|

市场调查报告书

商品编码

1635396

英国穿戴式科技:市场占有率分析、产业趋势与统计、成长预测(2025-2030)UK Wearable Technology - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

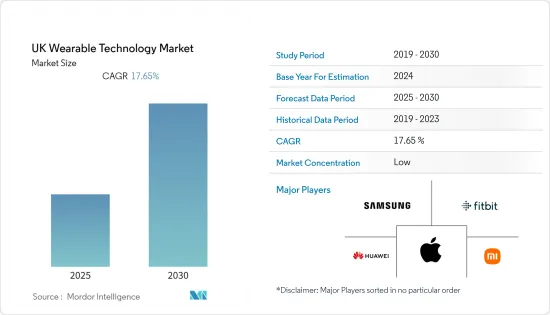

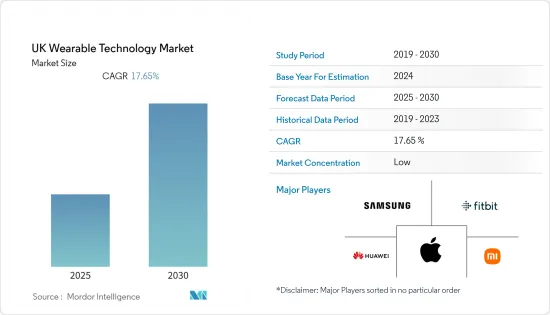

英国穿戴式科技市场预计在预测期内复合年增长率为 17.65%。

主要亮点

- 智慧型手錶、头戴式显示器、腕带、耳戴式装置和其他装置类型(智慧服饰)等穿戴式技术正在推动穿戴式科技市场的显着成长。智慧型手錶和健身追踪器正在改善消费者的健康和健身。

- 英国政府预计,2024年英国物联网(IoT)设备数量将增加超过1.5亿台。白色家电市场和消费者穿戴式装置占所有物联网 (IoT) 连线的 40% 以上。智慧型手錶、健康和健身追踪器以及耳挂型设备可能是最主要的类别。许多人广泛使用智慧型手錶来监测他们的健康状况并追踪心率。

- 穿戴式科技的采用正在不断增长,尤其是在医疗保健领域。患者越来越多地采用穿戴式科技和行动应用程式来持续监测自己的健康状况,并透过早期疗育和行为改变来减少与健康相关的问题。例如,根据英国政府的说法,国防和安全加速器(DASA)为英国军方提供了一个重要的机会,可以透过使用穿戴式技术来减少现役士兵的伤害。

- 然而,缺乏高效可靠的电池系统来让用户长时间使用穿戴式装置而不影响其紧凑性是限制所研究市场成长的主要因素。

- 疫情对英国穿戴式科技市场产生了显着影响。 COVID-19 大流行对供应链造成了许多干扰。此外,各种限制也延迟了这些设备的交付。然而,随着疫情提高了人们对数位技术的认识,这些设备的采用可能会增加。

英国穿戴式科技市场趋势

智慧型手錶实现巨大成长

- 物联网主导的智慧型手錶正在推动穿戴式装置市场的成长。这款智慧型手錶作为独立技术运行,并与其他 IoT(物联网)设备交互,可显着提高消费者的生活品质。这些智慧型手錶在骑自行车或跑步时的无线连接允许用户追踪他们的健身,并帮助他们监控他们在参与活动时遇到的情况。

- 资料科学技术和物联网等技术进步正在推动该市场的需求。智慧型手錶还使用各种应用程式追踪健身,并在仪表板上显示用户的健康相关问题。

- 5G 等高速通讯技术的日益普及预计将推动英国智慧型手錶产业的进一步成长,因为它可以实现更快的连接并进一步扩展智慧型手錶的使用案例。例如,2021年4月,该国所有通讯业者增加了700MHz和3.6-3.8GHz频段的频谱持有。

- 2022年2月,Virgin Media O2宣布其5G网路覆盖首都三分之二,使伦敦成为该集团最大的5G足迹。

- 考虑到不断增长的需求,多家智慧型手錶製造商已在该国推出了产品。例如,2021 年 10 月,苹果在英国推出了最新的 Watch Series 7。据该公司称,Apple Watch Series 7 采用 Watch OS 8、快速充电、更大且改进的显示器以及新的铝製外壳颜色。

健康管理的应用预计将显着促进市场成长

- 智慧型手錶正在彻底改变医疗保健产业,因为它们帮助个人在健康上投入时间,并像医疗感测器一样发挥作用。这些设备可以收集资料,并在监测心率、血氧水平和活动水平方面发挥重要作用。苹果、Fitbit、三星和 Fossil 是在该国提供具有医疗保健追踪功能的智慧型手錶的主要智慧型手錶品牌。

- 此外,健身追踪器也为穿戴式装置市场的成长做出了重大贡献。借助这些设备,使用者可以监控卡路里消耗、睡眠、运动和计步器。健身追踪器还收集使用者资料,帮助医生分析患者的健康状况并提供及时的药物治疗。自 COVID-19 爆发以来,对这些设备的需求大幅增加。这些设备允许医生远端记录使用者的体温和其他属性,例如心率。

- 这些设备中的新技术使血糖监测变得更加容易。借助这些设备也可以轻鬆追踪心血管疾病的增加。随着人们越来越多地使用这些设备,电子商务产业正在见证这个市场的巨大成长。

- 考虑到智慧型手錶和其他穿戴式装置所带来的好处,尤其是对老年人来说,随着人口老化,中国对这些装置的需求正在显着增加。例如,Fitbit UK 提供 Sense智慧型手錶,该公司称该手錶使用创新的 EDA 感测器来帮助用户管理压力。

英国穿戴科技产业概况

研究的市场高度分散。该市场的主要企业包括苹果、三星电子、Fitbit、华为科技公司、小米公司和Garmin公司。公司正在透过多个联盟和合併、计划投资以及将新产品推向市场来增加市场占有率。

- 2021 年 5 月 - 最近更名为 Facebook 的母公司 Meta Platforms, Inc. 在伦敦启动了名为计划 Aria 的扩增实境(AR) 智慧眼镜的开发,旨在开发下一代元宇宙解决方案。该公司将开始试验智慧眼镜,透过头戴式显示器(HMD)中的感测器记录环境资料。

- 2022 年 4 月 - 中国扩增实境(AR)新兴企业Nreal 宣布计划将其智慧眼镜引入英国。该公司宣布,将从今年春季开始,透过与当地通讯业者EE 的独家合作,在英国推出 AR 眼镜 Nreal Air。

其他好处:

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间的敌对关係

- COVID-19 对穿戴式科技市场的影响

第五章市场动态

- 市场驱动因素

- 穿戴式装置市场的技术不断进步

- 提高消费者健康意识

- 市场挑战

- 穿戴式装置的复杂性不断增加、功能有限且安全风险增加

第六章 市场细分

- 依设备类型

- 智慧型手錶

- 头戴式显示器

- 腕带

- 耳戴式

- 其他设备类型(智慧服饰)

第七章 竞争格局

- 公司简介

- Apple Inc.

- Samsung

- Fitbit Inc.

- Huawei Technologies Co. Ltd

- Xiaomi

- Garmin Ltd.

- Fossil Group Inc.

- OnePlus

- Sekonda

- Honor Device Co., Ltd

第八章投资分析

第九章 市场未来展望

简介目录

Product Code: 91647

The UK Wearable Technology Market is expected to register a CAGR of 17.65% during the forecast period.

Key Highlights

- Wearable technology such as Smart Watches, Head-mounted Displays, Wristbands, Ear-wearables, and Other Device Types (Smart Clothing) are propelling the significant growth of the wearable technology market. Smartwatches, Fitness trackers are enhancing the consumer's wellness and fitness.

- According to UK Government, the number of IoT(Internet of Things) devices in the UK is projected to grow by over 150 million in 2024. The white goods market and consumer wearables account for over 40% of all IoT(Internet of Things) connections. Smartwatches, health and fitness trackers with ear-worn devices will become the most dominant category. Smartwatches are widely used as many people monitor their health and track heart rate.

- The adoption of wearable Technology is growing, especially across the healthcare sector as patients are increasingly adopting wearable technology and mobile apps to monitor their health constantly and mitigate health-related problems through early intervention and behavioral change. For instance, according to the Government of the United Kingdom, Defence and Security Accelerator (DASA) is using wearable technology to present a significant opportunity for the UK Armed Forces to reduce injury to in-service personnel.

- However, the absence of efficient and reliable battery system that can enable the users to use the wearable devices for an extended period without compromising the compactness of the devices is a major factor restraining the growth of the studied market.

- A notable impact of the pandemic has been observed on the UK's wearable technology market. Due to the COVID-19 pandemic, there were many disruptions in the supply chain. Additionally, due to various restrictions, the deliveries of these devices were delayed. However, the adoption of these devices is set to increase as the pandemic has raised awareness of digital technologies.

UK Wearable Technology Market Trends

Smartwatches to Witness Significant Growth

- IoT-driven smartwatches are driving the wearables market growth that will operate as a standalone technology and interact with other IoT(Internet of Things) devices to vastly improve a consumer's quality of life. The wireless connections of these smartwatches while cycling and running enable the users to track their fitness and help them monitor the conditions they encounter while involved in the activities.

- Technological advancements like data science techniques and IoT propel the demand for this market. Smartwatches also track fitness using various applications and display the user's health-related issues on the dashboards.

- The increasing penetration of high-speed telecommunication technologies such as 5G is expected to further the growth of the smartwatches segment in the United Kingdom as they offer high-speed connectivity, which will further expand the use cases of smartwatches. For instance, in April 2021, every operator in the country boosted their spectrum holdings across the 700 MHz and 3.6-3.8 GHz spectrum bands.

- In February 2022, Virgin Media O2 announced that its 5G network had hit two-thirds of the capital, giving London the largest 5G footprint within the group.

- Considering the growing demand, several smartwatch manufacturers are launching their products in the country. For instance, in October 2021, Apple launched its latest Watch Series 7 in the United Kingdom. According to the company, the Apple Watch Series 7 features Watch OS 8, faster charging, a larger and more advanced display, and new aluminum case colors.

Application For Tracking Health Is Expected To Majorly Contribute For Market's Growth

- Smartwatches are revolutionizing the healthcare industry as they help individuals invest time toward their well-being and act like medical sensors. These devices allow data collection and play a vital role in monitoring heart rate, blood oxygen levels, and activity levels. Apple, Fitbit, Samsung, and Fossil are among the leading smartwatch brands offering smartwatches with healthcare tracking features in the country.

- Additionally, fitness trackers also contribute significantly to wearables market growth. With the help of these devices, users can monitor the calories burnt, sleep, exercises, and the step counter. Fitness Trackers also collects the user's data, which helps the doctors analyze the patient's health to offer quick medication. The demand for these devices has increased significantly since the outbreak of Covid-19 as these devices enabled the doctors to record users' body temperature and other attributes such as heart rate remotely.

- With the adoption of new technologies in these devices, glucose monitoring is made easy. The rising cardiovascular cases can also be easily tracked with the help of these devices. The e-commerce industry is witnessing significant growth in this market as people are inclined toward more usage of these devices.

- Considering the benefits smartwatches and other wearables provide, especially to old people, the demand for these devices is increasing significantly in the country along with the aging population. For instance, Fitbit UK offers a Sense smartwatch, which according to the company, enables the users to manage stress with an innovative EDA sensor.

UK Wearable Technology Industry Overview

The market studied is highly fragmented. Some of the significant players in the market are Apple Inc., Samsung Electronics Co. Ltd., Fitbit Inc., Huawei Technologies Co. Ltd., Xiaomi Corporation, and Garmin Ltd. The companies are increasing their market share by forming multiple partnerships and mergers, investing in projects, and launching new products in the market.

- May 2021 - Meta Platforms Inc, the parent company of recently-rebranded Facebook, in a bid to develop the next generation of Metaverse solutions, kicked off the research for its Project Aria augmented reality (AR) smart glasses in London. The company will begin trialling its smart glasses by recording data from environments via the head-mounted display's (HMDs) sensors.

- April 2022 - Nreal, a Chinese augmented reality start-up, unveiled their plans to bring its smart glasses to the U.K. The company announced that it would launch its Nreal Air AR glasses in Britain later this spring through an exclusive deal with local carrier EE.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Impact of COVID-19 on the Wearable Technology Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Technological Advancements in the Wearables Market

- 5.1.2 Increase in Health Awareness among the Consumers

- 5.2 Market Challenges

- 5.2.1 Growing Complexity of Wearable Devices and Limited Use of Features, augmented With Security Risks

6 MARKET SEGMENTATION

- 6.1 By Type of Device

- 6.1.1 Smart Watches

- 6.1.2 Head-mounted Displays

- 6.1.3 Wristbands

- 6.1.4 Ear-wearables

- 6.1.5 Other Device Types (Smart Clothing)

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Apple Inc.

- 7.1.2 Samsung

- 7.1.3 Fitbit Inc.

- 7.1.4 Huawei Technologies Co. Ltd

- 7.1.5 Xiaomi

- 7.1.6 Garmin Ltd.

- 7.1.7 Fossil Group Inc.

- 7.1.8 OnePlus

- 7.1.9 Sekonda

- 7.1.10 Honor Device Co., Ltd

8 INVESTMENT ANALYSIS

9 FUTURE OUTLOOK OF THE MARKET

02-2729-4219

+886-2-2729-4219