|

市场调查报告书

商品编码

1635399

北美线上约会服务:市场占有率分析、行业趋势、统计和成长预测(2025-2030)North America Online Dating Services - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

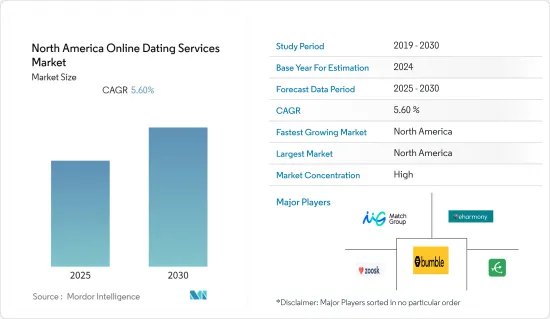

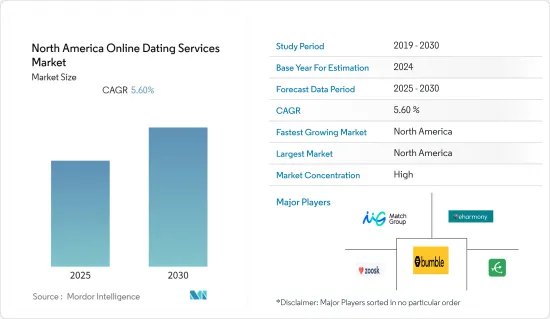

北美线上约会服务市场预计在预测期内复合年增长率为 5.6%。

在过去的几十年里,约会服务业的销售额经历了显着的成长。这是由于世界各地单身人数的增加,尤其是在北美。网路服务使用的增加增加了各种线上约会服务平台的受欢迎程度。近年来,随着各类线上交友网站的普及,合约数量也大幅增加。

主要亮点

- 线上交友服务和平台可以在心态和生活方式上快速匹配合适的伴侣,让客户轻鬆快速找到理想的伴侣。这些线上约会服务提供的高盈利服务正在提高其目标客户的会员率和註册率,并刺激当地约会服务市场的扩张。

- 然而,该行业还必须应对诈骗以及重大的隐私和安全风险。随着虚假线上帐户问题的日益严重,用户即时建立可信任的对话变得越来越困难。这些事件也对线上约会网站的地位产生负面影响。因此,诈骗是阻碍全球约会服务市场成长的主要问题之一。

- 科技的问题在于,电子邮件地址可以在几分钟内创建,因此可以轻鬆启动约会资料。因此,一些网站可能会创建虚假的个人资料,供那些不把寻找合作伙伴作为首要任务的人使用。他们的行为可能是出于恶作剧,也可能是为了取得网路银行密码等个人资讯而进行网路钓鱼。

- 随着互联网在该地区变得越来越流行,线上约会服务市场显着增长。这为服务提供者打开了一个巨大的窗口,可以透过创建专门满足目标用户需求的功能来在其目标用户中建立支援。由于网路在全球的迅速普及,线上约会服务市场显着成长。这为服务提供者创造了巨大的机会,透过开发满足其需求的独特功能,在其目标客户之间建立一致。

- COVID-19 对北美线上约会服务市场产生了积极影响。随着新冠肺炎 (COVID-19) 期间社交媒体使用量的增加,线上约会已成为约会。 Tinder、Bumble 等约会应用程式的兴起正在帮助我们建立和维持健康的关係。

- 根据 Apptopia 的数据,美国排名前列的约会应用程式是 Tinder 和 Bumble,年平均 DAU 分别为 500 万和 420 万。其次是拥有 130 万用户的 Match、拥有 110 万用户的 Plenty of Fish 和拥有 67 万用户的 Hinge。需要注意的是,除了 Bumble 之外,所有这些应用程式均归 Match Group 所有。

北美线上约会服务市场趋势

服务交付的快速创新推动市场成长

- 线上约会之所以成为如此流行的消遣,是因为科技使其成为一个方便的社交平台。单身人士可以从数千个网站和应用程式中进行选择,所有这些网站和应用程式都可以透过网路浏览器访问,使他们能够立即接触到潜在的伴侣。

- 匹配功能对于任何约会应用程式都是必不可少的。人工智慧智慧让匹配过程更加客製化、精准化、个人化。我曾经使用过一个约会应用程式。该技术还有助于提高应用程式安全性并防止诈骗。

- 人们用来寻找浪漫伴侣的平台在历史上不断发展。随着线上约会网站和行动应用程式的兴起,这种演变仍在继续。例如,Tinder 使用 VecTec(一种与人工智慧相结合的机器学习演算法)来产生个人化推荐。该应用程式使用机器学习自动筛选可能令人反感的讯息。

- 由于消费者期望不断提高,市场主要企业不断致力于创建和提供针对用户的个人化新服务,这进一步表明线上约会服务市场很快就会扩大。主要企业正在扩展其服务以满足不断增长的消费者需求,因此将附加服务整合到其平台中以吸引更多客户并获得市场吸引力,这对市场成长产生了积极影响。

- 例如,拥有 Tinder 的 Match Group 最近发布了 Match Group 2018 年第一季至 2021 年第一季的季度约会收益。在最近的测量期间,北美地区的收益达到 3.2683 亿美元。 Match Group 以前属于 IAC,拥有并经营 Match.com、OkCupid、Tinder 和 PlentyofFish 等线上约会平台。

- 科技使线上约会变得完全安全,因为人工智慧可以消除所有威胁。如今线上约会网站的会员所面临的大部分风险并非源自于那里。网路约会已经使约会和关係的整个概念变得非人性化。线上约会节省时间、高效的特性已经变得比实际寻找伴侣更重要。各种应用程式中使用的约会技术无疑已经解决了寻找合适对象的问题。与传统的约会不同,这些应用程式使用年龄、偏好、兴趣和爱好等相关标准来寻找完美的匹配、基于位置的匹配。

智慧型手机和行动装置在美国的普及率不断扩大

- 行动革命彻底改变了美国的数位生态系统。在过去的几十年里,行动装置已成为数百万美国消费者的日常必需品,他们使用它们进行通讯、资讯和娱乐。在连网智慧型手机和平板电脑日益普及和普及的推动下,美国的行动网路用户数量稳定成长至历史新高。

- 如今,线上约会在美国已变得司空见惯。美国无党派智库皮尤研究中心的数据显示,美国年轻人最常拥有智慧型手机。 18 至 49 岁的成年人中 95% 拥有智慧型手机,而 65 岁及以上的成年人中只有 61% 拥有智慧型手机。

- 社群媒体上的约会服务广告已变得普遍,并有助于扩大市场。美国的社群媒体格局不断发展,以满足世界各地社群媒体用户的需求,每天都有新的网站和应用程式出现。

- 拥有智慧型手机的成年人数量不断增加,导致市场显着成长。此外,自 2011 年以来,美国成年人的智慧型手机拥有量增加了一倍以上。皮尤研究中心 (Pew Research) 的数据显示,2011 年,只有 35% 的美国成年人拥有智慧型手机,但截至 2021 年 2 月,这一比例已达 85%。在此期间,拥有智慧型手机的美国成年人比例增加了 50%。

北美线上约会服务产业概况

全球市场的主要企业正在专注于技术进步和市场扩张,以满足北美线上约会服务市场不断增长的需求。此外,服务供应商正在合作制定新策略并为最终用户提供协助。

- 2021 年 9 月 - 推出 Tinder 应用程式的新部分“探索”,其中包括流行的“滑动之夜”系列的回归、根据兴趣搜寻匹配项以及在匹配前跳转到快速聊天等活动。应用程序,以专注于社交和互动功能。这些变化使 Tinder 远离了其最初的基于快速匹配的约会应用程序,而转向更多帮助用户结识新朋友的社交网络。

其他好处:

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 竞争公司之间的敌对关係

- 替代品的威胁

- COVID-19 市场影响评估

第五章市场动态

- 市场驱动因素

- 服务交付持续创新

- 智慧型手机和行动装置的扩展

- 市场限制因素

- 有关资料隐私的安全问题

- 关键使用案例分析和案例研究

- 市场监管主要法规

第六章 市场细分

- 按类型(涵盖使用者数量的趋势分析)

- 非付费线上约会

- 付费网上约会

- 按国家/地区

- 美国

- 加拿大

- 美国

第七章 竞争格局

- 公司简介

- Match Group, Inc.

- Zoosk, Inc.

- Badoo

- BlackPeopleMeet

- Bumble

- Elite Singles

- happn

- OurTime

- Spark

- Hinge

- eHarmony

第八章投资分析

第9章市场的未来

The North America Online Dating Services Market is expected to register a CAGR of 5.6% during the forecast period.

Over the past few decades, the dating service industry has experienced significant growth in terms of sales. This results from a rise in the number of single people globally, especially in North America. The increased use of internet services has increased the visibility of various online platforms for dating services. Due to the popularity of various online dating sites over the past few years, there has been a substantial increase in subscriptions.

Key Highlights

- Online dating services and platforms offer quick matches between suitable partners in terms of outlook and way of life, making it simple for their customers to find their ideal partners quickly. The profitable services offered by these online dating services increase the target customers' enrollment or sign-up rate, which fuels the expansion of the regional dating services market.

- However, the industry must also deal with fraud and significant privacy and security risks. As the issue of fake online accounts grew, it became increasingly difficult for real-time users to establish conversations they could trust. These incidents also harm the standing of dating websites online. Therefore, fraud is one of the main issues preventing the growth of the global dating services market.

- One issue with technology is that because email addresses can be created in a matter of minutes, a dating profile can be launched with minimal effort. This can lead to fake profiles on some sites, used by people who don't have finding a partner at the top of their list of priorities. They might be acting out of mischief, or phishing for personal details, such as online banking passwords.

- The market for online dating services has grown significantly as internet usage spreads increased in the region. This has opened up a huge window of opportunity for service providers to establish a following among their intended users by creating specifically tailored features to meet their requirements. The surge in internet penetration around the globe has resulted in significant growth of the online dating services market. This has created a tremendous opportunity for service providers to establish an accompanying among their intended clients by developing unique features that meet those needs.

- COVID-19 has positively affected the North American Online Dating Services market. Online dating has become just plain dating due to the increased use of social media during COVID-19. The rage of dating apps like Tinder, Bumble, and numerous others, to establish and uphold healthy relationships, dating apps, online games, and social media can all offer meaningful ways of connecting with others.

- According to Apptopia, the top dating app in the United States are Tinder and Bumble, which come out on top with the highest average DAU throughout the year with 5 million and 4.2 million, respectively. They are followed by Match with 1.3 million, Plenty of Fish with 1.1 million and Hinge with 670k. It is critical to note that all of these applications, except Bumble are owned by the Match Group.

North America Online Dating Services Market Trends

Rapid innovation in service offerings is driving the market growth

- Online dating has become such a popular pastime, down to how technology has made this a convenient socializing platform. Singles can choose from thousands of websites or apps, which can be accessed via a web browser, allowing instant access to prospective partners.

- The matching feature is integral for any dating app. Artificial IntelligenceIntelligence makes the matching process much more tailored, accurate, and personalized. Before, in a dating application. The technology also helps to improve app security, as well as prevent fraud activities.

- The platforms people use to seek out romantic partners have evolved throughout history. This evolution has continued with the rise of online dating sites and mobile apps. For example, Tinder uses VecTec, a machine-learning algorithm paired with artificial Intelligence to generate personalized recommendations. The app uses ML to screen for potentially offensive messages automatically.

- The key market players are constantly working to create and provide new, personalized services to their users due to the rising consumer expectations, which further illustrates the potential for the market for online dating services to expand soon. Companies are expanding their services to cater to the increasing consumer needs, which has led to the integration of additional services on their platforms to attract more customers and gain traction in the market, positively impacting the market growth.

- For example, Tinder company owner Match Group has recently announced its quarterly dating revenue of the Match Group from the first quarter of 2018 to the first quarter of 2021. North American revenue amounted to USD 326.83 million in the most recently measured period. Match Group, formerly owned by IAC, owns and operates online dating platforms such as the eponymous Match.com, OkCupid, Tinder, PlentyofFish, and others.

- Technology made online dating completely safe because AI keeps all the threats away. Most risks members of online dating sites face today aren't coming from. Internet dating gives the whole notion of dating and loves a dehumanizing state. The time-saving, efficient nature of online dating has become more important than actually finding a partner. Dating technology used in various apps ensures that the problem of finding a good match is eradicated. Unlike good old dating, these apps use relevant criteria like age, sexual preference, interests, and hobbies to find the perfect match, Location-based matching.

Growing Penetration of Smartphones and Mobile Devices in the United States

- The mobile revolution has significantly changed the American digital ecosystem. Over the past few decades, mobile devices have become a daily necessity for millions of American consumers, who use them for communication, information, and entertainment. Due to the rising popularity and accessibility of web-enabled smartphones and tablets, the number of mobile internet users in the United States has steadily increased, reaching an all-time high.

- Online dating has become the norm in the U.S. these days. Young, tech-savvy singles have embraced swiping for local dates, and it's become the most popular way to meet a future spouse in the U.S. According to Pew Research, a nonpartisan American think tank, younger age groups in the United States are the ones who own smartphones the most frequently. While 95% of adults between 18 and 49 have a smartphone, only 61% of adults 65 and older are smartphone owners.

- Social media dating service advertising is becoming more popular, assisting the market's expansion. To meet the demands of social media users worldwide, the social media landscape in the United States of America is constantly evolving, with new websites and applications appearing every day.

- The increasing number of adults having a smartphone has led the market to grow substantially. Furthermore, the percentage of U.S. adults who own a smartphone has more than doubled since 2011. According to Pew Research, only 35% of all U.S. adults owned a smartphone in 2011, compared to 85% of adults who owned a smartphone as of February 2021. The share of U.S. adults owning a smartphone increased by 50% over the highlighted period.

North America Online Dating Services Industry Overview

Major players in the global market are concentrating on technological advancements and market expansions to meet the rising demand for North America Online Dating Services Market. Additionally, service providers are collaborating to create new strategies and aid end users.

- September 2021 - With the introduction of "Explore," a new section of the Tinder app that will include events like the return of the well-liked "Swipe Night" series as well as ways to find matches by interests and jump into quick chats before a match is made, Tinder is redesigning its app to place a greater emphasis on its social, interactive features. When taken together, the changes aid in moving Tinder further away from its origins as a quick match-based dating app and toward something more akin to a social network designed to assist users in meeting new people.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Intensity of Competitive Rivalry

- 4.2.5 Threat of Substitutes

- 4.3 Assessment of COVID-19 Impact on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Continuous Innovation in Service Offerings

- 5.1.2 Growing Penetration of Smartphones and Mobile Devices

- 5.2 Market Restraints

- 5.2.1 Security Concerns of Data Privacy

- 5.3 Analysis of major use-cases and case-studies

- 5.4 Key Regulations Monitoring the Market

6 MARKET SEGMENTATION

- 6.1 By Type (Trend Analysis with coverage on number of users)

- 6.1.1 Non- paying online dating

- 6.1.2 Paying Online Dating

- 6.2 By Country

- 6.2.1 United States

- 6.2.1.1 Canada

- 6.2.1 United States

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Match Group, Inc.

- 7.1.2 Zoosk, Inc.

- 7.1.3 Badoo

- 7.1.4 BlackPeopleMeet

- 7.1.5 Bumble

- 7.1.6 Elite Singles

- 7.1.7 happn

- 7.1.8 OurTime

- 7.1.9 Spark

- 7.1.10 Hinge

- 7.1.11 eHarmony