月——三星电子宣布整合行动和消费电子部门,并任命新的联席首席执行官,这是自 2017 年以来的首次重大重组,专注于薄型化组织并扩大逻辑晶片业务。 7月至9月期间行动产业的营业利润为3.36兆日圆(28.4亿美元),而家用电子电器产业为7,600亿日圆。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究成果

- 研究场所

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买方议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间的敌对关係

- 技术简介

- 价值链分析

- COVID-19 市场影响评估

第五章市场动态

- 市场驱动因素

- 蓝牙、Wi-Fi 和 NFC 等通讯技术的进步

- 智慧型手机和笔记型电脑的普及

- 半导体的小型化

- 市场限制因素

- 随着应用程式的增加,设计的复杂性也随之增加

- 产品的不断发展影响着需求

- 市场机会

- 物联网和人工智慧的进步

第六章 市场细分

- 区域细分

- 中国

- 日本

- 台湾

- 印度

- 其他的

第七章 竞争格局

- 公司简介

- Qualcomm Inc.

- NXP Semiconductors NV

- Texas Instruments Inc.

- Microchip Technology Inc.

- Infenion Technologies Ag

- Broadcom Inc.

- STMicroelectronics NV

- Toshiba Corporation

- Renesas Electronics

- Marvell Semiconductor, Inc.

- Intel Corporation

第八章投资分析

第9章 未来展望

The Consumer Special Purpose Logic IC Market is expected to register a CAGR of 6.1% during the forecast period.

Key Highlights

- Furthermore, demand for low-cost smartphones, combined with increasing Internet penetration, propels the worldwide special purpose logic IC market forward. The global special purpose logic IC market is growing due to the increasing use of logic ICs in industries other than electronics. Leading automotive businesses like Audi and Toyota are progressively requesting and offering electronic devices incorporated into their vehicles, driving the worldwide special purpose logic IC market forward.

- According to Ministry of Economy, Trade and Industry Japan, In 2021, the value of logic integrated circuits (ICs) produced in Japan was estimated to be around JPY 130.5 billion. Metal oxide semiconductor integrated circuits (Logic ICs) are a form of metal oxide semiconductor integrated circuit (MOS IC). This category also includes microcomputers, memory ICs, and miscellaneous MOS ICs, in addition to logic ICs. Such huge production value will create aopportunity for the Special purpose logic IC to grow.

- According to GSMA, the usage of 5G in GCC states will be slightly higher (16% customer 5G adoption) than the global average (15%) by 2025, mainly driven by governments and mobile operators with the support of mobile technology partners. Moreover, number of 5G subscriptions is expected to reach 129.62 million in Middle East and North African regions. With the increase in the adoption of 5g the demand for consumer special purpose IC will observe significant growth.

- The COVID-19 pandemic and work from home scenarios have also boosted the demand for certain segments in the consumer electronic market across the globe. In various global markets, demand for PCs and laptops witnessed a significant surge. Furthermore, gaming consoles & devices and fitness consumer devices witnessed record-break sales during the pandemic. For instance, in 2020, lower notebook ASPs were recorded, resulting from higher demand for consumer education PCs globally. Time spent on PCs has increased dramatically across all major usage categories, as well as the number of PCs per household.

- On the flip side, semiconductor fabs require vast amounts of liquid nitrogen to maintain the atmosphere within the facility and within specialisedsealed boxes known as front opening unified pods, or FOUPs, that are used to transport the wafers in order to assure optimal yield in the completed product. Further, IC substrate is thin and can easily be deformed, especially in protruding cases, when a board is less than 0.2mm thick. In order to overcome the difficulties, breakthroughs have to be made, in terms of board shrinking, lamination parameters, and layer positioning systems, in order to control substrate warpage and lamination thickness.

Consumer Special Purpose Logic IC Market Trends

Rapid Advancements in Technology is Expected to Drive the Market's Growth

- The rapid adoption of AR and VR is transforming the gaming industry, creating more opportunities for the XR market. Several companies are making rapid developments in their products and solutions to gain robust market traction. For instance, recently, the Oculus Quest VR headset improvised its VR system by adding a hand tracking feature, which may enable the VR users to use fingers to manipulate the VR worlds.

- Gaming, TVs, electronics, kiosks, medical, 3D sculpting, engineering, medical experts, designers, advertisers, and even those with physical limitations are all adopting gesture-based computing. Gesture-based gaming has grown in popularity beyond standard gaming consoles, and it is increasingly being used in instructional games for youngsters. Magic Touch Math, for example, is the first game to focus on teaching arithmetic with unique gesture drawings. As a result, gesture-based recognition can be employed in areas other than traditional gaming.

- According to a report from Snapchat, by 2025, around 75% of all the global population and almost all of the smartphone users will be frequent AR technology users, out of which more than 1.5 billion users are anticipated to be millennials. According to GSMA's Mobile Economy China 2021, China will be adding around 340 million smartphone connections by 2025, with adoption rising to 9 in 10 connections with 1.5 billion in Mainland China, 12.3 million in Hong Kong, 1.9 million in Macao, and 25.7 million in Taiwan.

- Further, according to Sony, PlayStation 4 consoles worldwide sales reached 115.68 million in June 2021. Moreover, PlayStation 2 had record sales of 157.68 million units worldwide, including over 50 million units in North America and Europe, making it the most popular video game console globally.

- OLED technology holds the promise of significantly enhanced picture quality, with the potential for innovative new consumer display presentations. It is often hailed as the future of digital displays and screens. For instance, in April 2022, LG Business Solutions has launched and installed a video "Wave Wall" with multiple curved OLED displays to form a high-definition surface at the AVI-SPL office in Dallas. The video wall features a 65-inch LG interactive digital signage board that provides wayfinding information. The continuous advancements in technology coupled with the increasing penetration of consumer electronics is likely to drive the growth of the studied market.

- According to a survey conducted by Organisation for Economic Co-operation and Development, by 2025, the number of households having a computer is expected to increase to 1,262.47 million. Homes with at least one computer are referred to as computer households. Such huge increase in the computer adoption will create aopportunity for the market players to expand their standard logic IC product portfolio and expand their presence in different regions and increase their market share.

The Asia Pacific Region is Expected to Witness a High Market Growth

- According to National Bureau of Statistics of China, China produced approximately 32.66 million completed computers in April 2022. Furthermore, according to Ministry of Electronics and Information Technology The value of computer hardware output in India was roughly INR 215 billion in fiscal year 2020. In fiscal year 2021, this is expected to rise to INR 220 billion . The value of computer hardware produced in the country has been steadily increasing.Such huge spending on the computer production will create an opportunity for the local computer and consumer special purpose logic IC manufacturers to expand their product portfolio.

- Emerging nations, such as India, have witnessed a decline in data costs since 2013. This has increased the number of smartphone users. According to ASSOCHAM, the number of smartphone users in the country is anticipated to double from around 468 million in 2017 to 859 million by 2022, registering a CAGR of 12.9%.

- Also, as of May 2021, Google announced that it is engaging closely with its partner Reliance Jio on the initiative of creating an affordable smartphone and the work is underway on the project. The company previously picked up a 7.7% stake in Jio Platforms for INR 33,737 crore in 2020 and had also entered into a commercial agreement with the Jio Platforms to jointly develop an entry-level, affordable smartphone. Product developments like these will create aopportunity for the studied market to grow and the enable the companies to expand their market share.

- Japan aims to attract overseas companies through financial incentives to secure its chip supplies and address the global shortage. Japan imports significant semiconductors from overseas and wants to build a supply chain of this technology at home. For instance, in June 2021, Japan signed off on a JPY 37-billion semiconductor research project to develop chip technology in the country with TSMC. About 20 Japanese companies, including Hitachi High-Tech Corp., will work with TSMC on the project, with the Japanese government paying just over half of the cost.

- Also, the move of the Indian government by announcing an INR 76,000 crore policy-push for semiconductor and display manufacturing is anticipated to further bolster the growth of the Asian market. The Ministry of Electronics and Information Technology (MeitY) in India started receiving applications from companies to set up manufacturing fabs in India from January 2022. The boost in semiconductor manufacturing ecosystem in the Asia Pacific region is expected to offer lucrative opportunities for the studied market.

Consumer Special Purpose Logic IC Industry Overview

The Consumer Special Purpose Logic IC Market is a moderately fragmented market with the presence of significant players like Qualcomm Inc., NXP Semiconductors NV, Texas Instruments Inc., Infenion Technologies, etc. Product innovation, collaborations, and acquisitions are some of the techniques frequently employed by market players. Further, as the IC manufacturing process advances, catering to numerous applications, new industry participants are extending their market presence and expanding their corporate footprint in emerging nations.

- February 2022 - As new geopolitical and technological dynamics alter the global semiconductor business, German and Japanese semiconductor material suppliers are continuing to strengthen their presence in Taiwan. According to the Consulting Director of the Industrial Technology Research Institute (ITRI), as Taiwan Semiconductor Manufacturing Company (TSMC) continues to implement new techniques, Japanese and German factories are seeking to collaborate with TSMC in order to improve their own competitive position in the industry.

- December 2021- Samsung Electronics Co Ltd announced the merger of its mobile and consumer electronics divisions and the appointment of new co-CEOs in its significant reorganization since 2017 to streamline its structure and focus on increasing its logic chip business. In the July-September quarter, the mobile industry had an operating profit of JPY 3.36 trillion (USD 2.84 billion), compared to JPY 760 billion in consumer electronics.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power Of Suppliers

- 4.2.2 Bargaining Power Of Buyers

- 4.2.3 Threat Of New Entrants

- 4.2.4 Threat Of Substitutes

- 4.2.5 Intensity Of Competitive Rivalry

- 4.3 Technology Snapshot

- 4.4 Value Chain Analysis

- 4.5 Assessment of the Impact of Covid-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Advancements in communication technologies like Bluetooth, Wi-Fi, and NFC

- 5.1.2 Increasing penetration of smartphones and laptops

- 5.1.3 Miniaturization of Semiconductors

- 5.2 Market Restraints

- 5.2.1 Increasing Design Complexity with Increasing Applications

- 5.2.2 Constant Evolution of Products Influencing Demand

- 5.3 Market Opportunities

- 5.3.1 Advancements in Internet of Things and Artificial Intelligence

6 MARKET SEGMENTATION

- 6.1 Segmentation - By Geography

- 6.1.1 China

- 6.1.2 Japan

- 6.1.3 Taiwan

- 6.1.4 India

- 6.1.5 Rest of the world

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Qualcomm Inc.

- 7.1.2 NXP Semiconductors NV

- 7.1.3 Texas Instruments Inc.

- 7.1.4 Microchip Technology Inc.

- 7.1.5 Infenion Technologies Ag

- 7.1.6 Broadcom Inc.

- 7.1.7 STMicroelectronics NV

- 7.1.8 Toshiba Corporation

- 7.1.9 Renesas Electronics

- 7.1.10 Marvell Semiconductor, Inc.

- 7.1.11 Intel Corporation