|

市场调查报告书

商品编码

1635387

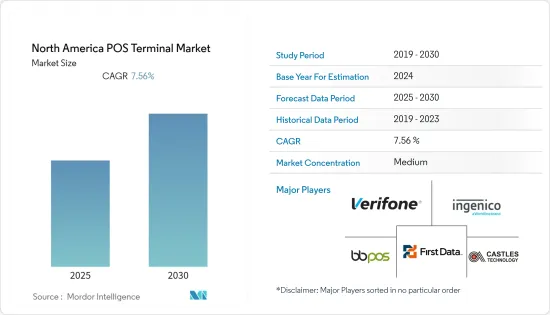

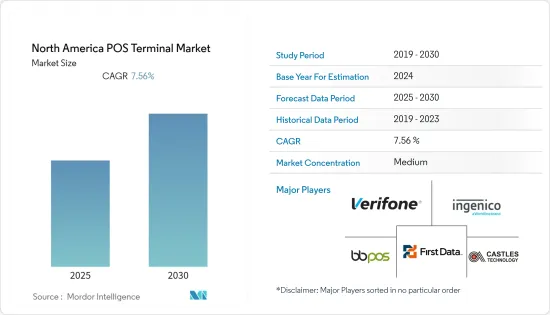

北美 POS 终端机:市场占有率分析、产业趋势、成长预测(2025-2030)North America POS Terminal - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

北美POS终端市场预计在预测期间内复合年增长率为7.56%。

主要亮点

- POS终端广泛用于无现金付款,由于其易用性和投资收益的提高,近年来已成为一种商品。无现金社会正在北美迅速普及,预计未来付款终端的引入将大幅增加。

- POS 终端系统正在从以交易为中心的终端/设备发展为可以与公司的 CRM 和其他金融解决方案整合的系统。这种演变为最终用户提供了商业情报,以更好地管理收益流和库存。降低维护成本、准确交易和即时库存管理是 POS 系统的主要优点。先进的 POS 系统提供的功能优势正在使企业以 POS 系统取代传统的收费软体,从而确保 POS 系统市场的成长。

- 该地区政府对电子付款的支持也支持了 POS 终端的成长。 2021 年 5 月,Moneris Solutions Corporation 宣布推出与 CNIB 和加拿大政府合作开发的电子付款终端的新辅助功能。

- 该地区国家正在见证所研究市场的重大技术创新。例如,2021 年 6 月,Paypal 宣布为美国小型企业推出 PayPal Zettle。它是一种数位 POS 解决方案,旨在帮助小型企业集中管理所有管道的销售、库存、报告和付款。这种新的 POS 解决方案允许商家使用二维码、签帐金融卡、信用卡和流行的数位钱包。

- COVID-19疫情对非接触式POS终端的市场需求产生了正面影响。严格的政府指导方针和客户透过现金处理遏制病毒传播的意识正在推动北美市场的成长。

北美POS终端市场趋势

零售业务预计将大幅成长

- 零售业是POS终端机的主要使用者之一。预计该细分市场将在全球占据很大份额。随着世界各地实体店重新开业,零售业正逐渐復苏。精通技术和不懂技术的客户都希望在他们最喜欢的零售商店中获得无缝体验。

- 大型零售商、超级市场和百货公司对具有强大且集中式系统的多个 POS 系统的需求不断增长,推动了 POS 终端市场零售业的稳定成长。对消费行为的日益重视导致 POS 实施与消费者地图应用程式的增加。

- 全部区域越来越多的零售商店透过大幅折扣和其他服务吸引顾客。此外,美国商务部预计,到2025年美国零售额将达5.35兆美元。然而,客户维繫是维持市场的主要挑战。这种竞争越来越需要重塑经营模式,以避免价格竞争,并在尖端技术投资和收益之间找到平衡。

- 此外,2022 年 6 月,商务平台 Lightspeed Commerce Inc. 宣布为北美时尚、户外和运动零售商推出新的 Lightspeed B2B 平台。这项创新解决方案的推出使数以千计的品牌和零售商能够使用供应商网路工具,将 B2B 订单直接整合到他们的 POS 中。

- 此外,数位经济预计将迅速扩张并创造巨大的需求。淡马锡和Google预测,到 2023 年,前六大国家的线上消费者支出将达到近 25 兆美元。可支配收入增加、互联网使用增加、物流网络改善和替代付款方式推动了电子商务的兴起。

美国预计将成为成长最快的市场

- 美国是北美POS终端市场的主要部分。各种 POS 终端机已在该国商店使用多年,并且越来越需要用最新技术替换它们。 POS 终端的出现可能会在加强该地区市场方面发挥重要作用。供应商和製造商之间日益激烈的竞争预计将为自动化领域带来有趣的成长前景。

- 在该地区,POS上的信用卡和签帐金融卡日益普及,有利于市场发展。根据 Worldpay 的数据,美国商店的主要支付方式是信用卡(38%),其次是签帐金融卡(29%)和现金(12%)。

- 人工智慧是一项正在影响 POS 系统 (AI) 的技术。人工智慧驱动的 POS 解决方案超越了基本任务,可以轻鬆包含语音辨识和机器学习等高级功能。根据ConnectPOS称,到2021年,美国15%的企业将使用具有人工智慧功能的POS,40%的企业计划在明年内采用支援人工智慧的POS。

- 该地区的大公司正在透过併购向美国扩张,目标是小商户。 2021 年 10 月,以其紧凑型信用卡读卡机而闻名的 SumUp 以 3.17 亿美元收购了美国行销新兴企业Fivestars,扩大了其在美国的业务范围,并与 PayPal 和 Square 等公司竞争。

北美POS终端产业概况

北美POS终端市场适度分散。该市场由三星电子、BBPOS Limited、PAX Technology Ltd、NCR Corporation 和 NEC Corporation 等主要企业组成。市场上的每个参与者都在投资发明吸引和留住客户的新方法。下面列出了市场的主要发展。

- 2022 年 2 月 - Apple 宣布计划在 iPhone 上推出 Tap to Pay。借助这项新功能,美国各地数以百万计的商家,从小型企业到大型零售商,只需轻按一下 iPhone 即可使用 iPhone 进行 Apple Pay 和非接触式支付,无需任何额外的硬体或付款签帐金融卡。

- 2021 年 10 月 - POS 系统供应商 POSTRON 宣布推出一套新的智慧 POS 系统,可增强用餐体验并提高接受付款时的安全性。 POSTRON 专为中小型餐厅和餐车开发,提供独特的手持式智慧 POS 设备,透过自动设备侦测和配置软体连接,并依靠云端储存来储存销售资料和客户资料,始终可用。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 北美POS终端市场规模及预估

- 产业价值链分析

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买方议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间敌对关係的强度

- COVID-19 市场影响评估

第五章市场动态

- 市场驱动因素

- 付款产业对 POS数位化的投资增加预计将推动市场成长

- 市场挑战

- 有关网路攻击和资料外洩的安全性问题

- POS终端主要法规及申诉标准

- 2020年至2027年POS终端销售市场预测

- 2020年至2027年每台POS终端机付款笔数市场预测

- 2020年至2027年每台POS终端付款金额市场预测

- 关于非接触式付款的日益普及及其对行业影响的说明

- 重大案例分析

第六章 市场细分

- 按类型

- 固定POS系统

- 行动/可携式POS 系统

- 按最终用户产业

- 零售

- 款待

- 卫生保健

- 其他的

- 按国家/地区

- 美国

- 加拿大

第七章 竞争格局

- 公司简介

- VeriFone System Inc.(Francisco Partners)

- Ingenico(Worldline)

- First Data Merchant Services LLC(Fiserv, Inc)

- BBPOS Limited(Stripe, Inc)

- Castles technology(RISC OS Developments Ltd)

- UIC Payworld Inc.

- PAX Technology

- SZZT Electronics Co.,Ltd

- Dspread Technology(Beijing)Inc.

- Block, Inc.

- Nayax

- Shanghai Smartpeak Technology Co.,LTD.

- WizarPOS

- YouTransactor(Jabil Payment Solutions)

- UROVO TECHNOLOGY CORPORATION LIMITED

第八章投资分析

第九章 市场未来展望

简介目录

Product Code: 91628

The North America POS Terminal Market is expected to register a CAGR of 7.56% during the forecast period.

Key Highlights

- POS terminals are being used extensively for accepting cashless payments and have become a commodity in recent years due to their ease of use and improved return on investment. With the rapid adoption of a cashless society in North America, the adoption of payment terminals is expected to increase significantly in the future.

- POS terminal systems have evolved from being transaction-oriented terminals/devices to systems that can integrate with the company's CRM and other financial solutions. This evolution has empowered end-users with business intelligence to better manage their revenue streams and inventory. Lower maintenance costs, accurate transactions, and real-time inventory are key advantages of POS systems. With the functional benefits that the advanced POS systems offer, companies have replaced their traditional billing software with POS systems, thus, securing the growth of the POS system market.

- The support from the government in the region for electronic payments is also pushing the growth of POS terminals. In May 2021, Moneris Solutions Corporation announced the launch of new accessibility features in electronic payment terminals developed in partnership with CNIB and the Government of Canada.

- The countries in the region are witnessing significant innovation in the studied market. For instance, in June 2021, Paypal announced PayPal Zettle for small businesses in the U.S., a digital POS solution designed to help small businesses manage sales, inventory, reporting, and payments across all channels and in one place. The new POS offering will also allow merchants to accept QR codes, debit cards, credit cards, and popular digital wallets.

- The COVID-19 pandemic has positively impacted the market demand for contactless POS terminals. Stringent government guidelines and customer awareness to control the spread of the virus through cash handling have driven the market growth in North America.

North America POS Terminal Market Trends

Retail Segment is Expected to Grow Significantly

- The retail industry is one of the major users of POS terminals. The segment is expected to hold a significant share globally. The retail segment is slowly picking up with the reopening of brick-and-mortar stores in different parts of the world. Tech and non-tech savvy customers are equally demanding in desiring a seamless experience at their preferred retailers.

- The increasing need for multiple POS systems among big retailers, supermarkets, and departmental stores with a robust and centralized system has propelled the retail sector's steady growth in the POS terminal market. The increased emphasis on consumer behavior has led to increased POS adoption due to its consumer mapping application.

- The rising number of retail stores across regions attracts customers due to significant discounts and other services. Further, the US Department of Commerce has projected the retail revenue to reach USD 5.35 trillion in the United States by 2025. However, customer retention becomes the primary challenge to sustaining in the market. This competition increases the requirement to reinvent their business models to avoid competition concerning price and find the balance between investing in the latest technologies and revenue.

- Moreover, in June 2022, Lightspeed Commerce Inc., a commerce platform, announced the launch of the new Lightspeed B2B platform to North American fashion, outdoor, and sports retailers, with broader vertical and feature availability in the coming future. Launching this transformative solution will bring thousands of brands and retailers together with a supplier network tool that integrates B2B orders directly into the point of sale (POS).

- Furthermore, the digital economy is expected to expand rapidly, thereby creating significant demand. Temasek and Google predict that by the year 2023, online consumer spending across the top 6 economies will witness almost a quarter of a trillion dollars. The rise of e-commerce is fueled by rising disposable incomes, increased internet usage, improved logistical networks, and alternative payment methods.

United States anticipated to be the Fastest-growing Market

- The United States is a major North American POS terminal market segment. For several years, various POS terminals have been used in outlets in the country, thus boosting the need for replacement with updated technologies. The emergence of POS terminals would go a long way in bolstering the regional market. The increased competitiveness among the vendors and manufacturers is expected to bring about interesting growth prospects in the world of automation.

- The robust adoption of credit cards and debit cards at the point-of-sale in the region is also developing a favorable landscape for the market. According to Worldpay, the major payment methods in stores in the United States included credit cards (38%), followed by debit cards (29%), and cash (12%).

- Artificial intelligence is the technology that is affecting POS systems (AI). A POS solution powered by AI may easily go beyond basic tasks to include advanced capabilities like speech recognition and machine learning. According to ConnectPOS, by 2021, 15% of businesses in the United States will have utilized POS with AI capabilities, and 40% of firms aim to employ AI-enabled POS within the next year.

- The major companies in the region are expanding in the United States through mergers and acquisitions to target small merchants. In October 2021, SumUp, best known for its small credit card readers, acquired United States marketing start-up Fivestars for USD 317 million to expand its reach across the U.S. and take on companies such as PayPal and Square.

North America POS Terminal Industry Overview

The North American point of sale terminals market is moderately fragmented. The market consists of major players, such as Samsung Electronics Co. Ltd, BBPOS Limited, PAX Technology Ltd, NCR Corporation, and NEC Corporation. The players in the market are investing in inventing new ways to attract and retain customers. Some of the key developments in the market are listed below.

- February 2022 - Apple announced its plans to introduce Tap to Pay on iPhone. The new capability will enable millions of merchants across the United States, from small businesses to large retailers, to use their iPhones to seamlessly and securely accept Apple Pay, contactless credit and debit cards, and other digital wallets through a simple tap of their phone without any additional hardware or payment terminal required.

- October 2021 - POS systems provider POSTRON introduced a new set of smart POS systems to improve the dine-in experience and enhance the security of receiving payments. POSTRON, created specifically for small-to-medium-sized restaurants and food trucks, offers unique handheld smart POS devices connected through automatic device detection and configuration software and relies on cloud storage to make sales data and customer profiles always available.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Market Sizing and Estimates of North America POS Terminals Market

- 4.3 Industry Value Chain Analysis

- 4.4 Industry Attractiveness - Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

- 4.5 Assessment of COVID-19 Impact on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growing Investments in POS and Digitalization in the Payment Industry are Expected to Boost the Market Growth

- 5.2 Market Challenges

- 5.2.1 Security Concerns Related to Cyber Attacks and Data Breaches

- 5.3 Key Regulations and Complaince Standards of PoS Terminals

- 5.4 Market Estimates of Number Of POS Terminal for the period of 2020-2027

- 5.5 Market Estimates of Number Of Payments Per POS Terminal for the period of 2020-2027

- 5.6 Market Estimates of Value Of Payments Per POS Terminal for the period of 2020-2027

- 5.7 Commentary on the rising use of contactless payment and its impact on the industry

- 5.8 Analysis of Major Case Studies

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 Fixed Point-of-sale Systems

- 6.1.2 Mobile/Portable Point-of-sale Systems

- 6.2 By End-User Industry

- 6.2.1 Retail

- 6.2.2 Hospitality

- 6.2.3 Healthcare

- 6.2.4 Others

- 6.3 By Country

- 6.3.1 United States

- 6.3.2 Canada

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 VeriFone System Inc. (Francisco Partners)

- 7.1.2 Ingenico (Worldline)

- 7.1.3 First Data Merchant Services LLC (Fiserv, Inc)

- 7.1.4 BBPOS Limited (Stripe, Inc)

- 7.1.5 Castles technology (RISC OS Developments Ltd)

- 7.1.6 UIC Payworld Inc.

- 7.1.7 PAX Technology

- 7.1.8 SZZT Electronics Co.,Ltd

- 7.1.9 Dspread Technology (Beijing) Inc.

- 7.1.10 Block, Inc.

- 7.1.11 Nayax

- 7.1.12 Shanghai Smartpeak Technology Co.,LTD.

- 7.1.13 WizarPOS

- 7.1.14 YouTransactor (Jabil Payment Solutions)

- 7.1.15 UROVO TECHNOLOGY CORPORATION LIMITED

8 INVESTMENT ANALYSIS

9 FUTURE OUTLOOK OF THE MARKET

02-2729-4219

+886-2-2729-4219