|

市场调查报告书

商品编码

1644856

欧洲暖气设备市场:市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)Europe Heating Equipment - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

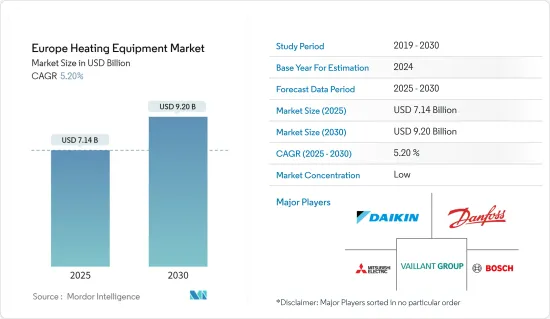

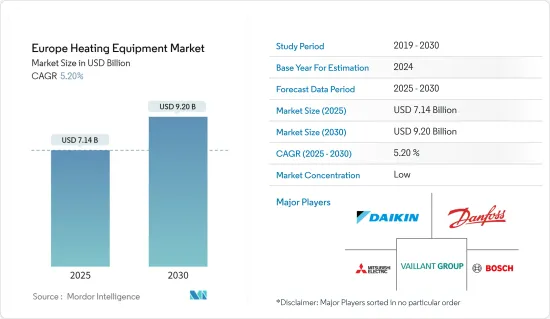

预计 2025 年欧洲暖气设备市场规模为 71.4 亿美元,到 2030 年将达到 92 亿美元,预测期内(2025-2030 年)的复合年增长率为 5.2%。

政府关于能源效率的法规和对节能供暖系统日益增长的需求正在推动欧洲已开发地区(尤其是英国、德国和法国)的市场成长。

关键亮点

- 各个新兴经济体建筑业的蓬勃发展和不断扩大的终端用户市场是预测期内推动热泵和燃烧器设备市场成长的关键因素。采用热泵燃烧器设备的好处包括能源效率、性能提高和使用寿命延长。

- 在人们对环境议题日益关注的背景下,欧盟近期提高了2030年气候目标,作为迈向气候中和的中间步骤,承诺在2030年将排放减少约55%。例如,「Fit for 55」是欧盟委员会制定的脱碳战略计画之一。该指令规定,必须继续采取措施提高能源效率,并实现从传统石化燃料供暖向可再生能源的转变。因此,这些趋势为所研究市场的成长创造了良好的前景。

- 此外,随着欧盟绿色交易的出台,多家暖气设备製造商已扩大其减少碳排放的承诺,到2050年将欧盟打造成其第一个气候中和区。考虑到供暖和製冷行业约占二氧化碳排放的 40%,预计该行业的脱碳将对这一目标做出重大贡献,因此预计在预测期内欧洲对节能供暖设备的需求将会增长。

- 为回应这些指令,地方政府也采取了类似的措施。例如,德国政府正透过新立法积极推动可再生和高效供热技术的快速发展和整合,并提供有吸引力的奖励,进一步推动该地区对供热设备的需求。

- 供暖设备市场与欧洲向永续性和环保实践的转变一致。研究市场的供应商正忙于推出能够促进各个终端用户产业绿色转型的产品。

- 预计宏观经济因素也将对研究市场的成长发挥重要作用。例如,最近俄罗斯和乌克兰之间的战争预计将推高欧洲的能源价格,迫使工业、企业和消费者寻求更节能的解决方案,为研究市场成长创造有利可图的前景。

欧洲暖气设备市场趋势

热泵预计将占据很大份额

- 热泵不仅广泛用于供暖,还用于冷气。热泵是一种机械传热装置,可从任何来源收集低品位热量,对其进行升级,并以更高的温度分配。热泵在住宅和工业领域都有应用。近年来,欧洲对热泵的需求大幅增加。例如,根据欧洲热泵协会的数据,义大利将在2022年成为热泵销售的领导者(502,350台)。

- 英国政府已经设定了2028年每年安装60万块太阳能板的目标,以减少英国对石化燃料的依赖并协助应对全球暖化。此外,锅炉升级计画将于 2022 年 4 月启动,为安装热泵的居民提供高达 6,000 欧元(6,438 美元)的补贴。

- 此外,作为气候行动计画的一部分,爱尔兰政府计划用可再生电力热泵取代燃油和固态燃料锅炉。该国已宣布计划在2030年安装60万台热泵,其中40万台将安装在现有建筑中。该计画是爱尔兰政府未来十年向环境、气候和通讯部拨出的129亿欧元(约138亿美元)新资金的一部分,也是修订后的爱尔兰2021-2030年国家发展计画(NDP)的一部分。爱尔兰政府还计划在 2030 年将约 50 万栋建筑维修至 B2 标准。

- 此外,MAN Energy Solutions 和BASF已建立战略伙伴关係关係,在路德维希港的BASF工厂建造工业规模的热泵。该计划旨在减少温室气体排放,在化学生产中建立低二氧化碳技术,并减少现场的天然气消费量。计画中的大型热泵将捕获冷却水系统中的废热作为能源来源,并利用再生能源来源发电产生蒸气。

工业用途预计将占很大份额

- 加热设备在工业应用上有着广泛的应用。德国、法国和义大利等国家的各个终端用户产业对蒸气锅炉的需求正在增加。此外,生产和扩建计划的增加以及建设活动也在推动对锅炉的需求。

- 製造公司正在该地区投资新的製造设施,预计将创造对蒸气锅炉和热泵等暖气设备的需求。例如,2022年3月,拜耳宣布计画未来几年向位于贝格卡门、柏林、勒沃库森、魏玛和伍珀塔尔的製药生产基地投资14亿欧元(约15亿美元)。

- 此外,食品和饮料行业是主要的行业领域之一,由于使用案例,热泵的采用预计将大幅增长。随着该行业向各个地区扩张,预计将出现新的商机。例如,根据德国联邦统计局的数据,德国食品和饮料产业的收益预计将从 2016 年的 1,505.4 亿欧元(1,615 亿美元)成长到 2022 年的 1,950.4 亿欧元(2,093.1 亿美元)。

- 为了回应政府和监管机构最近对热泵应用的展望,一些公司已加强增加热泵的应用。例如,瑞士雀巢公司最近宣布承诺在2030年将排放减少一半,到2050年实现碳中和。作为永续性蓝图的一部分,该公司正在欧洲几乎所有雀巢製造地安装热水热泵。

- 市场供应商正在提出创新的解决方案和策略来促进欧洲对热泵的采用。例如,2023年2月,Cepi与欧洲热泵协会(EHPA)达成合作协议,推动现有造纸厂引进热泵。建立伙伴关係的目的是节省造纸生产中所使用的约 50% 的能源并帮助实现脱碳。

欧洲供热产业概况

由于全球工业和商业部门对暖气设备的需求不断增加,导致欧洲暖气设备市场分散。大金工业株式会社、罗伯特·博世有限公司和三菱电机欧洲公司等市场主要企业不断创新新产品,并活性化併购、产能扩张等活动,进一步加剧了竞争。

2023年9月,瑞典Aira宣布进军德国。 Aira 是一家直接面向消费者、以每月订购方式提供热泵的企业,推出是该公司欧洲扩张计划的一部分。该公司还收购了一家英国安装商,以进一步促进其发展。

2023 年 7 月,松下供暖和製冷解决方案开始在欧洲全面生产其最新的 Aquaria L 系列,这是使用 R290 天然冷媒的新一代热泵。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 购买者/消费者的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

- 产业价值链分析

- 评估主要宏观经济趋势的市场影响

第五章 市场动态

- 市场驱动因素

- 节能供暖系统的需求不断增加

- 暖气设备的技术进步

- 市场问题

- 政府对环境问题的严格监管

第 6 章 分割

- 按类型

- 锅炉/散热器/其他加热器

- 热泵

- 按最终用户

- 住宅

- 商业的

- 工业的

- 按国家

- 欧洲

- 英国

- 德国

- 法国

- 西班牙

- 东欧

- 比荷卢

- 俄罗斯、独联体、其他

- 欧洲

第七章 竞争格局

- 公司简介

- Daikin Industries Ltd.

- Robert Bosch GmbH

- Mitsubishi Electric Europe BV

- Danfoss A/S

- Valliant Group

- Alfa Laval AB

- Carrier Global Corporation

- Lennox International Inc

- Ariston Thermo SpA

- BDR ThermeaGroup

第八章投资分析

第九章:市场的未来

The Europe Heating Equipment Market size is estimated at USD 7.14 billion in 2025, and is expected to reach USD 9.20 billion by 2030, at a CAGR of 5.2% during the forecast period (2025-2030).

The government regulations concerning energy efficiency and the increasing requirement for energy-efficient heating systems are providing thrust to the market growth in the developed European regions, particularly in the UK, Germany, and France.

Key Highlights

- The booming construction business in individual emerging economies and the increasing end-user markets are the significant factors driving the growth of the heat pumps and burners equipment market over the forecast period. Some of the benefits of adopting the equipment include energy efficiency, improved results, and lifespan.

- Amid the growing environmental concerns, the European Union recently raised its 2030 climate ambition as an intermediate step towards climate neutrality, committing to cutting emissions by about 55 percent by 2030. For instance, "Fit for 55" is one of the European Commission's plans to put the decarbonization strategy. The directive governs the need to maintain policies targeting higher energy efficiency and a shift from traditional fossil-based heat supply to renewable sources. Hence, such trends create a favorable outlook for the growth of the studied market.

- Furthermore, with the introduction of the EU Green Deal, several heating equipment suppliers have extended their commitment to reduce carbon emissions and make the European Union the first climate-neutral bloc by 2050. As decarbonization of the heating and cooling sector is believed to contribute significantly to this cause, considering the fact that it contributes about 40% of CO2 emissions, the demand for energy-efficient heating equipment is anticipated to grow in the European region during the forecast period.

- Influenced by such directives, regional governments are also taking similar initiatives. For instance, the government of Germany is aggressively promoting the rapid development and integration of renewable and efficient heating technologies through new laws, and attractive incentives are the factors further driving the demand for the heating equipment market in the region.

- The heating equipment market is aligned with the change to sustainability and green initiatives marking the European region. Vendors of the studied market are indulging in introducing products that facilitate the green transition of various end-user industries.

- Macroeconomic factors are also anticipated to play an influential role in the growth of the studied market. For instance, owing to the recent Russia-Ukraine war, energy prices in Europe are anticipated to shoot up, forcing industries, businesses, and consumers alike to look for energy-efficient solutions, thus creating a favorable outlook for the growth of the studied market.

Europe Heating Equipment Market Trends

Heat Pumps is Expected to Hold Significant Share

- Heat pumps are widely used not only for heating purposes but also for cooling. They are mechanical heat transfer devices that collect low-grade heat from any source and then upgrade it to distribute it at a high temperature. The heat pumps find applications in the residential as well as industrial sectors. In recent years, the demand for heat pumps has grown significantly in Europe. For instance, according to the European Heat Pump Association, in 2022, Italy was the leading country in terms of the number of heat pumps sold (502.35 thousand).

- The government of the UK has already set a target of installing 600,000 per year by 2028 to reduce the UK's reliance on fossil fuels and help fight global warming. Further, in April 2022, the boiler upgrade scheme was launched, which will provide a grant of up to EUR 6,000 (USD 6,438) for residents to install a heat pump that will cover about 90,000 homes.

- Furthermore, as part of the Climate Action Plan, the Irish government plans to replace boilers based on oil and solid fuel with heat pumps powered by renewable electricity. The country announced the plan to install 600,000 heat pumps by 2030, among which 400,000 will be in existing buildings. The plan is part of a new EUR 12.9 billion (USD 13.8 billion) funding that the Ireland government has allotted for the Department of the Environment, Climate, and Communications by the end of the decade as part of the revision of Ireland's National Development Plan (NDP) 2021-2030. The Irish government also aims to retrofit about 500,000 buildings with insulation to a B2-equivalent rating by 2030.

- Moreover, MAN Energy Solutions and BASF have entered into a strategic partnership to construct a heat pump of industrial-scale at the BASF site in Ludwigshafen. The project intends to reduce greenhouse gas emissions, establish low-CO2 technologies in chemical production, and reduce the site's natural gas consumption. The planned large-scale heat pump will enable steam production using electricity from renewable energy sources, trapping waste heat from the cooling water system as a thermal energy source.

Industrial Applications is Expected to Hold Major Share

- The heating equipment is widely used in industrial applications. The demand for steam boilers is increasing from various end-user industries in countries such as Germany, France, Italy, etc. Also, an increase in production activities and a rise in expansion projects with construction activities are propelling the demand for boilers.

- The manufacturing companies are investing in the new manufacturing facility in the region, which is projected to create demand for heating equipment such as steam boilers and heat pumps. For instance, in March 2022, Bayer announced its plan to invest EUR 1.4 billion (~USD 1.5 billion) in its pharmaceutical production sites in Bergkamen, Berlin, Leverkusen, Weimar, and Wuppertal in the coming years.

- Furthermore, the food and beverage industry is among the major industrial sectors wherein the adoption of heat pumps is anticipated to grow significantly owing to a broad number of use cases. With the industry expanding across various regions, new opportunities are expected to be created. For instance, according to Statistisches Bundesamt, the revenue of the food & beverage industry in Germany is anticipated to reach EUR 195.04 billion (USD 209.31 billion) in 2022, from EUR 150.54 billion (USD 161.5 billion) in 2016.

- To respond to the recent outlook of the governments and regulatory authorities towards the adoption of heat pumps, several businesses are increasing their efforts to enhance the adoption of heat pumps; for instance, Nestle, a Swiss company, recently announced its commitment to cutting its emissions in half by 2030, becoming carbon-neutral by 2050. As part of its sustainability roadmap, the company has a hot water heat pump at almost every Nestle manufacturing site in Europe.

- The vendors in the market are coming up with innovative solutions and strategies to drive the adoption of heat pumps in Europe. For instance, in February 2023, Cepi and the European Heat Pump Association (EHPA) entered into a collaboration to drive the adoption of heat pumps into existing paper mills; the partnership has been established to save about 50 percent of the energy used in paper manufacturing and assist its decarbonization.

Europe Heating Equipment Industry Overview

The European heating equipment market is fragmented as the demand for heating equipment is increasing with the growing demand from industrial and commercial sectors across the globe. The key players in the market, like Daikin Industries Ltd., Robert Bosch GmbH, Mitsubishi Electric Europe B.V., and others, are continuously innovating new products and rising activities such as mergers and acquisitions and capacity expansion, further increasing the competition.

In September 2023, Aira, the Swedish company, announced its entry into Germany. The launch of Aira, a direct-to-consumer company offering heat pumps on a monthly subscription, is part of the company's European expansion plans. To further support its growth, the company also acquired a U.K. installer.

In July 2023, Panasonic Heating & Cooling Solutions started full production of its latest Aquarea L Series, a new generation of heat pump using R290 natural refrigerant, in Europe.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers/Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Assessment of Impact of Key Macro Economic Trends on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growing Demand for Energy Efficient Heating System

- 5.1.2 Technological Advancements in Heating Equipments

- 5.2 Market Challenges

- 5.2.1 Stringent Government Regulations TowardS Environmental Concern

6 SEGMENTATION

- 6.1 By Type

- 6.1.1 Boilers/Radiators/Other Heaters

- 6.1.2 Heat Pumps

- 6.2 By End-user

- 6.2.1 Residential

- 6.2.2 Commercial

- 6.2.3 Industrial

- 6.3 By Country

- 6.3.1 Europe

- 6.3.1.1 United Kingdom

- 6.3.1.2 Germany

- 6.3.1.3 France

- 6.3.1.4 Spain

- 6.3.1.5 Eastern Europe

- 6.3.1.6 Benelux

- 6.3.1.7 Russia & CIS and Other Countries

- 6.3.1 Europe

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Daikin Industries Ltd.

- 7.1.2 Robert Bosch GmbH

- 7.1.3 Mitsubishi Electric Europe B.V

- 7.1.4 Danfoss A/S

- 7.1.5 Valliant Group

- 7.1.6 Alfa Laval AB

- 7.1.7 Carrier Global Corporation

- 7.1.8 Lennox International Inc

- 7.1.9 Ariston Thermo SpA

- 7.1.10 BDR ThermeaGroup