|

市场调查报告书

商品编码

1635389

法国POS终端市场:份额分析、产业趋势、成长预测(2025-2030)France POS Terminal - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

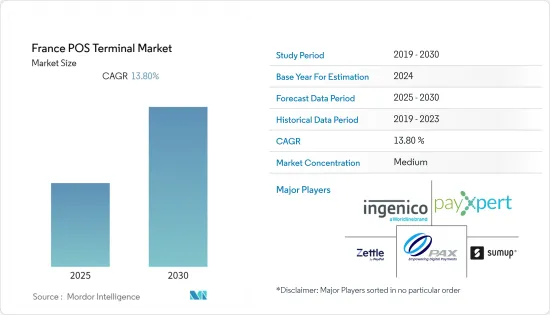

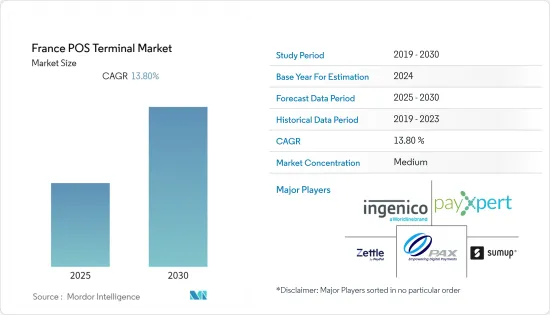

法国POS终端市场预计在预测期间内复合年增长率为13.8%

主要亮点

- 当使用信用卡或签帐金融卡付款时,传统的POS终端机会读取磁条,检查是否有足够的金额可以转给商家,然后进行转帐。销售交易被记录下来,收据被列印、透过电子邮件或透过简讯发送给消费者。

- 目前的趋势是安装在平板电脑和行动装置上的基于软体的 POS 系统,而不是传统的专有硬体。 POS 终端製造商正在推出可携式和行动 POS 设备版本,以在竞争中保持领先地位。

- 目前,商家可以根据需要选择多种POS终端。 Soft POS让企业可以透过安装简单的软体,轻鬆地将现有的行动电话变成POS终端。

- 典型的零售商店和餐厅都设有 POS 终端,店主明白消费者不喜欢等待付款或用餐。价格、功能和易用性都是 POS 系统购买者的重要考量。在当今日益互联的世界中,系统安全至关重要。使用作业系统过时的 POS 终端机曾发生过一些备受瞩目的资料外洩事件。这可能对 POS 终端市场构成挑战。

- COVID-19 大流行增加了对非接触式付款的需求,需要安装配备 NFC、RFID 和其他可以透过非接触式晶片卡或数位介面卡接受付款的技术的 POS 终端。

法国POS终端市场趋势

使用支援 NFC 的智慧型手机和智慧卡进行付款增加

- NFC 是一种无线资料传输方法,可让智慧型手机、笔记型电脑、平板电脑和其他装置在附近共用资料。 NFC 技术支援使用行动钱包和非接触感应卡(例如 Apple Pay 和 Android Pay)进行非接触式付款。当支援 NFC 的智慧型手机或信用卡或签帐金融卡卡在 POS 终端机上轻触时,就会交换付款资讯。这提高了交易效率

- 超级市场、专卖店和大卖场的增加增加了对NFC POS终端的需求。法国是NFC POS终端机市场收益占有率最高的主要国家之一。推动 NFC POS 终端需求的几个因素包括法国公民越来越倾向于使用相容 NFC 的智慧型手机进行付款。

- 由于安全威胁,为市场创建的硬体更新主要围绕着促进更顺畅的交易。但因疫情而被迫分离,却加速了身分验证功能明确的非接触式付款的发展。

- 摄影机和指纹感应器的加入迫使产品变得更大。然而,这被工业创新所抵消,工业创新允许製造商在追求微电子的过程中实现小型化。法国的一些公司也提供非接触式版本,用于接受常规信用卡交易和非接触式脸部认证生物识别,作为脸部认证的替代方案。 NFC、RFID、晶片卡和磁条卡交易也是可能的。

- 根据 Worldpay 的一项研究,2019 年至 2024 年 POS 交易价值将成长约 16.03%。 2020 年,法国的付款受到了 COVID-19 大流行的影响。商店(暂时)关闭,导致 POS 交易量减少。

零售业带动POS终端市场成长

- 大幅折扣和其他服务增加了每个地区的零售店数量以吸引顾客,但客户维繫已成为继续留在市场的关键挑战。这种竞争迫使企业重新考虑经营模式,以进行价格竞争,并在新技术投资与创收之间取得平衡。

- POS 终端机提供的功能,例如销售报告、库存、财务管理和客户分析功能,可协助商家应对客户维繫挑战。因此,客户维繫需求和日益激烈的市场竞争正在推动 POS 终端的兴起。

- 利用数位解决方案日益驱动的行业,一些零售商正在投资商店进行高科技改进,并扩展其多通路产品。

- 随着奥运会预计将于 2024 年举行,Maison France 的国际声誉已成为寻求加强其在法国市场地位的跨国公司的新吸引力。主要奢侈品集团的全球销售强劲成长支撑了主要奢侈品贸易商的兴奋,其中法国在国际排名中遥遥领先。

- 法兰西银行数据显示,经过季节性因素和纳入工作日调整后,2022年4月零售额较2022年3月下降0.8%。食品销售额成长 1.9%,但製成品销售额下降 3.0%。这是由于新车销量下降 6.9%,家具销量下降 7.5%。在家用电子电器产品的推动下,过去三个月(2022 年 1 月至 3 月)製成品销售额成长了 3.7%,而 4 月则下降了 6.5%。

- 根据电子商务和通讯销售联合会(FEVAD)的研究,2021年电子商务约占法国零售总额的14.1%。与前一年同期比较,成长了13.4%。而且,2021年,法国电商销售额约1,290亿欧元。

法国POS终端产业概况

法国 POS 终端市场竞争适中,有大量区域性参与企业。公司正在利用策略合作计划、收购和产品推出来增加市场占有率和盈利。

- 2022 年 4 月 - PayPal 在法国推出 Zettle 终端机。它是一款一体化 POS(销售点)解决方案,可提高小型企业的店内移动性。 Zettle 终端可以根据商家的喜好进行客製化,商家可以选择具有整合式条码扫描器的终端来加快销售和日常业务。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 法国POS终端市场规模及预估

- 产业价值链分析

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买方议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间敌对关係的强度

- COVID-19 市场影响评估

第五章市场动态

- 市场驱动因素

- 使用支援 NFC 的智慧型手机和智慧卡进行付款增加

- 零售业将大量采用 NFC POS 解决方案

- 非接触式和行动 POS 终端需求大幅成长

- 市场问题

- 交易限制问题 安装成本

- 因使用机密资讯而引起的安全问题

- 市场机会

- 扩大非接触式付款

第六章 市场细分

- 按类型

- 固定POS系统

- 行动/可携式POS 系统

- 按最终用户产业

- 零售

- 款待

- 医疗保健

- 其他的

第七章 竞争格局

- 公司简介

- Ingenico Group(Worldline)

- PayXpert LTD

- Zettle(PayPal)

- SumUp Limited

- PAX Technology

- myPOS World Ltd

- NEC Corporation

- AURES Group

- Smile&Pay

- dejamobile

- Innovorder SAS

第八章投资分析

第九章 市场未来展望

简介目录

Product Code: 91638

The France POS Terminal Market is expected to register a CAGR of 13.8% during the forecast period.

Key Highlights

- When a credit or debit card is used to pay for anything, a conventional point-of-sale (POS) terminal reads the magnetic strip, sees if there is enough money to send to the merchant, and then makes the transfer. The sale transaction is documented, and a receipt is printed, emailed, or texted to the consumer.

- The current trend is toward software-based POS systems installed onto a tablet or mobile device rather than traditional proprietary hardware. POS terminal manufacturers are launching their versions of portable and mobile POS equipment to stay ahead of the competition.

- Merchants now have a variety of PoS terminals to choose from, depending on their needs. With soft POS, businesses can easily transform their existing cellphones into POS terminals by installing simple software, eliminating the need for extra hardware installation, or employing personnel trained to administer this software which drives the market growth.

- POS devices can be seen in popular retail stores and restaurants where owners understand consumers do not prefer waiting to pay for a product or meal. Price, function, and user-friendliness are all essential considerations for POS system purchasers. The security of the systems is necessary in today's increasingly interconnected world. Some high-profile data breaches have happened using POS terminals with out-of-date operating systems. This can be a challenge for the POS terminal market.

- The COVID-19 pandemic increased demand for contactless payments, necessitating the installation of POS terminals equipped with NFC, RFID, and other technologies capable of receiving payments via contactless chip cards or digital interface cards.

France POS Terminal Market Trends

Increased Payments from NFC-Compatible Smartphones and Smart Cards

- NFC is a wireless data transfer method that allows smartphones, laptops, tablets, and other devices to share data nearby. NFC technology enables contactless payments using mobile wallets such as Apple Pay and Android Pay, as well as contactless cards. When an NFC-enabled smartphone or a credit or debit card is tapped against a POS terminal, then payment credentials are exchanged. This increases transaction efficiency.

- The increasing number of supermarkets, specialty stores, and hypermarkets are driving increased demand for NFC POS terminals. France is one of the major countries contributing the highest revenue share in the NFC POS terminal market. Some factors stimulating the need for NFC POS terminals include an increasing preference for NFC-compatible smartphones for payment among the France population.

- Because of security threats, updated hardware created for the market is centered on facilitating smoother transactions. However, the forced separation caused by the epidemic has accelerated the development of contactless payments with distinct authentication capabilities.

- The inclusion of cameras and fingerprint sensors forces bigger form shapes. However, this is offset by industry innovations that allow manufacturers to go smaller in pursuing micro-electronics. Some companies in France were also offering Contactless and built to accept regular credit card transactions and contactless facial biometrics as alternatives to facial verification; NFC, RFID, chip, and magnetic stripe card transactions are also enabled.

- According to a survey conducted by Worldpay, approximately 16.03% of the value of Point of Sale transactions has increased from 2019 to 2024. In 2020, payments in France had influenced by the COVID-19 pandemic. The stores were (temporarily) closed, leading to a decline in the value of POS transactions.

Retail Sector driving the growth of POS Terminal Market

- Due to substantial discounts and other services, a rising number of retail establishments throughout regions attract clients; however, customer retention becomes the key difficulty for them to continue in the market. This rivalry raises the need for businesses to rethink their business models to compete on pricing and strike a balance between investing in new technology and generating income.

- The features provided by POS terminals, such as sales reporting, inventory, financial management, and customer analytics features, help merchants address client retention challenges. As a result, the demand for client retention and increased competitiveness in the market drive the rise of POS terminals.

- Taking advantage of the industry's expanding spectrum of digital solutions, several retailers have invested in high-tech improvements for their storefronts and expanded their multichannel offerings.

- The prospect of the 2024 Olympic Games and the international reputation of "Maison France" is a new point of appeal for multinational firms trying to strengthen their position in the French market. The excitement of the leading luxury merchants is supported by significant growth in the global turnover of the major luxury groups, with a strong French representation in the international rankings.

- According to the Banque de France, Adjusted for seasonal and working day take-ups, retail trade turnover was down 0.8 percent in April 2022 compared to March 2022. Food sales climbed by 1.9 percent, while manufactured goods sales decreased by 3.0 percent, influenced by a drop in new car sales and furniture sales, which fell by 6.9 percent and 7.5 percent, respectively. Over the previous three months (Jan2022-March2022), manufactured goods sales increased by 3.7 percent, led by consumer electronics, which dropped by 6.5 percent in April but increased by 6.5 percent over the three months.

- According to a survey by the Federation of E-Commerce and Distance Selling (FEVAD), E-commerce accounted for approximately 14.1 percent of all retail sales in France in 2021. There is an increment of 13.4 percent from the previous year. Moreover, in 2021, e-commerce sales in France amounted to about 129 billion euros.

France POS Terminal Industry Overview

The France POS Terminal Market is moderately competitive, with a considerable number of regional players. The companies leverage strategic collaborative initiatives, acquisitions, and product launches to increase market share and profitability.

- April 2022- PayPal launched Zettle Terminal in France, an all-in-one point-of-sale (POS) solution that offers increased in-store mobility for small businesses. Zettle Terminal can be customized to fit merchants' preferences - sellers can choose a terminal with an integrated barcode scanner to speed up sales and daily tasks.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definitions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHT

- 4.1 Market Overview

- 4.2 Market Sizing and Estimates of France POS Terminals Market

- 4.3 Industry Value Chain Analysis

- 4.4 Industry Attractiveness - Porter's Five Force Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

- 4.5 Assessment of COVID-19 Impact on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increased Payments from NFC-Compatible Smartphones and Smart Cards

- 5.1.2 Retail Sector Adopting the NFC POS Solutions Considerably

- 5.1.3 Significant Rise in the Demand for Contactless and Mobile POS Terminals

- 5.2 Market Challenges

- 5.2.1 Problems With Transaction Limit Installation Costs

- 5.2.2 Security Concerns Due to the Usage of Sensitive Information

- 5.3 Market Opportunities

- 5.3.1 Rising Adoption of Contactless Payment

6 MARKET SEGMENTATION

- 6.1 BY Type

- 6.1.1 Fixed Point-of-sale Systems

- 6.1.2 Mobile/Portable Point-of-sale Systems

- 6.2 By End-User Industry

- 6.2.1 Retail

- 6.2.2 Hospitality

- 6.2.3 Healthcare

- 6.2.4 Others

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Ingenico Group (Worldline)

- 7.1.2 PayXpert LTD

- 7.1.3 Zettle (PayPal)

- 7.1.4 SumUp Limited

- 7.1.5 PAX Technology

- 7.1.6 myPOS World Ltd

- 7.1.7 NEC Corporation

- 7.1.8 AURES Group

- 7.1.9 Smile&Pay

- 7.1.10 dejamobile

- 7.1.11 Innovorder SAS

8 Investment Analysis

9 Future Outlook of the Market

02-2729-4219

+886-2-2729-4219