|

市场调查报告书

商品编码

1635382

英国暖气设备:市场占有率分析、产业趋势、成长预测(2025-2030)United Kingdom Heating Equipment - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

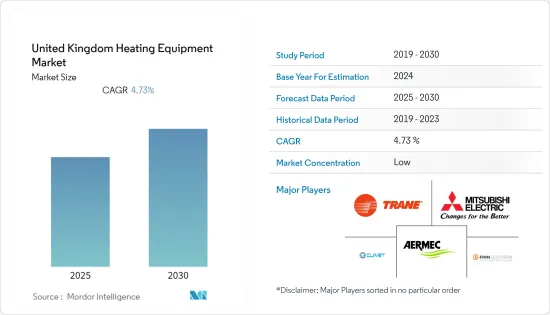

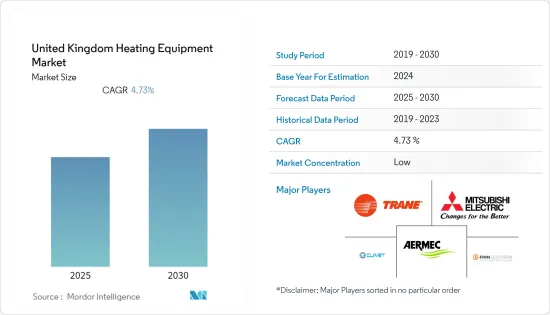

英国暖气设备市场预计在预测期内复合年增长率为 4.73%

主要亮点

- 支持性政府法规,包括增加性能更好的现有设备的更换以及透过税额扣抵计划提高能源效率的激励措施,正在预测期内推动英国供暖设备市场的发展。例如,英国政府已经制定了2028年每年安装60万台热泵的目标,以减少英国对石化燃料的依赖,以协助应对全球暖化。

- 该国蓬勃发展的建筑业务和不断扩大的终端用户市场是预测期内推动热泵和锅炉设备市场成长的关键因素。设备的采用包括能源效率、改进的结果和寿命。

- 供应商必须遵守政府制定的各种有关环境保护的法规,因为加热设备中使用的冷媒和其他物质会增加全球排放。选择 R-32 是因为其对环境影响小、能源效率高、可用性广泛且易于使用。

- 暖气设备市场正与国家的永续性变革和绿色措施保持同步。研究市场的供应商正忙于推出促进各个最终用户产业绿色转型的产品。例如,2021年8月,金属产业绿色转型永续解决方案供应商Tenova宣布采用200kW Tenova自恢復式无焰智慧燃烧器。这款智慧燃烧器适用于完全使用氢气的热处理炉,同时将氮氧化物排放保持在严格的监管限制以下。

- 据英国再生能源中心称,与燃气锅炉相比,热泵可以为消费者节省 52% 的能源费用。然而,由于初始成本高昂,英国政府于2021年宣布,将为英格兰和威尔斯的住宅提供5000英镑安装热泵为房屋供暖。因此,该国使用热泵更换锅炉的需求预计将大幅增加。

英国暖气设备市场趋势

支持性政府法规推动市场成长

- 研究领域的多项法规改变了製造商为商业和住宅领域的低层建筑设计商用热泵和热空气的方式,以提高 RTU 效率并减少能源使用和浪费。

- 此外,一些製造商正在开发逐步淘汰 HCFC-22(氟烃塑胶)的设备,以满足客户需求并符合替换旧型号的绿色技术要求,从而促进家用暖气设备的使用。

- 来自包括英国在内的欧洲国家的报告数据表明,热泵的普及迅速,预计 2022 年将持续成长。该市场的特点是各种新的发展,并受到政府措施的推动。欧盟宣布在2050年大幅减少二氧化碳排放,间接支持了可再生能源和节能产品。热泵处于战略地位,可以从环境永续发展的推动中受益。

- 此外,2021年4月,英国制定了新的气候变迁目标,到2035年将碳排放减少78%。英国政府也将纳入英国的第六个碳预算,以消除对气候变迁的影响,并设定《巴黎协定》温度目标,将全球暖化限制在 2 度C以内,并努力实现 1.5 度C以内的目标,并确保英国继续保持这一目标。

- 2021 年 12 月,英国政府宣布投资 1,900 万欧元,为全国数千户住宅和建筑物提供低碳暖气。这项投资将扩大热力网络,为住宅提供绿色能源。此外,2022 年 6 月,英国政府启动了一项为期三年、价值 4.5 亿英镑的奖励计划,为用热泵替换石化燃料锅炉的安装成本提供高达 6,000 英镑的优惠。

热泵预计将大幅成长

- 欧盟 (EU) 宣布了空气对空气热泵的新法规。根据欧盟委员会法规(EU)2016/2281,马达驱动的空气对空气热泵的最低标准设定为137%。然而,由于2021年法规修订,马达驱动的空气对空气热泵的最低Hoki s,c标准将为189%。

- 同样,内燃机驱动的空气热泵的最低标准定为130%,但由于法规修订,内燃机驱动的空气热泵的最低标准现在为167%。因此,此类法规鼓励在所研究的市场中更换和新安装热泵。

- Rishi Sunak 在英国宣布的绿色家园计划将允许住宅申请高达 10,000 欧元的补助金,用于空气源热泵等改进,这是一种替代燃气供暖的环保替代品。然而,供热量低于锅炉、0℃以下效率较低等因素可能会阻碍空气源热泵的市场成长。

- 此外,热泵被认为是用于建筑物供暖和製冷的最高效、最环保的系统,这正在影响政府和市场相关人员投资这项技术。例如,在疫情期间,由 Amber Fund Management Limited 运营的伦敦市长能源效率基金 (MEEF) 支持高度创新的计划,为该地区 2000 多个住宅提供低碳供暖,并提供了 700 万欧元。克区。 MEEF贷款将用于安装水源热泵(WSHP),这是一种可再生节能技术,以取代该地区三个住宅现有的燃气锅炉。此外,根据英国石油公司的数据,2021年英国可再生能源消费量为1.24艾焦耳,比2020年下降了8%以上。

- 此外,2022 年 7 月,英国商业、能源和工业战略部授予了一项 5,400 万欧元的协议,为热网路资金筹措,该计划在伦敦和工作场所使用热泵和废弃物能等低碳热源。发展。热网可以释放无法利用的大规模可再生和回收热源,例如大河或工业热源。这可以提供一种经济有效的方式来降低供暖成本、支持局部再生并减少加热的碳排放。

- 此外,根据热泵协会的一项研究,到 2021 年,该国对热泵的需求预计将翻一番,这与该国的净零排放目标非常吻合。除此之外,CBI召集的一个高级委员会表示,英国将需要从2025年起禁止安装新的燃气锅炉,以实现净零气候目标,而类似的倡议将使热泵的需求预计将增加在预测期内。

英国暖气设备产业概况

英国暖气设备产业竞争激烈,国内外参与企业在英国市场经营。国际参与企业透过与当地参与企业合作在该国开展业务。随着市场预计将扩大并提供更多机会,预计将有更多参与企业很快进入市场。研究市场的主要企业包括 Mitsubishi Electric Europe BV、Systemair AB 等。这些主要企业正在采取各种成长策略,例如併购、新产品发布、业务扩张、合资和伙伴关係,以巩固其在该市场的地位。

- 2022 年 3 月 - 丹佛斯推出新型电动膨胀阀,可提高热泵效率、闭环控制和製程冷却器。 ETS 8M 使OEM和最终用户能够以更低的应用成本获得更高的效率和可靠性。全新 ETS 8M 系列代表了丹佛斯 EEV 产品组合低容量的新选择。具有从 12 到 40 HP(62 到 114 kW)的四种尺寸和高双向流 MOPD,只需在两个流向上使用一个阀门即可显着降低应用成本。

- 2022 年 3 月 - 作为英国天然气推出计画的一部分,英国天然气已完成首个空气源热泵安装。英国天然气母公司 Centrica 已在其 PH Jones 品牌的社会住宅中安装空气源热泵,目标是每年安装 1,000 台,到 2025 年安装至 20,000 台。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买方议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间的敌对关係

- 产业价值链分析

- COVID-19 市场影响评估

第五章市场动态

- 市场驱动因素

- 政府支持法规,包括透过税额扣抵计画实施节能激励措施

- 更换现有设备并提高性能

- 市场问题

- 竞争加剧限制净利率

- 节能係统的初始成本较高

第六章 市场细分

- 按类型

- 锅炉/散热器/其他加热器

- 炉

- 热泵

- 按最终用户产业

- 住宅

- 商业的

- 工业的

第七章 竞争格局

- 公司简介

- Trane Inc.

- Aermec SpA

- Mitsubishi Electric Europe BV(Mitsubishi Electric Corporation)

- Clivet SpA

- Finn Geotherm UK Limited

- Daikin Industries Ltd.

- Systemair AB

- Swegon Group AB

- Rhoss SpA

- Robert Bosch Gmbh

- Danfoss A/s

第八章投资分析

第9章 市场的未来

The United Kingdom Heating Equipment Market is expected to register a CAGR of 4.73% during the forecast period.

Key Highlights

- The increase in replacement of existing equipment with better-performing ones and supportive Government regulations, including incentives for saving energy through tax credit programs, is driving the United Kingdom heating equipment market over the forecast period. For instance, the government of the UK has already set a target of installing heat pumps of 600,000 per year by 2028 to reduce the UK's reliance on fossil fuels and help fight global warming.

- The booming construction business in the country and the increasing end-user markets are the significant factors driving the growth of the heat pumps and boilers equipment market over the forecast period. Adopting the equipment includes energy efficiency, improved results, and lifespan.

- Vendors need to comply with various regulations set by the government regarding environmental protection, as the coolants and other substances used in heating equipment add to the global emissions. R-32 was chosen for its lower environmental impact, high energy efficiency, wide availability, and ease of use.

- The heating equipment market is aligned with the change to sustainability and green initiatives marking the country. Vendors of the studied market are indulging in introducing products that facilitate the green transition of various end-user industries. For instance, in August 2021, Tenova, a company offering sustainable solutions for the metals industry's green transition, announced the introduction of the 200-kW Tenova Self-Recuperative flameless smart burner. The smart burners are meant for heat treatment furnaces using hydrogen entirely while keeping NOx emissions below the strictest limits.

- According to The Renewable Energy Hub UK, using heat pumps can save 52% on energy expenses for consumers compared to gas boilers. However, with high initial costs, the Government of the United Kingdom, in 2021, announced to offer homeowners in England and Wales GBP 5,000 to install heat pumps to warm their homes. This is expected to drive huge demand for boiler replacements in the country with heat pumps.

UK Heating Equipment Market Trends

Supportive Government Regulations is Driving the Market Growth

- Several regulations in the studied region have changed how manufacturers engineer commercial heat pumps and warm-air for low-rise buildings in the commercial and residential sectors to improve RTU efficiency and cut energy usage and waste.

- Moreover, several manufacturers have been developing equipment phasing out HCFC - 22 (Hydrochlorofluorocarbons) to cater to the customers' needs and to comply with the green technology requirements for replacing old models, thus, driving the usage of heating equipment in the country.

- The figures reported in the European countries, including the United Kingdom, suggest the rapid adoption of heat pumps which is expected to grow consistently in 2022. The market is characterized by various new developments and is favored by government policies. The European Union's announcement to drastically reduce carbon dioxide emissions by 2050 indirectly supports renewable energies and energy-efficient products. Heat pumps are strategically positioned to benefit from the drive to environmental sustainability.

- Moreover, in April 2021, the United Kingdom set a new climate change target to slash carbon emissions by 78% by 2035. The Government also incorporated the United Kingdom's sixth carbon budget, ensuring Britain remains on track to end its contribution to climate change while remaining consistent with the Paris Agreement temperature goal to limit global warming to well below 2 °C and pursue efforts toward 1.5°C.

- In December 2021, United Kingdom Government announced a EUR 19 million investment to supply low carbon heating for thousands of homes and buildings across the country. The investment will expand the heat network to power homes with green energy. Furthermore, in June 2022, The UK government launched a three-year GBP 450 million incentive program offering discounts of up to GBP 6,000 from the installation cost of replacing fossil fuel boilers with heat pumps.

Heat Pumps is Expected to Have a Significant Growth

- The European Union has issued a new regulation for air-to-air heat pumps. According to European Commission Regulation (EU) 2016/2281, the Minimum standard of ηs,c for air-to-air heat pumps driven by an electric motor was set at 137%. However, with revised regulations in 2021, the minimum ηs,c for air-to-air heat pumps driven by an electric motor is 189%.

- Similarly, the minimum standard of ηs,c for air-to-air heat pumps driven by an internal combustion engine was set at 130%, and the revised regulation allows air-to-air heat pumps driven by an internal combustion engine to have a Minimum standard of ηs,c at 167%. Thus, such regulations are driving the replacement and new installations of heat pumps in the studied market.

- The announcement of Rishi Sunak's Green Homes scheme in the United Kingdom allows homeowners to claim up to EUR 10,000 grants for improvements, including air-source heat pumps, a greener alternative to central gas heating. However, factors such as lower heat supply than boilers, lower efficiency below 0°C, etc., are likely to hinder the market growth of air-source heat pumps.

- Moreover, heat pumps are considered the most efficient, environment-friendly systems available for heating and cooling buildings, thus influencing the government and market players to invest in this technology. For instance, during the pandemic, the Mayor of London's Energy Efficiency Fund (MEEF), managed by Amber Fund Management Limited, provided EUR 7 Million to the London Borough of Southwark to support a highly innovative project and provide low carbon heat to over two thousand homes in the area. The MEEF finance is provided for installing water-source heat pumps (WSHP), a renewable and energy-efficient technology, to replace the existing gas boilers in three housing estates within the borough. Also, according to BP, renewable energy consumption in the United Kingdom amounted to 1.24 exajoules in 2021, a decrease of over eight percent compared to 2020.

- Further, in July 2022, the UK Department of Business, Energy, and Industrial Strategy awarded a EUR 54 million contract for heat network funding, which will support the development of the scheme in London and working that use low-carbon heat sources such as heat pumps and energy from waste to warm properties. Heat networks can unlock otherwise inaccessible large-scale renewable and recovered heat sources, such as large rivers and industrial heat. This allows them to reduce bills, support local regeneration and provide a cost-effective way of reducing carbon emissions from heating.

- Moreover, according to the survey by Heat Pump Association, it is anticipated that the surge of heat pump demand to double in the country by 2021, which is well aligned with the country's net-zero targets. In addition to this, according to a high-level commission convened by the CBI, the installation of new gas boilers should be banned in the United Kingdom from 2025 to meet the net-zero climate target; owing to similar trends, the demand for heat pumps is expected to witness augmented demand over the forecast period.

UK Heating Equipment Industry Overview

The United Kingdom heating equipment landscape is highly competitive, with several local and international players active in the United Kingdom market. International participants operate in the country through partnerships with local players. With the market expected to broaden and yield more opportunities, more players are expected to enter the market soon. The key players in the market studied include Mitsubishi Electric Europe BV, and Systemair AB, among others. These major players have adopted various growth strategies, such as mergers and acquisitions, new product launches, expansions, joint ventures, partnerships, and others, to strengthen their position in this market.

- March 2022 - Danfoss introduced a new electric expansion valve to enhance heat pump efficiency, close controls, and process chillers. The ETS 8M enables OEMs and ends users to benefit from greater efficiency and reliability with low applied costs. The new ETS 8M series offers additional options in the lower capacity end of the Danfoss EEV portfolio. With four sizes available from 12 to 40 HP (62 to 114 kW) with high bi-flow MOPD, application costs can be massively reduced by only using one valve in both flow directions.

- March 2022 - British Gas completed the first air source heat pump installation as a part of the British Gas rollout plan. Centrica - British Gas' parent company - is already installing air source heat pumps into social housing under the PH Jones brand, aiming to install up to 1,000 a year and up to 20,000 by 2025.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porters Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Assessment of Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Supportive Government Regulations Including Incentives for Saving Energy through Tax Credit Programs

- 5.1.2 Replacement Of Existing Equipment With Better Performing Ones

- 5.2 Market Challenges

- 5.2.1 Growing Competition To Limit Margins

- 5.2.2 High Initial Cost of Energy-efficient Systems

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 Boilers/Radiators/Other Heaters

- 6.1.2 Furnaces

- 6.1.3 Heat Pumps

- 6.2 By End-User Industry

- 6.2.1 Residential

- 6.2.2 Commercial

- 6.2.3 Industrial

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Trane Inc.

- 7.1.2 Aermec SpA

- 7.1.3 Mitsubishi Electric Europe BV (Mitsubishi Electric Corporation)

- 7.1.4 Clivet SpA

- 7.1.5 Finn Geotherm UK Limited

- 7.1.6 Daikin Industries Ltd.

- 7.1.7 Systemair AB

- 7.1.8 Swegon Group AB

- 7.1.9 Rhoss SpA

- 7.1.10 Robert Bosch Gmbh

- 7.1.11 Danfoss A/s